|

市场调查报告书

商品编码

1913344

钨市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Tungsten Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

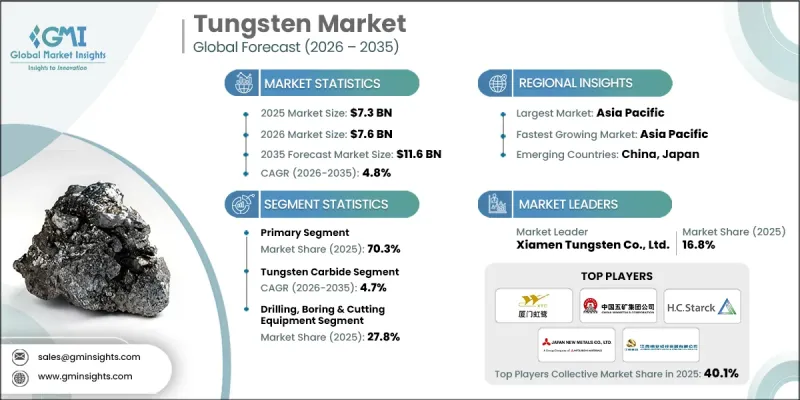

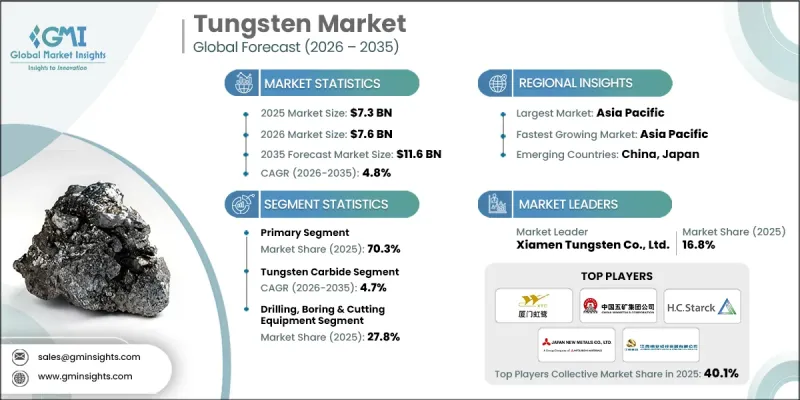

预计到 2025 年,全球钨市场价值将达到 73 亿美元,到 2035 年将达到 116 亿美元,年复合成长率为 4.8%。

在成本效益、监管压力和长期材料安全需求的驱动下,随着循环经济实践在整个供应链中的实施,市场正在经历结构性变革。回收技术的进步使再生钨能够达到与原生钨相同的化学纯度、晶体结构和性能稳定性,从而使回收变得越来越重要。与传统的采矿和提炼製程相比,现代热回收和化学回收製程在实现高回收率的同时,显着降低了能源消耗和排放。这些改进增强了再生钨的经济合理性,尤其是在能源价格和碳排放成本较高的地区。同时,原生资源的地缘政治集中度持续影响市场趋势,推动多元化和对替代采购途径的投资。先进製造业、工业工具和高性能材料应用领域不断增长的需求持续支撑着市场的稳步扩张,而以永续性发展为导向的采购政策进一步增强了全球终端用户产业的长期成长潜力。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 73亿美元 |

| 预测金额 | 116亿美元 |

| 复合年增长率 | 4.8% |

到2025年,原生钨产业市占率将达到70.3%,主要得益于黑钨矿和白钨矿的开采和精矿生产。目前,钨的生产仍高度集中于特定地区,造成了供应风险。因此,各国推出了旨在透过贸易措施和供应链多元化倡议来降低对单一供应区域依赖的政策。

预计到 2025 年,碳化钨市场份额将达到 60%,到 2035 年将以 4.7% 的复合年增长率成长。其优势体现在其无与伦比的硬度、结构稳定性和对恶劣工作条件的耐受性,使其成为需要高耐磨性和高精度的工业应用的重要材料。

预计到2025年,美国钨市场规模将达到12亿美元,到2035年将达30亿美元。北美地区到2025年将占18.9%的市场份额,该地区下游加工能力强,但对进口原料的依赖程度较高。旨在增强国内能力和降低外部依赖性的政策措施将继续影响区域市场动态。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依原产国分類的市场估计与预测,2022-2035年

- 基本的

- 次要

第六章 2022-2035年按产品分類的市场估算与预测

- 六氟化钨

- 碳化钨

- 金属合金

- 轧延产品

- 其他的

- 电气和电子设备

- 其他(催化剂、化学品、国防设备等)

7. 依最终用途分類的市场估计与预测,2022-2035 年

- 汽车零件

- 航太零件

- 钻孔、钻孔设备

- 伐木设备

- 电气和电子设备

- 半导体

- 其他(催化剂、化学品、国防设备等)

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- Chongyi ZhangYuan Tungsten Co., Ltd

- Kennametal Inc.

- Sumitomo Electric Industries, Ltd

- China Minmetals Corporation

- Global Tungsten &Powders

- HC Starck Tungsten GmbH

- Japan New Metals Co., Ltd

- Soloro SLU

- WOLFRAM Company JSC

- Buffalo Tungsten Inc.

- Elmet Technologies

- Betek GmbH &Co. KG

- Accumet Materials Co.

- Xiamen Tungsten Co., Ltd

- Cleveland Tungsten, Inc.

The Global Tungsten Market was valued at USD 7.3 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 11.6 billion by 2035.

The market is undergoing a structural shift as circular economy practices become increasingly embedded across supply chains, driven by cost efficiency, regulatory pressure, and the need for long-term material security. Recycling is gaining strategic importance as recovery technologies now allow secondary tungsten to achieve the same chemical purity, crystalline structure, and performance consistency as primary material. Modern thermal and chemical recycling processes enable high recovery yields while significantly lowering energy use and emissions compared to conventional mining and refining. These improvements strengthen the economic rationale for recycled tungsten, particularly in regions facing high energy prices or carbon-related costs. At the same time, geopolitical concentration of primary resources continues to influence market behavior, encouraging diversification and investment in alternative sourcing routes. Growing demand from advanced manufacturing, industrial tooling, and high-performance materials applications continues to underpin steady market expansion, while sustainability-driven procurement policies further reinforce long-term growth potential across global end-use industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.3 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.8% |

The primary tungsten segment accounted for 70.3% share in 2025, supported by mining and concentrate production derived mainly from wolframite and scheelite ores. Production remains highly concentrated geographically, creating supply risk and driving policy actions aimed at reducing dependence on a single source region through trade measures and supply chain diversification initiatives.

The tungsten carbide segment held 60% share in 2025 and is projected to grow at a CAGR of 4.7% through 2035. Its dominance reflects unmatched hardness, structural stability, and resistance to extreme operating conditions, making it indispensable for high-wear and precision-critical industrial applications.

U.S. Tungsten Market was valued at USD 1.2 billion in 2025 and is forecast to reach USD 3 billion by 2035. North America held 18.9% share in 2025, with the region characterized by strong downstream processing capacity and heavy reliance on imported raw materials. Policy measures aimed at strengthening domestic capabilities and reducing external dependence continue to influence regional market dynamics.

Key participants in the Global Tungsten Market include Kennametal Inc., Xiamen Tungsten Co., Ltd., H.C. Starck Tungsten GmbH, China Minmetals Corporation, Global Tungsten & Powders, Sumitomo Electric Industries, Ltd., Buffalo Tungsten Inc., Elmet Technologies, Japan New Metals Co., Ltd., Chongyi ZhangYuan Tungsten Co., Ltd., Betek GmbH & Co. KG, Soloro S.L.U, Accumet Materials Co., WOLFRAM Company JSC, and Cleveland Tungsten, Inc. Companies operating in the Global Tungsten Market are strengthening their competitive position through a combination of vertical integration, recycling investments, and technology-driven process optimization. Many players are expanding secondary material recovery capabilities to improve supply security and reduce exposure to raw material volatility. Strategic partnerships with industrial end users support customized product development and long-term contracts. Firms are also prioritizing geographic diversification of sourcing and processing assets to mitigate geopolitical risks. Continuous investment in high-purity powders and advanced carbide solutions enables differentiation in premium applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Origin

- 2.2.3 Product

- 2.2.4 End-use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Origin, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Primary

- 5.3 Secondary

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Tungsten Hexafluoride

- 6.3 Tungsten carbide

- 6.4 Metal alloys

- 6.5 Mill Products

- 6.6 Others

- 6.6.1 Electrical & electronics appliances

- 6.6.2 Others (catalyst, chemical, defense equipment, etc.)

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Automotive parts

- 7.3 Aerospace components

- 7.4 Drilling, boring & cutting equipment

- 7.5 Logging equipment

- 7.6 Electrical & electronic appliances

- 7.7 Semiconductor

- 7.8 Others (catalyst, chemical, defense equipment, etc.)

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Chongyi ZhangYuan Tungsten Co., Ltd

- 9.2 Kennametal Inc.

- 9.3 Sumitomo Electric Industries, Ltd

- 9.4 China Minmetals Corporation

- 9.5 Global Tungsten & Powders

- 9.6 H.C. Starck Tungsten GmbH

- 9.7 Japan New Metals Co., Ltd

- 9.8 Soloro S.L.U

- 9.9 WOLFRAM Company JSC

- 9.10 Buffalo Tungsten Inc.

- 9.11 Elmet Technologies

- 9.12 Betek GmbH & Co. KG

- 9.13 Accumet Materials Co.

- 9.14 Xiamen Tungsten Co., Ltd

- 9.15 Cleveland Tungsten, Inc.