|

市场调查报告书

商品编码

1892825

步入式冷藏库市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Walk-in Coolers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

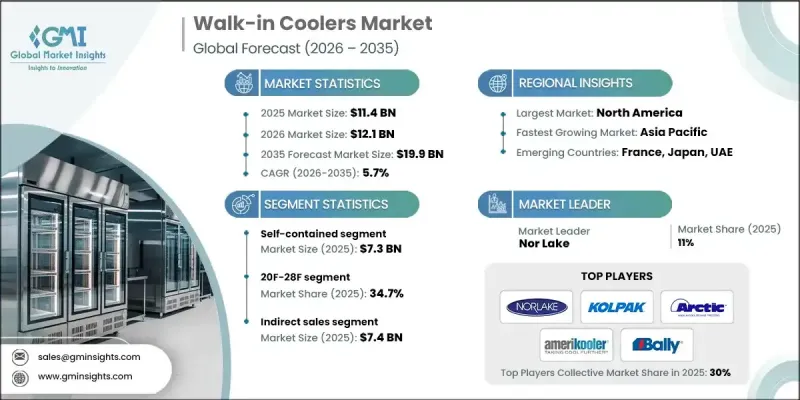

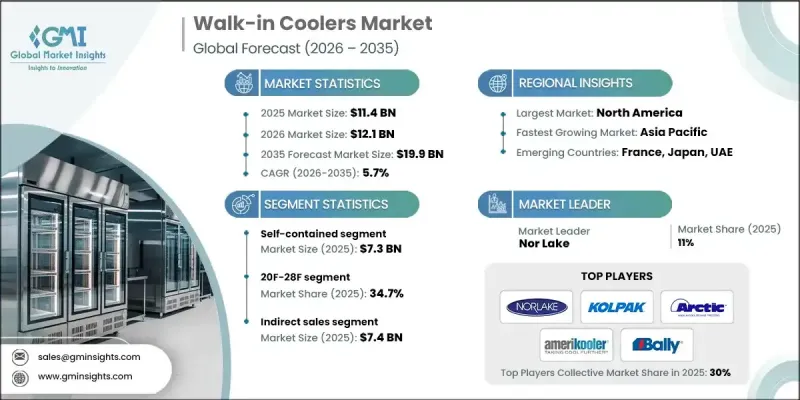

2025 年全球步入式冷藏库市场价值为 114 亿美元,预计到 2035 年将以 5.7% 的复合年增长率增长至 199 亿美元。

对肉类、海鲜和乳製品等易腐食品的需求不断增长,加上快餐店和云端厨房数量的增加,推动了对可靠冷藏解决方案的需求。步入式冷藏库透过控制温度和实现精确的库存跟踪,帮助经营者保障食品安全。这一趋势在城市地区尤其显着,较高的可支配收入和对即食食品的偏好,促使人们更多地选择预製食品而非传统的从零开始烹饪。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 114亿美元 |

| 预测值 | 199亿美元 |

| 复合年增长率 | 5.7% |

全球化的食品供应链也加剧了仓储和配送的复杂性,凸显了健全的冷链基础设施的重要性。零售商、餐饮服务商和製造商都在投资先进的冷冻系统,以确保产品在长途运输和多变的气候条件下保持品质。环保意识的增强推动了对使用环保冷媒的节能型冷藏设备的需求,这为製造商提供了透过技术创新实现差异化竞争并满足监管要求的途径。

预计到2025年,-7°C至-2°C的温度区间将占据34.7%的市占率。此温度范围是储存肉类、海鲜、乳製品、冷冻食品和罐头食品的理想温度,能够有效保持其品质和食用安全。专业零售商、肉店和餐厅都依赖此温度范围来符合食品安全标准,同时延长产品的保存期限。

到 2025 年,间接销售部门创造了 74 亿美元的收入。透过第三方分销商或批发商进行销售,製造商可以利用已建立的网络,扩大市场覆盖范围,并比单独进行直接销售更有效地进入多元化市场。

美国步入式冷藏库市场占79.6%的份额,预计2025年市场规模将达到31亿美元。美国成熟的餐饮服务业、庞大的零售网路以及严格的卫生法规推动了对可靠且节能的冷冻设备的需求。云端厨房的兴起进一步提升了美国各地对高品质步入式冷藏库和冷冻解决方案的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 食品饮料业的扩张

- 医药和医疗保健需求

- 都市化与零售业扩张

- 产业陷阱与挑战

- 高初始投资

- 能源管理与营运成本压力

- 机会

- 智慧互联的冷却解决方案

- 客製化和模组化设计

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 自给自足

- 远端冷凝

- 多厅影院步入式通道

第六章:市场估算与预测:依温度范围划分,2022-2035年

- 华氏20 - 28华氏度

- 华氏28 - 32华氏度

- 32华氏度 - 35华氏度

- 36华氏度 - 40华氏度

第七章:市场估算与预测:依电力消耗量划分,2022-2035年

- 最高 1 千瓦时

- 2至3千瓦时

- 4至5度

- 超过 5 千瓦时

第八章:市场估算与预测:依储存容量划分,2022-2035年

- 最多2吨

- 3至5吨

- 6至10吨

- 10吨以上

第九章:市场估价与预测:依窗帘类型划分,2022-2035年

- 条形帘

- 空气幕

第十章:市场估计与预测:依应用领域划分,2022-2035年

- 餐饮

- 医疗保健设施

- 製药

- 花的

- 零售

- 其他(农业、殡葬业等)

第十一章:市场估价与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十二章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- ABN Refrigeration Manufacturing

- American Panel

- Amerikooler

- Arctic Walk-in Coolers & Walk-in Freezers

- Bally Refrigerated Boxes

- Canadian Curtis Refrigeration

- Everidge

- Hussmann

- Imperial Brown

- Kolpak

- KPS Global

- Master-Bilt

- Nor-Lake

- Thermo-Kool

- US Cooler

The Global Walk-in Coolers Market was valued at USD 11.4 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 19.9 billion by 2035.

Rising demand for perishable goods such as meat, seafood, and dairy, combined with the growing number of quick-service restaurants and cloud kitchens, is fueling the need for reliable cold storage solutions. Walk-in coolers help operators maintain food safety by controlling temperature and enabling accurate inventory tracking. This trend is particularly strong in urban areas, where higher disposable income and a preference for ready-to-eat meals are driving the adoption of pre-prepared foods over traditional cooking from scratch.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $11.4 Billion |

| Forecast Value | $19.9 Billion |

| CAGR | 5.7% |

Globalized food supply chains have also heightened the complexity of storage and distribution, increasing the importance of robust cold chain infrastructure. Retailers, foodservice operators, and manufacturers are investing in advanced refrigeration systems that preserve product quality during long-distance transportation and variable climate conditions. Environmental concerns are pushing demand for energy-efficient coolers that use eco-friendly refrigerants, offering manufacturers a way to differentiate themselves through technological innovation while meeting regulatory requirements.

The 20°F-28°F segment accounted for a 34.7% share in 2025. This temperature range is ideal for storing meat, seafood, dairy, frozen, and canned items, preserving their quality and safety for consumption. Specialty retailers, butcheries, and restaurants rely on this range to comply with food safety standards while extending the shelf life of their products.

The indirect sales segment generated USD 7.4 billion in 2025. Selling through third-party distributors or wholesalers allows manufacturers to leverage established networks, expand market reach, and access diverse markets more efficiently than direct sales alone.

U.S Walk-in Coolers Market held a 79.6% share, generating USD 3.1 billion in 2025. The country's mature foodservice industry, large retail network, and strict health regulations drive demand for reliable and energy-efficient refrigeration. The rise of cloud kitchens has further increased the need for quality walk-in coolers and refrigeration solutions across the U.S.

Key players in the Walk-in Coolers Market include Hussmann, KPS Global, Canadian Curtis Refrigeration, Master-Bilt, Thermo-Kool, U.S. Cooler, ABN Refrigeration Manufacturing, American Panel, Kolpak, Everidge, Imperial Brown, Bally Refrigerated Boxes, Arctic Walk-in Coolers & Walk-in Freezers, Nor-Lake, and Amerikooler. Companies in the walk-in cooler market are strengthening their presence through product innovation, focusing on energy-efficient designs and eco-friendly refrigerants that meet strict regulatory standards. Many are expanding their portfolios with modular and customizable cooler solutions to suit restaurants, retail chains, and cloud kitchens. Strategic partnerships with distributors and wholesalers help extend market reach and improve penetration in regional and urban centers. Companies are also investing in advanced temperature control and monitoring technologies, providing customers with smart, connected solutions that enhance operational efficiency and reduce food waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Temperature range

- 2.2.4 Power consumption

- 2.2.5 Storage capacity

- 2.2.6 Curtain type

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of food & beverage industry

- 3.2.1.2 Pharmaceutical & healthcare needs

- 3.2.1.3 Urbanization & retail expansion

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Energy management & operational cost pressures

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected cooling solutions

- 3.2.3.2 Customization & modular designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Self-contained

- 5.3 Remote condensing

- 5.4 Multiplex walk-ins

Chapter 6 Market Estimates and Forecast, By Temperature Range, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 20F - 28F

- 6.3 28F - 32F

- 6.4 32F - 35F

- 6.5 36F - 40F

Chapter 7 Market Estimates and Forecast, By Power Consumption, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 1 KWH

- 7.3 2 to 3 KWH

- 7.4 4 to 5 KWH

- 7.5 Above 5 KWH

Chapter 8 Market Estimates and Forecast, By Storage Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 2 tons

- 8.3 3 to 5 tons

- 8.4 6 to 10 tons

- 8.5 Above 10 tons

Chapter 9 Market Estimates and Forecast, By Curtain Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Strip curtain

- 9.3 Air curtain

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Food and beverage

- 10.3 Healthcare & medical facilities

- 10.4 Pharmaceuticals

- 10.5 Floral

- 10.6 Retail

- 10.7 Others (agriculture, mortuary, etc.)

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 ABN Refrigeration Manufacturing

- 13.2 American Panel

- 13.3 Amerikooler

- 13.4 Arctic Walk-in Coolers & Walk-in Freezers

- 13.5 Bally Refrigerated Boxes

- 13.6 Canadian Curtis Refrigeration

- 13.7 Everidge

- 13.8 Hussmann

- 13.9 Imperial Brown

- 13.10 Kolpak

- 13.11 KPS Global

- 13.12 Master-Bilt

- 13.13 Nor-Lake

- 13.14 Thermo-Kool

- 13.15 U.S. Cooler