|

市场调查报告书

商品编码

1892870

高尔夫球车配件市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Golf Cart Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

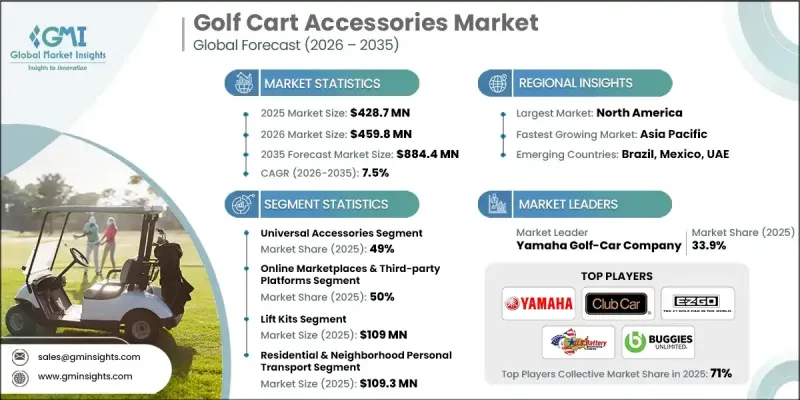

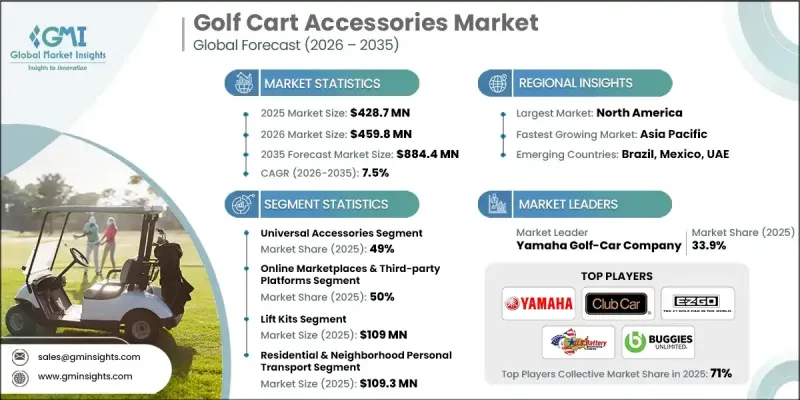

2025 年全球高尔夫球车配件市场价值为 4.287 亿美元,预计到 2035 年将以 7.5% 的复合年增长率增长至 8.844 亿美元。

推动该市场成长的因素包括:对个人化和高性能出行解决方案的需求不断增长、电动高尔夫球车的普及以及休閒和商业高尔夫球场营运的扩张。随着度假村、封闭式社区和城市中心将高效、永续和便利的交通放在首位,专业的电动高尔夫球车配件对于提升个人和商业用途的舒适性、安全性和功能性至关重要。先进的技术整合正在重塑高尔夫球车的实用性和性能。节能照明、智慧安全模组、增强型悬吊系统和符合人体工学的组件等配件,在满足严格安全标准的同时,提高了乘客的舒适度、操作效率和在各种地形上的操控性。製造商越来越多地使用耐腐蚀材料、轻量化设计和模组化组件,以提供满足不同消费者和商业需求的灵活解决方案。电动高尔夫球车车队的成长、多功能高尔夫球车在饭店和校园环境中的应用,以及工业设施、度假村和封闭社区需求的增加,进一步推动了市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 4.287亿美元 |

| 预测值 | 8.844亿美元 |

| 复合年增长率 | 7.5% |

2025年,通用配件市占率达到49%,预计2026年至2035年间将以7.5%的复合年增长率成长。通用配件之所以占据主导地位,是因为它们相容于电动、燃油和混合动力车辆,安装简便,且经济实惠。这些产品包括升降套件、车轮、轮胎、照明系统和安全增强组件,为车队营运商和个人用户提供了组件标准化、减少库存需求和大规模部署解决方案的灵活性。

到2025年,线上市场和第三方平台将占据50%的市场份额,预计2026年至2035年将以7%的复合年增长率成长。这个细分市场蓬勃发展的原因在于其便利性、覆盖范围广以及能够同时服务个人买家和车队营运商。线上平台提供丰富的商品选择、极具竞争力的价格和详细的规格说明,帮助消费者做出明智的购买决策。与物流网路的整合、即时库存更新以及便利的支付系统进一步增强了这些管道的吸引力,使其成为新购置产品和更换配件的首选。

美国高尔夫球车配件市场占91%的市场份额,预计2024年市场规模将达到2.992亿美元。该地区受益于成熟的消费群体、完善的高尔夫球场和住宅社区、电动和燃油高尔夫球车的广泛普及,以及消费者对安全性和舒适性功能的强烈认知。北美先进的製造能力和零售网路进一步巩固了其在全球高尔夫球车配件市场的领先地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电动高尔夫球车的普及率不断提高

- 高尔夫球场、度假村和封闭式社区的扩建

- 配件领域的技术创新

- 对个人化/客製化解决方案的需求日益增长

- 产业陷阱与挑战

- 高级配件价格昂贵

- 售后市场标准化程度有限

- 市场机会

- 智慧互联配件的集成

- 新兴市场的扩张

- 售后服务和车队升级

- 永续发展驱动的创新

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 美国环保署环境法规

- 美国能源部能源效率标准

- ADA无障碍要求

- 州和地方低速车辆法规

- 北美行业分类系统 (NAICS) 和行业分类标准 (SIC)

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 电动动力总成技术

- 瓦斯/汽油动力总成技术

- 充电基础设施

- 目前配件技术

- 新兴技术

- 先进的电池技术

- 电池管理系统(BMS)

- 自动驾驶系统

- 目前技术

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 最畅销的高尔夫球车配件

- 挡风玻璃

- 座椅套件

- 照明套件

- 储存和实用插件

- 防风雨

- 车轮和轮胎

- 电池及电子配件

- 安全配件

- 美容增强套装

- 产品创新流程

- 配件成本结构

- 材料成本分摊

- 人工成本分摊

- 增值成本(设计、客製化)

- 如果产品来自中国/泰国/美国,则需缴纳进口关税。

- 消费者购买行为

- 顾客偏好

- 更换週期和磨损率

- 配销通路经济学

- 售后市场与OEM策略

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依配件分类,2022-2035年

- 高尔夫球车罩

- 高尔夫球车围栏

- 升降套件

- 车轮和轮胎

- 灯具及照明配件

- 安全系统

- 其他的

第六章:市场估算与预测:依电源相容性划分,2022-2035年

- 通用配件

- 电动车专用配件

- 汽油/瓦斯推车专用配件

第七章:市场估计与预测:依应用领域划分,2022-2035年

- 居民及邻里个人交通

- 高尔夫球场运营及运营

- 饭店及度假村宾客服务

- 校园流动性

- 工业和仓储物料搬运

- 机场及大型客运场所

- 政府和市政设施运营

- 医疗病人及设备运输

第八章:市场估算与预测:依配销通路划分,2022-2035年

- 线上市场和第三方平台

- 直接面向消费者

- 单层分销

- 多层分销

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Global Player

- Caddyshack Golf Cars

- Club Car, Inc.

- Crown Battery Manufacturing

- Exide Technologies

- EZ-GO

- Garia A/S

- JH Global Services

- Polaris Industries Inc. (GEM)

- Trojan Battery Company

- Yamaha Motor Co., Ltd.

- Regional Player

- Buggies Unlimited

- Delta-Q Technologies

- Golf Cart King

- LESTER Electrical

- Madjax (NIVEL Holdings)

- Navitas Vehicle Systems

- Nivel Parts & Manufacturing Co.

- Red Hawk Golf Cart Parts & Accessories

- Star EV Corporation

- Tomberlin

- 新兴参与者

- Advanced EV

- Allied Lithium

- Eco Battery

- Evolution Electric Vehicles

- RELiON Battery

The Global Golf Cart Accessories Market was valued at USD 428.7 million in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 884.4 million by 2035.

Growth in this market is fueled by increasing demand for personalized and high-performance mobility solutions, wider adoption of electric golf carts, and expansion of recreational and commercial golf course operations. As resorts, gated communities, and urban centers prioritize efficient, sustainable, and convenient transportation, specialized golf cart accessories have become critical to enhance comfort, safety, and functionality for both personal and commercial applications. Advanced technological integration is reshaping the utility and performance of golf carts. Accessories such as energy-efficient lighting, smart security modules, enhanced suspension systems, and ergonomic components improve passenger comfort, operational efficiency, and navigation across diverse terrains while meeting stringent safety standards. Manufacturers are increasingly using corrosion-resistant materials, lightweight designs, and modular components to provide flexible solutions that cater to varying consumer and commercial needs. Market expansion is further driven by the growth of electric golf cart fleets, the adoption of multi-purpose carts in hospitality and campus settings, and increasing demand in industrial facilities, resorts, and gated communities.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $428.7 Million |

| Forecast Value | $884.4 Million |

| CAGR | 7.5% |

The universal accessories segment accounted for a 49% share in 2025 and is expected to grow at a CAGR of 7.5% between 2026 and 2035. Universal accessories dominate due to their compatibility across electric, gas, and hybrid carts, ease of installation, and cost-effectiveness. These products, including lift kits, wheels, tires, lighting systems, and safety enhancements, provide fleet operators and individual users the flexibility to standardize components, reduce inventory needs, and deploy solutions at scale.

The online marketplaces and third-party platforms represented a 50% share in 2025 and are projected to grow at a CAGR of 7% from 2026 to 2035. This segment thrives due to its convenience, broad reach, and ability to serve both individual buyers and fleet operators. Online platforms offer a wide product selection, competitive pricing, and detailed specifications, enabling informed purchase decisions. Integration with logistics networks, real-time inventory updates, and seamless payment systems further strengthen the appeal of these channels, making them preferred options for new purchases and replacement accessories.

U.S. Golf Cart Accessories Market held a 91% share, generating USD 299.2 million in 2024. The region benefits from a mature consumer base, established golf and residential communities, widespread electric and gas-powered cart adoption, and strong awareness of safety and comfort features. North America's advanced manufacturing capabilities and retail networks reinforce its leadership in global golf cart accessory adoption.

Key players in the Golf Cart Accessories Market include EZGO, Polaris Industries, Crown Battery Manufacturing, Buggies Unlimited, Club Car, Trojan Battery Company, Yamaha Golf-Car Company, Golf Cart Gurus, US Battery Manufacturing Company, and Red Hawk. Companies in the Golf Cart Accessories Market are strengthening their presence by investing in innovative, high-performance products that enhance safety, comfort, and efficiency. Manufacturers focus on lightweight, corrosion-resistant, and modular designs to meet diverse customer and commercial needs. Strategic partnerships with distributors, e-commerce platforms, and third-party retailers help expand market reach and improve accessibility. Businesses are also prioritizing technological integration, such as smart security systems, battery-efficient components, and connected features, to differentiate their offerings. Customization options for personal and fleet use further boost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Accessory

- 2.2.3 Power compatibility

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric golf carts

- 3.2.1.2 Expansion of golf courses, resorts, and gated communities

- 3.2.1.3 Technological innovations in accessories

- 3.2.1.4 Growing demand for personalized/customized solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of premium accessories

- 3.2.2.2 Limited aftermarket standardization

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart and connected accessories

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 Aftermarket services and fleet upgrades

- 3.2.3.4 Sustainability-driven innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 EPA environmental regulations

- 3.4.2 DOE energy efficiency standards

- 3.4.3 Ada accessibility requirements

- 3.4.4 State & local LSV regulations

- 3.4.5 NAICS & sic classification standards

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current Technology

- 3.7.1.1 Electric powertrain technology

- 3.7.1.2 Gas/petrol powertrain technology

- 3.7.1.3 Charging infrastructure

- 3.7.1.4 Current accessory technologies

- 3.7.2 Emerging Technologies

- 3.7.2.1 Advanced battery technology

- 3.7.2.2 Battery management systems (BMS)

- 3.7.2.3 Autonomous driving systems

- 3.7.1 Current Technology

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Best-Selling Golf Cart Accessories

- 3.12.1 Windshields

- 3.12.2 Seat kits

- 3.12.3 Lighting kits

- 3.12.4 Storage & utility add-ons

- 3.12.5 Weather protection

- 3.12.6 Wheels & tires

- 3.12.7 Battery & electrical accessories

- 3.12.8 Safety accessories

- 3.12.9 Aesthetic enhancement kits

- 3.13 Product Innovation Pipeline

- 3.14 Cost Structure of Accessories

- 3.14.1 Material cost share

- 3.14.2 Labor cost share

- 3.14.3 Value-add cost (design, customization)

- 3.14.4 Import duties if products are sourced from China/Thailand/US

- 3.15 Consumer buying behavior

- 3.15.1 Customer preference

- 3.15.2 Replacement Cycle & Wear-and-Tear Rates

- 3.15.3 Distribution Channel Economics

- 3.16 Aftermarket vs OEM strategy

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Accessory, 2022 - 2035 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Golf cart covers

- 5.3 Golf cart enclosures

- 5.4 Lift kits

- 5.5 Wheels and tires

- 5.6 Lights and lighting accessories

- 5.7 Security systems

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Power Compatibility, 2022 - 2035 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Universal accessories

- 6.3 Electric cart-specific accessories

- 6.4 Gas/petrol cart-specific accessories

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Residential & neighborhood personal transport

- 7.3 Golf course play & operations

- 7.4 Hospitality & resort guest services

- 7.5 Campus mobility

- 7.6 Industrial & warehouse material handling

- 7.7 Airport & large passenger venue

- 7.8 Government & municipal facility operations

- 7.9 Healthcare patient & equipment transport

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Online marketplaces & third-party platforms

- 8.3 Direct-to-consumer

- 8.4 Single-tier distribution

- 8.5 Multi-tier distribution

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Caddyshack Golf Cars

- 10.1.2 Club Car, Inc.

- 10.1.3 Crown Battery Manufacturing

- 10.1.4 Exide Technologies

- 10.1.5 E-Z-GO

- 10.1.6 Garia A/S

- 10.1.7 JH Global Services

- 10.1.8 Polaris Industries Inc. (GEM)

- 10.1.9 Trojan Battery Company

- 10.1.10 Yamaha Motor Co., Ltd.

- 10.2 Regional Player

- 10.2.1 Buggies Unlimited

- 10.2.2 Delta-Q Technologies

- 10.2.3 Golf Cart King

- 10.2.4 LESTER Electrical

- 10.2.5 Madjax (NIVEL Holdings)

- 10.2.6 Navitas Vehicle Systems

- 10.2.7 Nivel Parts & Manufacturing Co.

- 10.2.8 Red Hawk Golf Cart Parts & Accessories

- 10.2.9 Star EV Corporation

- 10.2.10 Tomberlin

- 10.3 Emerging Players

- 10.3.1 Advanced EV

- 10.3.2 Allied Lithium

- 10.3.3 Eco Battery

- 10.3.4 Evolution Electric Vehicles

- 10.3.5 RELiON Battery