|

市场调查报告书

商品编码

1913324

不织布滤材市场机会、成长要素、产业趋势分析及2026年至2035年预测Nonwoven Filter Media Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

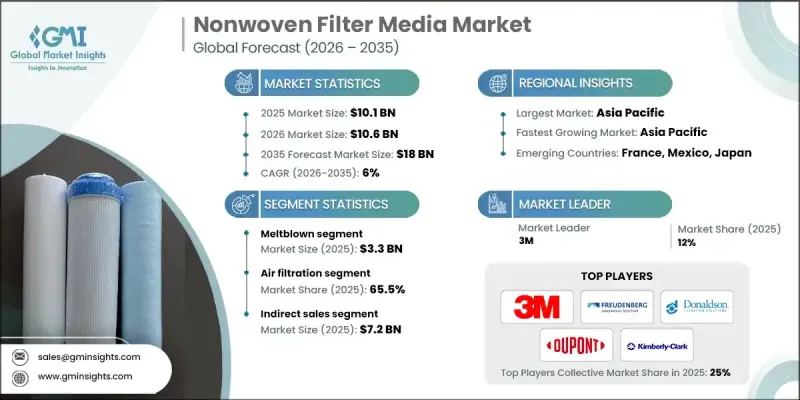

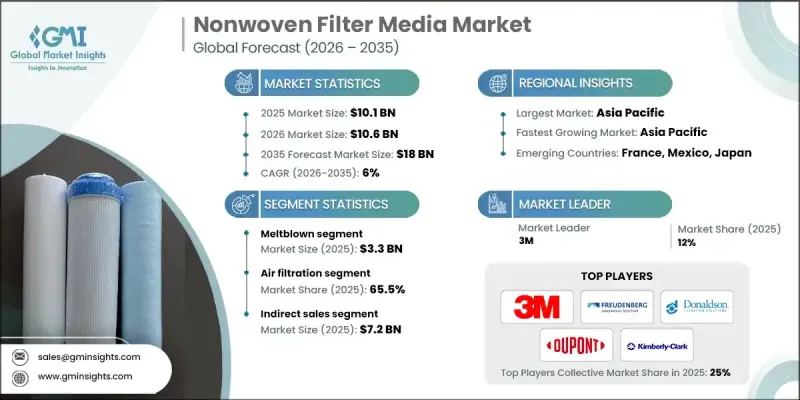

全球不织布滤材市场预计到 2025 年将达到 101 亿美元,到 2035 年将达到 180 亿美元,年复合成长率为 6%。

市场成长的驱动因素包括加速的城市发展、交通和工业活动排放的增加,以及人口密集地区空气品质问题日益严峻。人们对空气污染物日益增长的关注促使政府、机构和私人企业加大对建筑环境和工业系统高性能过滤技术的投资。同时,消费者对室内环境日益增长的关注也推动了住宅和商业建筑对高性能过滤解决方案的需求。这些因素共同促使製造商开发效率更高、使用寿命更长、且针对特定应用场景的不织布滤材。环境保护和职业安全方面的监管压力也进一步推动了此类产品的普及。工业领域对污染控制和合规性的重视程度日益提高,从而对可靠且扩充性的过滤材料产生了稳定的需求。材料科学和纺织工程的不断进步使得不织布滤材在空气和液体过滤系统中得到广泛应用,从而支撑了预测期内市场的持续成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 起始值 | 101亿美元 |

| 预测金额 | 180亿美元 |

| 复合年增长率 | 6% |

对品质和安全标准要求严格的行业越来越依赖先进的过滤结构来满足监管要求并确保产品完整性。多层过滤结构用于解决颗粒物、沉积物和微生物控制等复杂的过滤需求,从而满足市政和工业处理系统的稳定需求。

预计2025年,熔喷材料市场规模将达33亿美元。由于其能够形成具有高比表面积的超细纤维结构,熔喷材料在不织布滤材市场中占据关键地位。这些特性使其在需要精确颗粒捕获和气流平衡的应用中,能够实现高过滤效率和稳定的性能。

预计到2025年,空气过滤领域将占据65.5%的市场。不织布滤材在维持住宅、商业和工业环境中的室内空气品质方面发挥核心作用。其低空气阻力和高颗粒物捕获效率有助于实现节能目标,同时符合不断变化的环境和安全法规。

美国不织布滤材市场预计到2025年将达到22亿美元,占72.3%的市占率。美国市场的强劲势头得益于健全的法规结构、持续的基础设施建设以及医疗、工业和环保领域持续增长的需求。对先进纤维技术和永续材料的持续投资正在巩固其长期成长。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 对空气和水过滤的需求不断增长

- 消费品中过滤应用日益增多

- 水资源短缺及对更好水处理的需求

- 产业潜在风险与挑战

- 原料成本波动

- 恶劣环境下的效能限制

- 机会

- 永续性和生物基不织布

- 智慧过滤器和功能涂层

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 粗梳

- 湿法成网

- 熔喷

- 纺粘

- 气流成网

- 其他(针刺等)

6. 2022-2035年过滤介质市场估算与预测

- 空气过滤

- 液体过滤

7. 依最终用途分類的市场估计与预测,2022-2035 年

- 商业的

- 工业的

- HVAC

- 运输

- 水处理

- 食品/饮料

- 製造业

- 其他(医疗等)

第八章 按分销管道分類的市场估算与预测,2022-2035年

- 直销

- 间接销售

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十章:公司简介

- 3M

- Ahlstrom

- Americo

- Avintiv

- Camfil Group

- Donaldson

- DuPont

- Freudenberg Group

- Gessner

- Glatfelter

- Johns Manville

- Kimberly-Clark

- Mann+Hummel

- Mogul

- Sandler Group

The Global Nonwoven Filter Media Market was valued at USD 10.1 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 18 billion by 2035.

Market expansion is driven by accelerating urban development, rising emissions from transportation and industrial activity, and increasing concerns related to air quality across populated regions. Growing awareness of airborne pollutants has encouraged governments, institutions, and private organizations to invest in advanced filtration technologies across built environments and industrial systems. At the same time, heightened consumer focus on indoor environmental conditions is supporting demand for high-performance filtration solutions used in residential and commercial settings. These combined factors are pushing manufacturers to develop nonwoven filter media that deliver higher efficiency, longer service life, and application-specific performance. Regulatory pressure surrounding environmental protection and occupational safety is further reinforcing adoption. Industries are increasingly prioritizing contamination control and compliance, which is driving steady demand for reliable and scalable filtration media. Continuous improvements in material science and fiber engineering are enabling broader deployment of nonwoven filter media across air and liquid filtration systems, supporting sustained market growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $10.1 Billion |

| Forecast Value | $18 Billion |

| CAGR | 6% |

Industries with strict quality and safety standards are increasingly relying on advanced filtration structures to meet regulatory requirements and ensure product integrity. Multi-layer filtration architectures are being adopted to address complex filtration needs related to particulates, sediments, and microbial control, supporting stable demand across municipal and industrial treatment systems.

The meltblown segment generated USD 3.3 billion in 2025. This segment is described as a critical category within the nonwoven filter media market due to its ability to deliver ultra-fine fiber structures with high surface area. These characteristics enable high filtration efficiency and consistent performance in applications that require precise particle retention and airflow balance.

The air filtration segment accounted for 65.5% share in 2025. Nonwoven filter media play a central role in maintaining indoor air quality across residential, commercial, and industrial environments. Their low airflow resistance and high particle capture efficiency support energy efficiency goals while aligning with evolving environmental and safety regulations.

United States Nonwoven Filter Media Market held 72.3% share and generated USD 2.2 billion in 2025. Market strength in the country is supported by strong regulatory frameworks, ongoing infrastructure upgrades, and sustained demand across healthcare, industrial, and environmental applications. Continued investment in advanced fiber technologies and sustainable materials is reinforcing long-term growth.

Key companies operating in the Global Nonwoven Filter Media Market include DuPont, 3M, Freudenberg Group, Mann+Hummel, Ahlstrom, Donaldson, Kimberly-Clark, Johns Manville, Camfil Group, Glatfelter, Sandler Group, Gessner, Avintiv, Americo, and Mogul. Companies in the Global Nonwoven Filter Media Market are strengthening their competitive position by investing in advanced material development and high-efficiency fiber technologies. Many manufacturers are focusing on lightweight, durable, and sustainable nonwoven structures to meet evolving regulatory and performance standards. Strategic expansion of production capacity and regional manufacturing footprints is helping firms improve supply reliability and reduce lead times. Partnerships with system integrators and end-use industries are supporting customized product development. Continuous research into environmentally responsible materials and recyclable solutions is gaining priority. Companies are also enhancing quality control and certification capabilities to meet strict compliance requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filtration media

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for air and water filtration

- 3.2.1.2 Increase in filtration applications in consumer goods

- 3.2.1.3 Water scarcity & need for better water treatment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Performance limitations under extreme conditions

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability & bio-based nonwovens

- 3.2.3.2 Smart filters & functional coatings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Square Meters)

- 5.1 Key trends

- 5.2 Carded

- 5.3 Wetlaid

- 5.4 Meltblown

- 5.5 Spunbonded

- 5.6 Airlaid

- 5.7 Others (needlepunch etc.)

Chapter 6 Market Estimates and Forecast, By Filtration Media, 2022 - 2035 (USD Billion) (Million Square Meters)

- 6.1 Key trends

- 6.2 Air filtration

- 6.3 Liquid filtration

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion) (Million Square Meters)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 HVAC

- 7.5 Transportation

- 7.6 Water Filtration

- 7.7 Food & Beverages

- 7.8 Manufacturing

- 7.9 Others (healthcare etc.)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Square Meters)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Square Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Ahlstrom

- 10.3 Americo

- 10.4 Avintiv

- 10.5 Camfil Group

- 10.6 Donaldson

- 10.7 DuPont

- 10.8 Freudenberg Group

- 10.9 Gessner

- 10.10 Glatfelter

- 10.11 Johns Manville

- 10.12 Kimberly-Clark

- 10.13 Mann+Hummel

- 10.14 Mogul

- 10.15 Sandler Group