|

市场调查报告书

商品编码

1892884

携带式气体检测仪市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Portable Gas Detector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

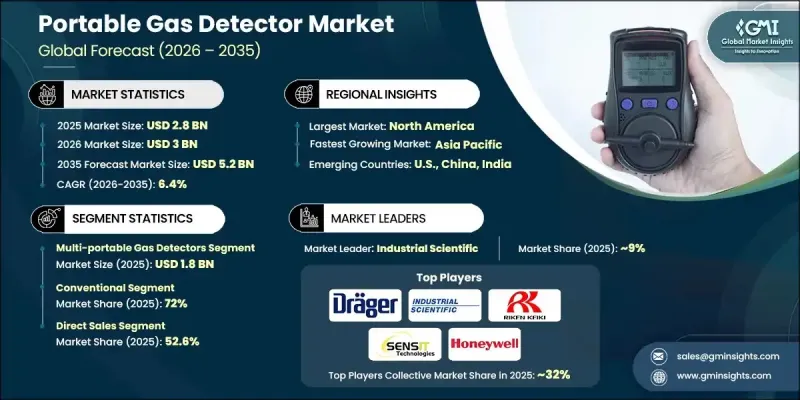

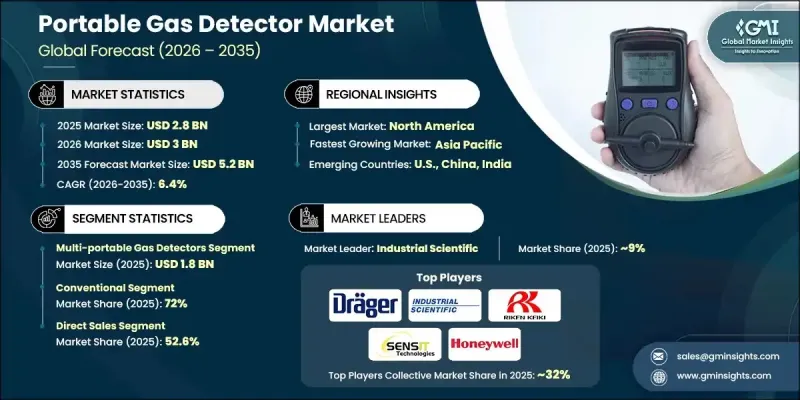

2025 年全球便携式气体检测仪市场价值为 28 亿美元,预计到 2035 年将以 6.4% 的复合年增长率增长至 52 亿美元。

随着监管机构和公众不断呼吁改善空气品质和加强工作场所安全措施,便携式气体检测设备的需求持续成长。化工、采矿、石油和天然气等有重大暴露风险的行业面临更严格的监管,加速了手持式检测设备的普及。企业越来越意识到有害气体洩漏会威胁工人健康并损害周围环境,因此增加了对可靠检测系统的投资。便携式气体检测仪日益被视为确保符合安全标准、减少有毒物质暴露和降低营运责任的关键工具。职业健康指南的日益完善和执行力度不断加大,进一步推动了各行业对先进检测技术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 28亿美元 |

| 预测值 | 52亿美元 |

| 复合年增长率 | 6.4% |

2025年,多气体便携式侦测仪的市场规模达到18亿美元,预计从2026年到2035年将以6.4%的复合年增长率成长。它们能够同时检测多种有害气体,这使其成为需要全面监测的行业(尤其是在气体暴露风险复杂的环境中)的标准配置。

到2025年,传统便携式气体检测仪的市占率将达到72%,预计到2035年将以5.5%的复合年增长率成长。由于价格实惠、操作简便、维护简单,这类检测仪持续受到欢迎,尤其适合预算有限或技术支援能力不足的企业。在需要进行基础气体监测的场所,这些检测仪仍然是可靠的选择。

2025年美国便携式气体检测仪市场规模达6.7亿美元,预计2026年至2035年将以6.2%的复合年增长率成长。严格的工作场所安全要求和持续的工业活动,尤其是在能源、采矿和化学工业,支撑了对先进多气体检测设备的需求。物联网整合设备的普及和对工人保护的坚定承诺进一步巩固了美国市场的领先地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 工业安全法规

- 危险工作环境增多

- 技术进步

- 陷阱与挑战:

- 初始成本高

- 维护和校准的复杂性

- 机会

- 智慧互联解决方案

- 新兴市场扩张

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 单便携式气体检测仪

- 多用途便携式气体检测仪

- 最多 4 种气体

- 4至6种气体

- 以上6种气体

第六章:市场估算与预测:依类别划分,2022-2035年

- 聪明的

- 传统的

第七章:市场估算与预测:依天然气类型划分,2022-2035年

- 氧

- 易燃气体

- 有毒气体

- 职业技能

- 可燃气体

- 其他(含氟氯化碳和不完全燃烧气体)

第八章:市场估算与预测:依最终用途划分,2022-2035年

- 石油和天然气

- 化学品和石油化工产品

- 金属与矿业

- 消防服务

- 发电与输电

- 其他(建筑)

第九章:市场估算与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十一章:公司简介

- ABB

- AIYI Technologies

- Blackline Safety Corp

- Dragerwerk

- GfG

- Honeywell

- Industrial Scientific

- MSA Safety

- Riken Keiki

- Sensit Technologies

- Sensitron

- Teledyne Technologies

- Thermo Fisher

- Uniphos

- Zetron Technology

The Global Portable Gas Detector Market was valued at USD 2.8 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 5.2 billion by 2035.

The need for portable gas detection devices continues to rise as regulatory bodies and the public push for better air quality and stronger workplace safety practices. Industries with significant exposure risks, such as chemical production, mining, oil and gas, face heightened oversight, which is accelerating the adoption of handheld detection devices. Businesses are becoming more aware of how hazardous gas leaks can threaten workers' health and harm the surrounding environment, prompting investments in reliable detection systems. Portable gas detectors are increasingly viewed as essential tools for ensuring compliance with safety standards, mitigating toxic exposure, and reducing operational liabilities. Improved awareness and stricter enforcement of occupational health guidelines are reinforcing the demand for advanced detection technologies across industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.4% |

The multi-gas portable detectors generated USD 1.8 billion in 2025 and are projected to grow at a CAGR of 6.4% from 2026 to 2035. Their ability to detect multiple hazardous gases at once has made them the standard among industries that require comprehensive monitoring, especially in environments with complex gas exposure risks.

The conventional portable gas detectors held a 72% share in 2025 and are expected to grow at a CAGR of 5.5% through 2035. Their popularity persists due to affordability, ease of operation, and straightforward maintenance, making them suitable for businesses operating under budget constraints or limited technical support capabilities. These detectors continue to serve as dependable options in settings that require baseline gas monitoring.

U.S Portable Gas Detector Market generated USD 670 million in 2025 and is forecasted to grow at a CAGR of 6.2% from 2026 to 2035. Strict workplace safety requirements and consistent industrial activity, particularly in energy, mining, and chemicals, sustain demand for advanced multi-gas detection equipment. Adoption of IoT-integrated devices and strong commitments to worker protection further cement U.S. market leadership.

Major companies in the Global Portable Gas Detector Market include Thermo Fisher, Industrial Scientific, MSA Safety, Sensitron, Blackline Safety Corp, Honeywell, Dragerwerk, Riken Keiki, GfG, Teledyne Technologies, AIYI Technologies, RKI Instruments, ABB, Sensit Technologies, Uniphos, and Zetron Technology. Companies in the Global Portable Gas Detector Market are strengthening their market presence through innovations centered on connectivity, durability, and precision. Many manufacturers are integrating IoT capabilities, real-time alerts, and cloud-based data platforms to enhance monitoring accuracy and streamline compliance reporting. Product portfolios are being diversified with multi-gas systems that reduce device redundancy and improve cost efficiency for industrial users. Strategic partnerships with industrial operators and safety service providers help expand distribution networks and accelerate adoption. Companies are also focusing on rugged designs suitable for harsh environments, extended battery life, and faster calibration systems to reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Category

- 2.2.4 Gas type

- 2.2.5 End use

- 2.2.6 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial Safety Regulations

- 3.2.1.2 Rise in Hazardous Work Environments

- 3.2.1.3 Technological Advancements

- 3.2.2 Pitfalls & Challenges:

- 3.2.2.1 High Initial Cost

- 3.2.2.2 Maintenance & Calibration Complexity

- 3.2.3 Opportunities

- 3.2.3.1 Smart & Connected Solutions

- 3.2.3.2 Emerging Markets Expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single-portable gas detectors

- 5.3 Multi-portable gas detectors

- 5.3.1 Upto 4 gases

- 5.3.2 4 to 6 gases

- 5.3.3 above 6 gases

Chapter 6 Market Estimates & Forecast, By Category, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Smart

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Gas Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Oxygen

- 7.3 Flammable gases

- 7.4 Toxic gases

- 7.5 Vocs

- 7.6 Combustible gas

- 7.7 Others (CFC-based & incomplete combustion gas)

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Oil & gas

- 8.3 Chemicals & petrochemicals

- 8.4 Metal & mining

- 8.5 Fire services

- 8.6 Power generation & transmission

- 8.7 Others (construction)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 AIYI Technologies

- 11.3 Blackline Safety Corp

- 11.4 Dragerwerk

- 11.5 GfG

- 11.6 Honeywell

- 11.7 Industrial Scientific

- 11.8 MSA Safety

- 11.9 Riken Keiki

- 11.10 Sensit Technologies

- 11.11 Sensitron

- 11.12 Teledyne Technologies

- 11.13 Thermo Fisher

- 11.14 Uniphos

- 11.15 Zetron Technology