|

市场调查报告书

商品编码

1892897

牙髓治疗市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Endodontics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

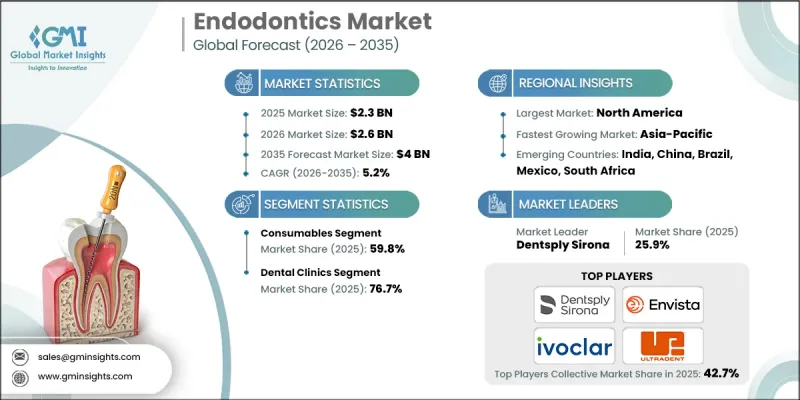

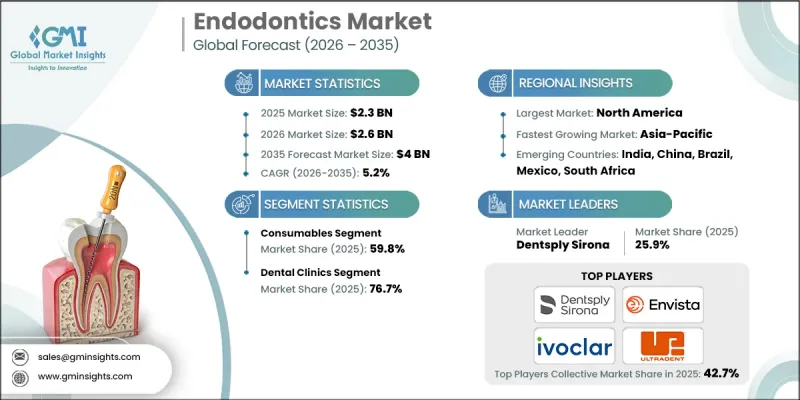

2025 年全球牙髓病市场价值为 23 亿美元,预计到 2035 年将以 5.2% 的复合年增长率增长至 40 亿美元。

根管治疗器械技术的快速发展、公众口腔健康意识的提高以及牙科疾病盛行率的上升推动了市场扩张。全球牙科专业人员和诊所数量的成长也进一步支撑了市场需求。根管治疗专注于诊断和治疗牙髓及周围组织的疾病,主要透过根管治疗来清除感染、缓解疼痛并保留天然牙齿。 Envista、Dentsply Sirona、Ivoclar 和 Ultradent Products 等领先企业透过创新、全球分销以及对研发的大量投入来维持其市场地位。包括旋转根管器械、根尖定位仪、雷射辅助治疗和 3D 成像系统在内的突破性技术提高了手术的精确性、安全性和患者舒适度,促进了现代技术的广泛应用,并加速了市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 23亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 5.2% |

预计到2025年,耗材市占率将达到59.8%。高频使用、频繁更换以及锉针、封闭剂、充填材料和冲洗剂在根管治疗中的重要作用,都维持了稳定的市场需求。随着全球龋齿和牙髓感染病例的增加,根管治疗量也随之上升,耗材仍是购买量最大的类别。

预计到2025年,牙科诊所细分市场将占据76.7%的市场份额,市场规模将达到32亿美元。诊所是根管治疗的主要诊疗场所,龋齿和牙髓感染的日益普遍导致患者就诊量增加,从而推高了对牙髓治疗服务的需求。

2025年,北美牙髓病市场预计将占据37.7%的市场份额,这主要受生活方式因素、糖分摄取量以及人口老化等因素导致的牙科疾病高发所驱动。根管治疗的需求依然旺盛,支撑着诊所对牙髓病器械和耗材的持续使用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 牙科疾病发生率不断上升

- 提高人们对口腔健康的认识与重视程度

- 技术进步

- 产业陷阱与挑战

- 发展中或农村地区获得先进牙髓治疗的机会有限

- 市场机会

- 拓展至新兴市场及欠发达市场

- 对无痛、微创和以患者为中心的治疗的需求日益增长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 消费者洞察

- 定价分析

- 未来市场趋势

- 供应链分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2022-2035年

- 消耗品

- 文件和成型器

- 根管充填材料

- 溶液和润滑剂

- 其他消耗品

- 仪器

- 马达

- 根尖定位器

- 根管刮治器

- 机器辅助根管充填系统

- 其他乐器

第六章:市场估算与预测:依最终用途划分,2022-2035年

- 牙医诊所

- 医院

- 其他最终用途

第七章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- BRASSELER

- COLTENE

- Dentsply Sirona

- DiaDent

- EdgeEndo

- Envista

- Essential Dental Systems

- FKG

- Ivoclar

- Kerr

- MANI

- Pac-Dent

- Septodent

- Shenzhen Perfect

- ULTRADENT

The Global Endodontics Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 4 billion by 2035.

Market expansion is fueled by rapid technological advancements in endodontic instruments, growing public awareness of dental health, and the increasing prevalence of dental diseases. The rising number of dental professionals and clinics worldwide further supports demand. Endodontics focuses on diagnosing and treating diseases of the dental pulp and surrounding tissues, primarily through root canal therapy aimed at removing infections, alleviating pain, and preserving natural teeth. Leading players such as Envista, Dentsply Sirona, Ivoclar, and Ultradent Products maintain their market positions through innovation, global distribution, and substantial investments in research and development. Breakthroughs, including rotary endodontic instruments, apex locators, laser-assisted therapies, and 3D imaging systems, have improved procedural precision, safety, and patient comfort, encouraged wider adoption of modern techniques, and accelerated market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.2% |

In 2025, the consumables segment captured a 59.8% share. High-frequency use, recurring replacement requirements, and the essential role of files, sealers, obturation materials, and irrigants in every root canal procedure sustain steady demand. As the volume of root canal treatments rises globally due to increasing dental caries and pulp infections, consumables continue to be the most purchased category.

The dental clinics segment held a 76.7% share in 2025, projected to reach USD 3.2 billion. Clinics serve as the primary point of care for root canal procedures and increasing patient visits driven by caries and pulp infection prevalence are boosting demand for endodontic services.

North America Endodontics Market held a share of 37.7% in 2025, driven by a high prevalence of dental issues linked to lifestyle factors, sugar consumption, and aging populations. Root canal procedures remain in significant demand, supporting sustained use of endodontic instruments and consumables across clinics.

Key players in the Global Endodontics Market include Kerr, BRASSELER, COLTENE, Dentsply Sirona, EdgeEndo, DiaDent, Envista, FKG, Ivoclar, MANI, Pac-Dent, Septodent, Shenzhen Perfect, ULTRADENT, and Essential Dental Systems. Companies in the Endodontics Market are strengthening their positions by continuously innovating products, launching technologically advanced instruments, and expanding distribution networks globally. Strategic R&D investments allow them to improve procedural efficiency, patient safety, and treatment precision. Firms are also investing in training programs for dental professionals, enhancing brand recognition, and fostering loyalty. Collaborations with dental associations, clinics, and research institutes help in promoting new technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dental disorders

- 3.2.1.2 Increasing awareness and importance of oral health

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited access to advanced endodontic care in developing or rural regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging and underserved markets

- 3.2.3.2 Growing demand for painless, minimally invasive and patient-centric treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer insights

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Supply chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.2.1 Files and shaper

- 5.2.2 Obturation materials

- 5.2.3 Solutions and lubricants

- 5.2.4 Other consumables

- 5.3 Instruments

- 5.3.1 Motors

- 5.3.2 Apex locator

- 5.3.3 Endodontic scalers

- 5.3.4 Machine assisted obturation system

- 5.3.5 Other instruments

Chapter 6 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BRASSELER

- 8.2 COLTENE

- 8.3 Dentsply Sirona

- 8.4 DiaDent

- 8.5 EdgeEndo

- 8.6 Envista

- 8.7 Essential Dental Systems

- 8.8 FKG

- 8.9 Ivoclar

- 8.10 Kerr

- 8.11 MANI

- 8.12 Pac-Dent

- 8.13 Septodent

- 8.14 Shenzhen Perfect

- 8.15 ULTRADENT