|

市场调查报告书

商品编码

1892788

船舶密封剂市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Marine Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

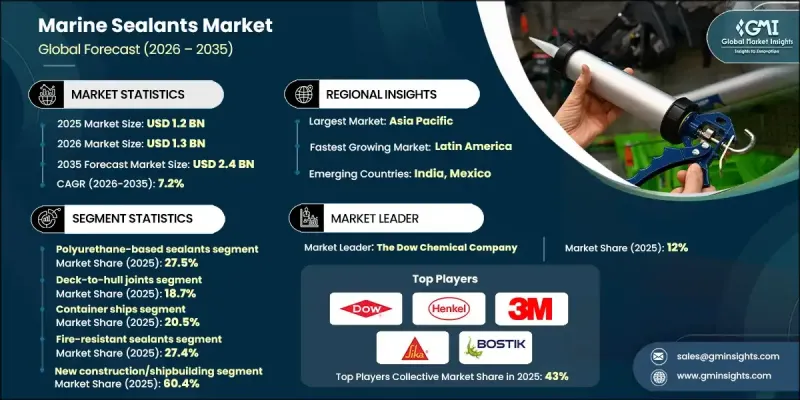

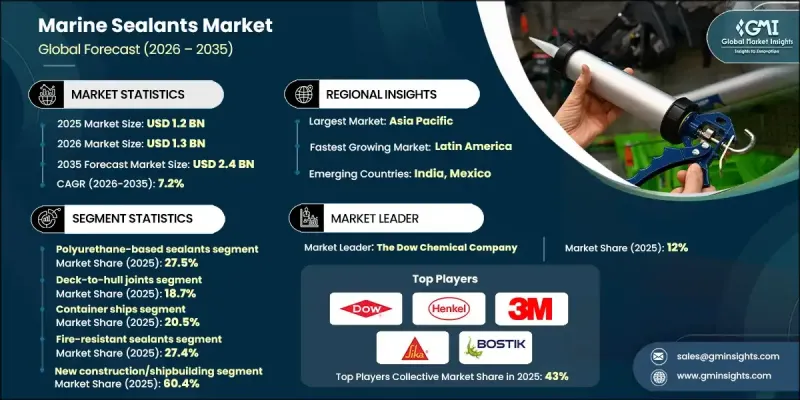

2025年全球海洋密封剂市场价值为12亿美元,预计2035年将以7.2%的复合年增长率成长至24亿美元。

船舶密封剂已从一种小众产品发展成为现代海事作业的关键组成部分。其重要性如今已超越了基本的密封功能,扩展到增强船舶完整性、防腐蚀和长期结构性能。永续性已成为该行业的主要驱动力,环保型和低排放密封剂在造船、维护和改造过程中越来越受欢迎。技术进步进一步推动了市场发展,包括混合聚合物配方和低挥发性有机化合物 (VOC) 体系,这些产品在满足严格环保标准的同时,还能在恶劣的海洋环境中提供卓越的性能。区域优先事项和当地海事产业的实力对该市场的成长模式有显着影响,因为创新与全球监管要求和脱碳目标相契合。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 12亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 7.2% |

2025年,聚氨酯基密封胶市占率达到27.5%,预计到2035年将以6.8%的复合年增长率成长。其高柔韧性和在动态负载下优异的黏合力使其成为船体连接和甲板结构的理想选择。硅酮基密封胶以其耐紫外线和耐海水腐蚀的特性而闻名,是严苛海洋环境下户外应用的首选。聚硫密封胶因其在恶劣工况下卓越的耐化学性和耐燃料性而持续受到市场青睐。

2025 年,甲板与船体连接件市场占有率为 18.7%,预计到 2035 年将以 6.9% 的复合年增长率成长。此应用中的密封剂必须能够承受持续运动产生的动态应力,而水线以上应用则需要具备抗紫外线和耐候性,水线以下密封则需要先进的黏合性和防水性才能实现长期性能。

受造船业、休閒游艇运动成长以及海上基础设施投资的推动,北美海洋密封剂市场预计在2025年将占据15.4%的市场份额。该地区拥有先进的製造业、完善的安全法规以及对永续发展的重视,这些优势为高性能海洋密封剂技术的发展创造了机会。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 快速扩张的离岸风能产业

- 国际海事组织严格的消防安全规定

- 全球船队扩张与现代化

- 产业陷阱与挑战

- 先进智慧密封剂成本高昂

- 熟练的申请要求

- 市场机会

- 自修復和智慧密封剂技术

- 离岸风电基础密封专业化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依化学类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依化学类型划分,2022-2035年

- 聚氨酯基密封剂

- 硅基密封剂(聚硅氧烷)

- 聚硫化物基密封剂

- 混合/改质硅烷聚合物(ms聚合物/stp)

- 环氧树脂密封剂

- 丁基密封剂

- 丙烯酸基密封剂

- 奈米混合智慧密封剂

- 生物基/可持续配方

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 甲板与船体连接处

- 水线以上密封

- 水线以下密封

- 窗户和舷窗粘合/直接玻璃安装

- 结构黏合与组装

- 离岸风电基础密封

- 单桩灌浆密封

- 预堆积护套密封

- 桩后护套密封

- 裙边密封(非灌浆单桩)

- 法兰密封件(福斯、VT 型)

- 气密平台密封件(CS-111/114、CS-80/70)

- 机舱和涡轮部件密封

- 防火封堵及耐火密封

- 压载舱涂层及密封

- 声学密封

- 防污应用

- 生物杀灭防污剂

- 不含杀菌剂的防污剂

第七章:市场估算与预测:依船舶/结构类型划分,2022-2035年

- 货柜船

- 散货船

- 好望角型(≥100,000载重吨)

- 巴拿马型(65,000-99,999载重吨)

- Handymax(40,000-64,999载重吨)

- 灵便型(10,000-39,999载重吨)

- 石油和化学品油轮

- 超大型原油运输船 (ULCC) 和超大型原油运输船 (VLCC)

- 苏伊士型油轮

- 阿芙拉型/LR2型油轮

- 巴拿马型/LR1型油轮

- 中型和小型油罐车

- 化学品油轮(特殊密封要求)

- 离岸风力涡轮机和结构

- 客船

- 液化气体运输船

- 海军和国防舰艇

- 海上油气结构

- 普通货船和多用途船

- 小型船隻和休閒船隻

- 渔船

第八章:市场估算与预测:依绩效特性划分,2022-2035年

- 防火密封剂

- 防腐蚀密封剂

- 抗紫外线密封剂

- 防污密封剂

- 高移动能力密封剂

- 自修復密封剂

第九章:市场估算与预测:依最终用途划分,2022-2035年

- 新造船/船舶建造

- 维修保养

- 改造与现代化

- 海上安装与施工

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十一章:公司简介

- Sika AG

- 3M Company

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Trelleborg AB

- Berger Maritiem

- Chugoku Marine Paints, Ltd.

- Jotun A/S

- Hempel A/S

- Feynlab

- Sea-Shield

- ITW Performance Polymers

- Bostik (Arkema Group)

- Wacker Chemie AG

- Momentive Performance Materials

- Evonik Industries AG

The Global Marine Sealants Market was valued at USD 1.2 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 2.4 billion by 2035.

Marine sealants have evolved from being a niche product to becoming a crucial component in modern maritime operations. Their importance now extends beyond basic sealing to enhancing vessel integrity, corrosion protection, and long-term structural performance. Sustainability has become a major driver in the industry, as eco-friendly and low-emission sealants are increasingly favored in shipbuilding, maintenance, and retrofitting processes. The market is further fueled by technological advancements, including hybrid polymer formulations and low volatile organic compound (VOC) systems, which meet stringent environmental standards while delivering superior performance in harsh marine environments. Regional priorities and the strength of local maritime industries strongly influence growth patterns in this market, as innovation aligns with regulatory requirements and decarbonization goals worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 7.2% |

The polyurethane-based sealants segment held a 27.5% share in 2025 and is expected to grow at a CAGR of 6.8% through 2035. Their high flexibility and excellent adhesion under dynamic loads make them essential for hull joints and deck structures. Silicone-based sealants, known for UV and saltwater resistance, are preferred for exterior applications in challenging marine conditions. Polysulfide sealants remain in demand for their exceptional chemical and fuel resistance under harsh operational conditions.

The deck-to-hull joints segment held 18.7% share in 2025 and is expected to grow at a CAGR of 6.9% by 2035. Sealants in this application must withstand dynamic stresses from constant motion, while above-waterline applications demand UV and weather resistance, and below-waterline sealing requires advanced adhesion and water impermeability for long-term performance.

North America Marine Sealants Market accounted for a 15.4% share in 2025, driven by shipbuilding activities, recreational boating growth, and investments in offshore infrastructure. The region benefits from advanced manufacturing, robust safety regulations, and a focus on sustainability, creating opportunities for high-performance marine sealant technologies.

Key players operating in the Global Marine Sealants Market include Sika AG, 3M Company, Henkel AG & Co. KGaA, The Dow Chemical Company, PPG Industries, Inc., The Sherwin-Williams Company, Trelleborg AB, Berger Maritiem, Chugoku Marine Paints, Ltd., Jotun A/S, Hempel A/S, Feynlab, Sea-Shield, ITW Performance Polymers, Bostik (Arkema Group), Wacker Chemie AG, Momentive Performance Materials, and Evonik Industries AG. Companies in the Global Marine Sealants Market are employing several strategies to strengthen their market position. They are investing in research and development to create eco-friendly formulations with improved adhesion, UV resistance, and chemical durability. Strategic partnerships with shipbuilders, maintenance providers, and offshore operators expand market reach and ensure adoption of high-performance products. Firms are also focusing on regional expansion, particularly in emerging maritime markets, and optimizing distribution channels for faster product delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemistry Type

- 2.2.3 Application

- 2.2.4 Vessel/Structure Type

- 2.2.5 Performance Characteristics

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid offshore wind energy expansion

- 3.2.1.2 Stringent IMO fire safety regulations

- 3.2.1.3 Global fleet expansion & modernization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced smart sealants

- 3.2.2.2 Skilled application requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Self-healing & smart sealant technologies

- 3.2.3.2 Offshore wind foundation sealing specialization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Chemistry type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Chemistry Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyurethane-based sealants

- 5.3 Silicone-based sealants (polysiloxanes)

- 5.4 Polysulfide-based sealants

- 5.5 Hybrid/modified silane polymers (ms polymers/stp)

- 5.6 Epoxy-based sealants

- 5.7 Butyl-based sealants

- 5.8 Acrylic-based sealants

- 5.9 Nano-hybrid smart sealants

- 5.10 Bio-based/sustainable formulations

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Deck-to-hull joints

- 6.3 Above waterline sealing

- 6.4 Below waterline sealing

- 6.5 Window & porthole bonding/direct glazing

- 6.6 Structural bonding & assembly

- 6.7 Offshore wind foundation sealing

- 6.7.1 Monopile grout seals

- 6.7.2 Pre-piled jacket sealing

- 6.7.3 Post-piled jacket sealing

- 6.7.4 Skirt seals (non-grouted monopiles)

- 6.7.5 Flange seals (VW, VT types)

- 6.7.6 Airtight platform seals (CS-111/114, CS-80/70)

- 6.7.7 Nacelle & turbine component sealing

- 6.8 Firestop & fire-resistant sealing

- 6.9 Ballast tank coating & sealing

- 6.10 Acoustic sealing

- 6.11 Anti-fouling applications

- 6.11.1 Biocidal anti-fouling

- 6.11.2 Biocide-free anti-fouling

Chapter 7 Market Estimates and Forecast, By Vessel/Structure Type, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Container ships

- 7.3 Bulk carriers

- 7.3.1 Capesize (≥100,000 dwt)

- 7.3.2 Panamax (65,000-99,999 dwt)

- 7.3.3 Handymax (40,000-64,999 dwt)

- 7.3.4 Handysize (10,000-39,999 dwt)

- 7.4 Oil & chemical tankers

- 7.4.1 ULCC & VLCC (Ultra/Very Large Crude Carriers)

- 7.4.2 Suezmax Tankers

- 7.4.3 Aframax/LR2 Tankers

- 7.4.4 Panamax/LR1 Tankers

- 7.4.5 MR & Handy Tankers

- 7.4.6 Chemical Tankers (Specialized Sealing Requirements)

- 7.5 Offshore wind turbines & structures

- 7.6 Passenger vessels

- 7.7 Liquefied gas carriers

- 7.8 Naval & defense vessels

- 7.9 Offshore oil & gas structures

- 7.10 General cargo & multi-purpose ships

- 7.11 Small craft & recreational vessels

- 7.12 Fishing vessels

Chapter 8 Market Estimates and Forecast, By Performance Characteristics, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Fire-resistant sealants

- 8.3 Anti-corrosion sealants

- 8.4 Uv-resistant sealants

- 8.5 Anti-fouling sealants

- 8.6 High-movement capability sealants

- 8.7 Self-healing sealants

Chapter 9 Market Estimates and Forecast, By End Use, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 New construction/shipbuilding

- 9.3 Repair & maintenance

- 9.4 Retrofit & modernization

- 9.5 Offshore installation & construction

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Sika AG

- 11.2 3M Company

- 11.3 Henkel AG & Co. KGaA

- 11.4 The Dow Chemical Company

- 11.5 PPG Industries, Inc.

- 11.6 The Sherwin-Williams Company

- 11.7 Trelleborg AB

- 11.8 Berger Maritiem

- 11.9 Chugoku Marine Paints, Ltd.

- 11.10 Jotun A/S

- 11.11 Hempel A/S

- 11.12 Feynlab

- 11.13 Sea-Shield

- 11.14 ITW Performance Polymers

- 11.15 Bostik (Arkema Group)

- 11.16 Wacker Chemie AG

- 11.17 Momentive Performance Materials

- 11.18 Evonik Industries AG