|

市场调查报告书

商品编码

1913320

无人交通管理市场机会、成长要素、产业趋势分析及2026年至2035年预测Unmanned Traffic Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

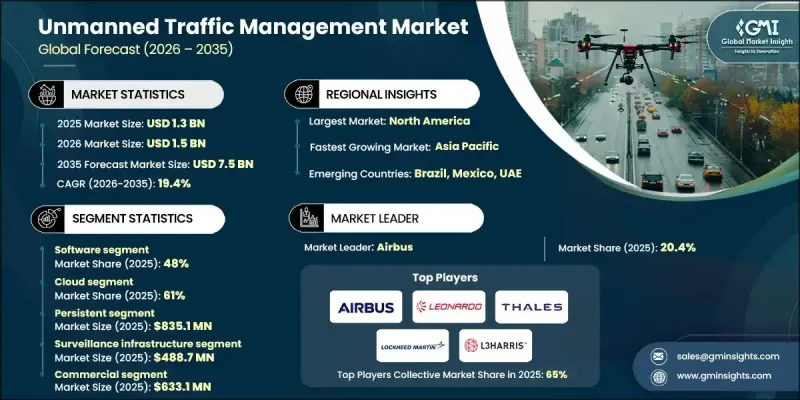

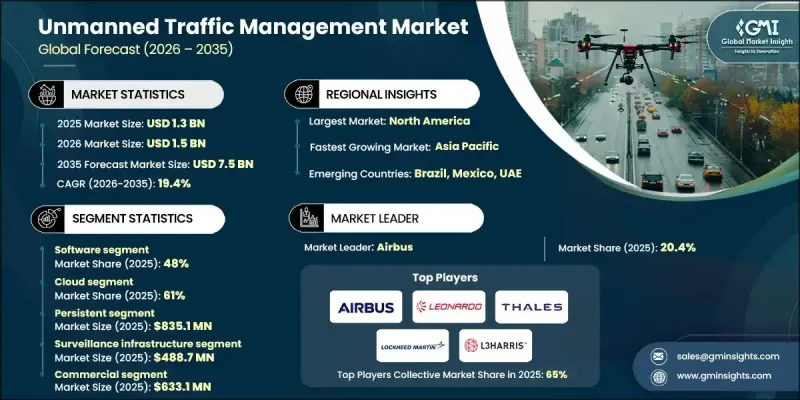

全球无人交通管理市场预计到 2025 年将达到 13 亿美元,到 2035 年将达到 75 亿美元,年复合成长率为 19.4%。

市场成长主要受商业和政府无人机营运的快速成长、对安全低空空域管理日益增长的需求以及无人机交通监管框架不断演进的推动。随着各组织和机构致力于将无人机(UAV)安全地融入共用空域,先进的无人机交通管理(UTM)解决方案对于及时、安全且可追踪的无人机运作至关重要。此外,对提升无人机监控、飞行规划和营运效率的技术投入不断增加,也促进了市场扩张。各行业的相关人员都在优先考虑端到端、数据驱动的系统,这些系统能够提供即时情境察觉、减少空域衝突,并支援扩充性的长期空中交通管理策略。这些进步已使UTM解决方案成为全球安全高效无人机运作的关键基础技术。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 13亿美元 |

| 预测金额 | 75亿美元 |

| 复合年增长率 | 19.4% |

人工智慧和机器学习飞行路径优化、物联网即时追踪、GPS和ADS-B监控、基于云端的无人机交通管理平台以及自动化无人机协调系统等技术创新正在变革传统的空域管理。这些工具能够全面掌控无人机运行,从任务规划和即时监控到碰撞侦测和合规性,无所不包。整合数位平台、自动化和分析技术的进步正在提高效率、降低风险并增强运行安全性,从而推动市场成长。

软体领域占了48%的市场份额,预计到2035年将以20.1%的复合年增长率成长。软体的主导地位源自于其在无人机即时追踪、空域监控、飞行路径优化和综合交通管理方面的核心作用。基于云端的无人机交通管理(UTM)平台、人工智慧驱动的分析、物联网监控和行动应用,能够帮助营运商、监管机构和商业用户有效地协调无人机运作、维护空域安全并优化效能。

预计到2025年,云端解决方案将占据61%的市场份额,并在2035年之前以18.8%的复合年增长率成长。扩充性、即时数据存取和低实施成本正在推动云端解决方案的主流化应用,使营运商和监管机构能够监控无人机交通、优化飞行路径、检测潜在衝突并管理跨多个区域的空域。其柔软性和整合能力使云端平台成为大规模无人机作业的理想选择。

预计到2025年,美国无人机交通管理市场将占据78%的份额,市场规模将达到3.671亿美元。北美凭藉着成熟的无人机生态系统、先进的空域基础设施以及对数位化空中交通管理技术的早期应用,在全球市场中占据领先地位。该地区受益于云端平台、人工智慧分析、物联网追踪和即时监控的广泛应用。

全球无人机交通管理市场的主要企业包括 Leonardo、L3Harris、洛克希德·马丁、空中巴士、Altitude Angel、PrecisionHawk、Frequentiss、泰雷兹和 Unifly。这些公司正透过大力投资软体和云端解决方案来增强其市场地位,这些解决方案能够提升即时空域监控和自动衝突解决能力。他们正与无人机运营商、监管机构和技术提供商建立战略伙伴关係,以建立端到端的无人机管理整合平台。人工智慧、机器学习和物联网系统的持续研发正在帮助企业改善飞行路径优化、情境察觉和预测分析。此外,多家公司正在拓展其全球业务,以服务高成长地区,并提升扩充性、合规性和客户参与。专注于柔软性、互通性和数据驱动型解决方案将使企业能够建立长期竞争优势并占据更大的市场份额。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 商业无人机运作的快速扩张

- 监管要求和安全标准

- 技术进步

- 拓展城市空中运输(UAM)和超视距飞行(BVLOS)

- 产业潜在风险与挑战

- 分裂世界中的监管

- 前期成本高

- 市场机会

- 与智慧城市和物联网网路集成

- 拓展新兴市场

- 政府和国防部门引入无人机

- 进阶分析和人工智慧驱动的优化

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 美国航空管理局(FAA)远端识别法规

- 美国国家空域系统(NAS)指南

- 欧洲

- 德国联邦交通运输数位化部 (BMVI) 和德国联邦航空局 (DFS) 的规定

- 法国民航总局 (DGAC) 和国家税务局 (ANAF) 指南

- 英国民航局(CAA)和无人机系统(UAS)条例

- 义大利ENAC指南

- 亚太地区

- 中国民用航空局(CAAC)和无人机系统(UAS)规章

- 日本民航局无人机指南

- 韩国国土交通部(MOLIT)与无人机法规

- 印度民航局无人机法规与唯一识别码系统

- 拉丁美洲

- 巴西ANAC和DECEA指南

- 墨西哥民航局无人机法规

- 中东和非洲

- 阿联酋民航总局无人机法规

- 沙乌地阿拉伯民航局无人机指南

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 使用案例场景

- UTM系统结构和空域模型

- 集中式与分散式UTM架构

- 战术性和战略衝突消除

- 与载人空中交通管理系统集成

- 互通性和标准化框架

- UTM经营模式和获利模式

- 相关人员生态系统和管治模型

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 按组件分類的市场估算与预测,2022-2035年

- 软体

- 硬体

- 服务

第六章 按类型分類的市场估算与预测,2022-2035年

- 执着的

- 不可持续性

7. 2022-2035年各车型市场估计与预测

- 本地部署

- 云

第八章 按应用领域分類的市场估算与预测,2022-2035年

- 监控基础设施

- 通讯基础设施

- 导航支援基础设施

- 其他的

9. 依最终用途分類的市场估计与预测,2022-2035 年

- 商业的

- 政府

- 私人的

第十章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

第十一章:公司简介

- Global Player

- Airbus

- Altitude Angel

- Frequentis

- Honeywell International

- L3 Harris

- Leonardo

- Lockheed Martin

- PrecisionHawk

- Thales

- Unifly

- Regional Player

- AirMap

- Airspace Link

- ANRA Technologies

- Dedrone

- DroneDeploy

- Flytrex

- Kittyhawk

- SkyGrid

- Terra Drone

- uAvionix

- 新兴企业

- Airborne Robotics

- Drone Harmony

- Simulyze

- UAV Navigation

Volocopter UT

The Global Unmanned Traffic Management Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 19.4% to reach USD 7.5 billion by 2035.

Market growth is fueled by a rapid increase in commercial and governmental drone operations, heightened demand for safe low-altitude airspace management, and evolving regulatory frameworks governing drone traffic. As organizations and authorities focus on integrating unmanned aerial vehicles (UAVs) into shared airspace safely, advanced UTM solutions are becoming essential to enable timely, secure, and traceable drone operations. The market's expansion is also supported by rising investments in technology that enhance drone monitoring, flight planning, and operational efficiency. Stakeholders across industries are prioritizing end-to-end, data-driven systems that provide real-time situational awareness, reduce airspace conflicts, and support scalable, long-term air traffic management strategies. These developments position UTM solutions as critical enablers of safe and efficient UAV operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 19.4% |

Technological innovations, including AI- and ML-driven flight path optimization, IoT-enabled real-time tracking, GPS and ADS-B monitoring, cloud-based UTM platforms, and automated drone coordination systems, are transforming traditional airspace management. These tools provide full visibility and control over UAV operations, from mission planning and real-time monitoring to conflict detection and regulatory compliance. The market continues to evolve as integrated digital platforms, automation, and analytics improve efficiency, reduce risks, and enhance operational safety.

The software segment held 48% share and is projected to grow at a CAGR of 20.1% through 2035. Software dominates due to its pivotal role in real-time drone tracking, airspace monitoring, flight path optimization, and comprehensive traffic management. Cloud-based UTM platforms, AI-powered analytics, IoT monitoring, and mobile-enabled applications help operators, regulators, and commercial users coordinate UAV operations efficiently, maintain airspace safety, and optimize performance.

The cloud segment accounted for 61% share in 2025 and is expected to grow at a CAGR of 18.8% through 2035. Cloud solutions dominate because of their scalability, real-time data access, and lower deployment costs. They enable operators and regulators to monitor drone traffic, optimize flight paths, detect potential conflicts, and manage airspace across multiple regions. Their flexibility and integration capabilities make cloud platforms ideal for large-scale UAV operations.

U.S. Unmanned Traffic Management Market held 78% share, generating USD 367.1 million in 2025. North America leads the global market due to its mature drone ecosystem, advanced airspace infrastructure, and early adoption of digital air traffic management technologies. The region benefits from widespread deployment of cloud-based platforms, AI-powered analytics, IoT-enabled tracking, and real-time monitoring.

Key players in the Global Unmanned Traffic Management Market include Leonardo, L3Harris, Lockheed Martin, Airbus, Altitude Angel, PrecisionHawk, Frequentis, Thales, and Unifly. Companies in the Global Unmanned Traffic Management Market are strengthening their presence by investing heavily in software and cloud-based solutions that enhance real-time airspace monitoring and automated conflict resolution. They are forming strategic partnerships with drone operators, regulators, and technology providers to create integrated platforms for end-to-end UAV management. Continuous R&D in AI, machine learning, and IoT-enabled systems is helping firms improve flight path optimization, situational awareness, and predictive analytics. Several companies are also expanding globally to serve high-growth regions, enhancing scalability, regulatory compliance, and customer engagement. Focusing on flexible, interoperable, and data-driven solutions enables firms to build long-term competitive advantages and capture larger market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 Deployment Model

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Growth of Commercial Drone Operations

- 3.2.1.2 Regulatory Mandates & Safety Requirements

- 3.2.1.3 Technological Advancements

- 3.2.1.4 Urban Air Mobility & BVLOS Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented Global Regulations

- 3.2.2.2 High Initial Costs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with Smart Cities & IoT Networks

- 3.2.3.2 Expansion into Emerging Markets

- 3.2.3.3 Government and Defense UAV Adoption

- 3.2.3.4 Advanced Analytics and AI-Driven Optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. FAA Remote ID Rules

- 3.4.1.2 U.S. National Airspace System (NAS) Guidelines

- 3.4.2 Europe

- 3.4.2.1 Germany BMVI & DFS Regulations

- 3.4.2.2 France DGAC & ANAF Guidelines

- 3.4.2.3 United Kingdom CAA & UAS Regulations

- 3.4.2.4 Italy ENAC Guidelines

- 3.4.3 Asia Pacific

- 3.4.3.1 China CAAC & UAS Regulations

- 3.4.3.2 Japan JCAB Drone Guidelines

- 3.4.3.3 South Korea MOLIT & Drone Regulations

- 3.4.3.4 India DGCA Drone Rules & UIN System

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANAC & DECEA Guidelines

- 3.4.4.2 Mexico DGAC UAV Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE GCAA Drone Regulations

- 3.4.5.2 Saudi Arabia GACA Drone Guidelines

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 UTM system architecture & airspace models

- 3.13.1 Centralized vs federated UTM architectures

- 3.13.2 Tactical vs strategic deconfliction

- 3.13.3 Integration with manned ATM systems

- 3.14 Interoperability & standards framework

- 3.15 UTM business & monetization models

- 3.16 Stakeholder ecosystem & governance model

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Hardware

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Persistent

- 6.3 Non-persistent

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 On premises

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Surveillance infrastructure

- 8.3 Communication infrastructure

- 8.4 Navigation infrastructure

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 Commercial

- 9.3 Government

- 9.4 Private

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Airbus

- 11.1.2 Altitude Angel

- 11.1.3 Frequentis

- 11.1.4 Honeywell International

- 11.1.5. L3 Harris

- 11.1.6 Leonardo

- 11.1.7 Lockheed Martin

- 11.1.8 PrecisionHawk

- 11.1.9 Thales

- 11.1.10 Unifly

- 11.2 Regional Player

- 11.2.1 AirMap

- 11.2.2 Airspace Link

- 11.2.3 ANRA Technologies

- 11.2.4 Dedrone

- 11.2.5 DroneDeploy

- 11.2.6 Flytrex

- 11.2.7 Kittyhawk

- 11.2.8 SkyGrid

- 11.2.9 Terra Drone

- 11.2.10 uAvionix

- 11.3 Emerging Players

- 11.3.1 Airborne Robotics

- 11.3.2 Drone Harmony

- 11.3.3 Simulyze

- 11.3.4 UAV Navigation

Volocopter UT