|

市场调查报告书

商品编码

1892799

乙氧基化物市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Ethoxylates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

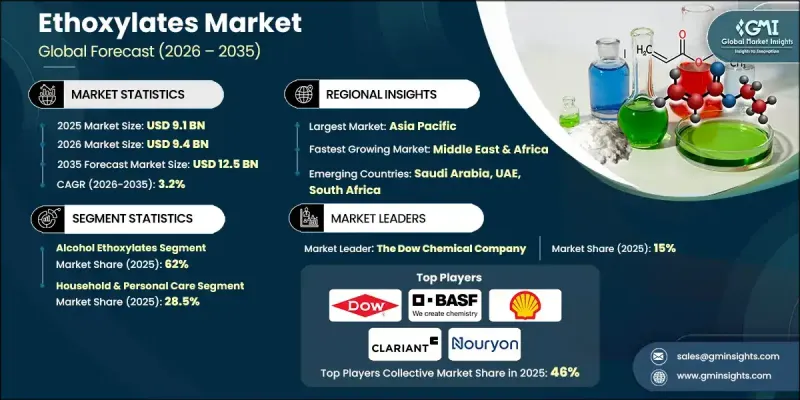

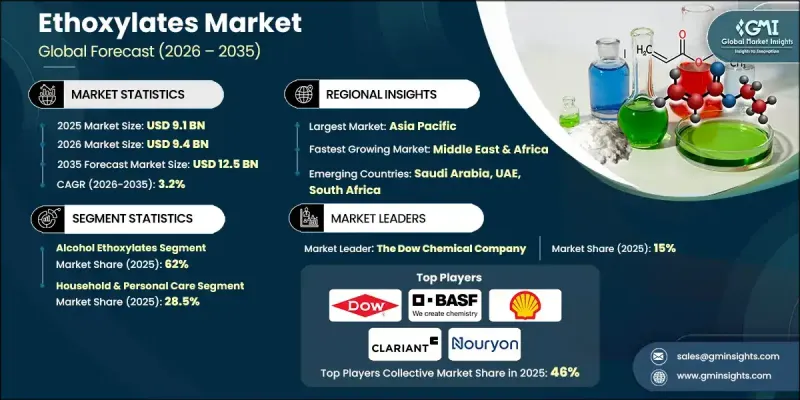

2025 年全球乙氧基化物市场价值为 91 亿美元,预计到 2035 年将以 3.2% 的复合年增长率增长至 125 亿美元。

乙氧基化物产业在广泛的工业和消费应用领域中发挥关键作用。市场评估包括生产趋势、定价模式、区域消费以及多个产品系列和应用领域的需求。其成长与个人护理、农业化学品和工业製造业的扩张密切相关,并得益于更广泛的化学工业的创新。由于亚太、北美和欧洲拥有成熟的化学品製造基地、农业活动和强大的消费品产业,其分销高度集中于这些地区。中东、非洲和拉丁美洲等新兴市场也为成长做出了贡献,因为当地生产规模的扩大以满足不断增长的消费需求,并逐步实现全球供应和消费的多元化。醇类乙氧基化物因其性能高效、符合法规要求和成本优势而占据主导地位,而特种级产品则因其技术规格而享有更高的价格。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 91亿美元 |

| 预测值 | 125亿美元 |

| 复合年增长率 | 3.2% |

2025年,醇类乙氧基化物市占率达到62%,预计2035年将以2.7%的复合年增长率成长。由于其优异的乳化和洗涤性能,醇类乙氧基化物是大多数清洁和个人护理配方中的关键成分。脂肪胺类乙氧基化物在农业化学品应用中仍然至关重要,可增强农药的扩散和渗透。此外,甲酯类乙氧基化物正逐渐成为一种永续的替代品,兼具温和的性质(适用于化妆品和工业用途)和生态优势。

预计到2025年,家用和个人护理应用领域将占据28.5%的市场份额,并预计2026年至2035年将以2.6%的复合年增长率成长。乙氧基化物对于洗髮精、洁面乳和护肤品的乳化、清洁和配方稳定性至关重要。在农业化学品领域,乙氧基化物作为润湿剂,可提高精准农业中农药的功效。在上游油气领域,它们被用作钻井液添加剂和破乳剂,从而提高萃取过程的运作可靠性。

预计到2025年,北美乙氧基化物市场将占据19.7%的份额,并正快速成长。先进的化学品製造能力和严格的永续发展法规使该地区成为战略成长中心。对环保配方和特种化学品创新产品的需求,为面向工业应用的高性能乙氧基化物提供了发展机会。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对环保表面活性剂的需求不断增长

- 消费者偏好转变

- 品牌永续发展承诺

- 产业陷阱与挑战

- 关于APE/NPE的环境问题

- 水生毒性

- 市场机会

- 生物基乙氧基化物市场扩张

- 特种乙氧基化物开发

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2022-2035年

- 醇醚

- 天然醇乙氧基化物

- 合成醇乙氧基化物

- 线性醇乙氧基化物(LAE)

- 支链醇乙氧基化物(BAE)

- 脂肪胺乙氧基化物

- 脂肪酸乙氧基化物

- 甲基酯乙氧基化物(MEE)

- 甘油酯乙氧基化物

- 烷基酚聚氧乙烯醚(APEs)

- 壬基酚聚氧乙烯醚(NPEs)

- 辛基酚聚氧乙烯醚(OPEs)

- 其他的

- 碳酸酯乙氧基化物(CO2基)

- 酵素法生成的乙氧基化物

- 高纯度药用级乙氧基化物

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 居家及个人护理

- 洗衣液和洗碗液

- 工业及机构清洁

- 个人护理

- 农业化学品

- 除草剂

- 杀菌剂

- 杀虫剂

- 肥料和微量元素

- 石油和天然气

- 提高石油采收率(EOR)

- 消泡剂和润湿剂

- 润滑剂和乳化剂

- 破乳作用

- 製药

- 药物溶解与递送

- 生物製剂和生物相似药

- 辅料和乳化剂

- 医疗器械灭菌(环氧乙烷相关)

- 纺织加工

- 擦洗和润湿

- 染色和整理

- 油漆和涂料

- 乳液聚合

- 润湿剂和分散剂

- 保护涂层

- 建筑涂料

- 工业涂料

- 纸浆和造纸

- 脱墨剂

- 分散剂

- 消泡剂

- 皮革加工

- 其他的

第七章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- BASF SE

- Royal Dutch Shell PLC

- The Dow Chemical Company

- Clariant AG

- Nouryon

- Huntsman International LLC

- Sasol Limited

- Stepan Company

- Evonik Industries AG

- Solvay SA

- INEOS Group Limited

- Croda International PLC

- Arkema SA

- SABIC (Saudi Basic Industries Corporation)

The Global Ethoxylates Market was valued at USD 9.1 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 12.5 billion by 2035.

The ethoxylates industry plays a pivotal role across a wide range of industrial and consumer applications. Market evaluation includes production trends, pricing patterns, regional consumption, and demand across multiple product families and applications. Growth is closely aligned with the expansion of personal care, agrochemical, and industrial manufacturing sectors, underpinned by innovations in the broader chemicals industry. Distribution is highly concentrated in Asia-Pacific, North America, and Europe due to established chemical manufacturing bases, agricultural activity, and robust consumer goods industries. Emerging markets in the Middle East, Africa, and Latin America are contributing to growth as domestic production scales up to meet increasing consumer demand, gradually diversifying global supply and consumption. Alcohol ethoxylates dominate due to performance efficiency, regulatory compliance, and cost advantages, while specialty grades command premium pricing for technical specifications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.1 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 3.2% |

The alcohol ethoxylates segment held a 62% share in 2025 and is projected to grow at a CAGR of 2.7% through 2035. They serve as key ingredients in most cleaning and personal care formulations due to their excellent emulsifying and detergent properties. Fatty amine ethoxylates remain essential in agrochemical applications for enhancing pesticide spreading and penetration. Additionally, methyl ester ethoxylates are emerging as a sustainable alternative, combining mildness for cosmetic and industrial uses with ecological advantages.

The household and personal care applications segment held a 28.5% share in 2025, with expected growth at a CAGR of 2.6% from 2026 to 2035. Ethoxylates are critical for emulsification, cleansing, and formulation stability in shampoos, cleansers, and skincare products. In agrochemicals, ethoxylates act as wetting agents that improve pesticide efficacy in precision farming. In upstream oil and gas, they are utilized as additives in drilling fluids and demulsifiers, enhancing operational reliability in extraction processes.

North America Ethoxylates Market accounted for a 19.7% share in 2025 and is expanding rapidly. Advanced chemical manufacturing capabilities and strong sustainability regulations make the region a strategic growth hub. Demand for environmentally compliant formulations and specialty chemical innovations provides opportunities for high-performance ethoxylates targeting industrial applications.

Key players in the Global Ethoxylates Market include BASF SE, Arkema SA, Croda International PLC, INEOS Group Limited, Clariant AG, The Dow Chemical Company, Evonik Industries AG, Huntsman International LLC, Nouryon, Royal Dutch Shell PLC, Sasol Limited, Solvay SA, and Stepan Company. Companies in the Global Ethoxylates Market are strengthening their position through multiple strategies. They are investing in research and development to create high-performance and sustainable formulations, expanding production facilities in strategic regions to reduce lead times, and diversifying product portfolios to meet sector-specific needs. Partnerships with end-user industries and distributors enhance market reach, while a focus on regulatory compliance and eco-friendly innovations ensures long-term competitiveness. Firms are also leveraging digitalization and advanced analytics for supply chain optimization and cost efficiency, ensuring timely delivery and improved customer satisfaction across industrial and consumer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for eco-friendly surfactants

- 3.2.1.2 Consumer preference shift

- 3.2.1.3 Brand sustainability commitments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental concerns regarding APEs/NPEs

- 3.2.2.2 Aquatic toxicity

- 3.2.3 Market opportunities

- 3.2.3.1 Bio-based ethoxylates market expansion

- 3.2.3.2 Specialty ethoxylates development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcohol ethoxylates

- 5.2.1 Natural alcohol ethoxylates

- 5.2.2 Synthetic alcohol ethoxylates

- 5.2.3 Linear alcohol ethoxylates (LAE)

- 5.2.4 Branched alcohol ethoxylates (BAE)

- 5.3 Fatty amine ethoxylates

- 5.4 Fatty acid ethoxylates

- 5.5 Methyl ester ethoxylates (MEE)

- 5.6 Glyceride ethoxylates

- 5.7 Alkylphenol ethoxylates (APEs)

- 5.7.1 Nonylphenol ethoxylates (NPEs)

- 5.7.2 Octylphenol ethoxylates (OPEs)

- 5.8 Others

- 5.8.1 Carbonate ethoxylates (CO2-based)

- 5.8.2 Enzymatically produced ethoxylates

- 5.8.3 High-Purity pharmaceutical-grade ethoxylates

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Household & personal care

- 6.2.1 Laundry & dishwashing detergent

- 6.2.2 Industrial & institutional cleaning

- 6.2.3 Personal care

- 6.3 Agrochemicals

- 6.3.1 Herbicides

- 6.3.2 Fungicides

- 6.3.3 Insecticides

- 6.3.4 Fertilizers & micronutrients

- 6.4 Oil & gas

- 6.4.1 Enhanced oil recovery (EOR)

- 6.4.2 Foam control & wetting agents

- 6.4.3 Lubricants & emulsifiers

- 6.4.4 Demulsification

- 6.5 Pharmaceuticals

- 6.5.1 Drug solubilization & delivery

- 6.5.2 Biologics & biosimilars

- 6.5.3 Excipients & emulsifiers

- 6.5.4 Medical device sterilization (EtO-related)

- 6.6 Textile processing

- 6.6.1 Scouring & wetting

- 6.6.2 Dyeing & finishing

- 6.7 Paints & coatings

- 6.7.1 Emulsion polymerization

- 6.7.2 Wetting & dispersing agents

- 6.7.3 Protective coatings

- 6.7.4 Architectural coatings

- 6.7.5 Industrial coatings

- 6.8 Pulp & paper

- 6.8.1 Deinking agents

- 6.8.2 Dispersing agents

- 6.8.3 Defoamers

- 6.9 Leather processing

- 6.10 Others

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 BASF SE

- 8.2 Royal Dutch Shell PLC

- 8.3 The Dow Chemical Company

- 8.4 Clariant AG

- 8.5 Nouryon

- 8.6 Huntsman International LLC

- 8.7 Sasol Limited

- 8.8 Stepan Company

- 8.9 Evonik Industries AG

- 8.10 Solvay SA

- 8.11 INEOS Group Limited

- 8.12 Croda International PLC

- 8.13 Arkema SA

- 8.14 SABIC (Saudi Basic Industries Corporation)