|

市场调查报告书

商品编码

1913275

百叶窗及百叶窗市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Blinds and Shutters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

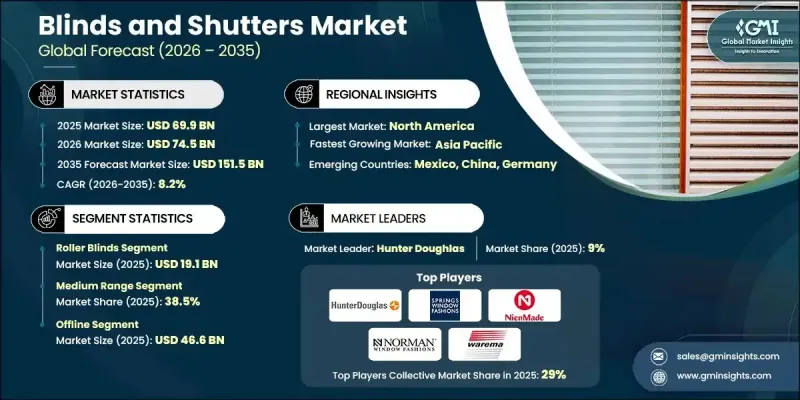

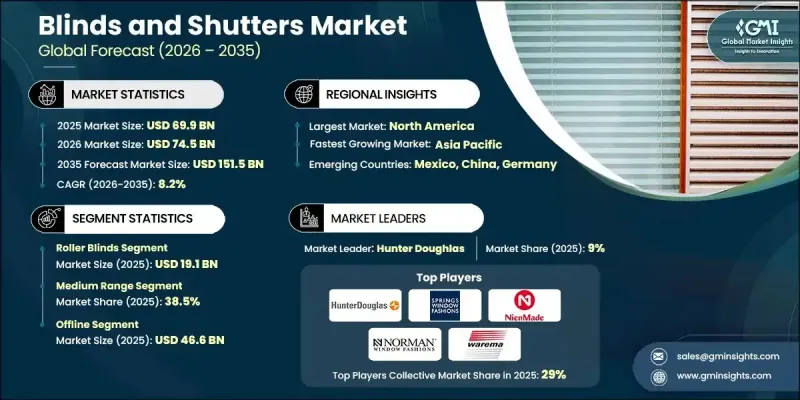

全球百叶窗和百叶窗市场预计到 2025 年将达到 699 亿美元,到 2035 年将达到 1,515 亿美元,年复合成长率为 8.2%。

这种成长反映了人们对窗饰观念的根本性转变,消费者越来越将百叶窗和百叶窗视为设计元素,而不仅仅是功能性产品。如今,住宅更加重视视觉和谐、材质质感以及与室内空间的风格一致性,这显着影响了他们的购买行为。製造商也积极回应,不断拓展产品系列,力求在外观、性能和客製化之间取得平衡。注重设计的消费者正在寻找能够体现其现代生活方式的窗饰解决方案,从简约到奢华,这种需求持续影响着产品开发策略。数位平台的日益普及也加速了潮流的传播,使消费者更容易发现新的设计概念和产品种类。因此,在不断变化的设计偏好、日益增长的住宅维修自由裁量权支出以及满足美观和实用需求的多样化产品选择的推动下,百叶窗和百叶窗行业正经历着一场变革。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 699亿美元 |

| 预测金额 | 1515亿美元 |

| 复合年增长率 | 8.2% |

百叶窗和百叶窗如今已被广泛认为是室内设计的重要组成部分,而不仅仅是窗帘。消费者越来越期望这些产品在保持功能性的同时,也能提升整体装潢效果。这种观念的转变促使供应商推出更丰富的色彩、纹理和材质选择,以及更精緻的饰面和客製化服务。产品设计旨在与现代、优雅和高端的室内设计主题相契合,帮助消费者在整个空间中打造统一的视觉风格。这种趋势也促使製造商精心打造多个系列,以满足不同的设计偏好和生活方式需求,同时确保产品品质和价格的合理性。

预计到2025年,捲帘将占据整体市场的主导份额,市场规模将达到191亿美元。其强劲的市场地位得益于其灵活的设计、便利的操作和简洁的视觉效果。这些特点使捲帘成为追求符合现代室内设计潮流的简约窗饰解决方案的消费者的首选。捲帘兼具实用性和精緻美感,进一步巩固了其在全球市场的广泛认可和持续需求。

中价位产品将成为最主要的价位区间,预计2025年将占据38.5%的市占率。此价位区间吸引着那些希望在耐用性、外观和材质方面比入门级产品有显着提升,同时又能维持成本绩效的消费者。此价位区间的消费者不追求高端产品的高昂价格,而是更重视性能可靠、外观精美的全方位解决方案。这种市场定位使得中等价位产品成为全球製造商重要的收入来源。

预计到2025年,美国百叶窗和百叶窗市场将占据79.7%的市场份额,销售额将达到221亿美元。该地区受益于强劲的需求,而这主要得益于住宅建设活动、维修支出以及较高的购买力。完善的分销体系和成熟的消费群将支撑销售的持续成长,巩固北美在全球百叶窗和百叶窗产业的重要地位。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 人们对住宅维修和室内设计的意识日益增强

- 能源效率和永续性义务

- 扩展智慧家庭集成

- 问题和风险

- 激烈的价格竞争与市场分散

- 供应链脆弱性和原物料价格波动

- 机会

- 拓展至环保及可回收材料领域

- 客製化和直接面向消费者的数位管道

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 贸易统计(HS编码 - 3925.30.00)

- 主要进口国

- 主要出口国

- 差距分析

- 风险评估与缓解

- 波特分析

- PESTEL 分析

- 消费行为分析

- 购买模式

- 偏好分析

- 消费行为的区域差异

- 电子商务如何影响购买决策

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依产品类型分類的市场估算与预测(2022-2035 年)

- 卷帘

- 百叶窗

- 垂直百叶窗

- 罗马帘和百褶帘

- 人工林

- 面板轨道/滑动面板

- 其他(蜂巢帘、智慧帘、户外帘)

第六章 市场估算与预测:依材料分类(2022-2035 年)

- 瞎的

- 织物

- 木头

- 铝

- 塑胶

- 复合材料

- 百叶窗

- 木材(椴木、雪松)

- 乙烯基/PVC

- 复合材料

- 铝

第七章 按类型分類的市场估计和预测(2022-2035 年)

- 手动输入

- 电的

- 智慧/物联网相容

第八章 市场估算与预测:依价格区间划分(2022-2035 年)

- 低价位

- 中价位

- 高价位范围

第九章 按分销管道分類的市场估计和预测(2022-2035 年)

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 零售店

- 其他(室内设计工作室、精品店等)

第十章 各地区市场估计与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十一章 公司简介

- 3 Day Blinds LLC

- Coulisse BV

- Griesser AG

- Hillarys Blinds Ltd.

- Hunter Douglas NV

- Lafayette Interior Fashions

- Nichibei Co., Ltd.

- Nien Made Enterprise

- Norman Window Fashions

- Rollease Acmeda

- Springs Window Fashions

- Tachikawa Corporation

- Thomas Sanderson Ltd.

- TOSO Company

- Warema Renkhoff SE

The Global Blinds and Shutters Market was valued at USD 69.9 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 151.5 billion by 2035.

This growth reflects a fundamental shift in how window coverings are perceived, as consumers increasingly treat blinds and shutters as design elements rather than purely functional products. Homeowners now prioritize visual harmony, material appeal, and design alignment with interior spaces, which has significantly influenced purchasing behavior. Manufacturers are responding by expanding product portfolios that balance appearance, performance, and customization. Design-conscious consumers are seeking window solutions that reflect modern lifestyles, whether minimalistic or upscale, and this demand continues to shape product development strategies. The growing influence of digital platforms has also contributed to faster trend adoption, allowing consumers to discover new design ideas and product variations with greater ease. As a result, the blinds and shutters industry is experiencing a transformation driven by evolving design preferences, increasing discretionary spending on home upgrades, and the availability of diverse product choices that meet both aesthetic and practical expectations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $69.9 Billion |

| Forecast Value | $151.5 Billion |

| CAGR | 8.2% |

Blinds and shutters are now widely recognized as integral components of interior styling rather than simple window coverings. Buyers increasingly expect these products to enhance overall decor while maintaining functionality. This change in perception has encouraged suppliers to introduce broader selections of colors, textures, and materials, along with refined finishes and customization capabilities. Products are being developed to align with contemporary, elegant, and high-end interior themes, allowing consumers to achieve a cohesive visual identity throughout their spaces. This evolution has prompted manufacturers to curate multiple collections that cater to varied design preferences and lifestyle needs without compromising quality or affordability.

The roller blinds segment generated USD 19.1 billion in 2025, securing a leading share within the overall market. Their strong position is supported by their adaptable design, ease of use, and visual simplicity. These characteristics have made roller blinds a preferred choice among consumers seeking streamlined window solutions that align with modern interior trends. Their ability to combine practicality with clean aesthetics has reinforced their widespread appeal and sustained demand across global markets.

The medium-priced category accounted for 38.5% share in 2025, making it the most dominant pricing segment. This range attracts buyers who seek noticeable improvements in durability, appearance, and material quality compared to entry-level offerings, while remaining cost-effective. Consumers in this segment value balanced solutions that deliver reliable performance and enhanced visual appeal without the premium pricing associated with luxury products. This positioning has made the medium range a critical revenue driver for manufacturers worldwide.

United States Blinds and Shutters Market held 79.7% share, generating USD 22.1 billion in 2025. The region benefits from strong demand driven by housing activity, renovation spending, and high purchasing power. Well-established distribution systems and a mature consumer base continue to support consistent sales growth, reinforcing North America's influential role within the global blinds and shutters industry.

Key companies actively shaping the Global Blinds and Shutters Market include Hunter Douglas N.V., Springs Window Fashions, 3 Day Blinds LLC, Norman Window Fashions, Hillarys Blinds Ltd., Griesser AG, Warema Renkhoff SE, Coulisse B.V., Lafayette Interior Fashions, Rollease Acmeda, Nichibei Co., Ltd., Tachikawa Corporation, Nien Made Enterprise, TOSO Company, and Thomas Sanderson Ltd. These players continue to invest in product innovation, brand positioning, and global expansion to strengthen their market presence. Companies operating in the Global Blinds and Shutters Market are strengthening their competitive position through a combination of product innovation, customization capabilities, and strategic expansion. Many brands are investing in advanced materials, improved operating mechanisms, and refined finishes to meet rising consumer expectations for quality and design. Custom-made solutions are being emphasized to address diverse style preferences and sizing requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Type

- 2.2.5 Price range

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising home renovation and interior design consciousness

- 3.2.1.2 Energy efficiency and sustainability mandates

- 3.2.1.3 Expansion of smart home integration

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Intense price competition and market fragmentation

- 3.2.2.2 Supply chain vulnerabilities and raw material volatility

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 Customization and direct-to-consumer digital channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-3925.30.00)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap Analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Roller blinds

- 5.3 Venetian blinds

- 5.4 Vertical blinds

- 5.5 Roman & pleated blinds

- 5.6 Plantation shutters

- 5.7 Panel track / sliding panels

- 5.8 Others (cellular, smart, outdoor)

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Blinds

- 6.2.1 Fabric

- 6.2.2 Wood

- 6.2.3 Aluminum

- 6.2.4 Plastic

- 6.2.5 Composite

- 6.3 Shutters

- 6.3.1 Wood (basswood, cedar)

- 6.3.2 Vinyl/PVC

- 6.3.3 Composite

- 6.3.4 Aluminum

Chapter 7 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Motorized

- 7.4 Smart / IoT-enabled

Chapter 8 Market Estimates and Forecast, By Price Range, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Retail stores

- 9.3.3 Others (interior design studios & boutiques, etc.)

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3 Day Blinds LLC

- 11.2 Coulisse B.V.

- 11.3 Griesser AG

- 11.4 Hillarys Blinds Ltd.

- 11.5 Hunter Douglas N.V.

- 11.6 Lafayette Interior Fashions

- 11.7 Nichibei Co., Ltd.

- 11.8 Nien Made Enterprise

- 11.9 Norman Window Fashions

- 11.10 Rollease Acmeda

- 11.11 Springs Window Fashions

- 11.12 Tachikawa Corporation

- 11.13 Thomas Sanderson Ltd.

- 11.14 TOSO Company

- 11.15 Warema Renkhoff SE