|

市场调查报告书

商品编码

1892830

商业海藻市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Commercial Seaweed Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

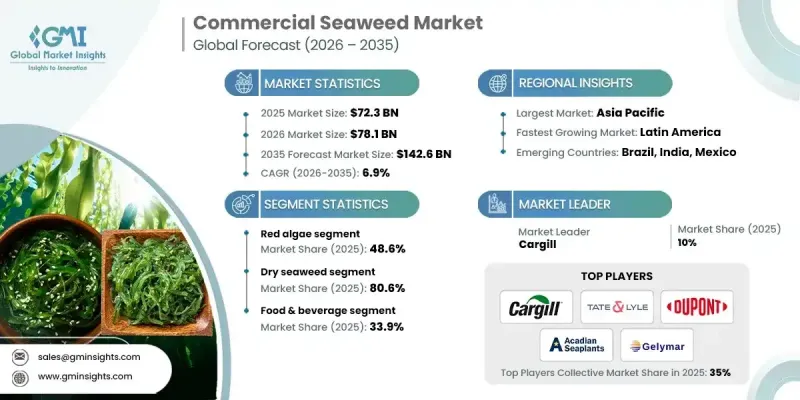

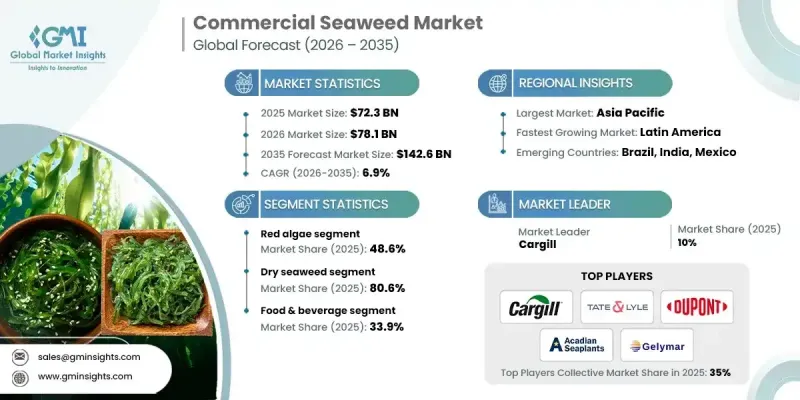

2025 年全球商业海藻市场价值为 723 亿美元,预计到 2035 年将以 6.9% 的复合年增长率增长至 1,426 亿美元。

随着海藻功能多样且可持续性强,其在多条价值链中的应用日益广泛,市场持续成长。需求成长与海藻衍生水胶体的应用日益普及密切相关,这些水胶体在食品、化妆品和工业配方中发挥重要的黏合、稳定和增稠作用。这些应用合计占全球商业海藻收入的40%以上。同时,向环境友善农业实践的转型正在加速海藻基投入品的应用,使海藻成为与再生和低影响农业模式相契合的天然解决方案。全球政策与永续农业的协调一致进一步增强了需求。此外,海藻生物技术的创新正在拓展市场价值潜力,生产商投资于先进加工技术,以提取用于营养、健康和特殊应用的高价值化合物。这些发展正在重塑商业海藻产业,使其从以产量为主导的产业转变为技术驱动、高价值的生态系统,拥有多元化的终端用途和强劲的长期成长前景。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 723亿美元 |

| 预测值 | 1426亿美元 |

| 复合年增长率 | 6.9% |

2025年,红藻市占率达到48.6%,预计到2035年将以6.8%的复合年增长率成长。其主导地位得益于其在水胶体生产中的广泛应用,而水胶体仍然是食品、製药和个人护理用品製造的基础原料,从而巩固了全球的稳定需求。

2025年,食品饮料应用领域占33.9%的市场份额,预计2026年至2035年将以6.8%的复合年增长率成长。海藻作为一种天然功能性成分,继续被广泛应用,有助于提高包装食品和加工食品的配方稳定性、增强营养价值,并实现清洁标籤定位。

北美商业海藻市场预计到2025年将占据11%的市场份额,并呈现快速成长态势。该地区受益于对永续水产养殖、气候友善材料和替代饲料解决方案的投资不断增加,从而推动了更广泛的商业应用和下游创新。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2022-2035年

- 红藻

- 褐藻

- 绿藻

第六章:市场估算与预测:依产品类型划分,2022-2035年

- 干海藻

- 湿/新鲜海藻

第七章:市场估算与预测:依最终用途划分,2022-2035年

- 餐饮

- 乳製品

- 烘焙食品和糖果

- 加工肉类和海鲜

- 纯素/植物性食品

- 功能饮料

- 可食用海藻零食

- 酱汁、汤料和调味料

- 动物饲料

- 牲畜饲料添加剂

- 家禽饲料

- 水产饲料

- 宠物食品补充剂

- 反刍动物的减甲烷饲料

- 医药及个人护理

- 伤口癒合软膏

- 药物输送系统

- 护肤乳液和乳霜

- 洗髮精和护髮素

- 抗衰老和抗发炎产品

- 口腔护理产品

- 生物燃料

- 生物乙醇生产

- 沼气发电

- 藻类生物质预处理投入

- 混合再生能源

- 其他的

- 农业生物刺激剂

- 土壤改良剂

- 水处理剂

- 纺织工业应用

- 生物塑胶和包装材料

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Acadian Seaplants

- Algaia

- Cargill

- DuPont

- FMC Corporation

- Gelymar

- Indo Alginate

- Irish Seaweeds

- KIMICA Corporation

- Mara Seaweed

- MCPI (Marine Chemicals & Polymers Industries)

- Ocean Harvest Technology

- Qingdao Gather Great Ocean Algae Industry Group

- Qingdao Seawin Biotech Group

- Seasol

- Seaweed Energy Solutions

- Shaanxi Hongda Phytochemistry Co., Ltd.

- Tate & Lyle

- TBK Manufacturing Corporation (Philippines)

- W Hydrocolloids, Inc.

- Others

The Global Commercial Seaweed Market was valued at USD 72.3 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 142.6 billion by 2035.

The market continues to gain momentum as seaweed becomes increasingly integrated into multiple value chains, supported by its functional versatility and sustainability profile. Demand growth is strongly linked to the rising use of seaweed-derived hydrocolloids that perform essential binding, stabilizing, and thickening functions across food, cosmetics, and industrial formulations. These applications collectively account for more than 40% of global commercial seaweed revenue. At the same time, the transition toward environmentally responsible agricultural practices is accelerating the adoption of seaweed-based inputs, positioning seaweed as a natural solution aligned with regenerative and low-impact farming models. Global policy alignment with sustainable agriculture has further strengthened demand. In parallel, innovation across seaweed biotechnology is expanding the market's value potential, as producers invest in advanced processing to extract high-value compounds for nutrition, health, and specialty applications. These developments are reshaping the commercial seaweed industry from a volume-driven sector into a technology-enabled, high-value ecosystem with diversified end uses and strong long-term growth visibility.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $72.3 Billion |

| Forecast Value | $142.6 Billion |

| CAGR | 6.9% |

The red algae segment held a 48.6% share in 2025 and is expected to grow at a CAGR of 6.8% through 2035. This dominance is supported by its widespread use in hydrocolloid production, which remains a foundational input across food, pharmaceutical, and personal care manufacturing, reinforcing steady global demand.

The food & beverage applications segment held 33.9% share in 2025 and is forecast to grow at a CAGR of 6.8% from 2026 to 2035. Seaweed continues to be widely incorporated as a natural functional ingredient, supporting formulation stability, nutritional enhancement, and clean-label positioning across packaged and processed food categories.

North America Commercial Seaweed Market accounted for 11% share in 2025 and is showing rapid growth. The region benefits from increasing investment in sustainable aquaculture, climate-aligned materials, and alternative feed solutions, driving broader commercial adoption and downstream innovation.

Key companies operating in the Global Commercial Seaweed Market include Cargill, Tate & Lyle, DuPont, FMC Corporation, Algaia, Gelymar, Acadian Seaplants, Irish Seaweeds, KIMICA Corporation, Qingdao Seawin Biotech Group, Ocean Harvest Technology, Seasol, Seaweed Energy Solutions, Indo Alginate, TBK Manufacturing Corporation, W Hydrocolloids, Inc., MCPI, Mara Seaweed, Qingdao Gather Great Ocean Algae Industry Group, and Shaanxi Hongda Phytochemistry. Companies in the Global Commercial Seaweed Market are strengthening their market position by expanding vertically across cultivation, processing, and formulation to secure supply consistency and improve margins. Significant investment is directed toward research and development to unlock high-value extracts and improve processing efficiency. Strategic partnerships with food, agriculture, and wellness manufacturers are helping accelerate commercialization and application development. Firms are also scaling production capacity in high-growth regions to reduce logistics costs and meet rising demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Form

- 2.2.4 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Red algae

- 5.3 Brown algae

- 5.4 Green algae

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry seaweed

- 6.3 Wet/Fresh seaweed

Chapter 7 Market Estimates and Forecast, By End use, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Dairy products

- 7.2.2 Bakery & confectionery

- 7.2.3 Processed meats & seafood

- 7.2.4 Vegan/plant-based foods

- 7.2.5 Functional beverages

- 7.2.6 Edible seaweed snacks

- 7.2.7 Sauces, soups & seasonings

- 7.3 Animal feed

- 7.3.1 Livestock feed additives

- 7.3.2 Poultry feed

- 7.3.3 Aquaculture feed

- 7.3.4 Pet food supplements

- 7.3.5 Methane-reducing feed for ruminants

- 7.4 Pharmaceutical & personal care

- 7.4.1 Wound healing ointments

- 7.4.2 Drug delivery systems

- 7.4.3 Skin care lotions & creams

- 7.4.4 Shampoos & conditioners

- 7.4.5 Anti-aging & anti-inflammatory products

- 7.4.6 Oral care products

- 7.5 Biofuels

- 7.5.1 Bioethanol production

- 7.5.2 Biogas generation

- 7.5.3 Algal biomass pre-treatment inputs

- 7.5.4 Hybrid renewable energy blends

- 7.6 Others

- 7.6.1 Agricultural biostimulants

- 7.6.2 Soil conditioners

- 7.6.3 Water treatment agents

- 7.6.4 Textile industry applications

- 7.6.5 Bioplastics & packaging materials

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants

- 9.2 Algaia

- 9.3 Cargill

- 9.4 DuPont

- 9.5 FMC Corporation

- 9.6 Gelymar

- 9.7 Indo Alginate

- 9.8 Irish Seaweeds

- 9.9 KIMICA Corporation

- 9.10 Mara Seaweed

- 9.11 MCPI (Marine Chemicals & Polymers Industries)

- 9.12 Ocean Harvest Technology

- 9.13 Qingdao Gather Great Ocean Algae Industry Group

- 9.14 Qingdao Seawin Biotech Group

- 9.15 Seasol

- 9.16 Seaweed Energy Solutions

- 9.17 Shaanxi Hongda Phytochemistry Co., Ltd.

- 9.18 Tate & Lyle

- 9.19 TBK Manufacturing Corporation (Philippines)

- 9.20 W Hydrocolloids, Inc.

- 9.21 Others