|

市场调查报告书

商品编码

1913349

数位变电站市场机会、成长要素、产业趋势分析及2026年至2035年预测Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

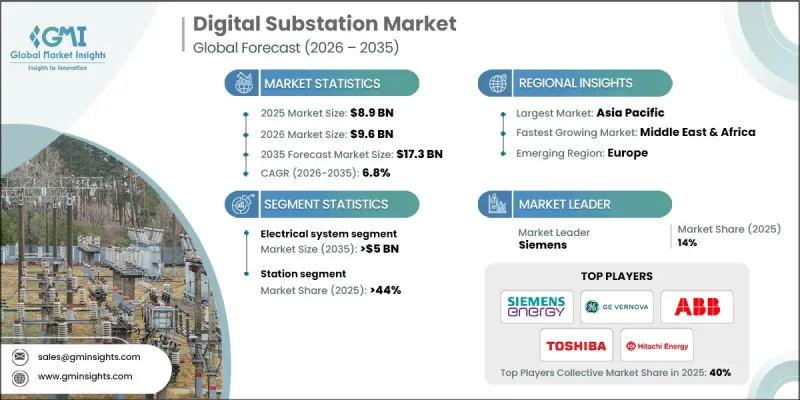

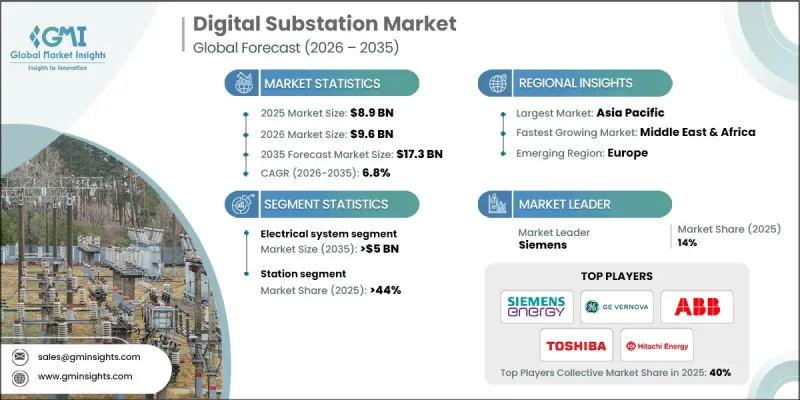

全球数位变电站市场预计到 2025 年将达到 89 亿美元,到 2035 年将达到 173 亿美元,年复合成长率为 6.8%。

随着电力公司和工业营运商将先进、可靠和智慧化的电网基础设施列为优先事项,市场正在稳步扩张。数位化变电站透过实现持续资料视觉化、自动化控制和基于状态的维护,加速了传统变电站的替换和现代化改造。这项转型不仅满足了不断增长的电力消耗量,还有助于提高电网稳定性和运作效率。数位化变电站利用标准化的通讯架构、高速资料传输和互联设备,提高了互通性,并显着减少了实体布线需求。即时分析、数位建模和网路安全框架的整合增强了系统韧性,降低了停电风险。数位化变电站对于管理分散式发电和复杂的能量流至关重要,在智慧电网开发投资不断增长的推动下,其应用正在加速普及。发展中地区的快速城市扩张和工业成长进一步推动了大规模电网升级和输电网路扩建。这些因素共同造就了全球公共产业、可再生能源併网计划和能源密集型产业对数位化变电站的强劲长期需求。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 89亿美元 |

| 预测金额 | 173亿美元 |

| 复合年增长率 | 6.8% |

预计到2035年,电气系统市场规模将达到50亿美元。该市场涵盖变电站的基础硬件,包括变压器、断路器和高压组件。在数位化环境下,这些设备配备了先进的感测和讯号转换技术,能够实现精确测量、快速保护响应以及与智慧控制系统的无缝通信,从而提升变电站的整体性能。

变电站部分在2025年占据了44.8%的市场份额,预计到2035年将以6%的复合年增长率成长。该部分构成了数位化变电站的架构基础,其中一次设备直接与智慧电子设备连接。透过将实体讯号转换数位资料流,它能够实现连续监测、快速故障检测和更高的运行透明度。

预计到 2035 年,美国数位变电站市场规模将达到 15 亿美元。该国市场成长的驱动力包括对电网现代化持续投资、不断增长的电力需求,以及注重升级老化的输配电基础设施以提高可靠性和效率。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 原料的供应情况;

- 影响价值链的因素

- 中断

- 监管环境

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 成长潜力分析

- 波特五力分析

- PESTEL 分析

- 新的机会与趋势

- 投资分析及未来展望

第四章 竞争情势

- 介绍

- 我们按地区分類的市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争标竿分析图示

- 战略仪錶板

- 创新与科技趋势

第五章 依组件分類的市场规模及预测(2022-2035年)

- 数位变电站自动化系统

- 通讯网路

- 电气系统

- 变压器

- 公车线路

- 保护装置

- 断路器

- 保护继电器

- 开关设备

- 监控系统

- 人机介面

- 可程式逻辑控制器

- 其他的

- 其他的

第六章 依建筑类型分類的市场规模及预测(2022-2035年)

- 流程

- 湾

- 车站

第七章 依应用领域分類的市场规模及预测(2022-2035年)

- 动力传输

- 配电

第八章 依连结方式分類的市场规模及预测(2022-2035年)

- 33千伏或以下

- 电压范围:33千伏特以上至110千伏以下

- 电压范围:110千伏特以上至220千伏以下

- 电压范围:220千伏特以上至550千伏以下

- 超过550千伏

第九章 依电压等级分類的市场规模及预测(2022-2035年)

- 低电压

- 中压

- 高的

第十章 依最终用途分類的市场规模及预测(2022-2035年)

- 公共产业

- 工业的

第十一章 依设备分類的市场规模及预测(2022-2035年)

- 新的

- 再生产品

第十二章 2022-2035年各地区市场规模及预测

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十三章:公司简介

- ABB

- Belden Inc

- Bharat Heavy Electricals Limited

- Cisco Systems

- Eaton

- GE Vernova

- NovaTech.

- OMICRON

- Ponovo Power

- Redeia

- Schneider Electric

- Siemens Energy

- Toshiba Energy Systems &Solutions

- WEG

The Global Digital Substation Market was valued at USD 8.9 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 17.3 billion by 2035.

The market is expanding steadily as power utilities and industrial operators prioritize advanced, reliable, and intelligent grid infrastructure. Digital substations are increasingly replacing or modernizing conventional substations by enabling continuous data visibility, automated control, and condition-based maintenance. This shift supports rising electricity consumption while improving grid stability and operational efficiency. Digital substations rely on standardized communication architectures, high-speed data transmission, and connected devices to enhance interoperability and significantly reduce physical cabling requirements. The integration of real-time analytics, digital modeling, and cybersecurity frameworks strengthens system resilience and reduces outage risks. Growing investments in smart grid development continue to accelerate adoption, as digital substations are critical for managing decentralized power generation and complex energy flows. Rapid urban expansion and industrial growth in developing regions are further driving large-scale grid upgrades and transmission network expansion. Collectively, these factors are creating strong long-term demand for digital substations across utilities, renewable integration projects, and energy-intensive industries worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.9 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 6.8% |

The electrical system segment is expected to reach USD 5 billion by 2035. This segment represents the fundamental hardware of substations, including transformers, breakers, and high-voltage assemblies. In digital environments, these assets are equipped with advanced sensing and signal conversion technologies that enable precise measurement, faster protection response, and seamless communication with intelligent control systems, improving overall substation performance.

The station segment accounted for 44.8% share in 2025 and is forecast to grow at a CAGR of 6% through 2035. This segment forms the structural backbone of digital substations, where primary equipment interfaces directly with intelligent electronic devices. By converting physical signals into digital data streams, this layer enables continuous monitoring, faster fault detection, and improved operational transparency.

U.S. Digital Substation Market is expected to reach USD 1.5 billion by 2035. Market growth in the country is supported by sustained investments in grid modernization, rising power demand, and a strong focus on upgrading aging transmission and distribution infrastructure to improve reliability and efficiency.

Key participants operating in the Global Digital Substation Market include Siemens Energy, ABB, Schneider Electric, GE Vernova, Eaton Corporation, Toshiba Energy Systems & Solutions, Cisco Systems, WEG, Belden Inc, NovaTech, OMICRON, Ponovo Power, Bharat Heavy Electricals Limited, and Redeia. Companies active in the Global Digital Substation Market are strengthening their market presence through continuous technology innovation, strategic partnerships, and expanded service portfolios. Key strategies include investing in interoperable solutions that align with global communication standards and enhance compatibility across grid assets. Market players are focusing on integrated hardware and software offerings that combine protection, control, and monitoring capabilities within unified platforms. Expansion into emerging markets through localized manufacturing and engineering support is also a priority. Additionally, firms are emphasizing cybersecurity, lifecycle services, and predictive maintenance solutions to deliver long-term value to utilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Digital substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.4.1 Transformer

- 5.4.2 Busbar

- 5.4.3 Protection devices

- 5.4.3.1 Circuit breaker

- 5.4.3.2 Protective relay

- 5.4.3.3 Switchgear

- 5.5 Monitoring & control system

- 5.5.1 Human machine interface

- 5.5.2 Programmable logic controller

- 5.5.3 Others

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Transmission

- 7.3 Distribution

Chapter 8 Market Size and Forecast, By Connectivity, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 ≤ 33 kV

- 8.3 > 33 kV to ≤ 110 kV

- 8.4 > 110 kV to ≤ 220 kV

- 8.5 > 220 kV to ≤ 550 kV

- 8.6 > 550 kV

Chapter 9 Market Size and Forecast, By Voltage Level, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Utility

- 10.3 Industrial

Chapter 11 Market Size and Forecast, By Installation, 2022 - 2035 (USD Million, Units)

- 11.1 Key trends

- 11.2 New

- 11.3 Refurbished

Chapter 12 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 France

- 12.3.3 Germany

- 12.3.4 Italy

- 12.3.5 Russia

- 12.3.6 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Australia

- 12.4.3 India

- 12.4.4 Japan

- 12.4.5 South Korea

- 12.5 Middle East & Africa

- 12.5.1 Saudi Arabia

- 12.5.2 UAE

- 12.5.3 Turkey

- 12.5.4 South Africa

- 12.5.5 Egypt

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 Belden Inc

- 13.3 Bharat Heavy Electricals Limited

- 13.4 Cisco Systems

- 13.5 Eaton

- 13.6 GE Vernova

- 13.7 NovaTech.

- 13.8 OMICRON

- 13.9 Ponovo Power

- 13.10 Redeia

- 13.11 Schneider Electric

- 13.12 Siemens Energy

- 13.13 Toshiba Energy Systems & Solutions

- 13.14 WEG