|

市场调查报告书

商品编码

1892855

自行车中轴市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Bicycle Bottom Bracket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

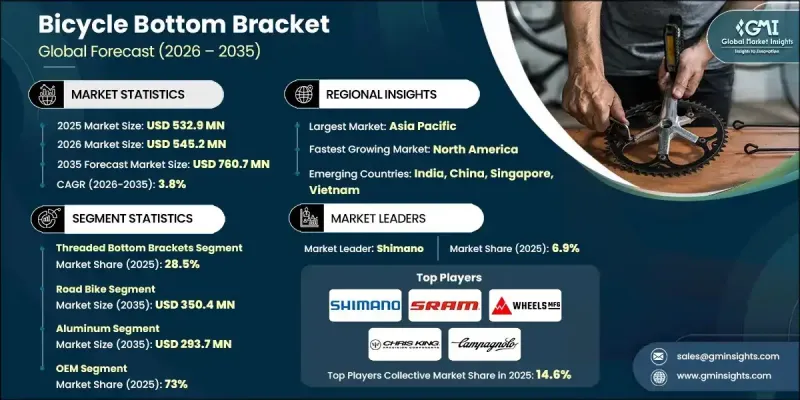

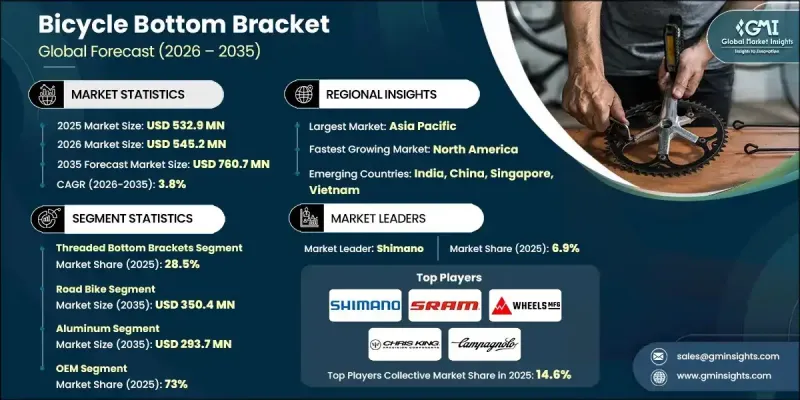

2025 年全球自行车中轴市场价值为 5.329 亿美元,预计到 2035 年将以 3.8% 的复合年增长率增长至 7.607 亿美元。

骑乘运动在健身、通勤和休閒方面的参与度不断提高,持续提升着对耐用高效动力传动系统部件的需求。随着骑乘者投资中高阶自行车,无论是原始设备製造商 (OEM) 还是售后市场供应商,对耐用型中轴的需求都在成长。整体市场前景与整个自行车行业的成长势头相呼应,多个地区都呈现出强劲的成长趋势。电动自行车的日益普及预计将成为主要推动因素,因为这些车型需要能够承受更高扭矩、更佳负载分布和更强减震能力的中轴。这种转变促使製造商开发采用先进轴承和耐用材料的强化设计。随着电动自行车在全球销售的加速成长,自行车品牌更加重视能够提供长寿命和强劲性能的中轴系统。轴承技术、加工精度和减摩技术的不断进步正在提升该品类的性能标准。提供具有更高刚度重量比、更有效率密封和更长保养週期的产品的品牌正在增强其竞争优势,并促进升级换代週期的增加和OEM的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 5.329亿美元 |

| 预测值 | 7.607亿美元 |

| 复合年增长率 | 3.8% |

2025年,螺纹式中轴市占率为28.5%,预计到2035年将达到1.773亿美元。这种配置因其可靠的适配性、耐用的结构和简单的安装过程而备受青睐。通勤车、旅行车、钢架车和修復型自行车仍然广泛使用螺纹式中轴,这凸显了其持续的重要性,即使新的车架标准正在兴起。强劲的售后市场需求也确保了螺纹式中轴系统在市场中占有重要地位。

2025年,公路车应用领域占51.35%的市场份额,预计到2035年将达到3.504亿美元。公路车高度重视效率、轻量化零件、顺畅的轴承和整体性能。成熟市场保持着稳定的更换需求,而发展中地区则为高端中轴的普及和定期升级提供了不断增长的机会。

2025年,美国自行车中轴市场规模预计将达8,990万美元。随着砾石骑行在美国的迅速兴起,对具备可靠密封、抗污染和长寿命的中轴的需求日益增长。追求长期可靠性、低维护成本和在各种地形上稳定性能的骑乘者,也对先进的售后市场解决方案表现出了更大的兴趣。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 全球自行车销售成长

- 电动自行车市场的扩张

- 材料技术的进步

- 竞技自行车运动日益普及

- 售后客製化成长

- 产业陷阱与挑战

- 跨 bb 标准的兼容性问题

- 先进材料成本高昂

- 市场机会

- 电动自行车专用五通设计

- 砾石/探险自行车运动的发展

- 整合和智慧组件采用

- 轻量化框架集成

- 成长潜力分析

- 监管环境

- 北美洲

- 美国:消费品安全委员会 (CPSC) 联邦法规第 16 篇 (CFR) 第 1512 部分

- 加拿大:国际标准化组织(ISO)4210

- 欧洲

- 德国:德国规范研究所 (DIN) 欧洲规范 (EN) ISO 4210

- 英国:欧洲标准 (EN) ISO 4210 / 英国合格评定 (UKCA)

- 法国:欧洲标准 (EN) ISO 4210

- 亚太地区

- 中国:国标 (GB) 3565

- 印度:印度标准 (IS) 10613

- 日本:日本工业标准(JIS)D 9110

- 拉丁美洲

- 巴西:Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 墨西哥:国际标准化组织(ISO)4210

- 中东和非洲

- 南非:南非国家标准 (SANS) 311

- 沙乌地阿拉伯:沙乌地阿拉伯标准、计量和品质组织 (SASO) 海湾标准化组织 (GSO) ISO 4210

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 定价分析与市场经济学

- 按地区

- 透过提供

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与机会

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 螺纹式中轴

- 压入式中轴

- 外置五通

- 筒式中轴

- 其他的

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 公路自行车

- 登山车

- 赛车

- 砾石自行车

第七章:市场估计与预测:依材料划分,2021-2034年

- 钢

- 铝

- 碳纤维

- 钛

- 复合材料

第八章:市场估算与预测:依配销通路划分,2021-2034年

- OEM

- 售后市场

第九章:市场估算与预测:依最终用途划分,2022-2035年

- 专业/竞技自行车手

- 休閒自行车骑行者

- 通勤用户

- 自行车製造商

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 葡萄牙

- 克罗埃西亚

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十一章:公司简介

- 全球参与者

- Campagnolo

- Full Speed Ahead (FSA)

- Hope Technology

- Praxis Works

- Race Face

- Shimano

- SRAM

- Wheels Manufacturing

- White Industries

- 区域玩家

- Cane Creek Cycling Components

- Chris King Precision Components

- MicroSHIFT

- Stronglight

- Sugino

- SunRace

- Token Products

- VP Components

- Emerging / Disruptor Players

- BBInfinite

- C-Bear

- CeramicSpeed

- Enduro Bearings

- Hambini Engineering

- Kogel Bearings

- AbsoluteBlack

- Tripeak Bearings

The Global Bicycle Bottom Bracket Market was valued at USD 532.9 million in 2025 and is estimated to grow at a CAGR of 3.8% to reach USD 760.7 million by 2035.

Increasing participation in cycling for fitness, commuting, and leisure continues to elevate the need for durable and efficient power-train components. As riders invest in mid-range and premium bicycles, demand from both OEMs and aftermarket suppliers for long-lasting bottom brackets is expanding. The overall market outlook mirrors the momentum seen across the broader cycling industry, with strong growth trends visible in multiple regions. The rising adoption of electric bicycles is expected to be a major catalyst, as these models require bottom brackets capable of handling higher torque, improved load distribution, and enhanced vibration control. This shift is pushing manufacturers to develop reinforced designs that incorporate advanced bearings and durable materials. With e-bike sales accelerating globally, bicycle brands are placing greater emphasis on bottom bracket systems that deliver longevity and robust performance. Continuous advancements in bearing technology, machining precision, and friction-reduction methods are raising the performance standards within the category. Brands offering products with superior stiffness-to-weight ratios, more effective seals, and longer service intervals are strengthening their competitive edge and contributing to growing upgrade cycles and OEM adoption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $532.9 Million |

| Forecast Value | $760.7 Million |

| CAGR | 3.8% |

The threaded bottom brackets segment held a 28.5% share in 2025 and is projected to reach USD 177.3 million by 2035. This configuration remains valued for its dependable fit, durable construction, and straightforward installation process. Its continued usage in commuter, touring, steel-frame, and restoration-focused bicycles highlights its ongoing relevance, even as newer frame standards gain traction. Strong aftermarket demand ensures threaded systems remain a vital part of the market.

The road bike application segment held a 51.35% share in 2025 and is anticipated to reach USD 350.4 million by 2035. Road cycling places high importance on efficiency, lightweight components, smooth bearings, and integrated performance. Established markets maintain steady replacement demand, while developing regions present expanding opportunities for premium bottom bracket adoption and regular upgrades.

US Bicycle Bottom Bracket Market was valued at USD 89.9 million in 2025. The rapid rise of gravel riding in the country is increasing the need for bottom brackets that offer robust sealing, contamination resistance, and extended durability. Riders seeking long-term reliability, minimal maintenance, and consistent performance across mixed terrain are driving greater interest in advanced aftermarket solutions.

Leading companies in the Global Bicycle Bottom Bracket Market include Campagnolo, Cane Creek Cycling Components, Chris King Precision Components, Enduro Bearings, Full Speed Ahead, Shimano, SRAM, Token Products, and Wheels Manufacturing. Companies in the Global Bicycle Bottom Bracket Market are strengthening their positions by advancing bearing technology, refining material engineering, and increasing product compatibility across multiple frame standards. Many manufacturers are investing in enhanced sealing systems, precision machining, and friction-reducing coatings to deliver smoother, longer-lasting performance. Product diversification aimed at serving both e-bike platforms and performance cycling segments is becoming a core strategic priority. Partnerships with OEMs help secure long-term integration into new bicycle models, while aftermarket-focused brands continue to expand upgrade options for riders seeking improved durability. Firms are also optimizing manufacturing processes to maintain consistent quality and reduce weight without sacrificing stiffness. Marketing efforts centered on product reliability, ease of maintenance, and technical innovation further reinforce brand competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Application

- 2.2.4 Material

- 2.2.5 Distribution channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in global bicycle sales

- 3.2.1.3 Expansion of e-bike market

- 3.2.1.4 Advancements in material technology

- 3.2.1.5 Rising popularity of performance cycling

- 3.2.1.6 Aftermarket customization growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Compatibility issues across bb standards

- 3.2.2.2 High cost of advanced materials

- 3.2.3 Market opportunities

- 3.2.3.1 E-bike-specific bb designs

- 3.2.3.2 Growth in gravel/adventure cycling

- 3.2.3.3 Integrated and smart component adoption

- 3.2.3.4 Lightweight frame integration

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.4.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.4.2 Europe

- 3.4.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.4.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.4.2.3 France: European Norm (EN) ISO 4210

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Guobiao (GB) 3565

- 3.4.3.2 India: Indian Standard (IS) 10613

- 3.4.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.4.4 Latin America

- 3.4.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.4.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.4.5 Middle East & Africa

- 3.4.5.1 South Africa: South African National Standard (SANS) 311

- 3.4.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Pricing analysis & market economics

- 3.10.1 By region

- 3.10.2 By Offering

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.14 Carbon footprint considerations

- 3.15 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Threaded bottom bracket

- 5.3 Press-fit bottom bracket

- 5.4 External bottom bracket

- 5.5 Cartridge bottom bracket

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bike

- 6.3 Mountain bike

- 6.4 Racing bike

- 6.5 Gravel bike

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Carbon fiber

- 7.5 Titanium

- 7.6 Composite materials

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2022-2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Professional / Performance Cyclists

- 9.3 Recreational Cyclists

- 9.4 Commuter Users

- 9.5 Bike Manufacturers

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Campagnolo

- 11.1.2 Full Speed Ahead (FSA)

- 11.1.3 Hope Technology

- 11.1.4 Praxis Works

- 11.1.5 Race Face

- 11.1.6 Shimano

- 11.1.7 SRAM

- 11.1.8 Wheels Manufacturing

- 111.9 White Industries

- 11.2 Regional Players

- 11.2.1 Cane Creek Cycling Components

- 11.2.2 Chris King Precision Components

- 11.2.3 MicroSHIFT

- 11.2.4 Stronglight

- 11.2.5 Sugino

- 11.2.6 SunRace

- 11.2.7 Token Products

- 11.2.8 VP Components

- 11.3 Emerging / Disruptor Players

- 11.3.1 BBInfinite

- 11.3.2 C-Bear

- 11.3.3 CeramicSpeed

- 11.3.4 Enduro Bearings

- 11.3.5 Hambini Engineering

- 11.3.6 Kogel Bearings

- 11.3.7 AbsoluteBlack

- 11.3.8 Tripeak Bearings