|

市场调查报告书

商品编码

1913304

汽车作业系统市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Automotive Operating System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

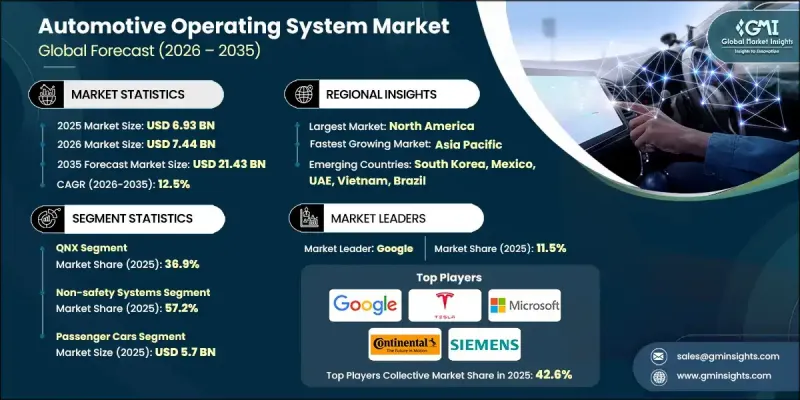

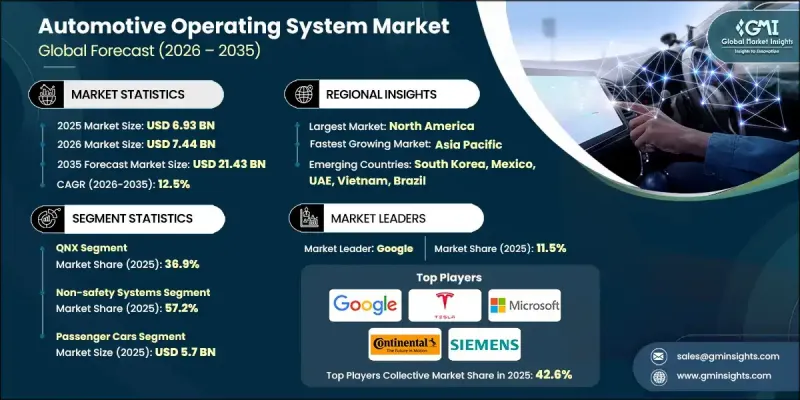

全球汽车作业系统市场预计到 2025 年将达到 69.3 亿美元,到 2035 年将达到 214.3 亿美元,年复合成长率为 12.5%。

市场扩张反映了车辆向软体定义架构的快速转型以及数位平台在车辆功能中日益重要的角色。多个地区的政府正在加快制定促进高级驾驶辅助系统(ADAS)整合的法规结构,这直接推动了对强大汽车操作系统的需求。同时,汽车销量的成长和数位显示器的广泛应用也推动了系统级软体的需求。现代汽车越来越依赖整合作业系统来支援连接、自动化、使用者介面和即时处理。为了应对日益复杂的系统,汽车製造商优先考虑采用安全、可扩展且高效的软体环境。空中下载(OTA)更新功能如今已成为一项基本要求,它能够无缝地提供软体和韧体更新,同时增强网路安全并优化效能。这种转变使製造商能够远端解决问题、更快地部署增强功能,并在无需实体服务的情况下引入新的收入模式。随着车辆发展成为互联的数位平台,作业系统已成为支撑全球汽车生态系统创新、合规性和长期竞争力的核心支柱。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 69.3亿美元 |

| 预测金额 | 214.3亿美元 |

| 复合年增长率 | 12.5% |

2025年,QNX系统将维持主导地位,市占率将达到36.9%,主要得益于其在全球汽车平臺中的高渗透率。同时,其他竞争平台也在加速创新,发展势头强劲,对整体市场扩张起到了积极作用。

预计到 2025 年,非安全系统领域将占 57.2% 的市场份额,从 2026 年到 2035 年,年复合成长率将达到 11.9%。监管限制的减少和开发週期的加快正在推动该领域的快速发展。

预计到 2025 年,美国汽车作业系统市场规模将达到 18.6 亿美元。美国汽车製造商正在迅速向支援空中更新 (OTA) 和跨域整合的集中式软体架构迁移,从而推动了对柔软性且扩充性的作业系统的需求。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 车辆快速电气化

- 软体定义车辆(SDV)的日益普及

- 扩展ADAS(高级驾驶辅助系统)的集成

- 车载资讯娱乐和互联功能的需求日益增长

- 产业潜在风险与挑战

- 软体整合和检验的高度复杂性

- 车辆网路安全和资料隐私问题

- 市场机会

- 透过订阅模式实现软体功能获利

- 扩展车联网(V2X)通信

- 汽车操作系统在商用车和车队车辆的应用日益广泛

- 智慧运输与共用交通平台的发展

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- ISO 26262(ASIL D)

- 美国国家公路交通安全管理局网路安全最佳实践

- SAE J3061

- FMVSS(联邦机动车辆安全标准)

- 欧洲

- 联合国第155号条例(R155)

- Automotive SPICE(ASPICE)

- 欧盟通用安全法规(GSR)

- 亚太地区

- JASO(日本汽车标准组织)

- 日本国土交通省规章

- AIS-189/AIS-190(印度)

- 拉丁美洲

- CONTRAN决议

- NOM-194-SE-2021

- 联合国欧洲经济委员会工作小组29号文件:一致性

- 中东和非洲

- GSO(海湾标准组织)标准

- 阿拉伯联合大公国(阿联酋)国家电动车政策

- 沙乌地阿拉伯 SASO 法规

- 北美洲

- 波特五力分析

- PESTEL 分析

- 技术与创新展望

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 永续性和环境影响

- 环境影响评估

- 社会影响力和社区参与

- 公司管治与企业社会责任

- 永续金融与投资趋势

- 成本細項分析

- 作业系统所需的硬体平台与运算成本

- 作业系统开发和整合成本

- 网路安全和功能安全合规成本

- 空中升级 (OTA) 基础设施和云端服务成本

- 授权、订阅和第三方软体生态系统成本

- 维护、错误修復和功能更新的生命週期成本

- 案例研究

- 未来前景与机会

- SDV交付中的实施挑战

- 软体客製化与即插即用功能之间的不匹配

- 缩小差距的企业策略

- 用例

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

5. 2022-2035年按作业系统分類的市场估算与预测

- Android

- Linux

- QNX

- Windows

- 其他的

第六章 汽车系统市场估算与预测,2022-2035年

- 非安全系统

- 安全关键系统

第七章 依车辆类型分類的市场估计与预测,2022-2035年

- 搭乘用车

- 掀背车车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- MCV

- 重型商用车(HCV)

第八章 2022-2035年按推进方式分類的市场估算与预测

- 内燃机(ICE)

- 电动车(EV)

- 杂交种

第九章 按应用领域分類的市场估算与预测,2022-2035年

- 资讯娱乐系统

- ADAS和安全系统

- 自动驾驶

- 通讯系统

- 连线服务

- 车载资讯系统

- 动力传动系统控制

- 其他的

第十章 依销售管道分類的市场估计与预测,2022-2035年

- OEM

- 售后市场

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ANZ

- 新加坡

- 马来西亚

- 印尼

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- 世界公司

- Microsoft

- Tesla

- NVIDIA

- Hyundai

- Mercedes-Benz

- BlackBerry

- Wind River

- Green Hills Software

- Apple

- Huawei

- Baidu

- Alibaba

- Red Hat

- Volkswagen

- 本地公司

- Elektrobit

- Continental

- Robert Bosch

- Siemens

- Vector Informatik

- ETAS

- Panasonic Automotive

- Denso

- Toyota Motor

- Aptiv

- 新兴企业

- Xpeng Motors

- NIO

- BYD

- Geely Automobile

- SAIC Motor

The Global Automotive Operating System Market was valued at USD 6.93 billion in 2025 and is estimated to grow at a CAGR of 12.5% to reach USD 21.43 billion by 2035.

Market expansion reflects the rapid shift of vehicles toward software-defined architectures and the increasing role of digital platforms in vehicle functionality. Governments across multiple regions are accelerating regulatory frameworks that encourage the integration of advanced driver assistance technologies, which directly elevates demand for robust automotive operating systems. At the same time, rising vehicle sales combined with growing adoption of digital displays are strengthening system-level software requirements. Modern vehicles increasingly rely on integrated operating systems to support connectivity, automation, user interfaces, and real-time processing. Automotive manufacturers are prioritizing secure, scalable, and efficient software environments to manage growing system complexity. Wireless update capabilities are now a baseline expectation, enabling seamless delivery of both software and firmware updates while enhancing cybersecurity and performance optimization. This transformation allows manufacturers to resolve issues remotely, deploy enhancements faster, and introduce new revenue models without physical servicing. As vehicles evolve into connected digital platforms, operating systems have become a central pillar supporting innovation, compliance, and long-term competitiveness across the global automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.93 Billion |

| Forecast Value | $21.43 Billion |

| CAGR | 12.5% |

The QNX segment accounted for 36.9% share in 2025 and maintained a leading position due to its strong penetration across global vehicle platforms. Competing platforms are gaining momentum as innovation accelerates, contributing positively to overall market expansion.

The non-safety systems segment held 57.2% share in 2025 and is expected to grow at a CAGR of 11.9% between 2026 and 2035. Fewer regulatory constraints and faster development cycles are enabling rapid adoption across this segment.

U.S. Automotive Operating System Market reached USD 1.86 billion in 2025. Automakers in the country are rapidly transitioning toward centralized software architectures that support over-the-air updates and cross-domain integration, driving demand for flexible and scalable operating systems.

Key companies active in the Global Automotive Operating System Market include BlackBerry, NVIDIA, Google, Apple, Microsoft, BMW, Mercedes-Benz, Siemens, Continental, and Tesla. Companies operating in the Automotive Operating System Market are strengthening their competitive position through platform innovation, ecosystem partnerships, and long-term collaborations with vehicle manufacturers. Investment in cybersecurity, real-time processing, and scalable architectures is helping vendors address increasing software complexity. Many players are focusing on modular system designs that enable faster deployment across vehicle models. Strategic alliances with semiconductor firms and cloud providers are improving system performance and integration capabilities. Continuous enhancement of update management, lifecycle support, and developer tools is expanding adoption.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Operating System

- 2.2.3 Auto system

- 2.2.4 Vehicle

- 2.2.5 Propulsion

- 2.2.6 Application

- 2.2.7 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid electrification of vehicles

- 3.2.1.2 Growing adoption of software-defined vehicles (SDVs)

- 3.2.1.3 Rising integration of Advanced Driver Assistance Systems (ADAS)

- 3.2.1.4 Increasing demand for in-vehicle infotainment and connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High complexity of software integration and validation

- 3.2.2.2 Concerns related to vehicle cybersecurity and data privacy

- 3.2.3 Market opportunities

- 3.2.3.1 Monetization of software features through subscription models

- 3.2.3.2 Increasing adoption of Vehicle-to-Everything (V2X) communication

- 3.2.3.3 Expansion of automotive OS use in commercial and fleet vehicles

- 3.2.3.4 Growth of smart mobility and shared transportation platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 ISO 26262 (ASIL D)

- 3.4.1.2 NHTSA Cybersecurity Best Practices

- 3.4.1.3 SAE J3061

- 3.4.1.4 FMVSS (Federal Motor Vehicle Safety Standards)

- 3.4.2 Europe

- 3.4.2.1 UN Regulation No. 155 (R155)

- 3.4.2.2 Automotive SPICE (ASPICE)

- 3.4.2.3 EU General Safety Regulation (GSR)

- 3.4.3 Asia Pacific

- 3.4.3.1 JASO (Japan Automotive Standards Organization)

- 3.4.3.2 MLIT Regulations (Japan)

- 3.4.3.3 AIS-189/AIS-190 (India)

- 3.4.4 Latin America

- 3.4.4.1 CONTRAN Resolutions

- 3.4.4.2 NOM-194-SE-2021

- 3.4.4.3 UNECE WP.29 Alignment

- 3.4.5 Middle East & Africa

- 3.4.5.1 GSO (Gulf Standardization Organization) Standards

- 3.4.5.2 UAE National EV Policy

- 3.4.5.3 Saudi SASO Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Sustainability and environmental impact

- 3.9.1 Environmental impact assessment

- 3.9.2 Social impact & community benefits

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable finance & investment trends

- 3.10 Cost breakdown analysis

- 3.10.1 Hardware platform and compute cost for OS

- 3.10.2 OS development and integration cost

- 3.10.3 Cybersecurity and functional safety compliance cost

- 3.10.4 Over-the-air update infrastructure and cloud service cost

- 3.10.5 Licensing, subscription, and third-party software ecosystem cost

- 3.10.6 Maintenance, bug-fixing, and feature update lifecycle cost

- 3.11 Case studies

- 3.12 Future outlook & opportunities

- 3.13 Execution gaps in SDV delivery

- 3.13.1 Mismatches in software customization and plug-and-play capabilities

- 3.13.2 Company strategies for bridging the gaps

- 3.13.3 Use cases

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Operating System, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Android

- 5.3 Linux

- 5.4 QNX

- 5.5 Windows

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Auto System, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Non-safety system

- 6.3 Safety-critical System

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 ICE

- 8.3 EV

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 Infotainment system

- 9.3 ADAS & safety system

- 9.4 Autonomous driving

- 9.5 Communication system

- 9.6 Connected services

- 9.7 Telematics

- 9.8 Powertrain control

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Google

- 12.1.2 Microsoft

- 12.1.3 Tesla

- 12.1.4 NVIDIA

- 12.1.5 Hyundai

- 12.1.6 Mercedes-Benz

- 12.1.7 BlackBerry

- 12.1.8 Wind River

- 12.1.9 Green Hills Software

- 12.1.10 Apple

- 12.1.11 Huawei

- 12.1.12 Baidu

- 12.1.13 Alibaba

- 12.1.14 Red Hat

- 12.1.15 Volkswagen

- 12.2 Regional companies

- 12.2.1 Elektrobit

- 12.2.2 Continental

- 12.2.3 Robert Bosch

- 12.2.4 Siemens

- 12.2.5 Vector Informatik

- 12.2.6 ETAS

- 12.2.7 Panasonic Automotive

- 12.2.8 Denso

- 12.2.9 Toyota Motor

- 12.2.10 Aptiv

- 12.3 Emerging companies

- 12.3.1 Xpeng Motors

- 12.3.2 NIO

- 12.3.3 BYD

- 12.3.4 Geely Automobile

- 12.3.5 SAIC Motor