|

市场调查报告书

商品编码

1892798

窗帘市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Window Coverings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

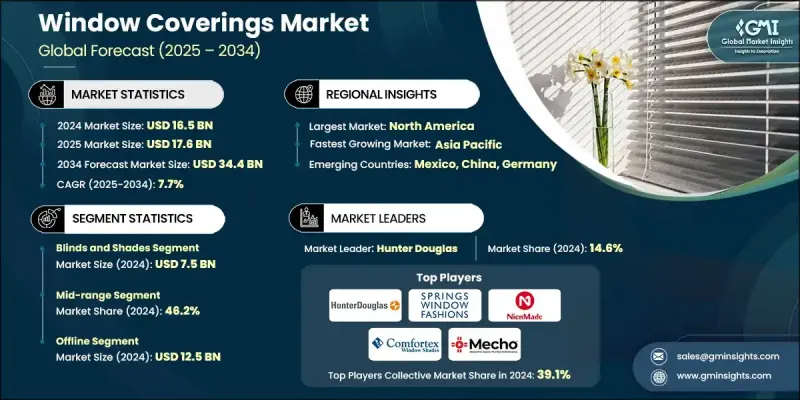

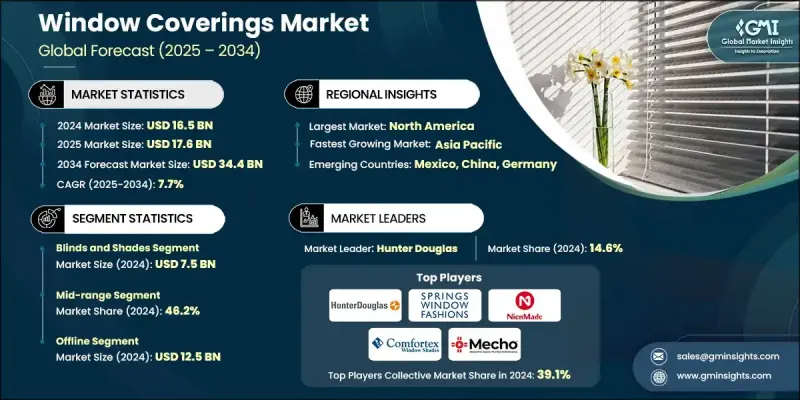

2024 年全球窗帘市场价值为 165 亿美元,预计到 2034 年将以 7.7% 的复合年增长率增长至 344 亿美元。

互联生活和智慧家庭自动化的日益普及推动了窗帘产业的成长,并不断重塑消费者的期望。随着智慧音箱和智慧家庭中心逐渐成为家庭标配,电动百叶窗和遮光帘也逐渐演变为触手可及的日常解决方案。这些产品提供远端操控、自订日程安排和更完善的安全功能,有助于营造有人居住的假象。物联网功能的整合还使窗帘能够与暖通空调和照明系统通信,从而提高能源效率并简化家居管理。随着人们越来越重视节能减排,消费者倾向于选择能够调节室内温度的高性能窗帘。例如,蜂巢帘等产品因其隔热结构而广受欢迎,成为节能家居设计的重要组成部分。随着全球对永续生活和智慧自动化的认知不断提高,窗帘产业在住宅和商业市场都持续保持着稳定成长的势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 165亿美元 |

| 预测值 | 344亿美元 |

| 复合年增长率 | 7.7% |

2024年,百叶窗和遮光帘市场规模达到75亿美元,凭藉其适应性和广泛的设计选择,继续保持领先地位。它们在多种室内风格和功能需求中的强大吸引力,持续巩固其市场主导地位。

2024年,中檔产品市占率占比46.2%,仍是最大的价格区间。该细分市场吸引那些追求兼具耐用性、时尚感和先进功能,但价格却不至于过高的消费者。越来越多的中檔产品开始提供诸如电动控制、更优质的隔热材料和更强的紫外线防护等功能,使其成为兼顾实用性和时尚感的消费者的理想选择。

2024年,美国窗帘市场占据71.2%的市场份额,预计在2025年至2034年期间创造38亿美元的收入。其领先地位得益于蓬勃发展的家居装修文化和智慧家居技术的广泛应用。该地区的消费者持续青睐符合现代生活方式和永续发展概念的自动化节能窗帘解决方案。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 智慧家庭生态系统的快速整合

- 住宅改造与都市化復兴

- 节能解决方案的需求

- 陷阱与挑战

- 原物料价格波动

- 严格的安全法规

- 机会

- 拓展至环保及可回收材料领域

- 汽车民主化

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 百叶窗和遮光帘

- 窗帘和帷幔

- 百叶窗

- 其他的

第六章:市场估算与预测:依材料划分,2021-2034年

- 自然的

- 合成的

第七章:市场估计与预测:依技术划分,2021-2034年

- 手册涵盖

- 智慧保护套/自动保护套

第八章:市场估算与预测:依价格区间划分,2021-2034年

- 经济

- 中檔

- 优质的

第九章:市场估算与预测:依不透明度程度划分,2021-2034年

- 停电

- 房间遮光

- 光线过滤

- 透明/轻薄

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 住宅

- 商业的

第十一章:市场估价与预测:依配销通路划分,2021-2034年

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 零售商店

- 其他的

第十二章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Bombay Dyeing & Manufacturing Co Ltd.

- Ching Feng Home Fashions Co.

- Comfortex Window Fashions

- Coulisse BV

- Griesser AG

- Hunter Douglas Inc.

- Insolroll Window Shading Systems

- Lafayette Interior Fashions

- MechoShade Systems, LLC

- Nien Made Enterprise Co. Ltd

- Schenker Storen AG

- SKANDIA WINDOW FASHIONS, INC.

- Springs Window Fashions

- TOSO CO. LTD

- Welspun

The Global Window Coverings Market was valued at USD 16.5 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 34.4 billion by 2034.

Growth is fueled by rising interest in connected living and smart home automation, which continues to reshape consumer expectations. As smart speakers and home automation hubs become household norms, motorized blinds and shades are evolving into accessible everyday solutions. These products offer remote operation, customizable schedules, and improved safety features that help create the appearance of an occupied home. The integration of IoT capabilities also enables window coverings to communicate with HVAC and lighting systems, contributing to enhanced energy efficiency and more streamlined home management. With increasing emphasis on reducing energy consumption, consumers are gravitating toward high-performance coverings designed to regulate indoor temperatures. Products such as cellular shades are gaining popularity due to their insulating structure, making them a key component of energy-conscious home design. As global awareness of sustainable living and smart automation grows, the window coverings industry continues to experience steady momentum across both residential and commercial markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 Billion |

| Forecast Value | $34.4 Billion |

| CAGR | 7.7% |

The blinds and shades segment generated USD 7.5 billion in 2024, maintaining its leadership position due to its adaptability and broad design range. Their strong appeal across multiple interior styles and functionality needs continues to reinforce their dominant market presence.

The mid-range segment accounted for a 46.2% share in 2024 and remains the largest pricing category. This segment appeals to consumers seeking products that blend durability, style, and advanced features without premium-level pricing. Increasingly, mid-tier offerings include options such as motorized control, improved insulation materials, and enhanced UV protection, making them an attractive middle ground for practical and style-focused buyers.

U.S. Window Coverings Market held 71.2% share in 2024, generating USD 3.8 billion during 2025-2034. Its leadership is supported by a robust home renovation culture and widespread adoption of smart home technologies. Consumers across the region continue to favor automated and energy-efficient window solutions that align with modern lifestyle expectations and sustainability priorities.

Key companies active in the Global Window Coverings Market include Bombay Dyeing & Manufacturing Co Ltd., Ching Feng Home Fashions Co., Comfortex Window Fashions, Coulisse B.V., Griesser AG, Hunter Douglas Inc., MechoShade Systems, LLC, Lafayette Interior Fashions, Insolroll Window Shading Systems, Nien Made Enterprise Co. Ltd, Schenker Storen AG, SKANDIA WINDOW FASHIONS, INC., Springs Window Fashions, TOSO CO. LTD, and Welspun.

Companies in the Global Window Coverings Market are strengthening their presence by expanding their portfolios with smart, app-enabled, and motorized products that align with growing home automation trends. Many manufacturers are investing in energy-efficient fabrics, sustainable materials, and customizable design options to appeal to environmentally conscious and style-oriented consumers. Partnerships with smart home technology providers, along with e-commerce expansion, allow brands to reach wider audiences. Firms are also prioritizing automated production techniques and advanced material engineering to enhance product durability and reduce lead times. Marketing strategies focused on personalization, virtual visualization tools, and direct-to-consumer channels further help companies capture market share in a rapidly evolving home decor landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Technology

- 2.2.5 Price range

- 2.2.6 Opacity level

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid integration of smart home ecosystems

- 3.2.1.2 Resurgence in residential renovation and urbanization

- 3.2.1.3 Demand for energy-efficient solutions

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Stringent safety regulations

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 democratization of motorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behaviour

- 3.12.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Blinds and shades

- 5.3 Curtains and drapes

- 5.4 Shutters

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual covers

- 7.3 Smart covers/automatic covers

Chapter 8 Market Estimates and Forecast, By Price Range, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By Opacity level, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Blackout

- 9.3 Room darkening

- 9.4 Light filtering

- 9.5 Sheer/transparent

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Retail stores

- 11.3.3 Others

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Bombay Dyeing & Manufacturing Co Ltd.

- 13.2 Ching Feng Home Fashions Co.

- 13.3 Comfortex Window Fashions

- 13.4 Coulisse B.V.

- 13.5 Griesser AG

- 13.6 Hunter Douglas Inc.

- 13.7 Insolroll Window Shading Systems

- 13.8 Lafayette Interior Fashions

- 13.9 MechoShade Systems, LLC

- 13.10 Nien Made Enterprise Co. Ltd

- 13.11 Schenker Storen AG

- 13.12 SKANDIA WINDOW FASHIONS, INC.

- 13.13 Springs Window Fashions

- 13.14 TOSO CO. LTD

- 13.15 Welspun