|

市场调查报告书

商品编码

1892796

卡车货箱衬垫市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Truck Bedliners Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

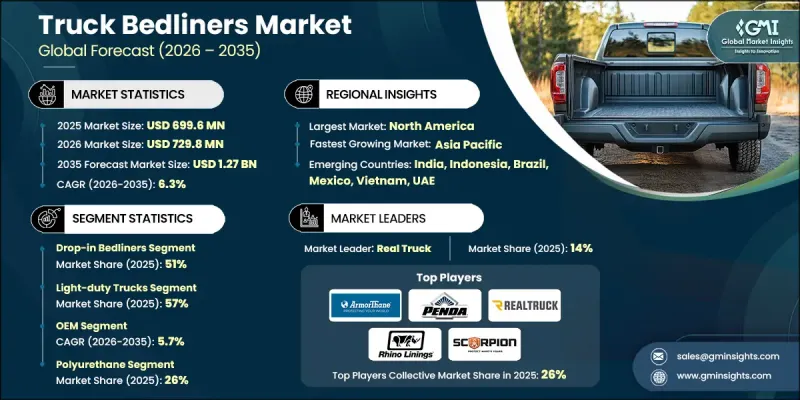

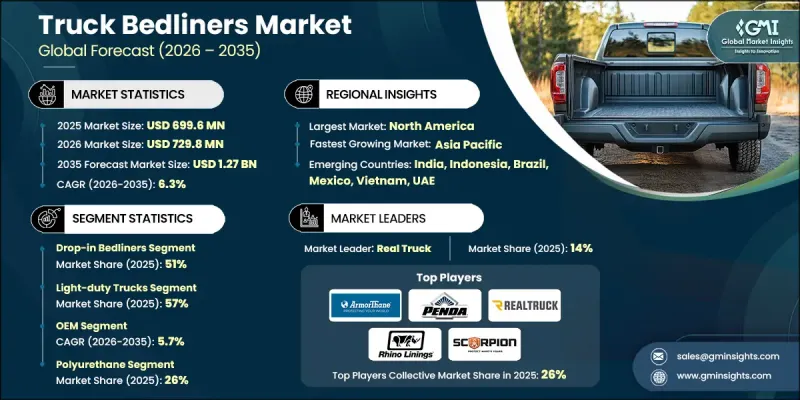

2025 年全球卡车货箱衬垫市场价值为 6.996 亿美元,预计到 2035 年将以 6.3% 的复合年增长率增长至 12.7 亿美元。

皮卡车在全球范围内,无论是个人用途、商业用途或休閒用途,其日益普及都推动了市场成长。车辆保有量的持续成长不断强化了皮卡车文化,并直接刺激了对货箱保护解决方案的需求。货箱衬垫被广泛视为必不可少的配件,有助于保持车辆良好状态,并有助于长期保值。OEM)和售后市场参与者均受益于更长的更换週期以及用户群体对个人化客製化的不断增长的需求。消费者越来越将皮卡车视为多功能资产,因此在提升车辆耐用性、外观和实用性的配件上投入更多资金。货箱衬垫仍然是最实用且经济实惠的升级选项之一,因此广受欢迎。配件零售网路的成长、DIY 普及以及产品供应的扩展进一步刺激了需求,尤其是在已开发市场和快速发展的城市地区。商业车队营运商也做出了重要贡献,因为耐用的货箱保护有助于延长车辆使用寿命并降低日常维护成本,从而巩固了货箱衬垫作为一项高性价比投资的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 6.996亿美元 |

| 预测值 | 12.7亿美元 |

| 复合年增长率 | 6.3% |

皮卡车主不断对车辆进行个人化改装,以提升车辆的功能性和视觉吸引力。货箱衬垫因其卓越的防护性能和性价比而日益受到青睐。更便利的安装方式以及消费者对自助安装解决方案日益增长的信心,推动了售后市场渗透率的提升。商业营运商优先考虑耐用性,以减少与磨损相关的费用,从而确保了车队应用领域对货箱衬垫的稳定需求。

轻型卡车市场在2025年占据57%的市场份额,预计2026年至2035年间将以7%的复合年增长率成长。该细分市场之所以领先,主要得益于较高的个人拥有率、配件支出增加、强劲的客製化趋势以及电动皮卡车型的日益普及。此外,大规模生产能力和遍布全球的持续高货箱衬垫安装率也进一步巩固了这些因素。

预计2026年至2035年间, OEM (原厂配套)细分市场将以5.7%的复合年增长率成长。 OEM安装的货箱衬垫可提供一体成型安装、保固衔接以及为买家带来的更多便利。轻型卡车产量不断增长、高端原厂配件供应充足以及与供应商合作伙伴为满足品质和监管标准而不断扩大的合作,都将推动该细分市场的成长。

预计到2025年,美国卡车货箱衬垫市场规模将达到2.619亿美元。美国市场对耐用涂层解决方案的需求持续成长,尤其针对那些能够承受高强度使用的场合。皮卡车的普及、车队客製化程度的提高以及消费者对车辆个人化的日益重视,都推动了市场成长。製造商正积极回应市场需求,研发出与原厂车辆设计在视觉上相协调,同时又能维持性能耐久性的涂层产品。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 皮卡车销量上升

- 售后客製化市场成长

- 车辆防护的需求不断增长

- 喷涂涂料技术的进步

- 产业陷阱与挑战

- 原料成本波动

- 来自低成本替代品的竞争

- 市场机会

- 新兴皮卡市场的扩张

- OEM合作伙伴关係整合

- 开发环保涂料

- 商业车队改装业务成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 全球的

- 环境法规

- 排放控制要求

- 废弃物处理条例

- 职业健康与安全标准

- 国际劳工组织标准

- 汽车OEM标准

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 全球的

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 聚氨酯化学与配方

- 聚脲化学与配方

- 混合系统技术

- 应用设备技术

- 新兴技术

- 自修復涂层技术

- 奈米科技增强涂层

- 抗菌和抗微生物溶液

- 变色和热致变色涂层

- 当前技术趋势

- 定价分析

- 专业安装价格

- 高级服务定价

- DIY产品定价

- 滚珠式套装定价分析

- 床垫和地毯价格

- 嵌入式衬垫定价

- 电子商务与零售定价

- OEM安装价格

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 製造成本结构

- 应用及安装费用

- 分销及通路成本

- 行销和销售成本

- 按细分市场进行获利能力分析

- 成本优化策略

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 消费者行为和客製化趋势

- 客製化市场概览

- 颜色和表面处理的偏好

- 纹理和表面定制

- 功能客製化

- 按人口统计特征分類的个人化趋势

- 新兴的客製化技术

- 区域购买偏好和使用模式

- 商业与个人区隔市场组合

- 按地区分類的使用模式分析

- 应用频率和维护

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依类型划分,2022-2035年

- 嵌入式货箱衬垫

- 喷涂式货箱衬里

- 床垫和地毯

- 滚涂/刷涂式货箱衬里

- 混合型/客製化床衬

第六章:市场估算与预测:依材料划分,2022-2035年

- 聚氨酯

- 聚脲

- 橡皮

- 复合/聚乙烯

- 环氧树脂配方

第七章:市场估价与预测:依车辆类型划分,2022-2035年

- 轻型卡车

- 中型卡车

- 重型卡车

第八章:市场估算与预测:依销售管道划分,2022-2035年

- OEM

- 售后市场

- 线上零售

- 经销商

第九章:市场估算与预测:依最终用途划分,2022-2035年

- 汽车

- 军事与国防

- 能源(石油、天然气和采矿)

- 建造

- 农业

- 零售与电子商务

- 其他的

- 售后市场

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 波兰

- 罗马尼亚

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球公司

- ArmorThane

- BASF

- Dee Zee

- DualLiner

- Husky Liners

- LINE-X

- PPG Industries

- Rhino Linings

- Rugged Liner

- Ultimate Linings

- U-POL (RAPTOR)

- WeatherTech

- 区域玩家

- Aeroklas

- Armadillo Liners

- BedRug

- Bullet Liner

- Lund International

- OKULEN

- Penda Corporation

- Scorpion Protective Coatings

- SPEEDLINER

- Tuff Liner

- Vortex Liners

- 新兴玩家

- AL's Liner

- Durabak

- Herculiner

- Iron Armor

- POR-15

The Global Truck Bedliners Market was valued at USD 699.6 million in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 1.27 billion by 2035.

Market momentum is driven by the rising global adoption of pickup trucks across personal, commercial, and recreational use. Increasing vehicle ownership continues to strengthen pickup truck culture, which directly fuels demand for protective cargo bed solutions. Bedliners are widely viewed as essential accessories that help preserve vehicle condition while supporting long-term value retention. Both OEM and aftermarket participants benefit from longer replacement timelines and a steady shift toward customization across user segments. Consumers increasingly view pickup trucks as multifunctional assets, prompting higher spending on accessories that enhance durability, appearance, and usability. Bedliners remain among the most practical and affordable upgrades, supporting their widespread acceptance. Growth in accessory retail networks, expanding do-it-yourself adoption, and broader product availability further stimulate demand, particularly in developed markets and fast-growing urban regions. Commercial fleet operators also contribute significantly, as durable bed protection helps extend vehicle service life and reduce ongoing maintenance expenses, reinforcing bedliners as a cost-efficient investment.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $699.6 Million |

| Forecast Value | $1.27 Billion |

| CAGR | 6.3% |

Pickup owners continue to personalize their vehicles to improve both functionality and visual appeal. Bedliners are increasingly selected for their protective performance and value proposition. Easier installation options and growing consumer confidence in self-installation solutions support rising aftermarket penetration. Commercial operators prioritize durability to limit wear-related expenses, reinforcing steady demand across fleet applications.

The light-duty truck segment accounted for a 57% share in 2025 and is projected to grow at a CAGR of 7% between 2026 and 2035. This segment leads due to higher personal ownership rates, increased spending on accessories, strong customization trends, and the growing presence of electric pickup models. These factors are reinforced by large-scale production capabilities and consistently high bedliner attachment rates across a broad geographic footprint.

The OEM segment is expected to grow at a CAGR of 5.7% from 2026 to 2035. OEM-installed bedliners offer integrated fitment, warranty alignment, and added convenience for buyers. Segment growth is supported by rising light truck production volumes, premium factory-installed accessory offerings, and expanding collaboration with supplier partners to meet quality and regulatory standards.

US Truck Bedliners Market reached USD 261.9 million in 2025. Demand in the US continues to be shaped by preferences for durable coating solutions suited for intensive use. Growth is supported by high adoption of pickup trucks, increased fleet customization, and strong consumer focus on vehicle personalization. Manufacturers are responding with finishes designed to align visually with factory vehicle designs while maintaining performance durability.

Key companies active in the Global Truck Bedliners Market include LINE-X, WeatherTech, Rhino Linings, DualLiner, Truck Hero (BedRug), Rugged Liner, Penda Corporation (Pendaliner), Ultimate Linings, SPEEDLINER (Industrial Polymers), and Scorpion Protective Coatings. Companies in the Global Truck Bedliners Market strengthen their competitive position through product innovation, expanded distribution networks, and strategic partnerships. Manufacturers invest in advanced materials to improve durability, appearance, and environmental performance. Many players focus on expanding OEM relationships to secure factory-fitment opportunities while also enhancing aftermarket reach through specialized retailers and installer networks. Brand differentiation is reinforced through customization options, improved installation efficiency, and consistent product quality. Geographic expansion into high-growth regions supports volume gains, while marketing strategies emphasize durability, long-term cost savings, and vehicle value preservation. Continuous investment in manufacturing efficiency and customer support further helps companies defend market share and build long-term brand loyalty.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 Sales channel

- 2.2.6 End use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pickup truck sales

- 3.2.1.2 Growth in aftermarket customization

- 3.2.1.3 Increasing demand for vehicle protection

- 3.2.1.4 Advancements in spray-on coating materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatile raw material costs

- 3.2.2.2 Competition from low-cost alternatives

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging pickup markets

- 3.2.3.2 OEM partnership integration

- 3.2.3.3 Development of eco-friendly coatings

- 3.2.3.4 Growth in commercial fleet upfitting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 Environmental regulations

- 3.4.1.2 Emissions control requirements

- 3.4.1.3 Waste disposal regulations

- 3.4.1.4 Occupational health & safety standards

- 3.4.1.5 International labor organization standards

- 3.4.1.6 Automotive OEM standards

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Polyurethane chemistry & formulations

- 3.7.1.2 Polyurea chemistry & formulations

- 3.7.1.3 Hybrid system technologies

- 3.7.1.4 Application equipment technology

- 3.7.2 Emerging technologies

- 3.7.2.1 Self-healing coating technologies

- 3.7.2.2 Nano-technology enhanced coatings

- 3.7.2.3 Antimicrobial & antibacterial solutions

- 3.7.2.4 Color-changing & thermochromic finishes

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1.1 Professional installation pricing

- 3.8.1.2 Premium service pricing

- 3.8.1.3 DIY product pricing

- 3.8.1.4 Roll-on kit pricing analysis

- 3.8.1.5 Bed mat & rug pricing

- 3.8.1.6 Drop-in liner pricing

- 3.8.1.7 E-commerce vs retail pricing

- 3.8.1.8 OEM factory-install pricing

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost structure

- 3.10.2 Application & installation costs

- 3.10.3 Distribution & channel costs

- 3.10.4 Marketing & sales costs

- 3.10.5 Profitability analysis by segment

- 3.10.6 Cost optimization strategies

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer behavior and customization trends

- 3.13.1 Customization market overview

- 3.13.2 Color & finish preferences

- 3.13.3 Texture & surface customization

- 3.13.4 Functional customization

- 3.13.5 Personalization trends by demographics

- 3.13.6 Emerging customization technologies

- 3.14 Regional purchasing preferences & usage patterns

- 3.14.1 Commercial vs personal segment mix

- 3.14.2 Usage pattern analysis by region

- 3.14.3 Application frequency & maintenance

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Drop-in bedliners

- 5.3 Spray-on bedliners

- 5.4 Bed mats & rugs

- 5.5 Roll-on/brush-on bedliners

- 5.6 Hybrid/custom-fitted bedliners

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Polyurethane

- 6.3 Polyurea

- 6.4 Rubber

- 6.5 Composite/polyethylene

- 6.6 Epoxy-based formulations

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Light-duty trucks

- 7.3 Medium-duty trucks

- 7.4 Heavy-duty trucks

Chapter 8 Market Estimates & Forecast, By Sales channel, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

- 8.4 Online Retail

- 8.5 Dealerships

Chapter 9 Market Estimates & Forecast, By End use, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Military & defense

- 9.4 Energy (Oil, Gas, & Mining)

- 9.5 Construction

- 9.6 Agriculture

- 9.7 Retail & e-commerce

- 9.8 Others

- 9.9 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 ArmorThane

- 11.1.2 BASF

- 11.1.3 Dee Zee

- 11.1.4 DualLiner

- 11.1.5 Husky Liners

- 11.1.6 LINE-X

- 11.1.7 PPG Industries

- 11.1.8 Rhino Linings

- 11.1.9 Rugged Liner

- 11.1.10 Ultimate Linings

- 11.1.11 U-POL (RAPTOR)

- 11.1.12 WeatherTech

- 11.2 Regional players

- 11.2.1 Aeroklas

- 11.2.2 Armadillo Liners

- 11.2.3 BedRug

- 11.2.4 Bullet Liner

- 11.2.5 Lund International

- 11.2.6 OKULEN

- 11.2.7 Penda Corporation

- 11.2.8 Scorpion Protective Coatings

- 11.2.9 SPEEDLINER

- 11.2.10 Tuff Liner

- 11.2.11 Vortex Liners

- 11.3 Emerging players

- 11.3.1 AL’s Liner

- 11.3.2 Durabak

- 11.3.3 Herculiner

- 11.3.4 Iron Armor

- 11.3.5 POR-15