|

市场调查报告书

商品编码

1892828

导丝市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Guidewires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

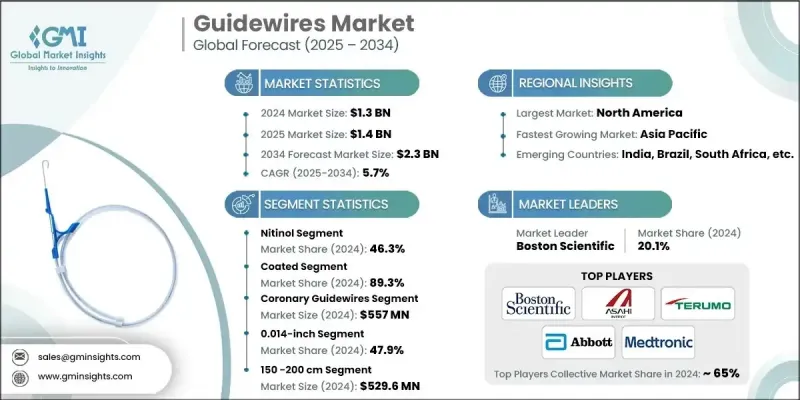

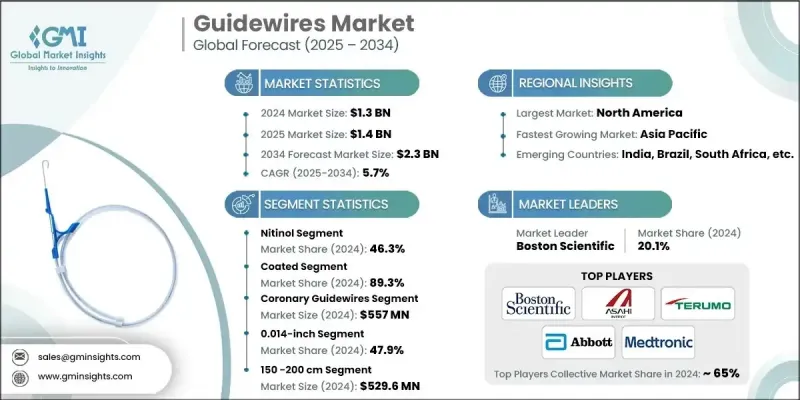

2024 年全球导丝市场价值为 13 亿美元,预计到 2034 年将以 5.7% 的复合年增长率增长至 23 亿美元。

市场扩张的驱动因素包括老年人口的成长、生活型态相关疾病盛行率的上升、已开发国家有利的健保报销政策以及心血管疾病发生率的增加。导丝设计的技术进步,例如智慧导丝和生物可吸收导丝,进一步推动了导丝的应用。医疗保健从传统开放性手术转变为微创手术(包括经皮冠状动脉介入治疗 (PCI)、神经血管介入治疗和血管内治疗)的转变,显着促进了市场成长。这些手术可以减少创伤、缩短住院时间并加速復原。导丝在帮助临床医生精准操控复杂血管结构、提高手术成功率和改善患者预后方面发挥着至关重要的作用。新兴经济体医疗基础设施的扩建也为导丝的应用创造了新的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 5.7% |

2024 年,镍钛诺细分市场占 46.3% 的市占率。由于有利的报销政策和优异的材料性能(包括形状记忆和超弹性),预计该细分市场将继续增长,这些性能为在心血管、外周和神经血管手术中穿过迂曲血管提供了增强的柔韧性和抗扭结性。

2024 年,涂层导丝占了 89.3% 的市占率。采用亲水、抗血栓、疏水和硅基技术的涂层导丝因其临床疗效和在介入手术中的广泛应用而备受青睐。

2024年,北美导丝市占率将达到37.7%。该地区受益于先进的医疗基础设施、高手术量、微创介入治疗的快速普及以及持续的技术创新。心血管疾病、週边动脉疾病、神经血管疾病和泌尿系统疾病的高发生率推动了导丝在诊断和治疗应用方面的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 微创手术的普及率不断提高

- 发展中国家生活方式疾病数量不断增加

- 已开发国家的各种报销政策

- 全球老年人口基数不断成长

- 产业陷阱与挑战

- 导丝成本高昂

- 发展中经济体缺乏技术熟练的专业人才

- 导丝相关风险

- 机会

- 新兴经济体医疗卫生基础设施的扩张

- 影像导引和机器人辅助介入治疗技术的应用日益广泛

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 中国

- 北美洲

- 技术与创新格局

- 当前技术趋势

- 增强型亲水和疏水涂层技术

- 扭矩控制和转向性能最佳化

- 多层复合材料的集成

- 新兴技术

- 奈米技术增强的表面工程

- 磁导导航系统

- 3D列印个人化导丝原型

- 当前技术趋势

- 未来市场趋势

- 向完全整合的数位化介入治疗中心转变的趋势日益明显

- 人们越来越倾向选择一次性、无菌且经济实惠的导丝

- 扩大微创和门诊介入治疗

- 报销方案

- 2024年各地区定价分析

- 按材料

- 透过申请

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料分类,2021-2034年

- 镍钛诺

- 不銹钢

- 杂交种

- 其他材料

第六章:市场估算与预测:依涂料产业划分,2021-2034年

- 涂层

- 亲水涂层

- 抗血栓/肝素涂层

- 疏水涂层

- 硅涂层

- 四氟乙烯(TFE)涂层

- 未涂层

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 冠状动脉导丝

- 外周导丝

- 泌尿科导丝

- 神经血管导丝

- 其他应用

第八章:市场估算与预测:依直径划分,2021-2034年

- 0.014英寸

- 0.018英寸

- 0.025英寸

- 0.032英寸

- 0.035英寸

- 0.038英寸

第九章:市场估计与预测:依长度划分,2021-2034年

- 80-145厘米

- 150-200厘米

- 210-300厘米

- 305公分以上

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 医院

- 门诊手术中心

- 其他最终用途

第十一章:市场估计与预测:按地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Abbott Laboratories

- AngioDynamics

- ASAHI INTECC

- B. Braun SE

- Becton, Dickinson and Company

- Boston Scientific

- Cordis

- Cook Medical

- Medtronic

- Merit Medical Systems

- Olympus

- Stryker

- Teleflex

- Terumo

The Global Guidewires Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2.3 billion by 2034.

Market expansion is driven by the rising elderly population, increasing prevalence of lifestyle-related disorders, supportive reimbursement policies in developed countries, and growing rates of cardiovascular diseases. Technological advancements in guidewire design, such as smart and bioresorbable models, are further fueling adoption. The shift in healthcare from traditional open surgeries to minimally invasive procedures, including Percutaneous Coronary Intervention (PCI), neurovascular interventions, and endovascular therapies, is significantly contributing to market growth. These procedures reduce trauma, shorten hospital stays, and accelerate recovery. Guidewires play a critical role in enabling clinicians to navigate complex vascular structures with precision, improving procedural success and patient outcomes. Expansion of healthcare infrastructure in emerging economies is also creating new opportunities for guidewire deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.7% |

In 2024, the nitinol segment held a 46.3% share 2024. This segment is expected to continue growing due to favorable reimbursement policies and superior material properties, including shape-memory and super-elasticity, which provide enhanced flexibility and kink resistance for navigating tortuous vessels in cardiovascular, peripheral, and neurovascular procedures.

The coated segment held a 89.3% share in 2024. Coated guidewires, using hydrophilic, anti-thrombogenic, hydrophobic, and silicone-based technologies, are preferred for their clinical efficiency and widespread use in interventional procedures.

North America Guidewires Market accounted for a 37.7% share in 2024. The region benefits from advanced healthcare infrastructure, high procedural volumes, rapid adoption of minimally invasive interventions, and continuous technological innovation. High prevalence of cardiovascular diseases, peripheral artery disease, neurovascular conditions, and urological disorders drives demand for guidewires for both diagnostic and therapeutic applications.

Key players operating in the Global Guidewires Market include Boston Scientific, Medtronic, Abbott Laboratories, Cook Medical, Stryker, B. Braun SE, AngioDynamics, Teleflex, Cordis, Olympus, Merit Medical Systems, ASAHI INTECC, Becton Dickinson and Company, and Terumo. Companies in the Global Guidewires Market are strengthening their position by focusing on technological innovation and product differentiation, including the development of smart, coated, and bioresorbable guidewires. Collaborations with hospitals, research centers, and medical device distributors enhance market penetration and clinical adoption. Firms are expanding their footprint in emerging markets by establishing local manufacturing and distribution networks to meet growing procedural demand. Regulatory compliance and securing favorable reimbursement policies also play a vital role in driving sales. Strategic mergers and acquisitions enable companies to consolidate expertise, expand product portfolios, and access advanced R&D capabilities.a

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends (USD Mn & 000' Units)

- 2.2.2 Material trends (USD Mn & 000' Units)

- 2.2.3 Coating trends

- 2.2.4 Application trends (USD Mn & 000' Units)

- 2.2.5 Diameter trends (USD Mn & 000' Units)

- 2.2.6 Length trends (USD Mn & 000' Units)

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of minimally invasive surgical procedures

- 3.2.1.2 Increasing number of lifestyle disorders in developing countries

- 3.2.1.3 Various reimbursement policies in developed countries

- 3.2.1.4 Growing geriatric population base across the globe

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of guidewires

- 3.2.2.2 Dearth of skilled professionals in developing economies

- 3.2.2.3 Risks associated with guidewires

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of healthcare infrastructure in emerging economies

- 3.2.3.2 Growing adoption of image-guided and robotic-assisted interventions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 China

- 3.4.1 North America

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Enhanced hydrophilic and hydrophobic coating technologies

- 3.5.1.2 Torque-control and steerability optimization

- 3.5.1.3 Integration of multi-layered composite materials

- 3.5.2 Emerging technologies

- 3.5.2.1 Nanotechnology-enhanced surface engineering

- 3.5.2.2 Magnetically guided navigation systems

- 3.5.2.3 3D-printed personalized guidewire prototypes

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Rising shift toward fully integrated digital interventional suites

- 3.6.2 Growing preference for single-use, sterile, and cost-efficient guidewires

- 3.6.3 Expansion of minimally invasive and outpatient-based interventions

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, by region, 2024

- 3.8.1 By Material

- 3.8.2 By Application

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nitinol

- 5.3 Stainless steel

- 5.4 Hybrid

- 5.5 Other materials

Chapter 6 Market Estimates and Forecast, By Coating, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Coated

- 6.2.1 Hydrophilic coating

- 6.2.2 Anti-thrombogenic/Heparin coating

- 6.2.3 Hydrophobic coating

- 6.2.4 Silicone coating

- 6.2.5 Tetrafluoroethylene (TFE) coating

- 6.3 Non-coated

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Coronary guidewires

- 7.3 Peripheral guidewires

- 7.4 Urology guidewires

- 7.5 Neurovascular guidewires

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Diameter, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 0.014 inch

- 8.3 0.018 inch

- 8.4 0.025 inch

- 8.5 0.032 inch

- 8.6 0.035 inch

- 8.7 0.038 inch

Chapter 9 Market Estimates and Forecast, By Length, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 80 - 145 cm

- 9.3 150 - 200 cm

- 9.4 210 - 300 cm

- 9.5 Above 305 cm

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Ambulatory surgical centers

- 10.4 Other End use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott Laboratories

- 12.2 AngioDynamics

- 12.3 ASAHI INTECC

- 12.4 B. Braun SE

- 12.5 Becton, Dickinson and Company

- 12.6 Boston Scientific

- 12.7 Cordis

- 12.8 Cook Medical

- 12.9 Medtronic

- 12.10 Merit Medical Systems

- 12.11 Olympus

- 12.12 Stryker

- 12.13 Teleflex

- 12.14 Terumo