|

市场调查报告书

商品编码

1892819

前列腺癌诊断市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Prostate Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

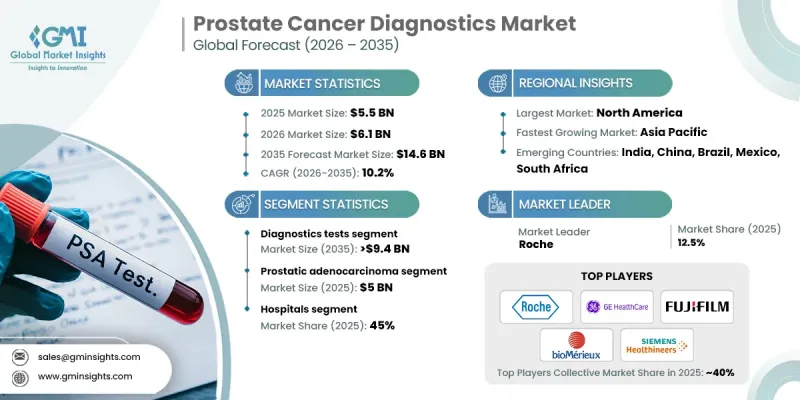

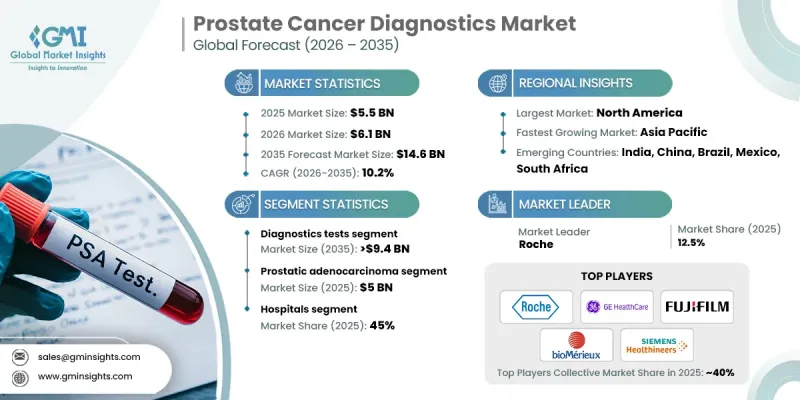

2025 年全球前列腺癌诊断市场价值为 55 亿美元,预计到 2035 年将以 10.2% 的复合年增长率增长至 146 亿美元。

这一增长得益于诊断技术的不断进步、全球前列腺癌负担的日益加重、公众意识的不断提高、筛检计画的不断扩展,以及男性人口的快速老化。前列腺癌诊断是指用于检测疾病、评估疾病进展和指导治疗决策的一系列全面的临床检测和医疗程序。这些诊断方法包括血液检测、先进的影像技术和组织分析方法,以支援疾病的准确识别和监测。近年来,诸如新一代定序、液基诊断方法、多参数影像和人工智慧辅助分析工具等技术的进步,显着提高了诊断的精确度,同时减少了不必要的干预。随着诊断路径向更精准、更微创的方向发展,以及对分子和基因组分析的日益依赖,整个行业持续受益,这些因素共同提高了早期检出率,并改善了医疗机构的临床决策。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 55亿美元 |

| 预测值 | 146亿美元 |

| 复合年增长率 | 10.2% |

到2025年,诊断测试领域将占据63.6%的市场。这一领先地位反映了筛检和基于生物标记的检测方法的日益普及、人们对早期检测的偏好不断增强以及非侵入性诊断方法的广泛接受。疾病盛行率的上升和患者意识的提高将继续推动对可靠、准确的检测解决方案的持续需求。

预计到2025年,医院业务将占前列腺癌诊断市场45%的份额,并在2025年至2035年间达到64亿美元。医院在前列腺癌诊断中仍然扮演着核心角色,因为它们在患者的初步评估、高级影像检查和确诊程序中发挥重要作用。整合的诊断能力支持在同一医疗机构内进行全面的疾病评估和分期。

预计到2025年,北美前列腺癌诊断市占率将达到40.4%。该地区强劲的市场表现得益于高发病率、完善的筛检体系和先进的医疗基础设施。设备齐全的诊断机构和早期检测措施持续推动该地区先进诊断技术的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 摄护腺癌发生率不断上升

- 影像和生物标记诊断技术的进步

- 提高公众意识和筛检力度

- 对微创诊断程序的需求日益增长

- 产业陷阱与挑战

- 先进诊断方式成本高昂

- 低收入和中等收入地区的可及性有限

- 市场机会

- 人工智慧诊断工具的扩展

- 个人化医疗的日益普及

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 报销方案

- 未来市场趋势

- 价值链分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依测试类型划分,2022-2035年

- 诊断测试

- 摄护腺特异性抗原

- 摄护腺切片

- 分子/基因组检测

- 其他诊断测试

- 影像检查

- 经直肠超音波(TRUS)

- 磁振造影

- CT扫描

- 其他影像学检查

第六章:市场估计与预测:依癌症类型划分,2022-2035年

- 摄护腺腺癌

- 小细胞癌

- 其他癌症类型

第七章:市场估算与预测:依最终用途划分,2022-2035年

- 医院

- 诊断实验室

- 癌症研究机构

- 其他最终用途

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott

- Beckman Coulter

- Becton, Dickinson and Company

- bioMerieux

- FUJIFILM

- GE HealthCare

- Glycanostics

- HEALGEN

- KOELIS

- Metamark Genetics

- Myriad Genetics

- OPKO Health

- PHILIPS

- Proteomedix

- Roche

- SIEMENS Healthineers

- Veracyte

The Global Prostate Cancer Diagnostics Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 10.2% to reach USD 14.6 billion by 2035.

This growth is driven by continuous progress in diagnostic technologies, the increasing global burden of prostate cancer, wider awareness initiatives, and expanding screening programs, along with a rapidly aging male population. Prostate cancer diagnostics refers to a comprehensive range of clinical tests and medical procedures used to detect the disease, assess its progression, and guide treatment decisions. These diagnostics include blood-based assessments, advanced imaging techniques, and tissue analysis methods that support accurate disease identification and monitoring. Recent technological advancements, such as next-generation sequencing, liquid-based diagnostic approaches, multiparametric imaging, and AI-supported analysis tools, have significantly enhanced diagnostic precision while reducing unnecessary interventions. The industry continues to benefit from a shift toward more accurate, less invasive diagnostic pathways and greater reliance on molecular and genomic profiling, which together are improving early detection rates and clinical decision-making across healthcare settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 10.2% |

The diagnostic tests segment held a 63.6% share in 2025. This leadership position reflects rising utilization of screening and biomarker-based tests, increased preference for early-stage detection, and broader acceptance of non-invasive diagnostic methods. Growing disease prevalence and improved patient awareness continue to drive consistent demand for reliable and accurate testing solutions.

The hospitals segment held a 45% share in 2025 and is expected to reach USD 6.4 billion during 2025-2035. Hospitals remain central to prostate cancer diagnosis due to their role in initial patient evaluation, advanced imaging, and confirmatory procedures. Integrated diagnostic capabilities support comprehensive disease assessment and staging within a single care setting.

North America Prostate Cancer Diagnostics Market held a 40.4% share in 2025. Strong regional performance is supported by high disease incidence, established screening practices, and advanced healthcare infrastructure. The presence of well-equipped diagnostic facilities and early detection initiatives continues to drive the adoption of advanced diagnostic technologies across the region.

Key companies operating in the Global Prostate Cancer Diagnostics Market include Roche, Abbott, Siemens Healthineers, GE HealthCare, PHILIPS, Myriad Genetics, Becton, Dickinson and Company, Beckman Coulter, bioMerieux, Veracyte, FUJIFILM, OPKO Health, Proteomedix, Glycanostics, Metamark Genetics, KOELIS, and HEALGEN. Companies in the Global Prostate Cancer Diagnostics Market implement focused strategies to strengthen their competitive positioning. Continuous investment in research and development supports the launch of more accurate and clinically validated diagnostic tools. Firms emphasize integration of molecular diagnostics, advanced imaging analytics, and AI-driven interpretation to enhance diagnostic confidence. Strategic collaborations with healthcare providers and research institutions accelerate technology adoption and clinical validation. Expansion into emerging markets supports long-term growth, while regulatory alignment ensures timely product approvals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Cancer type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of prostate cancer

- 3.2.1.2 Advancements in imaging and biomarker-based diagnostics

- 3.2.1.3 Surging awareness and screening initiatives

- 3.2.1.4 Growing demand for minimally invasive diagnostic procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic modalities

- 3.2.2.2 Limited accessibility in low- and middle-income regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of AI-powered diagnostic tools

- 3.2.3.2 Growing adoption of personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Future market trends

- 3.8 Value chain analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics tests

- 5.2.1 PSA

- 5.2.2 Prostate biopsy

- 5.2.3 Molecular/ genomic test

- 5.2.4 Other diagnostics tests

- 5.3 Imaging tests

- 5.3.1 Transrectal Ultrasound (TRUS)

- 5.3.2 MRI

- 5.3.3 CT Scan

- 5.3.4 Other imaging tests

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Prostatic adenocarcinoma

- 6.3 Small cell carcinoma

- 6.4 Other cancer types

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Cancer research institutes

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Beckman Coulter

- 9.3 Becton, Dickinson and Company

- 9.4 bioMerieux

- 9.5 FUJIFILM

- 9.6 GE HealthCare

- 9.7 Glycanostics

- 9.8 HEALGEN

- 9.9 KOELIS

- 9.10 Metamark Genetics

- 9.11 Myriad Genetics

- 9.12 OPKO Health

- 9.13 PHILIPS

- 9.14 Proteomedix

- 9.15 Roche

- 9.16 SIEMENS Healthineers

- 9.17 Veracyte