|

市场调查报告书

商品编码

1892823

被窃车辆找回市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Stolen Vehicle Recovery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

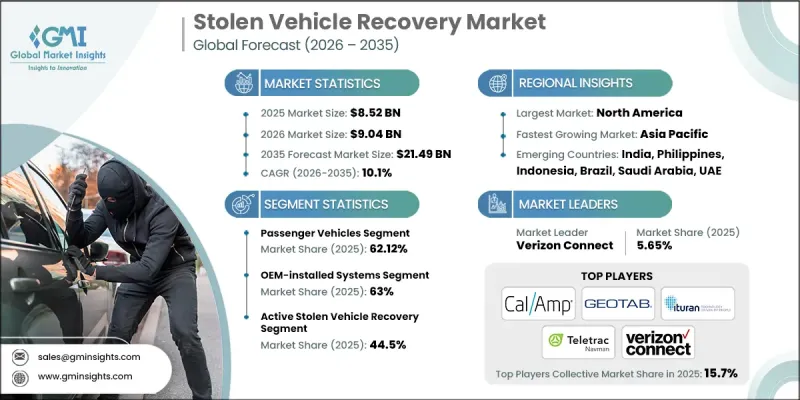

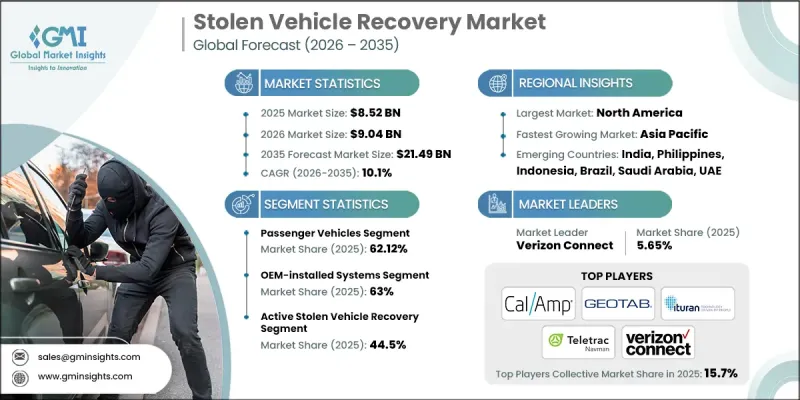

2025 年全球被盗车辆找回市场价值为 85.2 亿美元,预计到 2035 年将以 10.1% 的复合年增长率增长至 214.9 亿美元。

市场扩张的驱动力在于连网车辆架构、智慧车载资讯系统和嵌入式安全模组的快速普及,这些都正在重塑智慧车辆防盗(SVR)生态系统。现代SVR系统融合了全球导航卫星系统(GNSS)定位、蜂窝网路和物联网(IoT)连接以及基于人工智慧的分析技术,能够实现即时车辆追踪、地理围栏、远端车辆锁定和行为异常检测。汽车製造商、保险公司和车队营运商越来越依赖整合式SVR解决方案来减少窃盗损失、加快车辆找回速度并提升驾驶员安全。这些技术最大限度地减少了人工干预,支援持续的车辆监控,并加强了乘用车和商用车车队的网路安全。策略投资、平台整合和跨产业合作正在重塑竞争格局。领先的车载资讯系统供应商正在部署高灵敏度GNSS模组、下一代物联网调变解调器和基于云端的指挥中心,而汽车供应商则专注于加密通讯、抗干扰感测器和可互通的API,以加速全球普及的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 85.2亿美元 |

| 预测值 | 214.9亿美元 |

| 复合年增长率 | 10.1% |

到 2025 年,乘用车市占率将达到 62.12%,预计到 2035 年将以 9.8% 的复合年增长率成长。日益严重的车辆失窃问题、连网汽车的成长以及中等收入和高阶车辆拥有量的增加,正在推动个人车辆采用 GPS 追踪、地理围栏和远端锁定等技术。

2025年, OEM配套)安装系统市占率达63%,预计2026年至2035年将以10.4%的复合年增长率成长。原厂预先安装的车载资讯系统和连网汽车平台具有更高的可靠性、准确性和与车辆电子设备的整合度。 OEMOEM方案可透过製造商的连网汽车生态系统直接实现远端防盗、地理围篱、防篡改警报和自动防盗通知等功能,从而减少售后加装的需求。

预计到2025年,美国被窃车辆追回市场将占85%的市场份额,市场规模将达28.9亿美元。推动市场成长的因素包括远端资讯处理技术的普及、物联网连接以及人工智慧分析的兴起,这些技术有助于应对城市地区较高的车辆失窃率和复杂的犯罪网路。车队营运商、保险公司和汽车製造商正越来越多地部署先进的车辆追回系统(SVR)平台,以减少经济损失、加快车辆追回速度并提高驾驶员安全。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 车辆失窃率上升和复杂的汽车窃盗网络

- 技术创新不断发展(GPS、物联网、人工智慧/机器学习)

- 提高SVR安装的保险激励措施

- 车队营运、叫车和物流业不断发展

- 产业陷阱与挑战

- SVR安装和订阅成本高昂

- 资料隐私和网路安全问题

- 市场机会

- 随着汽车保有量的成长,新兴市场扩张势头强劲。

- 与智慧城市计画和公共安全网络的整合

- 开发人工智慧驱动的预测分析和加值服务

- 原始设备製造商、保险公司和车队管理公司之间的策略合作伙伴关係

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 基于GPS的追踪技术

- 射频(RF)技术

- 混合技术系统

- 新兴技术

- 地理围篱和虚拟边界技术

- 5G网路集成

- 物联网 (IoT) 和低功耗广域网路 (LPWAN) 技术

- 当前技术趋势

- 专利分析

- 定价分析

- 按地区

- 透过订阅和服务定价

- 成本細項分析

- 製造和组装成本

- 软体和平台开发成本

- 网路和连接成本

- 客户获取成本(CAC)

- 安装和启动费用

- 研发成本

- 永续性和环境影响分析

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 商业案例及投资报酬率分析

- 总拥有成本框架

- 投资报酬率计算方法

- 实施时间表和里程碑

- 风险评估与缓解策略

- 消费者行为与采纳趋势

- 采用生命週期分析

- 各细分市场技术采纳曲线

- 区域采用模式

- 世代采纳差异

- 季节性和时间性采用模式

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估价与预测:依车辆类型划分,2022-2035年

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估算与预测:依安装量划分,2022-2035年

- OEM安装的系统

- 售后市场

第七章:市场估计与预测:依技术划分,2022-2035年

- 基于GPS的追踪系统

- 射频(RF)系统

- 蜂窝和车载资讯服务平台

- 混合系统(GPS + RF)

- 其他的

第八章:市场估算与预测:依最终用途划分,2022-2035年

- 个人车辆所有者

- 车队车主

- 保险公司

- 政府和执法部门

- 其他的

第九章:市场估算与预测:依应用领域划分,2022-2035年

- 主动追回被盗车辆

- 车队管理与安保

- 保险远端资讯处理和UBI

- 汽车经销商解决方案

- 资产和设备追踪

- 其他的

第十章:市场估价与预测:依服务模式划分,2022-2035年

- 硬体 + 订阅

- 综合服务计划

- 一次性购买

- 企业/车队许可

第十一章:市场估计与预测:按地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- CalAmp

- General Motors

- Geotab

- Robert Bosch

- Spireon

- Verizon Communications

- Vodafone Automotive

- 区域玩家

- Ituran Location & Control

- MiX Telematics

- Netstar (Altron)

- Samsara

- Teletrac Navman

- TomTom International

- 新兴参与者

- 3 Si Security Systems

- Ford Pro

- Lytx

- Matrack

- Powerfleet

- Quartix Technologies

- RecovR

- StarChase

- Telematica

- TRACKMATIC

- Trimble

- Zubie

The Global Stolen Vehicle Recovery Market was valued at USD 8.52 billion in 2025 and is estimated to grow at a CAGR of 10.1% to reach USD 21.49 billion by 2035.

The market expansion is driven by the rapid adoption of connected vehicle architectures, intelligent telematics, and embedded security modules, transforming the SVR ecosystem. Modern SVR systems combine GNSS positioning, cellular and IoT connectivity, and AI-based analytics, enabling live vehicle tracking, geofencing, remote immobilization, and behavioral anomaly detection. Automakers, insurers, and fleet operators increasingly rely on integrated SVR solutions to reduce theft losses, speed up recovery, and enhance driver safety. These technologies minimize manual intervention, support continuous vehicle monitoring, and strengthen cybersecurity across both passenger and commercial fleets. Strategic investments, platform consolidations, and cross-industry partnerships are reshaping the competitive landscape. Leading telematics providers are deploying high-sensitivity GNSS modules, next-generation IoT modems, and cloud-based command centers, while automotive suppliers are focusing on encrypted communications, anti-jamming sensors, and interoperable APIs to accelerate adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.52 Billion |

| Forecast Value | $21.49 Billion |

| CAGR | 10.1% |

The passenger vehicle segment held a 62.12% share in 2025 and is expected to grow at a CAGR of 9.8% through 2035. Rising vehicle theft concerns, the growth of connected cars, and the increase in mid-income and premium vehicle ownership are driving the adoption of GPS tracking, geofencing, and remote immobilization for personal vehicles.

The OEM-installed systems segment held a 63% share in 2025 and is projected to grow at a CAGR of 10.4% from 2026 to 2035. Factory-fitted telematics and connected-car platforms offer greater reliability, accuracy, and integration with vehicle electronics. OEM solutions enable features like remote immobilization, geofencing, tamper alerts, and automated theft notifications directly through the manufacturer's connected-car ecosystem, reducing the need for aftermarket installations.

United States Stolen Vehicle Recovery Market held an 85% share in 2025, generating USD 2.89 billion. Growth is fueled by rising telematics adoption, IoT connectivity, and AI-powered analytics, addressing higher vehicle theft rates in urban areas and complex criminal theft networks. Fleet operators, insurance companies, and OEMs are increasingly deploying advanced SVR platforms to mitigate financial losses, accelerate recovery, and improve driver safety.

Major players in the Global Stolen Vehicle Recovery Market include Geotab, CalAmp, Ituran Global, Netstar (Altron), Samsara, Spireon, Teletrac Navman, TomTom International, and Verizon Connect. Key strategies adopted by companies in the Stolen Vehicle Recovery Market include continuous R&D to enhance AI-driven analytics, GNSS accuracy, and IoT connectivity. Firms are focusing on integrating SVR solutions with OEM telematics platforms, fleet management systems, and insurance networks to offer value-added services. Expansion through strategic partnerships and acquisitions allows companies to extend their geographic presence and technological capabilities. Investment in cloud-based command centers, cybersecurity protocols, and anti-jamming technologies strengthens reliability and user trust. Additionally, companies are enhancing interoperability with cross-border tracking systems, offering scalable solutions for commercial fleets and high-value cargo, thereby consolidating their market position and improving customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Installation

- 2.2.4 Technology

- 2.2.5 End Use

- 2.2.6 Application

- 2.2.7 Service Model

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in vehicle theft rates and sophisticated auto-theft networks

- 3.2.1.2 Growing technological innovations (GPS, IoT, AI/ML)

- 3.2.1.3 Increase in insurance incentives for SVR installation

- 3.2.1.4 Growing fleet operations, ride-hailing, and logistics sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of SVR installation and subscription

- 3.2.2.2 Data privacy and cybersecurity concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets with growing vehicle ownership

- 3.2.3.2 Integration with smart-city initiatives and public-safety networks

- 3.2.3.3 Development of AI-powered predictive analytics and value-added services

- 3.2.3.4 Strategic partnerships among OEMs, insurers, and fleet managers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 GPS-based tracking technology

- 3.7.1.2 Radio frequency (RF) technology

- 3.7.1.3 Hybrid technology systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Geofencing & virtual boundary technology

- 3.7.2.2 5g network integration

- 3.7.2.3 Internet of things (Iot) & LPWAN technologies

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Pricing Analysis

- 3.9.1 By region

- 3.9.2 By subscription & service pricing

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing & assembly costs

- 3.10.2 Software & platform development costs

- 3.10.3 Network & connectivity costs

- 3.10.4 Customer acquisition costs (CAC)

- 3.10.5 Installation & activation costs

- 3.10.6 Research & development costs

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Business Case & ROI Analysis

- 3.12.1 Total cost of ownership framework

- 3.12.2 ROI calculation methodologies

- 3.12.3 Implementation timeline & milestones

- 3.12.4 Risk assessment & mitigation strategies

- 3.13 Consumer behavior & adoption trends

- 3.13.1 Adoption lifecycle analysis

- 3.13.2 Technology adoption curves by segment

- 3.13.3 Regional adoption patterns

- 3.13.4 Generational adoption differences

- 3.13.5 Seasonal & temporal adoption patterns

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Installation, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 OEM-installed systems

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 GPS-Based Tracking Systems

- 7.3 Radio Frequency (RF) Systems

- 7.4 Cellular & Telematics Platforms

- 7.5 Hybrid Systems (GPS + RF)

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Individual vehicle owners

- 8.3 Fleet owners

- 8.4 Insurance companies

- 8.5 Government & law enforcement

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Active Stolen Vehicle Recovery

- 9.3 Fleet Management & Security

- 9.4 Insurance Telematics & UBI

- 9.5 Automotive Dealer Solutions

- 9.6 Asset & Equipment Tracking

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Service Model, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Hardware + Subscription

- 10.3 Integrated Service Plans

- 10.4 One-Time Purchase

- 10.5 Enterprise/Fleet Licensing

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 CalAmp

- 12.1.2 General Motors

- 12.1.3 Geotab

- 12.1.4 Robert Bosch

- 12.1.5 Spireon

- 12.1.6 Verizon Communications

- 12.1.7 Vodafone Automotive

- 12.2 Regional Players

- 12.2.1 Ituran Location & Control

- 12.2.2 MiX Telematics

- 12.2.3 Netstar (Altron)

- 12.2.4 Samsara

- 12.2.5 Teletrac Navman

- 12.2.6 TomTom International

- 12.3 Emerging Players

- 12.3.1. 3 Si Security Systems

- 12.3.2 Ford Pro

- 12.3.3 Lytx

- 12.3.4 Matrack

- 12.3.5 Powerfleet

- 12.3.6 Quartix Technologies

- 12.3.7 RecovR

- 12.3.8 StarChase

- 12.3.9 Telematica

- 12.3.10 TRACKMATIC

- 12.3.11 Trimble

- 12.3.12 Zubie