|

市场调查报告书

商品编码

1892860

光学相干断层扫描市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Optical Coherence Tomography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

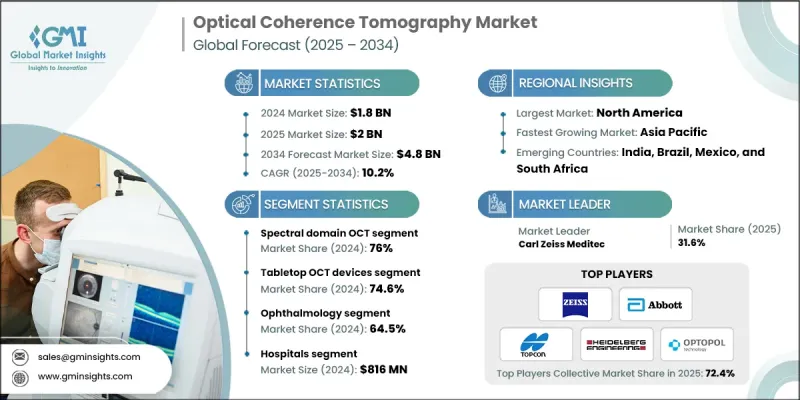

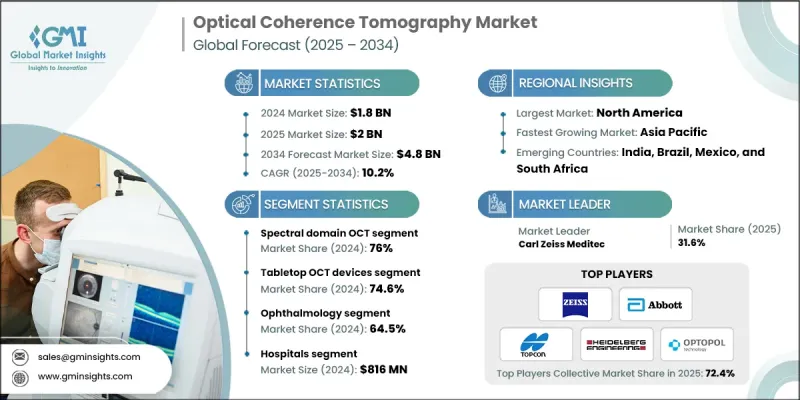

2024 年全球光学相干断层扫描市场价值为 18 亿美元,预计到 2034 年将以 10.2% 的复合年增长率成长至 48 亿美元。

光学相干断层扫描(OCT)是一种非侵入性成像方法,它利用低相干光产生生物组织的高解析度横断面影像。随着研发工作的加速,旨在提高诊断清晰度、增加组织探测深度和加快影像撷取速度的技术不断涌现,市场持续成长。这些进步推动了下一代诊断工具和治疗监测系统在各种临床环境中的应用。对小型便携式OCT设备的需求不断增长,也影响OCT的发展趋势,尤其是在医疗机构寻求便利的即时检测解决方案,以服务乡村诊所、流动诊所、家庭护理机构和门诊中心等场所时。对行动性和工作流程效率的日益重视,促使製造商推出更精简、用户友好的成像系统,以适应更广泛的临床应用。早期检测策略在眼部疾病诊断的应用日益广泛,进一步增强了现代眼科护理对OCT技术的依赖。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 48亿美元 |

| 复合年增长率 | 10.2% |

2024年,光谱域光学相干断层扫描(SD-OCT)市占率达76%。该细分市场占据领先地位,主要原因是影响视网膜健康的慢性眼部疾病发病率不断上升,从而推动了对精准、快速、高解析度成像的需求。 SD-OCT设备不仅常用于视网膜成像,也常用于评估眼前节、角膜状况和视神经。其适应性强,可用于从疾病分期到治疗后评估等各种临床应用,使其成为全面视力评估中不可或缺的一部分。

2024年,桌上型OCT设备市占率达到74.6%。这些系统仍然是眼科专业人士的首选,因为它们能够提供稳定、高精度的成像,并与多种扫描技术相容。它们在眼科中心、专科机构和医院科室的广泛应用,得益于其能够辅助分析青光眼进展、视网膜疾病和眼前节健康状况。现代桌上型设备通常将多种成像技术整合于单一平台,从而打造高效的诊断工作站。

美国光学相干断层扫描(OCT)市场预计在2024年达到6.31亿美元,并在2034年达到16亿美元。联邦医疗保险(Medicare)和私人保险公司对OCT相关检查的广泛覆盖,降低了患者和医疗机构的成本,从而促进了市场普及。 OCT的报销范围涵盖多种应用,包括视神经分析、视网膜扫描和OCT血管造影,这鼓励眼科诊所将OCT更常规地整合到临床工作流程中。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- OCT组件的原始设备製造商(OEM)

- 製造商

- 监管机构

- 经销商和供应商

- 最终用途

- 产业影响因素

- 成长驱动因素

- 眼部疾病日益增多

- 光学相干断层扫描技术的进步

- 非侵入性诊断技术的应用日益普及

- 提高新兴经济体的医疗保健投资和意识

- 产业陷阱与挑战

- 治疗费用高昂

- 缺乏训练有素、能够操作和解读OCT系统的专业人员。

- 市场机会

- 人工智慧驱动的诊断演算法和自动化分析

- 非处方药在儿科和重症监护的应用日益增多

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 我们

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 用于深层组织可视化的扫频源光学相干断层扫描技术

- 用于非侵入性血管成像的OCT血管造影

- 用于即时诊断的便携式多模式八面体电脑断层扫描(OCT)设备

- 新兴技术

- 用于超灵敏成像的量子增强型光学相干断层扫描技术

- 用于即时像差校正的自适应光学集成

- 3. 用于动态三维组织可视化的超高速OCT

- 当前技术趋势

- 专利分析

- 主要专利持有人和技术领导者

- 专利到期分析及影响

- 专利诉讼及纠纷

- 地理专利保护策略

- 2024年定价分析

- 未来市场趋势

- 用于预测诊断的AI驱动型OCT平台

- 基于云端的OCT资料管理和远距医疗集成

- OCT应用拓展至眼科以外领域

- 供应链和分销分析

- 原物料采购

- 製造中心分析

- 配销通路映射和合作伙伴网络

- 供应链脆弱性与风险缓解

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键发展

第五章:市场估计与预测:依技术划分,2021-2034年

- 光谱域光学相干断层扫描

- 扫频源光学相干断层扫描

- 时域光学相干断层扫描

第六章:市场估算与预测:依产品与服务划分,2021-2034年

- 仪器

- 桌上型OCT设备

- 基于导管的OCT设备

- 手持式OCT设备

- 多普勒OCT设备

- 组件更换服务、软体许可和升级

- 其他服务

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 眼科

- 心臟病学

- 皮肤科

- 肿瘤学

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 医院

- 诊断影像中心

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Agfa-Gevaert

- Canon

- Carl Zeiss Meditec

- Gentuity

- Heidelberg Engineering

- Huvitz

- Metall Zug AG (Haag-Streit Group)

- Moptim (Shenzhen Certainn Technology)

- NIDEK

- Nikon Corporation (Optos plc)

- NinePoint Medical

- Notal Vision

- Novacam Technologies

- OPTOPOL Technology

- Philophos

- Tomey

- Topcon Corporation

- TowardPi (Beijing) Medical Technology

- Visionx

- Vivolight

- YSENMED

- ZD medical

The Global Optical Coherence Tomography Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 4.8 billion by 2034.

OCT is a non-invasive imaging method that uses low-coherence light to produce highly detailed cross-sectional visuals of biological tissues. The market continues to grow as research and development efforts accelerate the launch of technologies aimed at improving diagnostic clarity, increasing tissue-depth reach, and speeding image acquisition. These advancements support the introduction of next-generation diagnostic tools and therapy-monitoring systems across various clinical environments. Rising demand for compact and portable OCT devices is also influencing development trends, especially as healthcare providers seek accessible solutions for point-of-care testing across rural practices, traveling clinics, home care facilities, and outpatient centers. The growing shift toward mobility and workflow efficiency is encouraging manufacturers to introduce more streamlined and user-friendly imaging systems designed for broader clinical use. Increasing adoption of early-detection strategies for major eye diseases further strengthens the reliance on OCT technology in modern ophthalmic care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 10.2% |

The spectral domain OCT segment accounted for a 76% share in 2024. This segment holds a leading position due to rising incidences of chronic eye disorders that impact retinal health and drive the need for precise, fast, and high-resolution imaging. SD-OCT devices are frequently used not only for retinal interpretation but also for assessing the anterior segment, corneal conditions, and the optic nerve. Their adaptability for various clinical tasks, from disease staging to post-treatment evaluations, makes them integral to comprehensive vision assessment.

The tabletop OCT equipment segment held a 74.6% share in 2024. These systems remain the preferred choice for ophthalmic professionals because they offer stable, highly accurate imaging and compatibility with multiple scanning techniques. Their widespread use in eye centers, specialty facilities, and hospital departments is supported by their ability to assist in analyzing glaucoma progression, retinal disorders, and anterior segment health. Modern tabletop devices often combine multiple imaging technologies into a single platform, creating efficient diagnostic workstations.

United States Optical Coherence Tomography Market is projected to reach USD 631 million in 2024 and reach USD 1.6 billion by 2034. Substantial coverage from Medicare and private payers for OCT-related procedures enhances market adoption by lowering costs for both patients and providers. Reimbursement applies to several applications, including optic nerve analysis, retinal scanning, and OCT angiography, which encourages eye care practices to integrate OCT more routinely into clinical workflows.

Key companies participating in the Optical Coherence Tomography Market include Abbott Laboratories, Canon, Agfa-Gevaert, Gentuity, Huvitz, Heidelberg Engineering, Carl Zeiss Meditec, NIDEK, Metall Zug AG (Haag-Streit Group), Moptim (Shenzhen Certainn Technology), Nikon Corporation (Optos plc), Philophos, NotaLVision, NinePoint Medical, Novacam Technologies, OPTOPOL Technology, Topcon Corporation, Tomey, TowardPi (Beijing) Medical Technology, Visionx, Vivolight, YSENMED, and ZD Medical. Key strategies employed by major companies in the Optical Coherence Tomography Market focus on enhancing imaging performance, broadening clinical applications, and expanding product accessibility. Firms continue to invest in advanced light-source technologies and upgraded scanning algorithms to deliver sharper resolution and faster image capture. Many players are integrating multimodal imaging into unified systems to streamline diagnostic processes for clinicians. Collaborations with healthcare providers and academic research centers help refine device accuracy and support clinical validation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Product and services trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Original equipment manufacturers (OEMs) of OCT components

- 3.1.2 Manufacturer

- 3.1.3 Regulatory authorities

- 3.1.4 Distributors and suppliers

- 3.1.5 End use

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of eye disorders

- 3.2.1.2 Advancements in OCT technology

- 3.2.1.3 Rising adoption of non-invasive diagnostic techniques

- 3.2.1.4 Increasing healthcare investments and awareness in emerging economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapies

- 3.2.2.2 Shortage of skilled professionals trained to operate and interpret OCT systems

- 3.2.3 Market opportunities

- 3.2.3.1 AI-powered diagnostic algorithms and automated analysis

- 3.2.3.2 Increasing applications of OTC in pediatric and critical care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Swept source OCT for deep tissue visualization

- 3.5.1.2 OCT angiography for non-invasive vascular mapping

- 3.5.1.3 Portable and multimodal oct devices for point-of-care diagnostics

- 3.5.2 Emerging technologies

- 3.5.2.1 Quantum-enhanced OCT for ultra-sensitive imaging

- 3.5.2.2 Adaptive optics integration for real-time aberration correction

- 3.5.2. 3. Ultra-high-speed OCT for dynamic 3D tissue visualization

- 3.5.1 Current technological trends

- 3.6 Patent analysis

- 3.6.1 Key patent holders and technology leaders

- 3.6.2 Patent expiration analysis and impact

- 3.6.3 Patent litigation and disputes

- 3.6.4 Geographic patent protection strategies

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.8.1 AI-driven OCT platforms for predictive diagnostics

- 3.8.2 Cloud-based OCT data management and telemedicine integration

- 3.8.3 Expansion of OCT applications beyond ophthalmology

- 3.9 Supply chain and distribution analysis

- 3.9.1 Raw material sourcing

- 3.9.2 Manufacturing hub analysis

- 3.9.3 Distribution channel mapping and partner networks

- 3.9.4 Supply chain vulnerabilities and risk mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key development

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Spectral domain OCT

- 5.3 Swept-source OCT

- 5.4 Time domain OCT

Chapter 6 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Instruments

- 6.2.1 Tabletop OCT devices

- 6.2.2 Catheter based OCT devices

- 6.2.3 Handheld OCT devices

- 6.2.4 Doppler OCT devices

- 6.3 Component replacement services and software licensing and upgrade

- 6.4 Other services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Ophthalmology

- 7.3 Cardiology

- 7.4 Dermatology

- 7.5 Oncology

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic imaging centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agfa-Gevaert

- 10.3 Canon

- 10.4 Carl Zeiss Meditec

- 10.5 Gentuity

- 10.6 Heidelberg Engineering

- 10.7 Huvitz

- 10.8 Metall Zug AG (Haag-Streit Group)

- 10.9 Moptim (Shenzhen Certainn Technology)

- 10.10 NIDEK

- 10.11 Nikon Corporation (Optos plc)

- 10.12 NinePoint Medical

- 10.13 Notal Vision

- 10.14 Novacam Technologies

- 10.15 OPTOPOL Technology

- 10.16 Philophos

- 10.17 Tomey

- 10.18 Topcon Corporation

- 10.19 TowardPi (Beijing) Medical Technology

- 10.20 Visionx

- 10.21 Vivolight

- 10.22 YSENMED

- 10.23 ZD medical