|

市场调查报告书

商品编码

1892907

低温设备市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Cryogenic Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

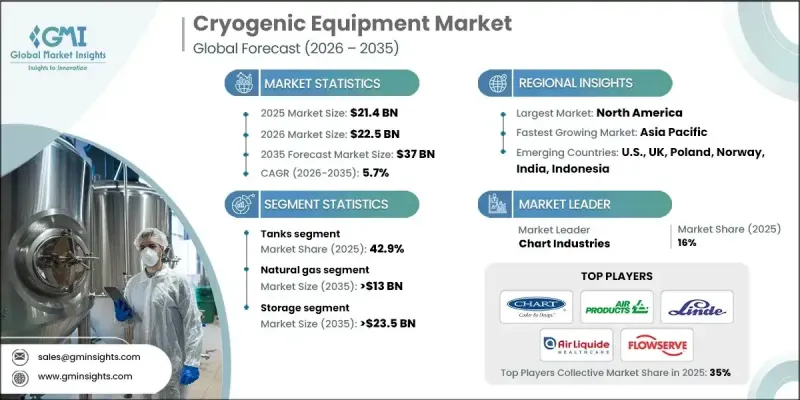

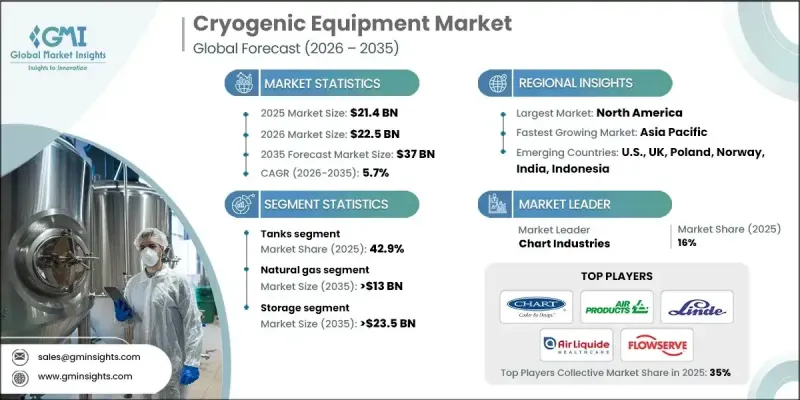

2025年全球低温设备市场价值为214亿美元,预计2035年将以5.7%的复合年增长率成长至370亿美元。

市场成长主要得益于先进液化系统在天然气储存领域的日益普及,以及优化低温运行的自动化阀门组件的持续整合。液化天然气加註用低温泵的广泛应用,以及海事领域减排措施的推进,正在重塑设计重点。低温设备涵盖用于在极低温下生产、处理、储存和运输物料的专用设备和系统,这些设备对于液化氮气、氧气、氢气、氦气和天然气等气体至关重要。真空绝缘管道、模组化低温储罐和撬装式系统日益普及的提高了效率和灵活性,而物联网感测器和预测性维护工具则提升了运作可靠性。工业和石化应用中低温汽化器、压缩机和灵活容量解决方案的日益普及,正在重新定义安装规范,并为超低温运行领域的创新创造机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 214亿美元 |

| 预测值 | 370亿美元 |

| 复合年增长率 | 5.7% |

预计到2035年,阀门市场规模将达到40亿美元,主要得益于市场对不銹钢和镍合金的偏好以及对严格性能标准的坚持。专注于零排放运作的先进阀门设计符合永续发展目标,能够更安全、更有效率地处理低温流体。

预计到2035年,氧气市场将以5.5%的复合年增长率成长。氧气汽化器和大容量储氧系统的日益普及正在推动包括航太燃料供应在内的工业流程。低温氧气泵的整合进一步促进了对精确可靠的低温管理有更高要求的特定应用领域的发展。

美国低温设备市场占85.7%的市场份额,预计2025年市场规模将达42亿美元。低温储槽的广泛应用,以及削峰设施的配套设施,有助于应对季节性电力需求。物联网赋能的低温泵和预测性维护解决方案的日益普及,正在推动工厂的智慧化和自动化运营,从而提升整个产业的效率和安全性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 低温设备成本结构分析

- 新兴机会与趋势

- 数位化和物联网集成

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- Key partnerships & collaborations

- Major M&A activities

- Product innovations & launches

- Market expansion strategies

- 策略倡议

- 竞争性标竿分析

- 创新与技术格局

第五章:市场规模及预测:依产品划分,2022-2035年

- 坦克

- 阀门

- 雾化器

- 水泵浦

- 管道

- 其他的

第六章:市场规模及预测:依低温液体类型划分,2022-2035年

- 氮

- 氧

- 天然气

- 氩气

- 其他低温液体

第七章:市场规模及预测:依应用领域划分,2022-2035年

- 贮存

- 分配

第八章:市场规模及预测:依最终用途划分,2022-2035年

- 石油天然气产业

- 力量

- 餐饮

- 化学

- 橡胶和塑料

- 冶金

- 卫生保健

- 船运

- 农业、林业和渔业

- 其他行业

第九章:市场规模及预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 义大利

- 西班牙

- 法国

- 波兰

- 挪威

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 印尼

- 泰国

- 马来西亚

- 菲律宾

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 科威特

- 阿曼

- 土耳其

- 卡达

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

第十章:公司简介

- Abhijit Enterprises

- Air Liquide

- Air Products and Chemicals

- AIR WATER

- Auguste Cryogenics

- BRUGG Pipes

- Chart Industries

- Cryogas Equipment

- Cryogenic OGS

- CRYOSPAIN

- Cryostar

- Cryoworld

- Demaco

- Emerson Electric

- Flowserve Corporation

- Hypro

- INOXCVA

- IWI Cryogenic Vaporization Systems (India) Pvt. Ltd.

- Kelvin International

- Linde

- Shell-n-Tube

- SLB

- Vacuum Barrier

The Global Cryogenic Equipment Market was valued at USD 21.4 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 37 billion by 2035.

Market growth is driven by the increasing adoption of advanced liquefaction systems for natural gas storage and the rising integration of automated valve assemblies that optimize low-temperature operations. The growing deployment of cryogenic pumps for LNG bunkering, coupled with emission reduction initiatives across the marine sector, is shaping design priorities. Cryogenic equipment encompasses specialized devices and systems for producing, handling, storing, and transporting materials at extremely low temperatures, essential for liquefying gases such as nitrogen, oxygen, hydrogen, helium, and natural gas. Rising adoption of vacuum-insulated piping, modular cryogenic tanks, and skid-mounted systems is enhancing efficiency and flexibility, while IoT-enabled sensors and predictive maintenance tools are improving operational reliability. Increasing utilization of cryogenic vaporizers, compressors, and flexible capacity solutions in industrial and petrochemical applications is redefining installation practices and creating opportunities for innovation in ultra-low temperature operations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.4 Billion |

| Forecast Value | $37 Billion |

| CAGR | 5.7% |

The valves segment is expected to reach USD 4 billion by 2035, driven by a preference for stainless steel and nickel alloys and adherence to stringent performance standards. Advanced valve designs focused on zero-emission operations are aligning with sustainability objectives, enabling safer and more efficient handling of cryogenic fluids.

The oxygen segment is projected to grow at a CAGR of 5.5% by 2035. Rising adoption of oxygen vaporizers and high-capacity storage systems is supporting industrial processes, including aerospace fueling applications. Integration of oxygen cryogenic pumps is further driving niche applications that demand precise and reliable low-temperature management.

U.S. Cryogenic Equipment Market held 85.7% share, generating USD 4.2 billion in 2025. Strong adoption of cryogenic tanks, coupled with peak shaving facilities, supports seasonal power demand management. Increasing deployment of IoT-enabled cryogenic pumps and predictive maintenance solutions is enabling smart and automated plant operations, improving efficiency and safety across the industry.

Major players active in the Global Cryogenic Equipment Market include Emerson Electric, Air Liquide, Chart Industries, Flowserve Corporation, Linde, Cryostar, Air Products and Chemicals, Kelvin International, IWI Cryogenic Vaporization Systems (India) Pvt. Ltd., Cryogas Equipment, CRYOSPAIN, BRUGG Pipes, Abhijit Enterprises, Cryoworld, Shell-n-Tube, Demaco, AIR WATER, Auguste Cryogenics, SLB, Cryogenic OGS, and Vacuum Barrier. Companies in the Cryogenic Equipment Market are focusing on multiple strategies to enhance their market presence and strengthen their competitive position. Key approaches include investing in R&D to develop next-generation, energy-efficient, and modular cryogenic solutions. Firms are pursuing strategic partnerships, joint ventures, and acquisitions to expand geographic reach and technological capabilities. Product differentiation through advanced materials, automated valve assemblies, and IoT-enabled monitoring systems is being emphasized to meet industry-specific requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Cryogen type trends

- 2.5 Application trends

- 2.6 End use trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of cryogenic equipment

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization and IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Tanks

- 5.3 Valves

- 5.4 Vaporizers

- 5.5 Pumps

- 5.6 Pipe

- 5.7 Others

Chapter 6 Market Size and Forecast, By Cryogen Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Nitrogen

- 6.3 Oxygen

- 6.4 Natural gas

- 6.5 Argon

- 6.6 Other cryogens

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Distribution

Chapter 8 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 O&G industry

- 8.3 Power

- 8.4 Food & beverage

- 8.5 Chemical

- 8.6 Rubber & plastics

- 8.7 Metallurgy

- 8.8 Healthcare

- 8.9 Shipping

- 8.10 Agriculture, forestry & fishing

- 8.11 Other industries

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 France

- 9.3.6 Poland

- 9.3.7 Norway

- 9.3.8 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Indonesia

- 9.4.5 Thailand

- 9.4.6 Malaysia

- 9.4.7 Philippines

- 9.4.8 South Korea

- 9.4.9 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Kuwait

- 9.5.4 Oman

- 9.5.5 Turkey

- 9.5.6 Qatar

- 9.5.7 Egypt

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Peru

Chapter 10 Company Profiles

- 10.1 Abhijit Enterprises

- 10.2 Air Liquide

- 10.3 Air Products and Chemicals

- 10.4 AIR WATER

- 10.5 Auguste Cryogenics

- 10.6 BRUGG Pipes

- 10.7 Chart Industries

- 10.8 Cryogas Equipment

- 10.9 Cryogenic OGS

- 10.10 CRYOSPAIN

- 10.11 Cryostar

- 10.12 Cryoworld

- 10.13 Demaco

- 10.14 Emerson Electric

- 10.15 Flowserve Corporation

- 10.16 Hypro

- 10.17 INOXCVA

- 10.18 IWI Cryogenic Vaporization Systems (India) Pvt. Ltd.

- 10.19 Kelvin International

- 10.20 Linde

- 10.21 Shell-n-Tube

- 10.22 SLB

- 10.23 Vacuum Barrier