|

市场调查报告书

商品编码

1913314

航太密封剂市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Aerospace Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

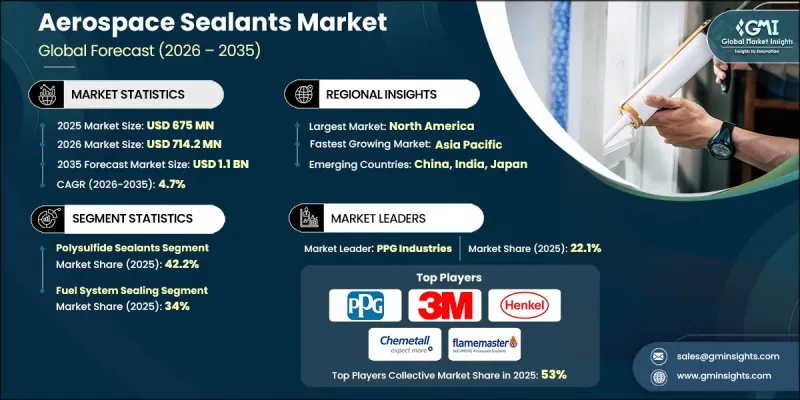

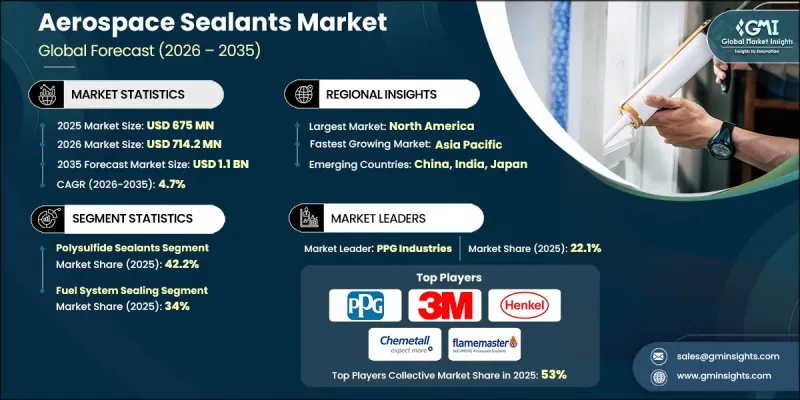

全球航太密封剂市场预计到 2025 年将达到 6.75 亿美元,到 2035 年将达到 11 亿美元,年复合成长率为 4.7%。

市场成长的驱动力在于飞机在极端温度环境下运作对性能需求的不断提高。航太密封剂必须能够承受反覆的热循环,从引擎周围的高温到巡航高度的低温,同时保持黏合性、弹性和耐化学性。这项要求正在加速向先进化学技术的过渡,这些技术能够提供长期耐久性、耐燃料性和机械稳定性。飞机製造商的轻量化目标也影响材料的选择,促使密封剂配方朝着更低的密度、更好的施工性能和更薄的涂层厚度进行优化。即使密封剂优化带来的微小重量减轻,也能在长期运作中显着提高燃油效率。同时,日益严格的环境法规(专注于排放气体和材料安全)迫使製造商转向低VOC、高固态和无溶剂的解决方案。此外,维护活动的增加也使市场受益,业者寻求能够更快固化、更易于操作且工作环境更安全的密封剂。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 6.75亿美元 |

| 预测金额 | 11亿美元 |

| 复合年增长率 | 4.7% |

截至2025年,聚硫化物基密封剂市占率达42.2%。该细分市场持续领先,主要得益于其优异的耐燃料和液压油性能,以及在长期暴露于温度波动和主导应力下仍能保持性能的能力。这些特性使得聚硫化物基配方成为要求严苛的航太密封应用的首选材料。

预计到2025年,燃油系统密封件市占率将达到34%。此类别涵盖燃油储存和输送部件的密封要求,其中长期化学稳定性以及在热浸和浸没条件下的性能保持仍然是关键的性能指标。对成熟密封化学品的持续依赖反映了应用于燃油相关航太部件的严格认证标准。

预计2025年,北美航太密封剂市占率将达到38%。该地区凭藉其蓬勃发展的飞机製造活动、大规模的商用和国防机队以及完善的维护和大修体系,保持着主导地位。机队的持续扩张也持续支撑着生产和售后市场对高性能密封剂的强劲需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依化学品类型分類的市场规模及预测(2022-2035年)

- 聚硫密封剂

- 可固化多硫化物

- 未固化(未硫化)多硫化物

- 硅酮密封胶

- RTV硅胶(无腐蚀性)

- 低挥发性硅酮

- 高温硅胶

- 氟硅酮密封剂

- 聚氨酯密封剂

- 聚醚聚氨酯

- 聚酯聚氨酯

- 聚丙烯酸酯密封剂

- 环氧密封剂

- 其他的

第六章 依应用领域分類的市场规模及预测(2022-2035年)

- 燃油系统密封件

- 一体燃料箱密封处理

- 燃油管路和接头密封件

- 飞机结构密封

- 机身密封

- 飞机挡风玻璃和座舱罩盖密封

- 飞行线维修和现场维护

- 引擎和推进系统密封

- 液压和气动系统密封件

- 航空电子设备和电气系统密封

- 环境控制系统(ECS)密封

- 天线和雷达罩密封

- 防腐蚀处理和接缝表面密封

- 其他的

7. 依飞机类型分類的市场规模及预测,2022-2035年

- 民航机

- 窄体飞机

- 宽体飞机

- 支线飞机

- 公务及通用航空飞机

- 军用机

- 战斗机和作战飞机

- 运输和加油飞机

- 旋翼机(直升机)

- 民用直升机

- 军用直升机

- 无人驾驶飞行器(UAV)/无人无人机

- 军用无人机

- 商用无人机(UAV)

- 其他的

第八章 依最终用途产业分類的市场规模及预测(2022-2035年)

- 商业航空

- 军事/国防

- 太空/卫星

- 其他的

第九章 2022-2035年各地区市场规模及预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第十章:公司简介

- 3M

- Chemetall

- Cytec Industries

- Dow Corning

- Flamemaster

- Henkel

- Master Bond

- Permatex

- PPG Industries

- Royal Adhesives &Sealants

The Global Aerospace Sealants Market was valued at USD 675 million in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 1.1 billion by 2035.

Market growth is driven by the increasing performance demands placed on aircraft operating across extreme temperature environments. Aerospace sealants must maintain adhesion, elasticity, and chemical resistance while withstanding repeated thermal cycling, ranging from high heat exposure in engine zones to subzero conditions at cruising altitudes. This requirement is accelerating the shift toward advanced chemistries delivering long-term durability, fuel resistance, and mechanical stability. Weight reduction targets set by aircraft manufacturers are also influencing material selection, with sealant formulations increasingly optimized for lower density, improved spreadability, and reduced application thickness. Even modest weight savings achieved through sealant optimization can generate measurable fuel efficiency gains over extended service periods. In parallel, tightening environmental regulations focused on emissions and material safety are pushing manufacturers toward low-VOC, high-solids, and solvent-free solutions. The market is also benefiting from rising maintenance activity, as operators seek sealants that support faster curing, improved handling, and safer working conditions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $675 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.7% |

The polysulfide sealants segment accounted for 42.2% share in 2025. This segment continues to lead due to its proven resistance to fuels and hydraulic fluids, combined with its ability to retain performance after prolonged exposure to temperature fluctuations and operational stress. These properties make polysulfide formulations a preferred choice across demanding aerospace sealing applications.

The fuel system sealing segment held 34% share in 2025. This category includes sealing requirements across fuel containment and transfer components, where long-term chemical stability and property retention under thermal and immersion conditions remain critical performance criteria. The continued reliance on established sealing chemistries reflects the stringent qualification standards applied to fuel-related aerospace components.

North America Aerospace Sealants Market accounted for 38% share in 2025. The region maintains its leading position due to strong aircraft manufacturing activity, a large installed commercial and defense fleet, and a well-developed maintenance and overhaul ecosystem. Ongoing fleet expansion continues to support recurring demand for high-performance sealants across both production and aftermarket applications.

Key companies active in the Global Aerospace Sealants Market include Henkel, PPG Industries, 3M, Dow Corning, Flamemaster, Chemetall, Cytec Industries, Royal Adhesives & Sealants, Master Bond, and Permatex. Companies operating in the Global Aerospace Sealants Market are strengthening their competitive position through sustained investment in material innovation and regulatory compliance. Manufacturers are focusing on developing advanced formulations that meet evolving thermal, chemical, and mechanical performance requirements while aligning with stricter environmental standards. Portfolio optimization is a key strategy, with companies refining product lines to balance performance reliability and sustainability. Strategic collaboration with aircraft manufacturers and maintenance providers is supporting early adoption and long-term supply relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chemistry type

- 2.2.2 Application

- 2.2.3 Aircraft type

- 2.2.4 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Chemistry Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Polysulfide sealants

- 5.2.1 Cured polysulfide

- 5.2.2 Non-cured (uncured) polysulfide

- 5.3 Silicone sealants

- 5.3.1 RTV silicone (non-corrosive)

- 5.3.2 Low-outgassing silicone

- 5.3.3 High-temperature silicone

- 5.4 Fluorosilicone sealants

- 5.5 Polyurethane sealants

- 5.5.1 Polyether polyurethane

- 5.5.2 Polyester polyurethane

- 5.6 Polyacrylate sealants

- 5.7 Epoxy sealants

- 5.8 Others

Chapter 6 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Fuel system sealing

- 6.2.1 Integral fuel tank sealing

- 6.2.2 Fuel line & fitting sealing

- 6.3 Airframe structural sealing

- 6.4 Fuselage sealing

- 6.5 Aircraft windshield & canopy sealing

- 6.6 Flight line repair & field maintenance

- 6.7 Engine & propulsion system sealing

- 6.8 Hydraulic & pneumatic system sealing

- 6.9 Avionics & electrical system sealing

- 6.10 Environmental control system (ECS) sealing

- 6.11 Antenna & radome sealing

- 6.12 Corrosion protection & faying surface sealing

- 6.13 Others

Chapter 7 Market Size and Forecast, By Aircraft Type, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial aircraft

- 7.2.1 Narrow-body aircraft

- 7.2.2 Wide-body aircraft

- 7.3 Regional aircraft

- 7.4 Business & general aviation

- 7.5 Military aircraft

- 7.5.1 Fighter & combat aircraft

- 7.5.2 Transport & tanker aircraft

- 7.6 Rotorcraft (helicopters)

- 7.6.1 Civil helicopters

- 7.6.2 Military helicopters

- 7.7 Unmanned aerial vehicles (UAVs) / drones

- 7.7.1 Military UAVs

- 7.7.2 Commercial UAVs

- 7.8 Others

Chapter 8 Market Size and Forecast, By End Use Industry , 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial aviation

- 8.3 Military & defense

- 8.4 Space & satellite

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Chemetall

- 10.3 Cytec Industries

- 10.4 Dow Corning

- 10.5 Flamemaster

- 10.6 Henkel

- 10.7 Master Bond

- 10.8 Permatex

- 10.9 PPG Industries

- 10.10 Royal Adhesives & Sealants