|

市场调查报告书

商品编码

1892881

备件物流市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Spare Parts Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

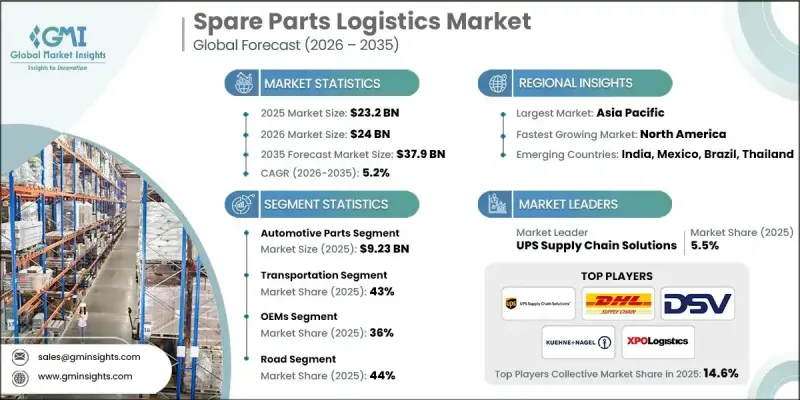

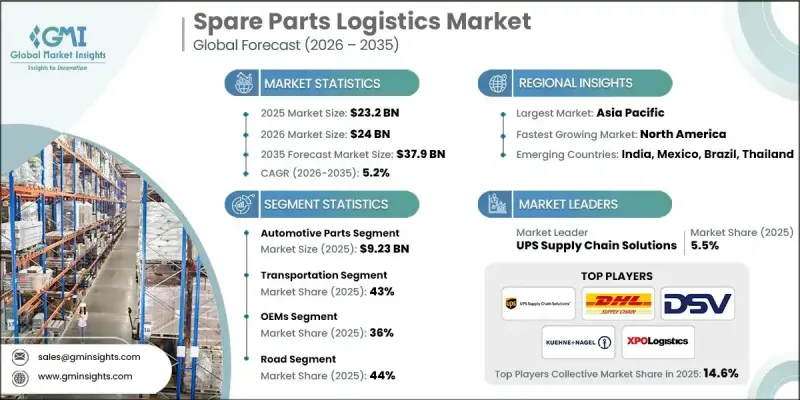

2025 年全球备件物流市场价值为 232 亿美元,预计到 2035 年将以 5.2% 的复合年增长率增长至 379 亿美元。

全球汽车、工业和电子设备车队的不断扩张推动了这一增长,也带来了日益增长的计划内和计划外维护需求。企业、车队营运商和终端用户越来越依赖高效的备件物流网路来处理大量的库存单位 (SKU)、时效性强的交付以及多层分销系统,从而最大限度地减少营运停机时间。原始设备製造商 (OEM) 和物流供应商正在积极推动数位化转型,以增强视觉性、追踪和预测能力。云端平台、物联网感测器和即时分析能够优化库存管理、加快订单履行速度并减少错误。 B2B 和 B2C 线上市场的兴起正在重塑客户的期望,促使供应商专注于规模更小、频率更高、地理分布更广的交付。这些发展趋势正在加强服务等级协定 (SLA),确保正常运作时间保证,并提升整体供应链效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 232亿美元 |

| 预测值 | 379亿美元 |

| 复合年增长率 | 5.2% |

2025年,汽车零件市场规模达到92.3亿美元,预计到2035年将以4.5%的复合年增长率成长。汽车保有量的成长、旧款车型需求的扩大以及线上销售的加速发展是推动成长的主要因素。数位化解决方案正在推动更快的运输速度、更有效率的最后一公里配送以及多仓库策略的实施。为了满足不断变化的配送需求,汽车製造商和售后市场供应商正在大力投资自动化仓储系统和整合物流平台。

预计到2025年,运输环节将占43%的市场份额,并预计在2026年至2035年间以6.4%的复合年增长率成长。备件物流高度依赖卡车、火车、航空和海运。电子商务的成长、更快的交付速度以及更精简的库存策略,都推动了对先进运输网路的需求。儘管面临货运成本波动和地缘政治动盪等挑战,供应商仍在开发多模式网络,并采用路线优化和运力管理系统,以确保网络的韧性和响应能力。

预计到2025年,美国备件物流市场将占据86%的份额,创造48.7亿美元的市场规模。电子商务的成长正在推动对更多物流中心、城市微型物流枢纽、当日送达服务和先进追踪系统的需求,以提升多个行业的售后服务能力。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 预测性维护的采用

- 电子商务零件扩张

- OEM垂直整合

- 物流自动化与机器人技术

- 设备电气化程度不断提高,零件复杂性日益增加

- 产业陷阱与挑战

- 库存复杂度高

- 运输成本波动

- 市场机会

- 增材製造在本地化生产的应用

- 人工智慧驱动的需求预测

- 数位市场的扩张

- 永续性和绿色物流

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 专利分析

- 定价分析

- 按地区

- 副产品

- 成本細項分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依备品分类,2022-2035年

- 汽车零件

- 引擎部件

- 活塞

- 过滤器

- 其他的

- 变速器和传动系统部件

- 煞车

- 暂停

- 转向系统

- 车身及外部组件

- 电气和电子系统

- 售后耗材

- 引擎部件

- 工业机械及设备零件

- 製造机械零件

- 马达

- 齿轮

- 腰带

- 工程机械部件

- 挖土机

- 装载机

- 农业机械零件

- 联结机

- 收割机

- 物料搬运及物流设备零件

- 液压、气动和机械子系统

- 製造机械零件

- 航太与国防备件

- 飞机部件

- 国防车辆部件

- 地面支援和维护设备

- 电子及半导体元件

- 半导体装置

- 电信设备组件

- 能源与公用事业部分

- 其他的

第六章:市场估算与预测:依服务类型划分,2022-2035年

- 运输

- 仓储

- 分配

- 库存管理

第七章:市场估算与预测:依最终用途划分,2022-2035年

- OEM(原始设备製造商)

- 售后市场供应商

- 经销商

- 电子商务平台

- 其他的

第八章:市场估算与预测:依运输方式划分,2022-2035年

- 路

- 轨

- 空气

- 海

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 新加坡

- 泰国

- 越南

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Agility Logistics

- Bollore Logistics

- CH Robinson

- CEVA Logistics

- DB Schenker

- DHL Supply Chain

- DSV Panalpina

- Expeditors International

- FedEx Supply Chain

- Hellmann Worldwide Logistics

- Kuehne+Nagel

- UPS Supply Chain Solutions

- XPO Logistics

- 区域玩家

- Ryder System

- Penske Logistics

- JB Hunt Transport Services

- BLG Logistics

- Nippon Express

- Kerry Logistics

- Yusen Logistics

- Kintetsu World Express

- COSCO Shipping Logistics

- 新兴参与者和颠覆者

- Overhaul

- FourKites

- Shippeo

- Convoy

- Transfix

- Shippo

- Locus Robotics

- Imperial Logistics

The Global Spare Parts Logistics Market was valued at USD 23.2 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 37.9 billion by 2035.

This growth is driven by the expanding fleets of automotive, industrial, and electronic equipment worldwide, which are creating a rising number of scheduled and unscheduled maintenance requirements. Businesses, fleet operators, and end-users are increasingly relying on efficient spare parts logistics networks to handle large volumes of SKUs, time-sensitive deliveries, and multi-tier distribution systems to minimize operational downtime. OEMs and logistics providers are embracing digital transformation to enhance visibility, tracking, and forecasting capabilities. Cloud platforms, IoT sensors, and real-time analytics enable optimized inventory management, faster order fulfillment, and reduced errors. The rise of B2B and B2C online marketplaces is reshaping customer expectations, prompting providers to focus on smaller, frequent, and geographically dispersed deliveries. These developments are strengthening service-level agreements, ensuring uptime guarantees, and enhancing overall supply chain efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.2 Billion |

| Forecast Value | $37.9 Billion |

| CAGR | 5.2% |

The automotive parts segment accounted for USD 9.23 billion in 2025 and is expected to grow at a CAGR of 4.5% through 2035. Growth is supported by rising vehicle numbers, expanding demand for older models, and accelerated online sales. Digital solutions are driving faster shipments, efficient last-mile delivery, and multi-warehouse strategies. OEMs and aftermarket suppliers are heavily investing in automated warehousing systems and integrated logistics platforms to meet evolving distribution demands.

The transportation segment held a 43% share in 2025 and is expected to grow at a CAGR of 6.4% from 2026 to 2035. Spare parts logistics depend heavily on truck, train, air, and sea transport. Growth in e-commerce, faster delivery expectations, and leaner inventory strategies are pushing the need for advanced transportation networks. Despite challenges like freight cost fluctuations and geopolitical disruptions, providers are developing multimodal networks with routing optimization and capacity management systems to ensure resilience and responsiveness.

US Spare Parts Logistics Market held 86% share in 2025, generating USD 4.87 billion. E-commerce growth is driving the need for additional fulfillment centers, urban micro-fulfillment hubs, same-day delivery, and advanced tracking systems to improve aftermarket service capabilities across multiple industries.

Key players in the Global Spare Parts Logistics Market include CEVA Logistics, DHL Supply Chain, DSV Panalpina, Penske Logistics, Ryder, XPO Logistics, DB Schenker, UPS Supply Chain Solutions, Kuehne + Nagel, and GXO Logistics. Companies in the Spare Parts Logistics Market are strengthening their market presence by investing in advanced technology solutions such as AI-driven inventory management, predictive analytics, and real-time tracking platforms. Strategic partnerships with OEMs and third-party logistics providers help expand geographic reach and improve operational efficiency. Providers are also implementing micro-fulfillment centers and last-mile delivery hubs to meet rising customer demands. Additionally, firms focus on multimodal transport solutions, routing optimization, and capacity management systems to enhance resilience and reliability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Spare part

- 2.2.2 Service

- 2.2.3 End use

- 2.2.4 Transportation mode

- 2.2.5 Regional

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Predictive maintenance adoption

- 3.2.1.2 E-commerce parts expansion

- 3.2.1.3 OEM vertical integration

- 3.2.1.4 Logistics automation & robotics

- 3.2.1.5 Increasing equipment electrification & component complexity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High inventory complexity

- 3.2.2.2 Transportation cost volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Additive manufacturing for localized production

- 3.2.3.2 Ai-driven demand forecasting

- 3.2.3.3 Expansion of digital marketplaces

- 3.2.3.4 Sustainability and green logistics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental aspects

- 3.12 Sustainable practices

- 3.13 Waste reduction strategies

- 3.14 Energy efficiency in production

- 3.15 Eco-friendly initiatives

- 3.16 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Spare Part, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Automotive parts

- 5.2.1 Engine components

- 5.2.1.1 Pistons

- 5.2.1.2 Filters

- 5.2.1.3 Others

- 5.2.2 Transmission and drivetrain parts

- 5.2.2.1 Brakes

- 5.2.2.2 Suspension

- 5.2.2.3 Steering systems

- 5.2.3 Body and exterior components

- 5.2.4 Electrical and electronic systems

- 5.2.5 Aftermarket consumables

- 5.2.1 Engine components

- 5.3 Industrial machinery & equipment components

- 5.3.1 Manufacturing machinery parts

- 5.3.1.1 Motors

- 5.3.1.2 Gears

- 5.3.1.3 Belts

- 5.3.2 Construction equipment components

- 5.3.2.1 Excavators

- 5.3.2.2 Loaders

- 5.3.3 Agricultural machinery parts

- 5.3.3.1 Tractors

- 5.3.3.2 Harvesters

- 5.3.4 Material handling and logistics equipment components

- 5.3.5 Hydraulic, pneumatic, and mechanical subsystems

- 5.3.1 Manufacturing machinery parts

- 5.4 Aerospace & defense spare parts

- 5.4.1 Aircraft components

- 5.4.2 Defense vehicle parts

- 5.4.3 Ground support and maintenance equipment

- 5.5 Electronics & semiconductor components

- 5.5.1 Semiconductor devices

- 5.5.2 Telecommunications equipment components

- 5.6 Energy & utilities parts

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Service, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Warehousing

- 6.4 Distribution

- 6.5 Inventory management

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 OEMs (Original Equipment Manufacturers)

- 7.3 Aftermarket Suppliers

- 7.4 Dealerships

- 7.5 E-commerce Platforms

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Transportation mode, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Road

- 8.3 Rail

- 8.4 Air

- 8.5 Sea

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Agility Logistics

- 10.1.2 Bollore Logistics

- 10.1.3 C.H. Robinson

- 10.1.4 CEVA Logistics

- 10.1.5 DB Schenker

- 10.1.6 DHL Supply Chain

- 10.1.7 DSV Panalpina

- 10.1.8 Expeditors International

- 10.1.9 FedEx Supply Chain

- 10.1.10 Hellmann Worldwide Logistics

- 10.1.11 Kuehne+Nagel

- 10.1.12 UPS Supply Chain Solutions

- 10.1.13 XPO Logistics

- 10.2 Regional Players

- 10.2.1 Ryder System

- 10.2.2 Penske Logistics

- 10.2.3 J.B. Hunt Transport Services

- 10.2.4 BLG Logistics

- 10.2.5 Nippon Express

- 10.2.6 Kerry Logistics

- 10.2.7 Yusen Logistics

- 10.2.8 Kintetsu World Express

- 10.2.9 COSCO Shipping Logistics

- 10.3 Emerging players and disruptors

- 10.3.1 Overhaul

- 10.3.2 FourKites

- 10.3.3 Shippeo

- 10.3.4 Convoy

- 10.3.5 Transfix

- 10.3.6 Shippo

- 10.3.7 Locus Robotics

- 10.3.8 Imperial Logistics