|

市场调查报告书

商品编码

1913282

球阀市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Ball Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

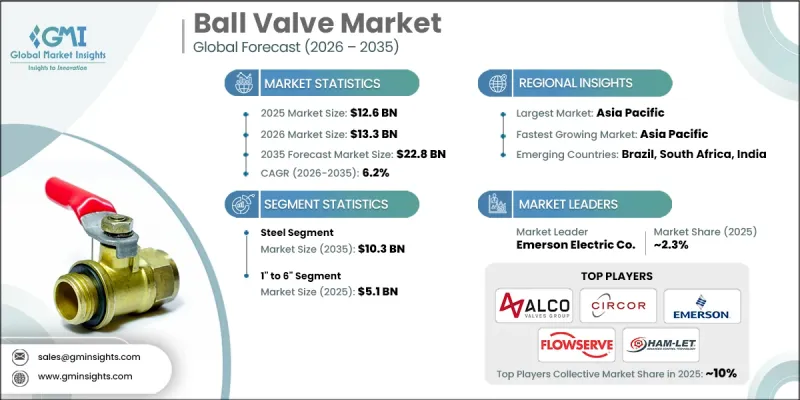

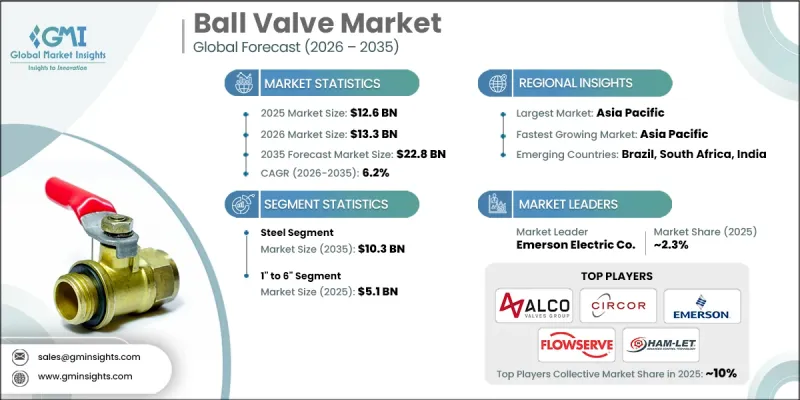

全球球阀市场预计到 2025 年将达到 126 亿美元,到 2035 年将达到 228 亿美元,年复合成长率为 6.2%。

日益增长的能源安全担忧和老旧管道网路的大规模维修持续支撑着全球需求。球阀在流量控制和快速切断功能中发挥着至关重要的作用,使其成为整体能源传输基础设施不可或缺的组成部分。日益严格的法律规范,尤其是对环境保护和运行安全的监管,推动了球阀的广泛应用,尤其是在需要先进流量控制解决方案的新建和升级管道项目中。全球能源消费量的成长推动了亚太和中东等高成长地区的基础设施投资,进一步刺激了市场需求。製造商受益于管道、加工设施和输送系统的长期资本投资,这些投资需要耐用可靠的阀门技术。安全要求、基础设施现代化和不断扩展的能源网路共同构成了市场持续成长的稳定基础。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 126亿美元 |

| 预测金额 | 228亿美元 |

| 复合年增长率 | 6.2% |

预计到 2025 年,钢球阀市场规模将达到 56 亿美元,到 2035 年将达到 103 亿美元。钢材具有优异的机械性能、耐久性以及承受极端压力和温度条件的能力,使其成为安全性和可靠性至关重要的关键工业应用的首选材料。

预计到2025年,1吋至6吋球阀市场规模将达到51亿美元,占市场份额的40.9%。此尺寸范围占据主导地位,因为它适用于中等流量系统,并在各种工业和商业设施中实现了容量和效率的最佳平衡。

美国球阀市场预计到 2025 年将达到 22 亿美元,从 2026 年到 2035 年将以 4.5% 的复合年增长率成长。能源供应链中强劲的製造业活动以及对先进安全阀的监管要求,继续推动全国对高性能球阀的需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 价格趋势

- 原料成本

- 原料供应中现实与认知之间的差距

- 检验供应商价格上涨情况

- 法律规范

- 按地区

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 产品系列基准测试

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 按材料分類的市场估算与预测,2022-2035年

- 钢材

- 塑胶

- 铸铁

- 合金基体

- 其他(青铜和黄铜)

第六章 按组件分類的市场估算与预测,2022-2035年

- 致动器

- 阀体

- 其他(定位器和I/P转换器)

第七章 市场规模估算与预测(2022-2035年)

- <1"

- 1英寸至6英寸

- 7英寸至25英寸

- 26英寸至50英寸

- >50"

第八章 依最终用途分類的市场估算与预测,2022-2035年

- 化学品

- 能源与公共产业

- 建造

- 金属和采矿

- 农业

- 製药

- 食品/饮料

- 纸浆和造纸

- 其他(纤维、玻璃、半导体)

9. 2022-2035年按分销管道分類的市场估算与预测

- 直销

- 间接

第十章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

第十一章:公司简介

- Alco Valves Group

- Circor International

- Emerson Electric Co

- Flowserve Corporation

- HAM-LET Group

- Haskel International, Inc

- Hex Valve

- HOKE

- HY-LOK Corporation

- KITZ Corporation

- Maximator GmbH

- Oliver Valves Ltd

- Parker Hannifin

- SMC Corporation

- Swagelok Company

The Global Ball Valve Market was valued at USD 12.6 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 22.8 billion by 2035.

Rising concerns around energy security and the large-scale refurbishment of aging pipeline networks continue to support demand worldwide. Ball valves play a critical role in flow isolation and rapid shutoff functions, making them essential components across energy transportation infrastructure. Increasing regulatory oversight focused on environmental protection and operational safety strengthens adoption, particularly for new and replacement pipeline installations that require advanced flow control solutions. As global energy consumption continues to rise, infrastructure investments expand across high-growth regions, including the Asia Pacific and the Middle East, further accelerating market demand. Manufacturers benefit from long-term capital spending on pipelines, processing facilities, and transmission systems that require durable and reliable valve technologies. The combination of safety requirements, infrastructure modernization, and expanding energy networks creates a stable foundation for continued market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.6 Billion |

| Forecast Value | $22.8 Billion |

| CAGR | 6.2% |

The steel-based ball valves segment generated USD 5.6 billion in 2025 and is projected to reach USD 10.3 billion by 2035. Strong mechanical performance, durability, and resistance to extreme pressure and temperature conditions make steel the preferred material across critical industrial applications where safety and reliability remain essential.

The ball valves sized between 1 inch and 6 inches segment accounted for USD 5.1 billion in 2025 and represent 40.9% share. This size range dominates due to its suitability for moderate flow systems, offering an optimal balance between capacity and efficiency across a wide range of industrial and commercial installations.

U.S. Ball Valve Market reached USD 2.2 billion in 2025 and is expected to grow at a CAGR of 4.5% from 2026 to 2035. Strong production activity across energy supply chains and regulatory requirements for advanced safety valves continue to drive demand for high-performance ball valves nationwide.

Leading companies operating in the Global Ball Valve Market include Flowserve Corporation, Emerson Electric Co, Swagelok Company, Parker Hannifin, KITZ Corporation, Circor International, SMC Corporation, Oliver Valves Ltd, HY-LOK Corporation, HOKE, Alco Valves Group, Maximator GmbH, HAM-LET Group, Hex Valve, and Haskel International, Inc. Companies strengthen their position in the Ball Valve Market through continuous product innovation, material optimization, and compliance-focused engineering. Many manufacturers invest in advanced sealing technologies and precision manufacturing to improve performance in demanding environments. Expanding regional production capabilities helps reduce lead times and improve supply reliability. Strategic partnerships with infrastructure developers and energy operators support long-term contract visibility. Firms also emphasize certification readiness, quality assurance, and lifecycle service offerings to enhance customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Material trends

- 2.2.3 Component trends

- 2.2.4 Size trends

- 2.2.5 End use trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Price trends

- 3.5.1 Raw material cost

- 3.5.2 Real vs. perceived capacity constraints in supply of raw materials

- 3.5.3 Supplier price increase validation

- 3.6 Regulatory framework

- 3.6.1 By region

- 3.7 Trade statistics

- 3.7.1 Major importing countries

- 3.7.2 Major exporting countries

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Steel

- 5.3 Plastic

- 5.4 Cast Iron

- 5.5 Alloy Based

- 5.6 Others (Bronze and Brass)

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Actuators

- 6.3 Valve Body

- 6.4 Others (Positioners and I/P Converters)

Chapter 7 Market Estimates & Forecast, By Size, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 <1"

- 7.3 1" to 6"

- 7.4 7" to 25"

- 7.5 26" to 50"

- 7.6 >50"

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Chemical

- 8.3 Energy & utilities

- 8.4 Construction

- 8.5 Metal & mining

- 8.6 Agriculture

- 8.7 Pharmaceutical

- 8.8 Food & beverage

- 8.9 Pulp & paper

- 8.10 Others (textile, glass, and semiconductor)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Alco Valves Group

- 11.2 Circor International

- 11.3 Emerson Electric Co

- 11.4 Flowserve Corporation

- 11.5 HAM-LET Group

- 11.6 Haskel International, Inc

- 11.7 Hex Valve

- 11.8 HOKE

- 11.9 HY-LOK Corporation

- 11.10 KITZ Corporation

- 11.11 Maximator GmbH

- 11.12 Oliver Valves Ltd

- 11.13 Parker Hannifin

- 11.14 SMC Corporation

- 11.15 Swagelok Company