|

市场调查报告书

商品编码

1892879

高压清洗机市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Pressure Washer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

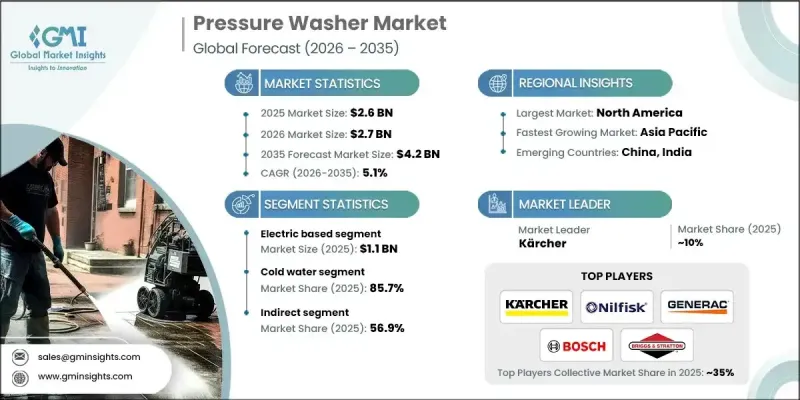

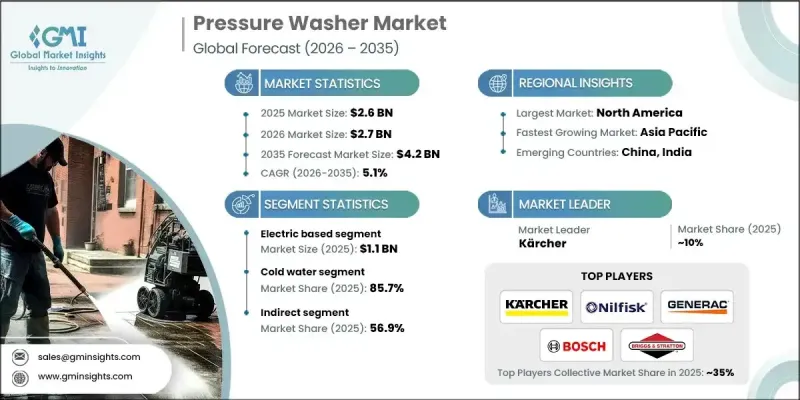

2025年全球高压清洗机市值26亿美元,预计2035年将以5.1%的复合年增长率成长至42亿美元。

人们越来越倾向于独立完成家庭清洁和维护工作,这是推动市场成长的最强劲动力之一。为了节省开支、更好地掌控周围环境,并享受维护居住空间的成就感,越来越多的房主开始自己动手清洁户外区域、车辆和房屋外墙。这种转变带动了对紧凑型、经济实惠且操作便捷的压力清洗机的强劲需求,这类产品已成为许多家庭的标配。同时,快速的城市扩张和持续的基础设施也为商业和工业领域带来了稳定的需求。不断发展的城市需要定期维护公共空间和建筑环境,这促使人们对耐用、可连续使用的大容量设备产生了浓厚的兴趣。随着城市计画的日益频繁和广泛,预计在预测期内,对高效清洁系统的需求将持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 26亿美元 |

| 预测值 | 42亿美元 |

| 复合年增长率 | 5.1% |

预计到2025年,电动高压清洗机市场规模将达到11亿美元,并预计在2035年之前以5.4%的复合年增长率成长。电动高压清洗机凭藉其成本效益高、维护成本低、操作简单等优势,仍是使用者的首选。它们被广泛应用于日常家庭清洁工作,从庭院清洁到车辆清洗,无所不包。随着环保意识的增强和旨在减少排放的全球性倡议的推进,电动高压清洗机的吸引力进一步提升,因为它们的设计符合永续发展的目标。

2025年,冷水式净水器市占率达到85.7%,预计2026年至2035年间将以5%的复合年增长率成长。这类净水器之所以占据主导地位,是因为它们价格实惠、结构轻巧,并且适合日常家庭清洁。此外,它们节能高效,且可透过零售和线上通路便捷购买,这进一步巩固了它们作为DIY用户首选的地位。虽然热水式净水器在重型工业领域仍然十分重要,但冷水式净水器凭藉其易用性和多功能性,继续保持领先地位。

2025年,美国高压清洗机市场规模达5亿美元,预计2026年至2035年将以5.9%的复合年增长率成长。美国市场发展成熟,住宅、商业和工业领域的需求强劲。家庭装修趋势和蓬勃发展的DIY文化推动了电动高压清洗机的持续销售。同时,农业、建筑和汽车等产业则依赖耐用的燃气动力高压清洗机来满足营运需求。不断增长的线上销售、不断变化的消费者期望以及快速的产品创新,持续影响该地区的购买决策。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- DIY居家装潢需求不断成长

- 都市化进程加速与基础建设

- 技术进步

- 陷阱与挑战

- 燃气动力车型的初始投资较高

- 新兴市场意识有限

- 机会

- 新兴市场的扩张

- 环保节能车型的成长

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码 - 8424)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 电动

- 气基

- 燃料

第六章:市场估算与预测:依类型划分,2022-2035年

- 便携的

- 不可携带

第七章:市场估计与预测:依组件划分,2022-2035年

- 水泵浦

- 电动马达/燃气发动机

- 高压软管

- 喷嘴

第八章:市场估算与预测:依水务营运划分,2022-2035年

- 热水

- 冷水

第九章:市场估算与预测:依PSI压力划分,2022-2035年

- 0-1500 PSI

- 1501-3000磅/平方英寸

- 3001-4000磅/平方英寸

- 高于 4000 PSI

第十章:市场估计与预测:依应用领域划分,2022-2035年

- 洗车

- 花园洗衣机

- 房屋外墙清洗机

- 工业的

- 其他的

第十一章:市场估价与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十二章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十三章:公司简介

- Be Pressure

- Bosch

- Craftsman

- Generac Power Systems

- Hotsy

- Honda Power Equipment

- Karcher

- MTM Hydro

- Nilfisk

- Pressure-Pro

- Ryobi

- Simpson Cleaning

- Stanley Black & Decker

- Sun Joe

- Troy-Bilt

The Global Pressure Washer Market was valued at USD 2.6 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 4.2 billion by 2035.

The expanding preference for handling household cleaning and maintenance tasks independently is one of the strongest contributors to market growth. Homeowners are increasingly taking on projects such as cleaning outdoor areas, vehicles, and home exteriors to save costs, gain greater control over their surroundings, and enjoy the personal satisfaction that comes with maintaining their living spaces. This shift has driven strong demand for compact, budget-friendly, and user-oriented pressure washer models, which have become a standard component of many households. Simultaneously, rapid urban expansion and ongoing infrastructure development continue to generate steady demand across commercial and industrial settings. Growing cities require regular upkeep of public spaces and construction environments, fueling interest in high-capacity equipment built for durability and constant use. As urban projects become more frequent and widespread, the need for efficient cleaning systems is set to rise steadily throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 5.1% |

The electric-based segment reached USD 1.1 billion in 2025 and is forecast to grow at a CAGR of 5.4% through 2035. Electric models remain a leading choice due to their cost efficiency, low maintenance needs, and ease of operation. They are widely adopted for everyday residential tasks ranging from patio cleaning to vehicle washing. Increasing environmental awareness and global initiatives aimed at lowering emissions have further boosted the appeal of electric pressure washers, as their designs align with sustainable usage goals.

The cold-water category accounted for an 85.7% share in 2025 and is expected to grow at a CAGR of 5% between 2026 and 2035. These systems dominate because of their affordability, lightweight structure, and suitability for routine household cleaning. Their energy-efficient nature and convenient availability through retail and online channels reinforce their status as the preferred option for DIY users. While hot-water systems remain important in heavy-duty industrial settings, cold-water units continue to lead due to their accessibility and versatility.

U.S. Pressure Washer Market generated USD 500 million in 2025 and is predicted to grow at a CAGR of 5.9% from 2026 to 2035. The country's well-established market benefits from strong uptake across residential, commercial, and industrial sectors. Household improvement trends and a robust DIY culture contribute to consistent sales of electric units. At the same time, sectors such as agriculture, construction, and automotive rely on durable gas-powered models to meet operational demands. Growing online sales, evolving consumer expectations, and rapid product innovation continue to shape purchasing decisions across the region.

Key companies in the Pressure Washer Market include Be Pressure, Bosch, Craftsman, Generac Power Systems, Hotsy, Honda Power Equipment, Karcher, MTM Hydro, Nilfisk, Pressure-Pro, Ryobi, Simpson Cleaning, Stanley Black & Decker, Sun Joe, and Troy-Bilt. Companies in the Global Pressure Washer Market are employing multiple strategies to strengthen their competitive stance. Many are broadening their product portfolios by introducing models with improved energy efficiency, enhanced ergonomics, and advanced safety features, appealing to both residential and professional users. Firms are also expanding their presence in e-commerce channels to improve accessibility and reach a broader audience. Strategic collaborations with retailers and distributors help accelerate market penetration, especially in emerging regions. Manufacturers are investing in sustainability-focused design and electric-powered technologies to meet stricter environmental expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Component

- 2.2.5 Water operation

- 2.2.6 PSI pressure

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for DIY home improvement

- 3.2.1.2 Rising urbanization and infrastructure development

- 3.2.1.3 Advancements in technology

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial investment for gas-based models

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Growth of eco-friendly and energy-efficient models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 8424)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric based

- 5.3 Gas based

- 5.4 Fuel based

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Non-portable

Chapter 7 Market Estimates & Forecast, By Component, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water pump

- 7.3 Electric motor/gas engine

- 7.4 High pressure hose

- 7.5 Nozzle

Chapter 8 Market Estimates & Forecast, By Water Operation, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Cold water

Chapter 9 Market Estimates & Forecast, By PSI Pressure, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 0-1500 PSI

- 9.3 1501-3000 PSI

- 9.4 3001-4000 PSI

- 9.5 ABOVE 4000 PSI

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Car washer

- 10.3 Garden washer

- 10.4 Home exterior washer

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Be Pressure

- 13.2 Bosch

- 13.3 Craftsman

- 13.4 Generac Power Systems

- 13.5 Hotsy

- 13.6 Honda Power Equipment

- 13.7 Karcher

- 13.8 MTM Hydro

- 13.9 Nilfisk

- 13.10 Pressure-Pro

- 13.11 Ryobi

- 13.12 Simpson Cleaning

- 13.13 Stanley Black & Decker

- 13.14 Sun Joe

- 13.15 Troy-Bilt