|

市场调查报告书

商品编码

1892827

尿囊素市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Allantoin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

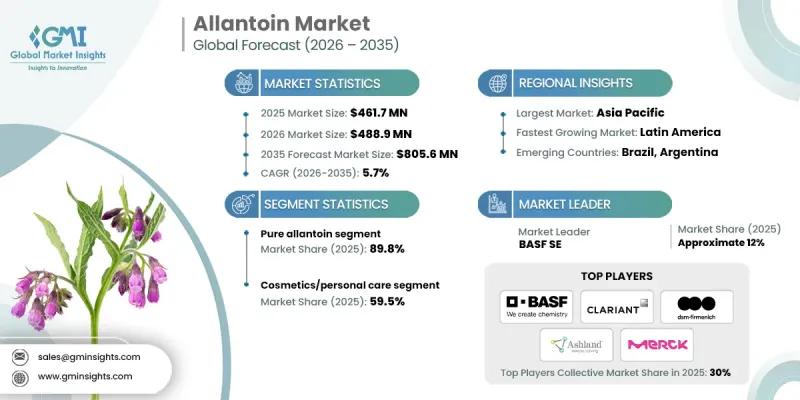

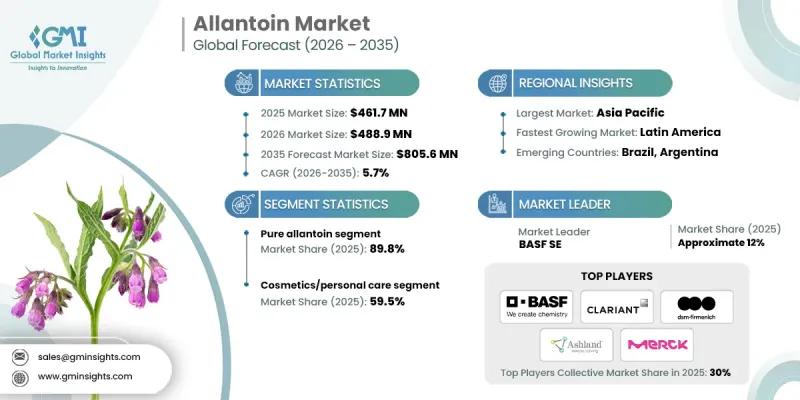

2025 年全球尿囊素市场价值为 4.617 亿美元,预计到 2035 年将以 5.7% 的复合年增长率增长至 8.056 亿美元。

市场扩张主要受化妆品、个人护理和外用治疗配方中对多功能护肤成分日益增长的需求所驱动。尿囊素有植物来源和合成两种形式,因其舒缓、保湿和促进肌肤更新的功效而备受推崇,尤其适用于针对干燥、刺激和表层皮肤损伤的配方。监管机构的认可进一步增强了製造商的信心,因为尿囊素在规定的浓度范围内被认定为安全有效,可用于非处方外用保护剂。此外,更清洁的配方、以植物为主导的原料采购以及不断发展的生产技术也促进了市场成长,这些都有助于确保产品品质和配方的稳定性。对某些合成化合物的调节压力加速了向更安全、更成熟的活性成分的过渡,提高了安全性和功效俱佳的成分的采用率。这些因素共同巩固了尿囊素作为现代护肤和治疗产品开发中核心成分的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 4.617亿美元 |

| 预测值 | 8.056亿美元 |

| 复合年增长率 | 5.7% |

2025 年,纯尿囊素市占率达到 89.8%,预计到 2035 年将以 5.6% 的复合年增长率成长。其稳定的性能、配方稳定性和与多种产品的兼容性,使其在临床级和清洁标籤配方中广泛应用。

2025年,化妆品和个人护理应用领域占市场份额的59.5%,预计从2026年到2035年将以5.4%的复合年增长率成长。由于尿囊素具有多功能功效,其在护肤、美容和护髮产品中的广泛应用将继续推动需求成长。

2025年欧洲尿囊素市场创造了1.551亿美元的收入。强大的生产标准、稳固的製药能力以及对优质製剂的高需求支撑了该地区的业绩,儘管经济扩张速度相对较慢。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2022-2035年

- 纯尿囊素

- ALCLOXA(尿囊素+氢氧化铝)

- ALDIOXA(尿囊素 + 二羟基尿囊素铝)

- ALPANTHA(尿囊素 + D-泛醇)

- 其他衍生性商品

第六章:市场估算与预测:依来源划分,2022-2035年

- 合成的

- 天然/植物

第七章:市场估算与预测:依等级划分,2022-2035年

- USP/EP(药品)

- CTFA(化妆品级)

- 技术级

第八章:市场估算与预测:依应用领域划分,2022-2035年

- 化妆品/个人护理

- 护肤霜和乳液

- 抗衰老产品

- 痤疮治疗

- 防晒乳

- 刮鬍产品

- 护髮产品

- 唇部护理及润唇膏

- 婴儿护理产品

- 製药

- 伤口癒合软膏

- 烧伤治疗产品

- 痔疮膏

- 外用消炎凝胶

- 处方皮肤科产品

- 疤痕修復产品

- 口腔卫生

- 牙膏

- 漱口水

- 牙龈癒合产品

- 敏感牙齿配方

- 农业

- 植物生长促进剂

- 土壤改良剂

- 作物保护喷雾剂

- 生物刺激剂

- 其他的

- 宠物护理产品

- 工业皮肤保护霜

- 盥洗用品和卫生湿纸巾

- 消毒霜

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- BASF SE

- Akema Srl

- Alfa Aesar

- Allan Chemical Corporation

- Ashland Inc.

- Clariant AG

- DSM-Firmenich

- Hubei Guanhao Biological Technology Co., Ltd.

- Innospec Inc.

- Jeen International Corporation

- Luotian Guanghui Chemical Co., Ltd.

- Luvena SA

- Merck KGaA

- Rita Corporation

- Shandong Xinhua Pharmaceutical Co., Ltd.

- SinoLion Chemical Co., Ltd.

- Suzhou-Chem Inc.

- Yongan Pharmaceutical Co., Ltd.

- Zhanjiang Dongjian Chemicals Co., Ltd.

- Zhejiang NHU Co., Ltd.

- Others

The Global Allantoin Market was valued at USD 461.7 million in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 805.6 million by 2035.

Market expansion is shaped by rising demand for multifunctional skin-conditioning ingredients used across cosmetic, personal care, and topical therapeutic formulations. Allantoin, available in plant-derived and synthetic forms, is widely valued for its skin-soothing, moisturizing, and renewal-supporting properties, which make it suitable for formulations targeting dryness, irritation, and surface-level skin damage. Regulatory recognition has further strengthened confidence among manufacturers, as allantoin is classified as safe and effective for over-the-counter topical protectants within regulated concentration limits. Growth is also supported by the broader movement toward cleaner formulations, plant-forward ingredient sourcing, and evolving production technologies that support consistent quality and formulation stability. Regulatory pressure on certain synthetic compounds has accelerated the transition toward safer and well-established actives, increasing the adoption of ingredients with a strong safety and performance profile. These factors collectively reinforce allantoin's role as a staple ingredient across modern skincare and therapeutic product development.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $461.7 Million |

| Forecast Value | $805.6 Million |

| CAGR | 5.7% |

The pure allantoin segment held 89.8% share in 2025 and is expected to grow at a CAGR of 5.6% through 2035. Its consistent performance, formulation stability, and compatibility with a wide range of products support strong uptake across clinical-grade and clean-label formulations.

The cosmetics and personal care application segment accounted for a 59.5% share in 2025 and is forecast to grow at a CAGR of 5.4% from 2026 to 2035. Broad adoption across skincare, grooming, and haircare products continues to drive demand due to allantoin's multifunctional benefits.

Europe Allantoin Market generated USD 155.1 million in 2025. Strong manufacturing standards established pharmaceutical capabilities, and high demand for premium formulations supports regional performance, despite comparatively slower economic expansion.

Key companies active in the Global Allantoin Market include Merck KGaA, BASF SE, DSM-Firmenich, Ashland Inc., Clariant AG, Alfa Aesar, Akema S.r.l., Innospec Inc., Allan Chemical Corporation, Rita Corporation, Jeen International Corporation, Zhejiang NHU Co., Ltd., Yongan Pharmaceutical Co., Ltd., SinoLion Chemical Co., Ltd., Shandong Xinhua Pharmaceutical Co., Ltd., Hubei Guanhao Biological Technology Co., Ltd., Luotian Guanghui Chemical Co., Ltd., Suzhou-Chem Inc., Zhanjiang Dongjian Chemicals Co., Ltd., and Luvena S.A. Companies operating in the Global Allantoin Market are strengthening their market position by focusing on high-purity production, consistent quality assurance, and compliance with global cosmetic and pharmaceutical regulations. Many players are investing in cleaner manufacturing processes and traceable sourcing to align with the rising demand for transparent and sustainable ingredients. Strategic partnerships with cosmetic formulators and OTC product manufacturers help secure long-term supply agreements and expand application reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Source

- 2.2.4 Grade

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pure Allantoin

- 5.3 ALCLOXA (Allantoin + Aluminum Chlorohydroxide)

- 5.4 ALDIOXA (Allantoin + Aluminum Dihydroxyallantoinate)

- 5.5 ALPANTHA (Allantoin + D-Panthenol)

- 5.6 Other Derivatives

Chapter 6 Market Estimates and Forecast, By Source, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Synthetic

- 6.3 Natural/Botanical

Chapter 7 Market Estimates and Forecast, By Grade, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 USP/EP (Pharmaceutical)

- 7.3 CTFA (Cosmetic Grade)

- 7.4 Technical Grade

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Cosmetics/Personal Care

- 8.2.1 Skin Care Creams & Lotions

- 8.2.2 Anti-aging Products

- 8.2.3 Acne Treatments

- 8.2.4 Sunscreens

- 8.2.5 Shaving Products

- 8.2.6 Hair Care Products

- 8.2.7 Lip Care & Balms

- 8.2.8 Baby Care Products

- 8.3 Pharmaceutical

- 8.3.1 Wound Healing Ointments

- 8.3.2 Burn Treatment Products

- 8.3.3 Hemorrhoid Creams

- 8.3.4 Topical Anti-inflammatory Gels

- 8.3.5 Prescription Dermatology Products

- 8.3.6 Scar Recovery Products

- 8.4 Oral Hygiene

- 8.4.1 Toothpastes

- 8.4.2 Mouthwashes

- 8.4.3 Gum Healing Products

- 8.4.4 Sensitive Teeth Formulations

- 8.5 Agricultural

- 8.5.1 Plant Growth Promoters

- 8.5.2 Soil Conditioners

- 8.5.3 Crop Protection Sprays

- 8.5.4 Bio-Stimulants

- 8.6 Others

- 8.6.1 Pet Care Products

- 8.6.2 Industrial Skin Protection Creams

- 8.6.3 Toiletries & Hygiene Wipes

- 8.6.4 Sanitizing Creams

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Akema S.r.l.

- 10.3 Alfa Aesar

- 10.4 Allan Chemical Corporation

- 10.5 Ashland Inc.

- 10.6 Clariant AG

- 10.7 DSM-Firmenich

- 10.8 Hubei Guanhao Biological Technology Co., Ltd.

- 10.9 Innospec Inc.

- 10.10 Jeen International Corporation

- 10.11 Luotian Guanghui Chemical Co., Ltd.

- 10.12 Luvena S.A.

- 10.13 Merck KGaA

- 10.14 Rita Corporation

- 10.15 Shandong Xinhua Pharmaceutical Co., Ltd.

- 10.16 SinoLion Chemical Co., Ltd.

- 10.17 Suzhou-Chem Inc.

- 10.18 Yongan Pharmaceutical Co., Ltd.

- 10.19 Zhanjiang Dongjian Chemicals Co., Ltd.

- 10.20 Zhejiang NHU Co., Ltd.

- 10.21 Others