|

市场调查报告书

商品编码

1892901

工业车辆市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Industrial Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

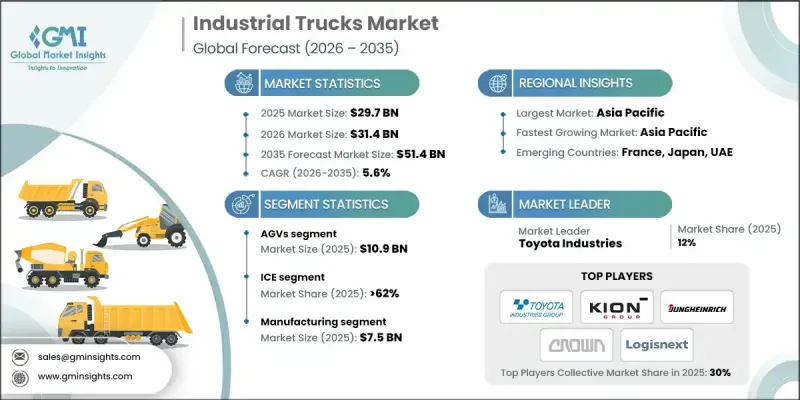

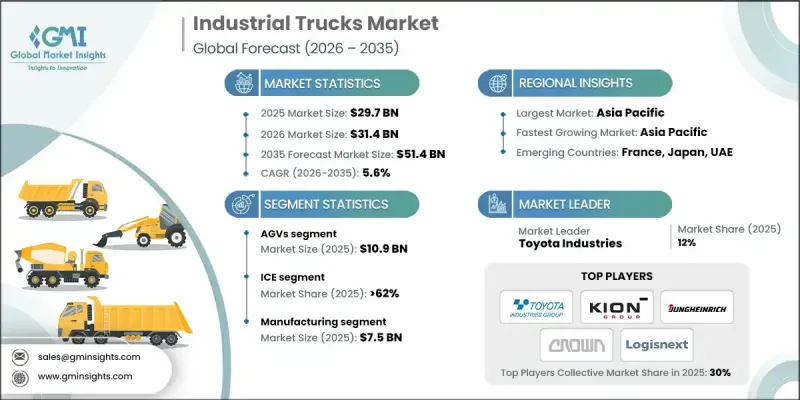

2025年全球工业车辆市场价值为297亿美元,预计2035年将以5.6%的复合年增长率成长至514亿美元。

电子商务的快速发展持续重塑供应链,促使企业采用更快、更有效率的物料搬运解决方案。不断增长的线上订单量推动企业投资建造大型配送中心和小型物流中心,以满足消费者对快速交付的期望。这种日益增长的业务量提升了对堆高机、托盘搬运车和自动驾驶车辆的需求,这些设备能够支援仓库内货物的高速搬运。随着企业将快速内部运输和提高吞吐量作为优先事项,工业车辆正成为物流环境中至关重要的竞争优势。仓库自动化技术的进步,包括机器人、基于感测器的系统和整合储存技术,进一步推动了市场需求,因为企业希望优化劳动力、提高准确性并更好地利用宝贵的仓库空间。这种转变在人口密集的城市市场尤其明显,自动化流程正在改善工作流程并提高生产效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 297亿美元 |

| 预测值 | 514亿美元 |

| 复合年增长率 | 5.6% |

预计到2025年,AGV(自动导引车)市场规模将达到109亿美元。 AGV利用雷射导航、感应系统和成像工具等技术独立运作。这些车辆遵循预先设定的路线,并能即时调整路径,无需人工操作即可在仓库内安全高效地运输物料。 AGV能够稳定、精准地搬运托盘、货柜和其他货物,使其成为现代物料搬运环境中不可或缺的一部分。

预计到2025年,内燃机卡车市占率将达到62%。内燃机卡车在室内外各种高强度物料搬运作业中仍占有重要地位。这些车辆以柴油、汽油或液化石油气为动力,以其高扭矩和耐用性着称,因此非常适合需要在严苛条件下进行重物起吊和运输的行业。其卓越的性能在采矿、大型製造和建筑等行业至关重要。

美国工业车辆市场占75%的市场份额,预计2025年市场规模将达63亿美元。仓储设施的扩张以及自动化技术的加速应用,持续推动製造业、物流业和电子商务领域的强劲需求。对电动设备和先进搬运解决方案日益增长的兴趣,反映了企业不断推进的永续发展目标和安全合规要求。许多全球主要原始设备製造商的入驻,以及对下一代物料搬运技术的巨额投资,使美国成为工业车辆领域重要的创新中心。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 电子商务拓展与仓储自动化

- 采用工业4.0技术

- 製造业、建筑业和物流业的成长

- 已开发市场劳动力短缺

- 产业陷阱与挑战

- 高昂的前期成本和维护费用

- 供应链中断和零件短缺

- 机会

- 电动零排放卡车

- 自动导引车(AGV)和自动驾驶卡车

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- AGV(自动导引车)

- 手动搬运车、平台搬运车和托盘搬运车

- 拣货员

- 托盘搬运车

- 侧装式

- 步行式堆迭器

第六章:市场估算与预测:以推进方式划分,2021-2034年

- 冰

- 电的

第七章:市场估计与预测:依业者划分,2021-2034年

- 手动的

- 半自动

- 全自动

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 餐饮

- 汽车

- 零售与电子商务

- 建筑与采矿

- 製造业

- 製药

- 物流与仓储

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Anhui Heli

- BYD Company

- Clark Material Handling Company

- Combilift

- Crown Equipment

- Doosan Corporation Industrial Vehicle

- Hangcha Group

- Hyster-Yale Materials Handling

- Hyundai Heavy Industries

- Jungheinrich AG

- KION Group AG

- Komatsu

- Manitou Group

- Mitsubishi Logisnext

- Toyota Industries

The Global Industrial Trucks Market was valued at USD 29.7 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 51.4 billion by 2035.

The rapid acceleration of e-commerce continues to reshape supply chains, pushing businesses to adopt faster and more efficient material-handling solutions. Rising online order volumes are driving companies to invest in large distribution hubs and smaller fulfillment sites to keep pace with expectations for rapid delivery. This increasing activity is elevating the need for forklifts, pallet trucks, and autonomous vehicles that support high-speed movement of goods throughout warehouse operations. As organizations prioritize quick internal transport and improved throughput, industrial trucks are becoming a vital competitive advantage in logistics environments. Advancements in warehouse automation including robotics, sensor-based systems, and integrated storage technologies are further propelling demand, as companies seek to optimize labor, maximize accuracy, and better utilize valuable warehouse space. This shift is particularly evident in dense urban markets, where automated processes are improving workflows and supporting higher productivity levels.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.4 Billion |

| CAGR | 5.6% |

The AGVs segment generated USD 10.9 billion in 2025. Automated guided vehicles operate independently using technologies such as laser-based navigation, induction systems, and imaging tools. These vehicles follow mapped routes and can modify their paths in real time, enabling safe and efficient transportation of materials throughout warehouses without the need for manual operation. Their ability to move pallets, containers, and other goods with consistency and precision has made them an integral part of modern material-handling environments.

The ICE segment held a 62% share in 2025. Internal combustion engine trucks remain heavily relied upon for demanding material-handling activities both indoors and outdoors. These vehicles, powered by diesel, gasoline, or LPG, are known for high torque and durability, making them suitable for industries that require lifting and transporting heavy loads under challenging conditions. Their performance capabilities are crucial in sectors including mining, large-scale manufacturing, and construction.

U.S. Industrial Trucks Market accounted for a 75% share and generated USD 6.3 billion in 2025. The expansion of warehouses, paired with the accelerated adoption of automation technologies, continues to drive strong demand across manufacturing, logistics, and e-commerce operations. Growing interest in electric-powered equipment and enhanced handling solutions reflects ongoing corporate sustainability goals and safety compliance requirements. The presence of major global original equipment manufacturers and significant investment in next-generation material-handling technologies positions the U.S. as a key center for innovation within the industrial trucks sector.

Major companies in the Industrial Trucks Market include Anhui Heli, BYD Company, Clark Material Handling Company, Combilift, Crown Equipment, Doosan Corporation Industrial Vehicle, Hangcha Group, Hyster-Yale Materials Handling, Hyundai Heavy Industries, Jungheinrich AG, KION Group AG, Komatsu, Manitou Group, Mitsubishi Logisnext, and Toyota Industries. Companies in the Industrial Trucks Market are strengthening their competitive position by expanding electric and automated product lines that support sustainability goals and reduce operating costs. Many manufacturers are integrating advanced telematics and fleet management systems to provide real-time data on performance, maintenance, and utilization. Continuous investment in autonomous technologies such as AGVs and semi-automated forklifts helps improve productivity and minimize reliance on manual labor. Firms are also diversifying their global production bases to improve supply stability and reduce lead times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Propulsion

- 2.2.4 Operator type

- 2.2.5 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-commerce expansion & warehouse automation

- 3.2.1.2 Adoption of Industry 4.0 technologies

- 3.2.1.3 Growth in manufacturing, construction, and logistics sectors

- 3.2.1.4 Labour shortages in developed markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs & maintenance expenses

- 3.2.2.2 Supply chain disruptions & component shortages

- 3.2.3 Opportunities

- 3.2.3.1 Electric & zero-emission trucks

- 3.2.3.2 Automated guided vehicles (AGVs) & autonomous trucks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 AGVs

- 5.3 Hand, platform and pallet trucks

- 5.4 Order pickers

- 5.5 Pallet jacks

- 5.6 Side-loaders

- 5.7 Walkie stackers

Chapter 6 Market Estimates and Forecast, By Propulsion, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

Chapter 7 Market Estimates and Forecast, By Operator, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automated

- 7.4 Fully automated

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Automotive

- 8.4 Retail & e-commerce

- 8.5 Construction & mining

- 8.6 Manufacturing

- 8.7 Pharmaceuticals

- 8.8 Logistics & warehousing

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Anhui Heli

- 10.2 BYD Company

- 10.3 Clark Material Handling Company

- 10.4 Combilift

- 10.5 Crown Equipment

- 10.6 Doosan Corporation Industrial Vehicle

- 10.7 Hangcha Group

- 10.8 Hyster-Yale Materials Handling

- 10.9 Hyundai Heavy Industries

- 10.10 Jungheinrich AG

- 10.11 KION Group AG

- 10.12 Komatsu

- 10.13 Manitou Group

- 10.14 Mitsubishi Logisnext

- 10.15 Toyota Industries