|

市场调查报告书

商品编码

1892801

儿童安全座椅市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Child Safety Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

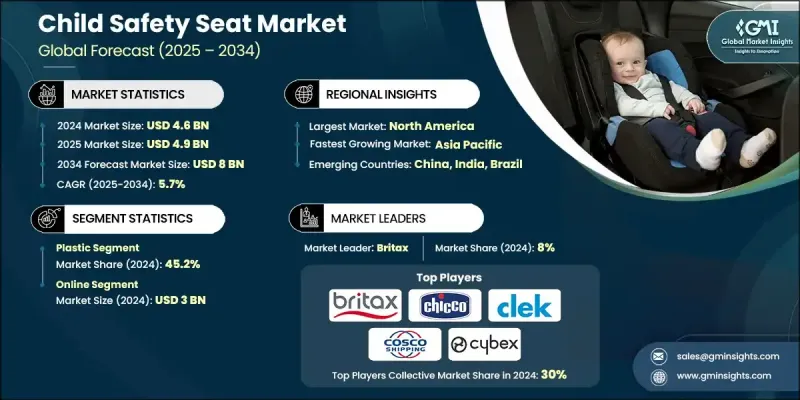

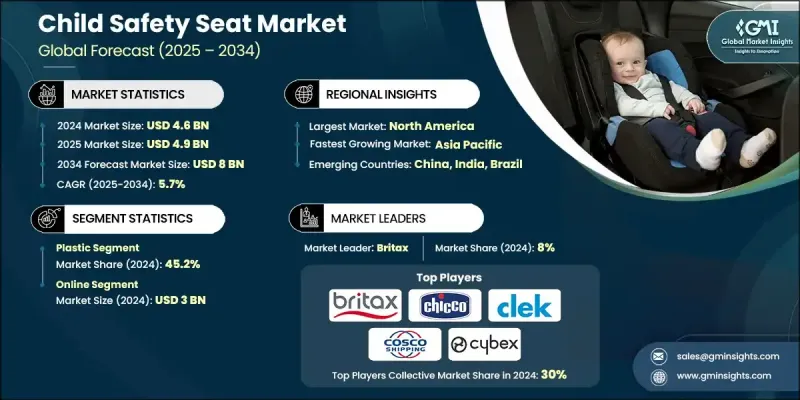

2024 年全球儿童安全座椅市场价值为 46 亿美元,预计到 2034 年将以 5.7% 的复合年增长率增长至 80 亿美元。

政府法规和法律强制措施在推动儿童安全座椅市场发展方面发挥关键作用。世界各地的监管机构都已颁布严格的法律,要求儿童必须根据年龄和体重使用合适的儿童安全座椅。这些法规旨在透过确保儿童在旅行过程中使用正确的约束系统,减少儿童乘客的伤亡事故。执法措施和对违规行为的处罚提高了儿童安全座椅的普及率,尤其是在已开发地区。家长对儿童安全的日益重视也进一步促进了市场成长,因为监护人越来越认识到使用认证安全座椅的重要性。儿童安全标准和法规的不断更新刺激了对符合标准产品的需求。此外,消费者对紧凑、易用且兼顾舒适性的创新设计和增强保护性能的产品的需求也支撑着市场发展。这些因素共同推动了全球儿童安全座椅市场的稳定成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 80亿美元 |

| 复合年增长率 | 5.7% |

2024年,线上销售额达30亿美元。电子商务通路因其便利性、丰富的产品选择以及製造商提供的配置、安装指导和持续维护支援而备受青睐。

由于塑胶具有轻盈、耐用性和成本效益高等优点,预计到2024年,塑胶产业将占据45.2%的市场份额。先进聚合物的应用日益广泛,旨在提高抗衝击性并减轻重量。

2024年,美国儿童安全座椅市场占84.5%的份额,创造了14亿美元的收入。北美市场持续保持强劲成长势头,这得益于先进的物流网络、消费者对技术的广泛接受,以及加州等州政府为推广智慧整合式儿童约束系统而製定的强制性规定。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 严格执行儿童安全法规

- 提高家长对儿童安全的意识和关注度

- 智慧座椅的技术集成

- 产业陷阱与挑战

- 高昂的初始成本和认证座椅系统

- 消费者困惑与安装差距

- 机会

- 新兴经济体的成长。

- 开发轻量化和电商优化座椅

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 可转换座椅

- 增高座椅

- 组合座位

- 一体式座椅

第六章:市场估算与预测:依类型划分,2021-2034年

- 后向座椅

- 前向座椅

第七章:市场估计与预测:依材料划分,2021-2034年

- 塑胶

- 泡棉

- 钢

- 其他(丙烯等)

第八章:市场估算与预测:依年龄组别划分,2021-2034年

- 6个月以下

- 6-12个月

- 12-24个月

- 超过 24 个月

第九章:市场估计与预测:依价格划分,2021-2034年

- 低的

- 中等的

- 高的

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 交通与旅行

- 家

- 游戏小组机构

- 卫生保健

- 游乐园

- HoReCa

- 其他(露营、购物车等)

第十一章:市场估价与预测:依配销通路划分,2021-2034年

- 在线的

- 离线

第十二章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- Baby Jogger

- Britax

- Chicco

- Clek

- Cosco

- Cybex

- Diono

- Evenflo

- Graco

- Joie

- Kidsembrace

- Maxi-Cosi

- Nuna

- Peg Perego

- Recaro

- Safety 1st

The Global Child Safety Seat Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 8 billion by 2034.

Government regulations and legal mandates play a pivotal role in driving this market, as authorities worldwide have introduced stringent laws that require children to be secured in appropriate car seats based on age and weight categories. These regulations aim to reduce injuries and fatalities among young passengers by ensuring proper restraint systems during travel. Enforcement measures and penalties for non-compliance have boosted adoption rates, particularly in developed regions. Rising parental awareness regarding child safety further contributes to market growth, as caregivers increasingly recognize the importance of using certified safety seats. Continuous updates to child safety standards and regulations encourage demand for compliant products. The market is further supported by the search for compact, user-friendly designs and innovations that enhance protection without compromising comfort. These factors collectively maintain a steady upward trajectory in the global child safety seat market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8 Billion |

| CAGR | 5.7% |

In 2024, the online sales segment generated USD 3 billion. E-commerce channels are preferred due to the convenience, wide product selection, and manufacturer support for configurations, installation guidance, and ongoing maintenance.

Plastic segment held 45.2% share in 2024, due to its lightweight, durability, and cost efficiency. Advanced polymers are increasingly utilized to improve impact resistance while reducing weight.

U.S. Child Safety Seat Market held an 84.5% share and generated USD 1.4 billion in 2024. North America continues to show strong growth, supported by advanced logistics networks, high consumer adoption of technology, and government mandates in states such as California that promote smart and integrated child restraint systems.

Key players in the Global Child Safety Seat Market include Graco, Chicco, Clek, Diono, Britax, Nuna, Cybex, Peg Perego, Cosco, Joie, Recaro, Baby Jogger, Evenflo, Kidsembrace, Maxi-Cosi, and Safety 1st. Companies in the Child Safety Seat Market focus on product innovation, including lightweight, compact designs and advanced safety features to meet evolving regulatory standards and consumer expectations. Expanding e-commerce presence allows brands to reach a broader audience while offering personalized customer support and installation guidance. Partnerships with retailers, online marketplaces, and childcare providers enhance distribution channels and increase product visibility. Many manufacturers invest in marketing campaigns that emphasize safety certifications, durability, and ergonomic designs to strengthen brand trust. Adoption of advanced materials and smart technologies, such as sensor-integrated seats, helps differentiate offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Age group

- 2.2.5 Pricing

- 2.2.6 Material

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enforcement of stringent child safety regulation

- 3.2.1.2 Increased parental awareness and focus on child safety

- 3.2.1.3 Technological integration of smart seats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost and certified seat systems

- 3.2.2.2 Consumer confusion and installation gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging economies.

- 3.2.3.2 Development of lightweight and e-commerce optimized seats

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Convertible seats

- 5.3 Booster seats

- 5.4 Combination seats

- 5.5 All-in-one seats

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Rearward facing seats

- 6.3 Forward facing seats

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Foam

- 7.4 Steel

- 7.5 Others (propylene, etc.)

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 6 months

- 8.3 6-12 months

- 8.4 12-24 months

- 8.5 Above 24 months

Chapter 9 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Transport & travel

- 10.3 Home

- 10.4 Playgroup institutes

- 10.5 Healthcare

- 10.6 Amusement parks

- 10.7 HoReCa

- 10.8 Others (camping, shopping carts, etc.)

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.3 Offline

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Baby Jogger

- 13.2 Britax

- 13.3 Chicco

- 13.4 Clek

- 13.5 Cosco

- 13.6 Cybex

- 13.7 Diono

- 13.8 Evenflo

- 13.9 Graco

- 13.10 Joie

- 13.11 Kidsembrace

- 13.12 Maxi-Cosi

- 13.13 Nuna

- 13.14 Peg Perego

- 13.15 Recaro

- 13.16 Safety 1st