|

市场调查报告书

商品编码

1892873

单株抗体市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Monoclonal Antibodies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

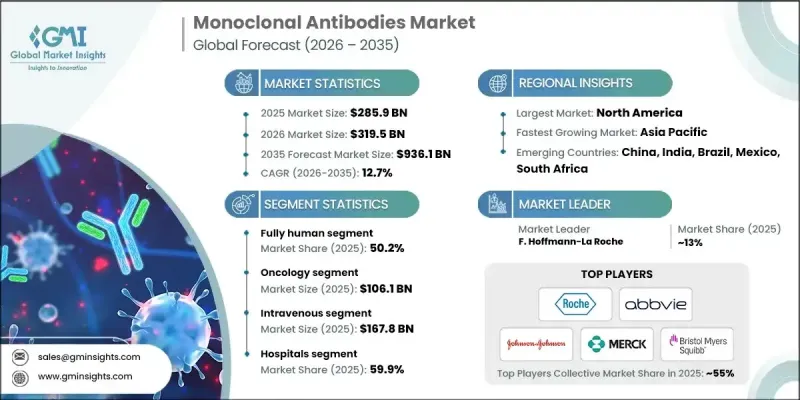

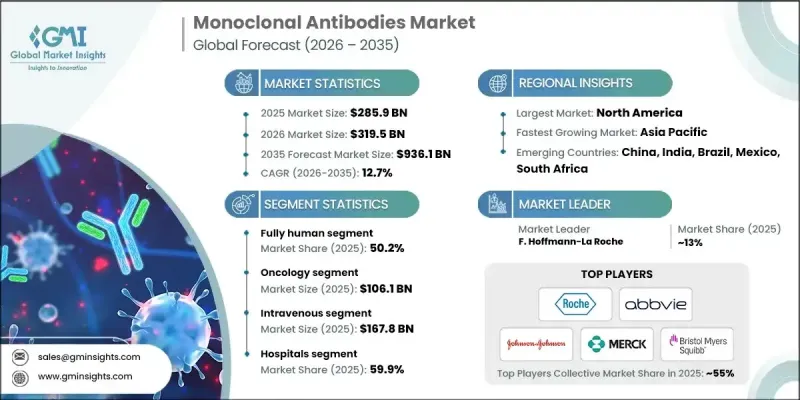

2025年全球单株抗体市场价值为2,859亿美元,预计到2035年将以12.7%的复合年增长率成长至9,361亿美元。

由于全球慢性病、自体免疫疾病和癌症相关疾病的盛行率不断上升,市场正经历强劲成长。单株抗体是实验室合成的分子,旨在模拟免疫系统识别和对抗有害病原体(包括癌细胞和病毒)的能力。它们针对特定抗原,与传统疗法相比,可提供高度精准的治疗,并减少脱靶效应。这些生物製剂正日益广泛地应用于肿瘤学、免疫学、传染病和其他治疗领域。市场成长的驱动力来自于精准医疗的日益普及、治疗效果的改善以及标靶疗法的开发。领先企业之间的策略合作、伙伴关係和收购正在重塑竞争格局,强化供应链,并支持全球扩张,尤其是在新兴市场,同时满足已开发地区和发展中地区不断增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2859亿美元 |

| 预测值 | 9361亿美元 |

| 复合年增长率 | 12.7% |

预计到2025年,全人源单株抗体市占率将达到50.2%,并有望以12.8%的复合年增长率成长。全人源单株抗体因其安全性高、免疫原性低和治疗效果好而备受青睐。它们与天然人类免疫球蛋白结构高度相似,可降低抗药性抗体反应,并确保长期治疗的持续疗效。主要全人源疗法的临床成功进一步巩固了该领域的领先地位。

预计到2025年,肿瘤治疗领域市场规模将达到1,061亿美元,年复合成长率(CAGR)为12.5%。全球癌症发生率的上升以及标靶治疗的普及是推动该领域成长的主要因素。单株抗体因其能够选择性靶向肿瘤相关抗原、最大限度降低脱靶毒性并改善患者生存预后,而被广泛应用于肿瘤治疗。抗体药物偶联物、双特异性抗体和免疫检查点抑制剂的创新进一步巩固了单株抗体在精准肿瘤治疗中的作用。

北美单株抗体市场预计到2025年将占据41.5%的市场份额,这主要得益于先进的医疗基础设施、慢性病和传染病的高发生率以及众多领先生物製药公司的存在。此外,下一代抗体技术的早期应用、个人化疗法的广泛使用、强劲的研发投入、有利的医保政策、生物类似药渗透率的不断提高以及传染病诊断率的提升,都对强劲的市场需求起到了推动作用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 全球慢性病和传染病之病率不断上升

- 不断成长的研发活动

- 已开发市场的高接受度与加速审批

- 生物製剂市场蓬勃发展,单株抗体的应用日益广泛

- 产业陷阱与挑战

- 单株抗体疗法成本高

- 严格的监管框架和合规要求

- 市场机会

- 下一代抗体技术的出现

- 拓展至医疗基础建设更完善的新兴市场

- 成长驱动因素

- 成长潜力分析

- 技术格局

- 当前技术趋势

- 新兴技术

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源类型划分,2022-2035年

- 嵌合体

- 小鼠

- 完全人类

- 人性化

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 肿瘤学

- 自体免疫疾病

- 传染病

- 神经系统疾病

- 其他应用

第七章:市场估计与预测:依给药途径划分,2022-2035年

- 静脉

- 皮下

- 肌肉内注射

第八章:市场估算与预测:依最终用途划分,2022-2035年

- 医院

- 专科中心

- 其他最终用途

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Amgen

- Arcus Biosciences

- AstraZeneca

- BioArctic

- Bristol Myers Squibb

- Eli Lilly and Company

- F. Hoffmann-La Roche

- GlaxoSmithKline

- Johnson & Johnson

- Merck & Co.

- Novartis AG

- Regeneron Pharmaceuticals

- Sanofi

- Takeda Pharmaceutical Company

- UCB Pharma

The Global Monoclonal Antibodies Market was valued at USD 285.9 billion in 2025 and is estimated to grow at a CAGR of 12.7% to reach USD 936.1 billion by 2035.

The market is witnessing strong growth due to the rising prevalence of chronic, autoimmune, and cancer-related diseases worldwide. Monoclonal antibodies are lab-engineered molecules designed to mimic the immune system's ability to recognize and combat harmful pathogens, including cancer cells and viruses. They target specific antigens, providing highly precise treatments with reduced off-target effects compared to conventional therapies. These biologics are increasingly applied in oncology, immunology, infectious diseases, and other therapeutic areas. The market is driven by the growing adoption of precision medicine, improved treatment outcomes, and the development of targeted therapies. Strategic collaborations, partnerships, and acquisitions among leading players are reshaping the competitive landscape, strengthening supply chains, and supporting global expansion, particularly in emerging markets, while addressing rising demand in both developed and developing regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $285.9 Billion |

| Forecast Value | $936.1 Billion |

| CAGR | 12.7% |

The fully human segment held a 50.2% share in 2025 and is expected to grow at a CAGR of 12.8%. Fully human monoclonal antibodies are preferred due to their safety, minimal immunogenicity, and high therapeutic efficacy. They closely resemble natural human immunoglobulins, reducing anti-drug antibody responses and enabling sustained effectiveness in long-term therapies. The clinical success of major fully human therapies has further reinforced the dominance of this segment.

The oncology segment generated USD 106.1 billion in 2025, growing at a CAGR of 12.5%. The increasing global incidence of cancer and the adoption of targeted therapies drive growth in this segment. Monoclonal antibodies are widely used in oncology because they selectively target tumor-associated antigens, minimize off-target toxicity, and improve survival outcomes. Innovations in antibody-drug conjugates, bispecific antibodies, and checkpoint inhibitors have further strengthened their role in precision oncology.

North America Monoclonal Antibodies Market held a 41.5% share in 2025, driven by advanced healthcare infrastructure, high prevalence of chronic and infectious diseases, and the presence of leading biopharmaceutical companies. Early adoption of next-generation antibody technologies, extensive use of personalized therapies, strong research investments, favorable reimbursement policies, increasing biosimilar penetration, and higher diagnostic rates for infectious diseases contribute to robust market demand.

Key companies active in the Global Monoclonal Antibodies Market include Johnson & Johnson, Takeda Pharmaceutical, Amgen, AbbVie, BioArctic, Eli Lilly and Company, AstraZeneca, Regeneron Pharmaceuticals, Novartis AG, F. Hoffmann-La Roche, GlaxoSmithKline, Arcus Biosciences, Bristol Myers Squibb, UCB Pharma, and Sanofi. Companies in the Global Monoclonal Antibodies Market are strengthening their market presence through several strategies. They are heavily investing in research and development to discover next-generation antibodies with enhanced efficacy and safety profiles. Strategic partnerships and collaborations with biotech firms and research institutions are expanding their global footprint. Companies are also focusing on geographic expansion, particularly into emerging markets, to capture rising demand. Additionally, mergers and acquisitions are used to enhance product portfolios and accelerate market penetration. Adoption of digital platforms for clinical trial management, patient engagement, and supply chain optimization is also being leveraged to improve operational efficiency and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Source type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases worldwide

- 3.2.1.2 Growing research and development activities

- 3.2.1.3 High adoption and accelerated approvals in developed markets

- 3.2.1.4 The booming biologics market and rising applications of monoclonal antibodies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of monoclonal antibody therapeutics

- 3.2.2.2 Stringent regulatory framework and compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of next-generation antibody technologies

- 3.2.3.2 Expansion into emerging markets with improved healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Chimeric

- 5.3 Murine

- 5.4 Fully human

- 5.5 Humanized

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Autoimmune diseases

- 6.4 Infectious diseases

- 6.5 Neurological diseases

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

- 7.4 Intramuscular

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Arcus Biosciences

- 10.4 AstraZeneca

- 10.5 BioArctic

- 10.6 Bristol Myers Squibb

- 10.7 Eli Lilly and Company

- 10.8 F. Hoffmann-La Roche

- 10.9 GlaxoSmithKline

- 10.10 Johnson & Johnson

- 10.11 Merck & Co.

- 10.12 Novartis AG

- 10.13 Regeneron Pharmaceuticals

- 10.14 Sanofi

- 10.15 Takeda Pharmaceutical Company

- 10.16 UCB Pharma