|

市场调查报告书

商品编码

1892889

抗菌玻璃市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Antibacterial Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

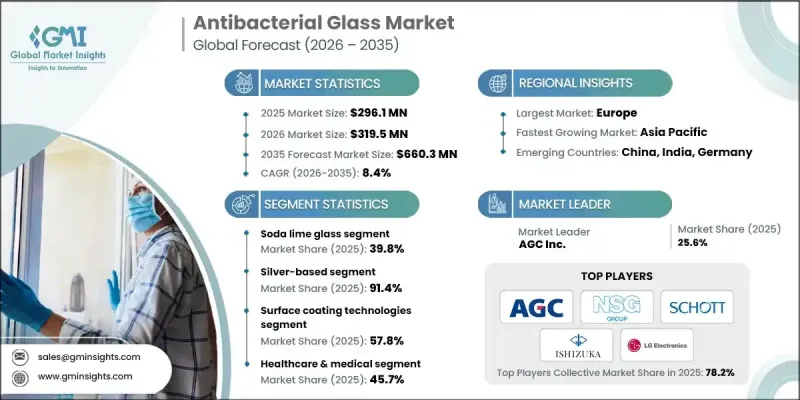

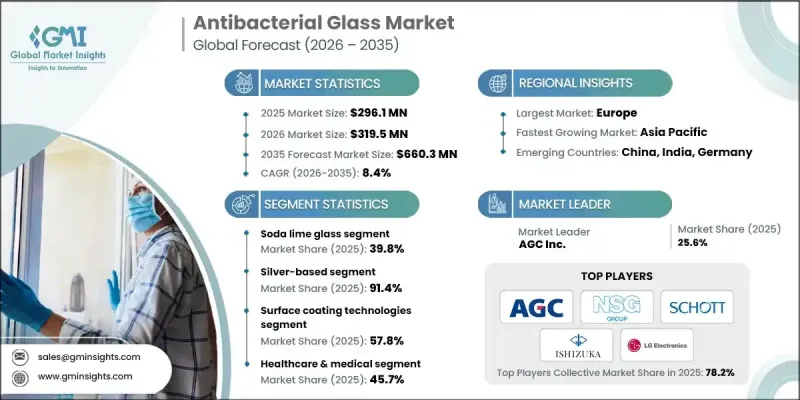

2025 年全球抗菌玻璃市场价值为 2.961 亿美元,预计到 2035 年将以 8.4% 的复合年增长率增长至 6.603 亿美元。

随着医疗保健、消费性电子和商业应用等各行业日益重视以卫生为中心的解决方案,市场正经历强劲成长。各公司正投资创新产品,推动高效能、高附加价值产品的开发。硼硅酸盐玻璃因其卓越的耐热性和耐化学性,预计将持续成长,非常适合实验室和食品接触应用。银基抗菌产品因其对多种微生物的有效性和持久的抗菌性能而继续占据主导地位。同时,铜基、锌基和钛基抗菌产品正作为环保、速效和紫外线活化的替代方案崭露头角。北美地区由于医院和实验室卫生意识的提高而引领市场应用,而欧洲,尤其是德国,正在将抗菌玻璃应用于建筑、交通和工业领域。快速的城市化和不断增长的医疗保健投资推动了亚太地区的显着成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2.961亿美元 |

| 预测值 | 6.603亿美元 |

| 复合年增长率 | 8.4% |

2025年,钠钙玻璃市占率为39.8%,预计到2035年将以7%的复合年增长率成长。这种玻璃经济实惠、供应充足,常用于公共场所和家庭应用。硼硅酸盐玻璃具有更强的耐热性和耐化学性,正在逐步蚕食先前由钠钙玻璃主导的市场,尤其是在实验室、製药和食品接触应用领域。

2025年,银基抗菌玻璃市占率达到91.4%,预计到2035年将以8.2%的复合年增长率成长。银因其能够灭活多种病原体,仍是应用最广泛的抗菌剂。它与不同类型的玻璃具有良好的相容性,并广泛应用于医院、大型公共设施和电子产品製造领域。

预计到2025年,北美抗菌玻璃市占率将达到28.1%,这主要得益于医疗基础设施的进步、日益严格的卫生法规以及抗菌技术在医疗、消费性电子和建筑领域的应用日益广泛。医院、研究实验室和公共设施越来越多地使用抗菌玻璃,以最大限度地降低感染风险并确保符合卫生标准。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 医疗保健和公共场所对以卫生为中心的解决方案的需求不断增长。

- 在消费性电子产品和高频接触的家居表面中的应用日益广泛。

- 提高食品饮料产业对污染风险的认识。

- 产业陷阱与挑战

- 高昂的製造成本限制了其在价格敏感型市场的普及。

- 在不影响玻璃品质的前提下,将抗菌性能融入玻璃的技术有其限制。

- 不同地区的监管和安全合规要求。

- 市场机会

- 开发创新涂层和基于奈米技术的抗菌解决方案。

- 随着新兴市场卫生意识的提高,业务正在扩张。

- 汽车、交通运输和工业应用领域的需求不断增长。

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按玻璃类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依玻璃类型划分,2022-2035年

- 钠钙玻璃

- 硼硅酸盐玻璃

- 铝硅酸盐玻璃

- 玻璃陶瓷

- 生物活性玻璃

- 特殊涂层浮法玻璃

第六章:市场估算与预测:依抗菌剂类型划分,2022-2035年

- 表面涂层技术

- 溶胶-凝胶涂层法

- 喷涂/浸涂法

- 物理气相沉积(PVD)/化学电镀

- 高温嵌入/高温嵌入

- 光催化在线涂层

- 批量整合技术

- 传统熔融/添加剂掺入

- 离子交换法

- 化学强化与抗菌剂的融合

- 混合/先进技术

- 玻璃陶瓷形成

- 奈米颗粒/奈米技术集成

第七章:市场估算与预测:依製造技术划分,2022-2035年

- 银基抗菌玻璃

- 铜基抗菌玻璃

- 锌基抗菌玻璃

- 钛基(TiO2/光催化)抗菌玻璃

- 多离子组合抗菌玻璃

第八章:市场估算与预测:依应用领域划分,2022-2035年

- 医疗保健

- 食品和饮料

- 消费性电子产品

- 建筑与施工

- 交通运输与汽车

- 军事与国防

- 住宅/家庭

- 实验室与研究

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- AGC Inc.

- AGI Glaspac

- Fuyao Glass Industry Group Co., Ltd.

- HMI Glass

- Ishizuka Glass Co., Ltd.

- LC Corporations

- Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington)

- Saint-Gobain

- Schott AG

- Xinyi Glass Holdings Limited

The Global Antibacterial Glass Market was valued at USD 296.1 million in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 660.3 million by 2035.

The market is experiencing strong growth as industries increasingly prioritize hygiene-focused solutions across healthcare, consumer electronics, and commercial applications. Companies are investing in innovative offerings, driving the development of high-performance, value-added products. Borosilicate glass is expected to see sustained growth due to its superior thermal and chemical resistance, making it highly suitable for laboratories and food-contact applications. Silver-based antimicrobial products continue to dominate due to their proven effectiveness against a broad spectrum of microorganisms and long-lasting performance. Meanwhile, copper, zinc, and titanium-based antimicrobial products are emerging as eco-friendly, fast-acting, and UV-activated alternatives. North America leads adoption due to heightened hygiene awareness in hospitals and laboratories, while Europe, particularly Germany, is integrating antibacterial glass into construction, transportation, and industrial sectors. Rapid urbanization and growing healthcare investments have driven remarkable growth in the Asia Pacific region.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $296.1 Million |

| Forecast Value | $660.3 Million |

| CAGR | 8.4% |

The soda lime glass segment held a 39.8% share in 2025 and is anticipated to grow at a CAGR of 7% by 2035. This type of glass is cost-effective, widely available, and commonly used for public spaces and household applications. Borosilicate glass, with enhanced thermal and chemical resistance, is gradually capturing markets previously dominated by soda lime glass, particularly in laboratories, pharmaceuticals, and food-contact applications.

The silver-based antibacterial glass segment accounted for a 91.4% share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. Silver remains the most widely used antimicrobial agent due to its ability to inactivate a wide variety of pathogens. It is highly compatible with different glass types and finds extensive use in hospitals, large public facilities, and electronic product manufacturing.

North America Antibacterial Glass Market held a 28.1% share in 2025, driven by advancements in healthcare infrastructure, stringent hygiene regulations, and rising adoption of antimicrobial technology across medical, consumer electronics, and building sectors. Hospitals, research laboratories, and public facilities increasingly use antibacterial glass to minimize infection risks and ensure hygiene compliance.

Leading players in the Global Antibacterial Glass Market include AGC Inc., AGI Glaspac, Fuyao Glass Industry Group Co., Ltd., HMI Glass, Ishizuka Glass Co., Ltd., LC Corporations, Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington), Saint Gobain, Schott AG, and Xinyi Glass Holdings Limited. Companies in the Global Antibacterial Glass Market strengthen their position by focusing on product innovation and R&D to develop high-performance, durable, and eco-friendly glass products. They invest in advanced coating technologies, expand regional manufacturing capabilities, and form strategic partnerships to enhance distribution networks. Regulatory compliance, brand differentiation, and marketing of superior antimicrobial solutions help attract institutional and consumer clients. Firms also adopt cost optimization and sustainability initiatives, while targeting high-growth regions through localized operations to maintain a competitive edge and increase market penetration globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Glass type

- 2.2.3 Antimicrobial agent

- 2.2.4 Manufacturing technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for hygiene-focused solutions in healthcare and public spaces.

- 3.2.1.2 Growing use in consumer electronics and high-touch household surfaces.

- 3.2.1.3 Increasing awareness of contamination risks in food and beverage industries.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs limiting adoption in price-sensitive markets.

- 3.2.2.2 Technical limitations in integrating antimicrobial properties without affecting glass quality.

- 3.2.2.3 Regulatory and safety compliance requirements across different regions.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of innovative coatings and nanotechnology-based antimicrobial solutions.

- 3.2.3.2 Expansion in emerging markets with rising hygiene awareness.

- 3.2.3.3 Growing demand in automotive, transportation, and industrial applications.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By glass type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Glass Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soda Lime Glass

- 5.3 Borosilicate Glass

- 5.4 Aluminosilicate Glass

- 5.5 Glass-Ceramic

- 5.6 Bioactive Glass

- 5.7 Specialty Coated Float Glass

Chapter 6 Market Estimates and Forecast, By Antimicrobial Agent, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Surface Coating Technologies

- 6.2.1 Sol-Gel Coating Method

- 6.2.2 Spray/Dip Coating Method

- 6.2.3 Physical Vapor Deposition (PVD)/Chemical Plating

- 6.2.4 Burn-In/High-Temperature Embedding

- 6.2.5 Photocatalytic On-Line Coating

- 6.3 Bulk Integration Technologies

- 6.3.1 Conventional Melting/Additive Incorporation

- 6.3.2 Ion-Exchange Method

- 6.3.3 Chemical Strengthening with Antimicrobial Integration

- 6.4 Hybrid/Advanced Technologies

- 6.4.1 Glass-Ceramic Formation

- 6.4.2 Nanoparticle/Nanotechnology Integration

Chapter 7 Market Estimates and Forecast, By Manufacturing Technology, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Silver-Based Antibacterial Glass

- 7.3 Copper-Based Antibacterial Glass

- 7.4 Zinc-Based Antibacterial Glass

- 7.5 Titanium-Based (TiO2/Photocatalytic) Antibacterial Glass

- 7.6 Multi-Ion Combination Antibacterial Glass

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Healthcare & Medical

- 8.3 Food & Beverage

- 8.4 Consumer Electronics

- 8.5 Building & Construction

- 8.6 Transportation & Automotive

- 8.7 Military & Defense

- 8.8 Residential/Household

- 8.9 Laboratory & Research

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AGC Inc.

- 10.2 AGI Glaspac

- 10.3 Fuyao Glass Industry Group Co., Ltd.

- 10.4 HMI Glass

- 10.5 Ishizuka Glass Co., Ltd.

- 10.6 LC Corporations

- 10.7 Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington)

- 10.8 Saint-Gobain

- 10.9 Schott AG

- 10.10 Xinyi Glass Holdings Limited