|

市场调查报告书

商品编码

1913311

移动式心电遥测系统市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Mobile Cardiac Telemetry Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

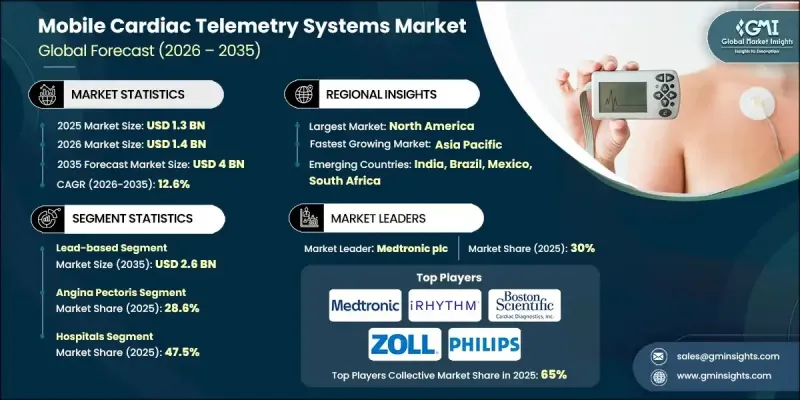

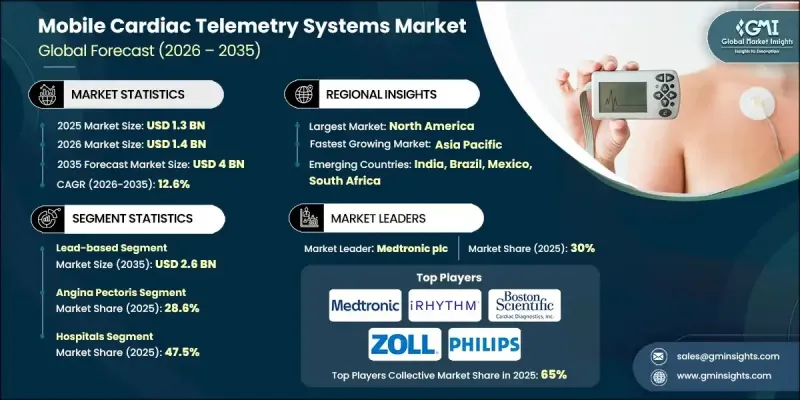

全球行动心电遥测系统市场预计到 2025 年将达到 13 亿美元,到 2035 年将达到 40 亿美元,年复合成长率为 12.6%。

这一增长反映了心臟相关疾病日益增多的趋势,推动了公共卫生支持措施的实施、人口老化以及远端心臟监测技术的不断创新。行动心电遥测系统使患者能够在日常生活中无缝追踪心率活动,为传统监测方法提供了更柔软性的替代方案。这些系统利用穿戴式感测器持续撷取心臟讯号,并透过无线连接自动将具有临床意义的数据传输至远端监测机构。全球心血管疾病负担的加重推动了对早期诊断和主动疾病管理的需求。持续的远端监测有助于更快地做出临床决策、加强护理协调并减少不必要的住院次数。随着医疗保健系统日益重视预防性护理和数位化健康解决方案,行动心电遥测正成为现代心臟护理服务的重要组成部分,并在临床和门诊环境中都保持着强劲的成长势头。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 13亿美元 |

| 预测金额 | 40亿美元 |

| 复合年增长率 | 12.6% |

预计到2025年,基于导线的产品类型销售额将达到8.216亿美元,到2035年将达到26亿美元,复合年增长率(CAGR)为12.8%。这些系统利用多个电极和外部导线提供可靠的心臟数据,有助于临床医师进行一致的解读。它们在医疗机构中久经考验,并已成功融入常规诊断流程,这持续推动它们在医院和专科医疗中心的广泛应用。

预计到2025年,心绞痛应用领域将占28.6%的市占率。心绞痛是一种与心肌组织血流减少有关的疾病,通常突发发生,需要持续监测才能有效控制。行动心电遥测系统可在日常活动中进行持续评估,使临床医生能够即时识别异常的心臟模式并进行快速干预。

预计2025年,北美行动心电遥测系统市占率将达到40.4%。强大的医疗基础设施、对数位医疗技术的早期应用以及心血管疾病发病率的上升,共同支撑了北美在该地区的市场领先地位。完善的医疗保险报销机制、意识提升以及对医疗研究的持续投入,进一步推动了美国和加拿大移动心臟遥测系统的应用。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 产业影响因素

- 司机

- 心臟病发生率增加

- 有利的政府政策

- 高龄化社会的发展

- 心电遥测系统的技术进步

- 产业潜在风险与挑战

- 缺乏专门的训练和教育

- 严格的监管政策和品管标准

- 市场机会

- 转向以价值为导向的预防性医疗模式

- 新兴市场的扩张

- 司机

- 成长潜力分析

- 监管环境

- 技术进步

- 当前技术趋势

- 新兴技术

- 供应链分析

- 救赎方案

- 2024年定价分析

- 未来市场趋势

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 合作伙伴关係和合资企业

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 铅基

- 基于补丁

第六章 依适应症分類的市场估计与预测,2022-2035年

- 心绞痛

- 冠状动脉疾病

- 动脉粥状硬化

- 心臟衰竭

- 中风

- 其他迹象

7. 依最终用途分類的市场估计与预测,2022-2035 年

- 医院

- 专科诊所

- 诊断中心

- 居家医疗环境

- 其他最终用途

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第九章:公司简介

- ACS Diagnostics

- AliveCor

- Baxter International Inc.

- BIOTRICITY INC.

- Biotronik

- Bittium

- Boston Scientific Cardiac Diagnostics Inc.

- Cardiosense

- iRhythm Technologies, Inc.

- Koninklijke Philips NV

- Medicomp Systems

- Medtronic plc

- ScottCare Cardiovascular Solutions

- Telerhythmics LLC

- Zoll Medical Corporation

The Global Mobile Cardiac Telemetry Systems Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 12.6% to reach USD 4 billion by 2035.

This expansion reflects the rising prevalence of heart-related conditions, supportive public health initiatives, an expanding elderly population, and continuous innovation in remote cardiac monitoring technologies. Mobile cardiac telemetry systems enable uninterrupted heart activity tracking while individuals continue their normal routines, offering a more flexible alternative to conventional monitoring methods. These systems rely on wearable sensors that continuously capture cardiac signals and automatically transmit clinically relevant data to off-site monitoring facilities through wireless connectivity. The growing global burden of cardiovascular conditions has intensified the demand for early diagnosis and proactive disease management. Continuous remote monitoring supports faster clinical decision-making, enhances care coordination, and helps limit unnecessary hospital visits. As healthcare systems increasingly prioritize preventive care and digital health solutions, mobile cardiac telemetry is becoming an essential component of modern cardiac care delivery, reinforcing its strong growth trajectory across both clinical and outpatient settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 12.6% |

The lead-based product category generated USD 821.6 million during 2025 and is expected to reach USD 2.6 billion by 2035, growing at a CAGR of 12.8%. These systems utilize multiple electrodes and external leads to deliver highly reliable cardiac data, supporting consistent clinical interpretation. Their established use in medical environments and integration into routine diagnostic workflows continue to drive widespread adoption across hospitals and specialized care centers.

The angina pectoris application segment held 28.6% share in 2025. This condition is associated with reduced blood supply to cardiac tissue and often occurs unpredictably, requiring continuous observation for effective management. Mobile cardiac telemetry systems facilitate ongoing assessment during daily activities, allowing clinicians to identify concerning cardiac patterns in real-time and intervene promptly.

North America Mobile Cardiac Telemetry Systems Market accounted for 40.4% share in 2025. Strong healthcare infrastructure, early adoption of digital medical technologies, and a rising incidence of cardiovascular conditions have supported market leadership in the region. Established reimbursement frameworks, increased patient awareness, and sustained investment in medical research further encourage adoption across the U.S. and Canada.

Key companies active in the Global Mobile Cardiac Telemetry Systems Market include Medtronic plc, Koninklijke Philips N.V., iRhythm Technologies, Inc., AliveCor, BIOTRICITY INC., Boston Scientific Cardiac Diagnostics Inc., Zoll Medical Corporation, Biotronik, Baxter International Inc., Medicomp Systems, ScottCare Cardiovascular Solutions, Bittium, Telerhythmics LLC, Cardiosense, and ACS Diagnostics. Companies operating in the Global Mobile Cardiac Telemetry Systems Market are strengthening their market position through technology upgrades, strategic partnerships, and geographic expansion. Many firms are investing in advanced analytics, cloud-based platforms, and artificial intelligence to enhance diagnostic accuracy and data transmission efficiency. Product portfolio diversification and the development of user-friendly wearable designs are being prioritized to improve patient adherence. Strategic collaborations with healthcare providers and payers help expand clinical adoption and reimbursement coverage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Indication trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cardiac disorders

- 3.2.1.2 Favorable government policies

- 3.2.1.3 Growing aging population

- 3.2.1.4 Technological advancements in cardiac telemetry systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of professional training & education

- 3.2.2.2 Stringent regulatory policies and quality control standards

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward value-based and preventive care models

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Lead-based

- 5.3 Patch-based

Chapter 6 Market Estimates and Forecast, By Indication, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Angina pectoris

- 6.3 Coronary artery disease

- 6.4 Atherosclerosis

- 6.5 Heart failure

- 6.6 Stroke

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Diagnostic centres

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACS Diagnostics

- 9.2 AliveCor

- 9.3 Baxter International Inc.

- 9.4 BIOTRICITY INC.

- 9.5 Biotronik

- 9.6 Bittium

- 9.7 Boston Scientific Cardiac Diagnostics Inc.

- 9.8 Cardiosense

- 9.9 iRhythm Technologies, Inc.

- 9.10 Koninklijke Philips N.V.

- 9.11 Medicomp Systems

- 9.12 Medtronic plc

- 9.13 ScottCare Cardiovascular Solutions

- 9.14 Telerhythmics LLC

- 9.15 Zoll Medical Corporation