|

市场调查报告书

商品编码

1913285

包装器材市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Packaging Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

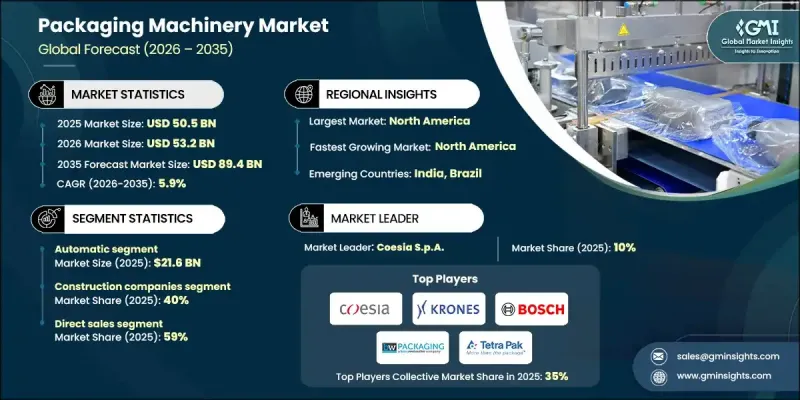

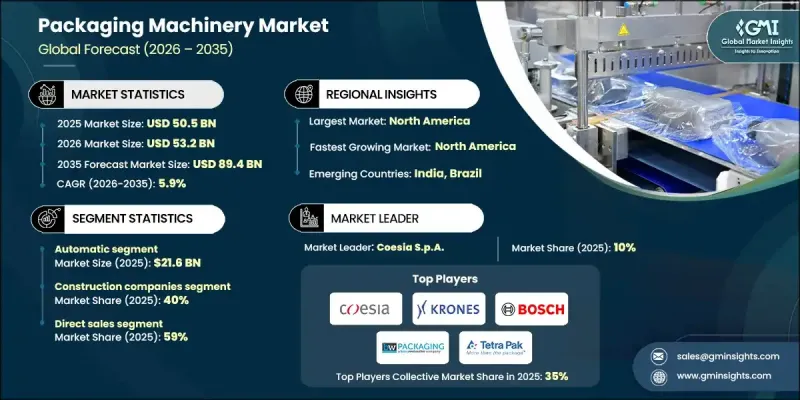

全球包装器材市场预计到 2025 年将达到 505 亿美元,到 2035 年将达到 894 亿美元,年复合成长率为 5.9%。

如今,包装器材在提升生产速度、维持产品品质、确保合规性以及减少环境影响方面发挥着至关重要的作用。製造商面临越来越大的压力,需要在满足永续性和营运效率目标的同时,大规模提供一致的高品质产品。自动化包装解决方案仍然是这些努力的核心,它能够实现高精度、更佳的卫生控制,并确保符合国际标准。随着产量增加和供应链日益复杂,企业越来越依赖先进的包装系统来确保安全密封和高效加工。兼顾生产力和环境责任的创新不断推动产业的变革。对自动化、数位化和材料优化的投资进一步强化了包装器材在多种工业工作流程中的重要性。市场成长轨迹反映了对可靠、扩充性且面向未来的包装解决方案日益增长的需求,这些解决方案能够满足现代製造业的需求。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 505亿美元 |

| 预测金额 | 894亿美元 |

| 复合年增长率 | 5.9% |

包装器材製造商正积极重新设计设备,透过数位化控制和基于感测器的监控整合智慧功能,从而提高运作和运行速度。永续性不再是可选项,而是一项基本价值,机器的设计旨在加工环保材料,同时减少废弃物产生。这些进步正是为了回应日益增长的环保生产方式需求。

预计到2025年,自动化系统市场规模将达到216亿美元。自动化能够提高生产一致性,减少人为干预,并显着降低错误率。这些系统支援大规模生产,同时实现灵活的包装形式,从而加快交付速度并提高营运可靠性。互联技术的应用进一步推动了市场需求,它能够实现预测性维护、即时视觉化和数据驱动的效率提升,最终带来长期的成本节约。

到2025年,直销通路将占据59%的市场份额,这反映出消费者强烈倾向于製造商与客户之间的直接交易。这种方式支援客製化的系统配置、快速部署和完善的售后服务监管,尤其是在大量生产的情况下。此外,直销通路还提供更大的定价弹性和更优质的售后支援。

预计2025年,美国包装器材市场将占71%的市场份额,市场规模达126亿美元。该地区受益于先进的基础设施、广泛的自动化应用以及对智慧製造的大力投资。不断成长的线上零售活动以及消费品和饮料製造商的稳定需求,持续推动高速系统的应用。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 对自动化和效率的需求日益增长

- 电子商务和消费品包装(CPG)的成长

- 融合科技进步与智慧包装

- 产业潜在风险与挑战

- 高初始资本投入

- 维护复杂性和熟练劳动力短缺

- 机会

- 永续性和环保包装解决方案

- 新兴市场的扩张

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 透过装置

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依设备类型分類的市场估算与预测,2022-2025年

- 灌装和计量设备

- 容积式灌装机

- 重力式灌装机

- 液体填充机

- 粉末填充机

- 装袋和软包装设备

- 立式成型填充封口机(VFFS)

- 卧式成型填充封口机(HFFS)

- 预製袋填充和密封

- 包装袋製造和填充

- 产品包装设备

- 装盒、装箱和多件包装设备

- 水平装盒机

- 立式装盒机

- 环绕式装箱机

- 托盘成型机

- 收缩捆扎机和多包装机

- 标籤、编码和标记设备

- 压敏贴标机

- 热熔/冷胶贴标机

- 袖标机

- 喷墨和雷射编码器

- 热感印表机

- 码垛和生产线末端设备

- 机器人堆垛机

- 传统堆垛机

- 托盘拉伸包装机

- 托盘收缩包装机

- 捆扎机

- 封箱机

- 输送、供应和搬运设备

- 皮带输送机和滚筒输送机

- 累积表

- 产品送料器和分类机

- 机器人拾取和放置

- 检验和品管设备

- 支票簿

- 金属探测器和X光机

- 视觉检测系统

- 洩漏测试仪

- 封盖和封口设备

- 螺丝帽

- 旋盖机和压盖机

- 封口机和感应封口机

- 散装袋和柔性货柜(FIBC)搬运设备

- 散装袋灌装机

- 纤维袋排放机

- 其他设备类型

- 泡壳包装机

- 瓶子吹塑成型

- 无菌包装系统

第六章 依自动化程度分類的市场估算与预测,2022-2025年

- 手动的

- 半自动

- 全自动

7. 依最终用途分類的市场估计与预测,2022-2025 年

- 食品/饮料

- 生鲜食品/冷冻食品

- 干粮和零食

- 饮料

- 乳製品

- 药品和医疗设备

- 片剂和胶囊

- 注射剂和生物製药

- 医疗设备和诊断设备

- 营养保健品

- 个人护理及化妆品

- 护肤和护髮

- 化妆品和色彩

- 盥洗用品和卫生用品

- 家用/工业/农业化学品

- 清洁剂和清洁剂

- 化肥和杀虫剂

- 工业化学品

- 宠物食品与动物营养

- 干燥宠物食品

- 湿宠物食品

- 零食和营养补充剂

- 动物饲料

- 其他的

第八章 按分销管道分類的市场估算与预测,2022-2025年

- 直销

- 间接销售

第九章 2022-2025年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十章:公司简介

- ARBURG GmbH+Co KG

- Barry-Wehmiller(BW Packaging)

- Coesia SpA

- ENGEL Holding GmbH

- Fres-co System USA, Inc.

- Ilapak International SA

- Ishida Co., Ltd.

- KraussMaffei Group GmbH

- Krones AG

- MULTIVAC Sepp Haggenmuller SE &Co. KG

- Robert Bosch Packaging Technology

- Rovema GmbH

- Sumitomo Heavy Industries, Ltd.

- Tetra Pak International SA

- Yamato Scale Co., Ltd

The Global Packaging Machinery Market is valued at USD 50.5 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 89.4 billion by 2035.

Packaging machinery now plays a critical role in supporting faster output, improved product integrity, regulatory adherence, and lower environmental impact. Manufacturers face increasing pressure to deliver consistent quality at scale while meeting sustainability targets and operational efficiency goals. Automated packaging solutions remain central to these efforts, as they deliver high precision, improved sanitation, and reliable compliance with global standards. As manufacturing volumes rise and supply chains become more complex, companies increasingly rely on advanced packaging systems to ensure secure sealing and efficient processing. The industry continues to transform through innovation that aligns productivity with environmental responsibility. Investments in automation, digitalization, and material optimization reinforce the importance of packaging machinery across multiple industrial workflows. The market's growth trajectory reflects rising demand for dependable, scalable, and future-ready packaging solutions that support modern manufacturing needs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $50.5 Billion |

| Forecast Value | $89.4 Billion |

| CAGR | 5.9% |

Packaging machinery producers are actively redesigning equipment to integrate intelligent functionality through digital controls and sensor-based monitoring, improving uptime and operational speed. Sustainability has become a foundational value rather than an optional feature, with machines engineered to handle eco-conscious materials while reducing waste generation. These advancements respond directly to rising demand for environmentally responsible production methods.

In 2025, the automatic systems segment generated USD 21.6 billion. Automation enhances consistency, limits human intervention, and significantly lowers error rates. These systems enable large-scale production while allowing flexible packaging formats, supporting faster turnaround times and improved operational reliability. The adoption of connected technologies further accelerates demand by enabling predictive servicing, real-time visibility, and data-driven efficiency improvements that lower long-term costs.

The direct sales segment accounted for a 59% share in 2025, reflecting a strong preference for manufacturer-to-client engagement. This approach supports tailored system configurations, faster implementation, and stronger service oversight, particularly for high-volume operations. Direct channels also enable greater pricing control and enhanced post-sale support.

United States Packaging Machinery Market held a 71% share in 2025, generating USD 12.6 billion. The region benefits from advanced infrastructure, widespread automation adoption, and strong investment in smart manufacturing. Expanding online retail activity and steady demand from consumer goods and beverage producers continue to drive high-speed system adoption.

Leading companies active in the Global Packaging Machinery Market include Tetra Pak International S.A., Krones AG, Coesia S.p.A., MULTIVAC Sepp Haggenmuller SE & Co. KG, Barry-Wehmiller, Ishida Co., Ltd., Yamato Scale Co., Ltd., Robert Bosch Packaging Technology, Ilapak International SA, Rovema GmbH, Fres-co System USA, Inc., ENGEL Holding GmbH, KraussMaffei Group GmbH, ARBURG GmbH + Co KG, Sumitomo Heavy Industries Ltd., and JSW Plastics Machinery Co., Ltd. Companies operating in the Global Packaging Machinery Market reinforce their competitive position through continuous innovation, automation expansion, and sustainability-driven design. Strategic investments in digital technologies improve machine intelligence, predictive maintenance, and system efficiency. Manufacturers focus on modular designs to enable customization while reducing deployment time. Global players strengthen distribution networks and after-sales services to enhance customer retention. Sustainability initiatives, including waste reduction and material compatibility, support compliance with environmental regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Automation

- 2.2.4 End-user industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automation and efficiency

- 3.2.1.2 Growth of e-commerce and consumer packaged goods (CPG)

- 3.2.1.3 Technological advancements and smart packaging integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Complexity in maintenance and skilled workforce shortage

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability and eco-friendly packaging solutions

- 3.2.3.2 Expansion in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2022 - 2025 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling & dosing equipment

- 5.2.1 Volumetric fillers

- 5.2.2 Gravimetric fillers

- 5.2.3 Liquid fillers

- 5.2.4 Powder fillers

- 5.3 Bagging & flexible packaging equipment

- 5.3.1 Vertical form-fill-seal (vffs)

- 5.3.2 Horizontal form-fill-seal (hffs)

- 5.3.3 Pre-made bag filling & sealing

- 5.3.4 Pouch making & filling

- 5.3.5 Product wrapping equipment

- 5.4 Cartoning, case packing & multipacking equipment

- 5.4.1 Horizontal cartoners

- 5.4.2 Vertical cartoners

- 5.4.3 Wraparound case packers

- 5.4.4 Tray formers

- 5.4.5 Shrink bundlers and multipack wrappers

- 5.5 Labeling, coding & marking equipment

- 5.5.1 Pressure-sensitive labelers

- 5.5.2 Hot-melt and cold-glue labelers

- 5.5.3 Sleeve labelers

- 5.5.4 Inkjet and laser coders

- 5.5.5 Thermal transfer printers

- 5.6 Palletizing & end-of-line equipment

- 5.6.1 Robotic palletizers

- 5.6.2 Conventional palletizers

- 5.6.3 Pallet stretch wrappers

- 5.6.4 Pallet shrink wrappers

- 5.6.5 Strapping machines

- 5.6.6 Case sealers

- 5.7 Conveying, feeding & handling equipment

- 5.7.1 Belt and roller conveyors

- 5.7.2 Accumulation tables

- 5.7.3 Product feeders and sorters

- 5.7.4 Robotic pick-and-place

- 5.8 Inspection & quality control equipment

- 5.8.1 Checkweighers

- 5.8.2 Metal detectors and x-ray inspection

- 5.8.3 Vision inspection systems

- 5.8.4 Leak testers

- 5.9 Capping & closing equipment

- 5.9.1 Screw cappers

- 5.9.2 Snap cappers and crimpers

- 5.9.3 Seamers and induction sealers

- 5.10 Bulk bag & fibc handling equipment

- 5.10.1 Bulk bag fillers

- 5.10.2 Fibc dischargers

- 5.11 Other equipment types

- 5.11.1 Blister packaging machines

- 5.11.2 Bottle blowing and molding

- 5.11.3 Aseptic packaging systems

Chapter 6 Market Estimates and Forecast, By Automation, 2022 - 2025 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2025 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Fresh & frozen foods

- 7.2.2 Dry foods & snacks

- 7.2.3 Beverages

- 7.2.4 Dairy

- 7.3 Pharmaceuticals & medical devices

- 7.3.1 Tablets and capsules

- 7.3.2 Injectables and biologics

- 7.3.3 Medical devices and diagnostics

- 7.3.4 Nutraceuticals

- 7.3.5 Personal care & cosmetics

- 7.3.6 Skincare and haircare

- 7.3.7 Cosmetics and color

- 7.3.8 Toiletries and hygiene products

- 7.4 Household, industrial & agricultural chemicals

- 7.4.1 Detergents and cleaners

- 7.4.2 Fertilizers and pesticides

- 7.4.3 Industrial chemicals

- 7.5 Pet food & animal nutrition

- 7.5.1 Dry pet food

- 7.5.2 Wet pet food

- 7.5.3 Treats and supplements

- 7.5.4 Animal feed

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2025 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2025 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ARBURG GmbH + Co KG

- 10.2 Barry-Wehmiller (BW Packaging)

- 10.3 Coesia S.p.A.

- 10.4 ENGEL Holding GmbH

- 10.5 Fres-co System USA, Inc.

- 10.6 Ilapak International SA

- 10.7 Ishida Co., Ltd.

- 10.8 KraussMaffei Group GmbH

- 10.9 Krones AG

- 10.10 MULTIVAC Sepp Haggenmuller SE & Co. KG

- 10.11 Robert Bosch Packaging Technology

- 10.12 Rovema GmbH

- 10.13 Sumitomo Heavy Industries, Ltd.

- 10.14 Tetra Pak International S.A.

- 10.15 Yamato Scale Co., Ltd