|

市场调查报告书

商品编码

1892789

门窗市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Windows and Doors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

2025年全球门窗市场价值为2,036亿美元,预计2035年将以5.8%的复合年增长率成长至3,551亿美元。

现代建筑趋势和消费者对兼具高性能和美观性的产品的需求正在重塑整个产业。建筑商和承包商越来越多地转向大型预製工厂和专业车间,以提供更快捷的安装和客製化解决方案。为了支援大批量、客製化生产,对自动化切割机、机器人组装线和高精度数控系统等专用製造设备的需求也在不断增长。能够有效率地将模组化门窗单元从生产地点运送到安装现场的公司将获得竞争优势。此外,节能建筑围护结构(包括低辐射涂层、断桥隔热技术和高性能保温材料)的普及应用,也进一步推动了该产业对先进製造流程和精密零件的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2036亿美元 |

| 预测值 | 3551亿美元 |

| 复合年增长率 | 5.8% |

预计到2025年,uPVC市场规模将达到700亿美元,因为它在价格和隔热性能方面始终保持平衡。其多腔室设计使其在各种气候条件下都能提供强大的隔热性能和可靠的表现,因此对于需要低维护、高性价比产品的大型住宅、多户住宅和商业项目而言,uPVC产品至关重要。

2025年,住宅市场规模达到1,194亿美元,主要得益于旨在提升能源效率、安全性和美观性的维修和改造活动。这些产品通常采用多点锁定係统、先进的玻璃技术和可客製化尺寸,从而支持市场在应对老旧住房和日益严格的能源法规方面实现稳健增长。

亚太地区门窗市场在2025年占据50.6%的市场份额,预计2026年至2035年该地区将以6.5%的复合年增长率成长。快速的工业化、基础设施扩张和蓬勃发展的建筑业正在推动市场成长,其中中国、印度和日本是主要贡献者。政府支持经济适用房和节能建筑的倡议,加上强大的本地製造业生态系统,正在推动大型住宅和商业开发项目中对传统金属框架和经济实惠的uPVC门窗的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 人们越来越关注能源效率和相关法规。

- 快速的都市化和基础建设

- 住宅翻新改造(R&R)业务成长

- 智慧家庭科技的应用

- 产业陷阱与挑战

- 原物料价格波动剧烈及供应链问题

- 先进产品的前期成本高

- 机会

- 永续和循环经济材料

- 自动化智慧门窗系统

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按材料

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料划分,2022-2035年

- uPVC

- 木头

- 金属

- 其他的

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 住宅

- 新建住宅

- 改进与维修

- 商业的

- 新广告

- 改进与维修

第七章:市场估算与预测:依配销通路划分,2022-2035年

- 在线的

- 离线

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 比利时

- 波兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Andersen Corporation

- BG Legno

- Cantera Doors

- Century Plyboards

- Deceuninck NV

- Fenesta Building Systems

- Glass-Rite

- JELD-WEN, Inc.

- LIXIL Corporation

- Nawa International

- Neuffer Windows + Doors

- Pella Corporation

- Performance Doorset Solutions Ltd. (PDS)

- Ponzio - P.IVA.

- RENSON

- Saudi Aluminum Industries Company (SALUMCO)

- Schuco International KG

- SGM Windows

- TAMCO GULF LTD.

- Vinylguard Windows and doors Systems Ltd

- Weru Group

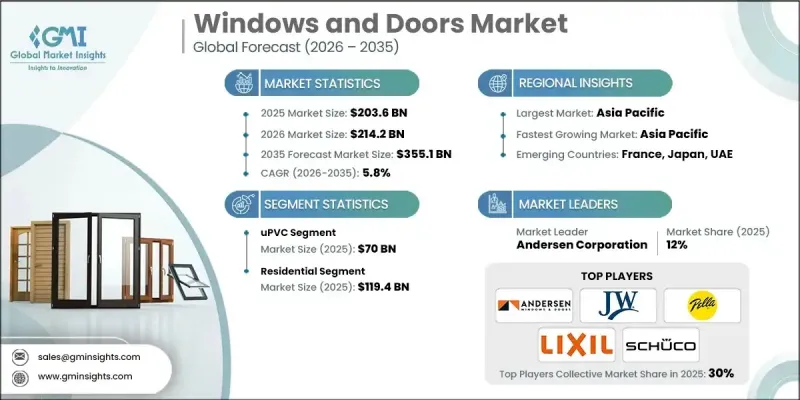

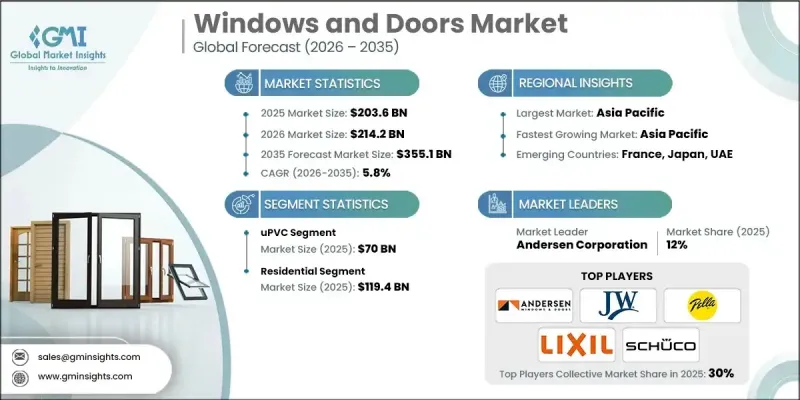

The Global Windows and Doors Market was valued at USD 203.6 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 355.1 billion by 2035.

The industry is reshaped by modern architectural trends and consumer demand for products that combine high performance with aesthetic appeal. Builders and contractors are increasingly moving toward large-scale pre-fabrication facilities and specialized workshops to deliver faster installations and customized solutions. The demand for specialized manufacturing equipment such as automated cutting machines, robotic assembly lines, and high-precision CNC systems is rising to support high-volume, tailored production. Companies that can efficiently transport modular window and door units from production to installation sites gain a competitive advantage. Additionally, the adoption of energy-efficient building envelopes, including low-emissivity coatings, thermal break technology, and high-performance insulating materials, is driving further demand for advanced manufacturing and precision components in the sector.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $203.6 Billion |

| Forecast Value | $355.1 Billion |

| CAGR | 5.8% |

The uPVC segment accounted for USD 70 billion in 2025, as it continues to offer a balanced solution of affordability and thermal efficiency. Its multi-chambered design provides strong insulation and reliable performance across diverse climates, making it essential for large-scale residential, multi-family, and commercial projects that require low-maintenance, cost-effective products.

In 2025, the residential segment reached USD 119.4 billion, driven by repair and improvement activities that enhance energy efficiency, security, and aesthetics. These products often feature multi-point locking systems, advanced glazing, and customizable sizing, supporting resilient growth in response to aging housing stock and stricter energy regulations.

Asia Pacific Windows and Doors Market held 50.6% share in 2025, and the region is expected to grow at a CAGR of 6.5% from 2026 to 2035. Rapid industrialization, infrastructure expansion, and a booming construction industry are fueling growth, with China, India, and Japan serving as key contributors. Government initiatives supporting affordable housing and energy-efficient buildings, combined with strong local manufacturing ecosystems, are boosting demand for both traditional metal frames and cost-effective uPVC units in large residential and commercial developments.

Key players operating in the Global Windows and Doors Market include Neuffer Windows + Doors, RENSON, Andersen Corporation, JELD-WEN, Inc., Deceuninck NV, B.G. Legno, Fenesta Building Systems, Glass-Rite, Nawa International, LIXIL Corporation, Performance Doorset Solutions Ltd. (PDS), TAMCO GULF LTD., Ponzio, Vinylguard Windows and Doors Systems Ltd, Schuco International KG, Cantera Doors, Saudi Aluminum Industries Company (SALUMCO), Weru Group, Century Plyboards, and Pella Corporation. Companies in the Global Windows and Doors Market are focusing on strategies such as investing in automated and precision manufacturing technologies to improve production efficiency and customization capabilities. They are expanding pre-fabrication facilities and local workshops to reduce lead times and enhance on-site delivery speed. Product innovation is prioritized, with emphasis on energy-efficient designs, thermal insulation, advanced glazing, and bespoke sizing solutions to meet evolving consumer needs. Firms are also forging partnerships with contractors, architects, and distributors to strengthen distribution networks.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising focus on energy efficiency & regulations

- 3.2.1.2 Rapid urbanization & infrastructure development

- 3.2.1.3 Growth in residential renovation & remodeling (R&R)

- 3.2.1.4 Adoption of smart home technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High raw material price volatility & supply chain issues

- 3.2.2.2 High upfront costs of advanced products

- 3.2.3 Opportunities

- 3.2.3.1 Sustainable & circular economy materials

- 3.2.3.2 Automated & smart door/window systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Material

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 uPVC

- 5.3 Wood

- 5.4 Metal

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022- 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Residential

- 6.2.1 New residential

- 6.2.2 Improvement & repair

- 6.3 Commercial

- 6.3.1 New commercial

- 6.3.2 Improvement & repair

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Russia

- 8.3.6 Belgium

- 8.3.7 Poland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Malaysia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Andersen Corporation

- 9.2 B.G. Legno

- 9.3 Cantera Doors

- 9.4 Century Plyboards

- 9.5 Deceuninck NV

- 9.6 Fenesta Building Systems

- 9.7 Glass-Rite

- 9.8 JELD-WEN, Inc.

- 9.9 LIXIL Corporation

- 9.10 Nawa International

- 9.11 Neuffer Windows + Doors

- 9.12 Pella Corporation

- 9.13 Performance Doorset Solutions Ltd. (PDS)

- 9.14 Ponzio - P.IVA.

- 9.15 RENSON

- 9.16 Saudi Aluminum Industries Company (SALUMCO)

- 9.17 Schuco International KG

- 9.18 SGM Windows

- 9.19 TAMCO GULF LTD.

- 9.20 Vinylguard Windows and doors Systems Ltd

- 9.21 Weru Group