|

市场调查报告书

商品编码

1913355

电弧焊接设备市场机会、成长要素、产业趋势分析及2026年至2035年预测Arc Welding Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

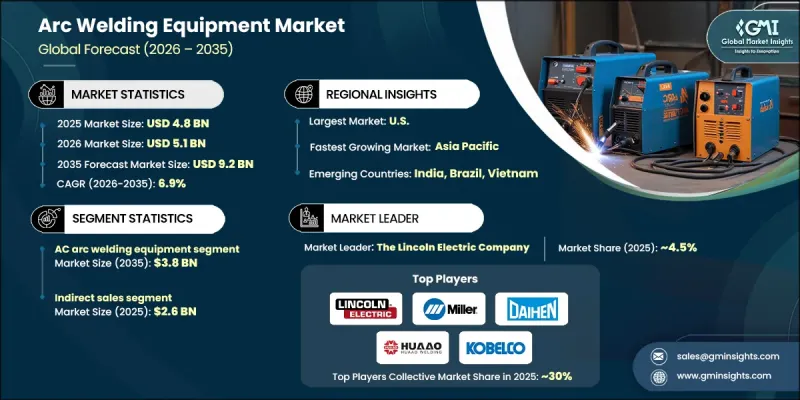

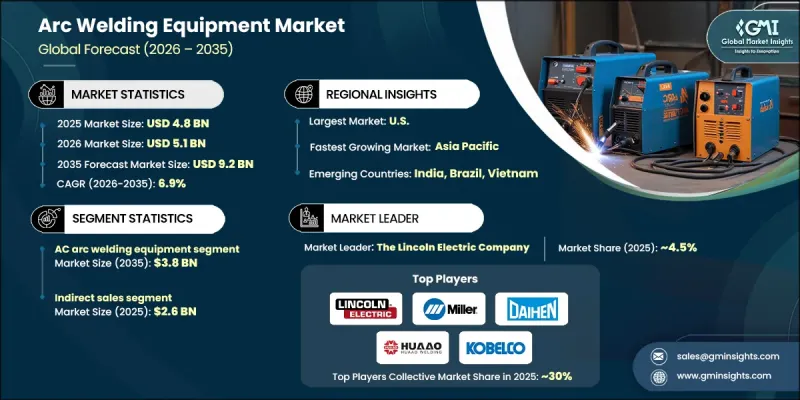

全球电弧焊接设备市场预计到 2025 年将达到 48 亿美元,到 2035 年将达到 92 亿美元,年复合成长率为 6.9%。

规范职场安全和设备设计的法规结构对依赖电弧焊接作业的各行业的需求有显着影响。对电压阈值、电气绝缘、接地通讯协定和气流标准的严格要求推动了合规焊接系统和安全解决方案的普及。人们对焊接相关健康风险的日益关注,强化了对适当通风、排气控制和呼吸防护的必要性。职业安全法规强制要求使用耐热、防火和耐电的防护设备,并规定了可视性和脸部防护的性能标准。这些规定共同影响设备设计、设施维修和采购决策。随着製造商和最终用户将合规性、作业安全和工人保护放在首位,对先进电弧焊接设备的需求持续成长。市场成长反映了对更安全、合规技术的持续投资,这些技术在提高生产力的同时,也降低了长期的职业风险。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 48亿美元 |

| 预测金额 | 92亿美元 |

| 复合年增长率 | 6.9% |

到2025年,交流电电弧焊接设备将占据40.3%的市场份额,预计到2035年将以7%的复合年增长率成长。此细分市场受益于成本竞争力以及在各种电气条件下都能稳定运作的特性。开路电压等级的监管限制直接影响产品设计,促使製造商开发符合既定安全标准的设备,以满足手动和自动应用的需求。

到2025年,间接销售管道将创造26亿美元的销售额,占总销售额的55%。此通路支援标准化产品、替换零件和耗材的广泛分销,同时将业务拓展至製造商尚未直接服务的地区和客户群。间接通路具有扩充性、柔软性和成本效益,尤其是在次市场和小规模的营运环境中。

预计到2025年,北美电弧焊接设备市场将占据38.2%的市场份额,并在2035年之前以7.1%的复合年增长率成长。强大的製造能力、严格的安全标准执行以及持续的设备升级巩固了该地区的市场主导地位。监管要求规定了详细的技术规范,这些规范直接影响采购行为和设备更换週期。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 严格的安全规章

- 永续钢铁生产和基础设施发展

- 对健康风险意识的提高促进了更安全技术的进步。

- 产业潜在风险与挑战

- 高昂的资本和整合成本

- 工程师短缺和合规负担

- 机会

- 扩大可再生能源和绿色基础设施计划

- 开发人工智慧驱动和物联网赋能的焊接解决方案

- 司机

- 成长潜力分析

- 未来市场趋势

- 价格趋势分析

- 区域和焊接技术

- 科技与创新趋势

- 目前技术

- 新兴技术

- 法律规范

- 按地区

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 产品系列基准测试

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 焊接技术市场估算与预测(2022-2035)

- 手工电电弧焊接(SMAW)

- 气体保护金属极电弧焊接(GMAW/MIG)

- 药芯焊丝电弧焊接(FCAW)

- 钨电弧焊接(GTAW)

- 潜弧焊接(SAW)

- 其他(等离子电弧焊接(PAW)等)

第六章 依能源类型分類的市场估计与预测,2022-2035年

- 交流电电弧焊接设备

- 直流电电弧焊接设备

- 其他的

7. 2022-2035年按最终用途产业分類的市场估算与预测

- 汽车/运输设备

- 重工业/製造业

- 建筑和基础设施

- 造船和海洋工业

- 航太与国防

- 能源与电力

- 石油和天然气

- 其他的

第八章 按分销管道分類的市场估算与预测,2022-2035年

- 直销

- 间接销售

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Ador Welding

- Amada Miyachi America

- Arcon Welding Equipment

- CLOOS Welding Equipment

- Daihen

- Denyo

- ESAB

- Fronius International

- Illinois Tool Works(ITW Welding)

- Jinan Huaao Electric Welding Machine

- Kobe Steel(Kobelco)

- Miller Electric Mfg.(part of ITW Welding)

- OTC Daihen

- Panasonic Welding Systems

- The Lincoln Electric Company

The Global Arc Welding Equipment Market was valued at USD 4.8 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 9.2 billion by 2035.

Regulatory frameworks governing workplace safety and equipment design strongly shape demand across industries that rely on arc welding operations. Strict requirements related to voltage thresholds, electrical insulation, grounding protocols, and airflow standards have increased the adoption of compliant welding systems and supporting safety solutions. Growing recognition of welding-related health risks has further intensified the need for proper ventilation, exhaust management, and respiratory protection. Occupational safety regulations mandate protective equipment with resistance to heat, fire, and electrical exposure, while also specifying performance standards for visibility and facial protection. These rules collectively influence equipment engineering, facility upgrades, and purchasing decisions. As manufacturers and end users prioritize compliance, operational safety, and workforce protection, demand for advanced arc welding equipment continues to rise. The market's growth reflects sustained investment in safer, regulation-aligned technologies that support productivity while reducing long-term occupational risk.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.8 Billion |

| Forecast Value | $9.2 Billion |

| CAGR | 6.9% |

In 2025, the AC arc welding equipment accounted for a 40.3% share and is expected to grow at a CAGR of 7% through 2035. This segment benefits from cost competitiveness and operational characteristics that support stable performance under varying electrical conditions. Regulatory limits on open-circuit voltage levels directly influence product design, prompting manufacturers to align equipment development with established safety thresholds for both manual and automatic applications.

The indirect sales channel generated USD 2.6 billion in 2025, representing a 55% share. This route supports the broad distribution of standardized products, replacement components, and consumables while extending reach into regions and customer groups not served directly by manufacturers. Indirect channels offer scalability, flexibility, and cost efficiency, particularly in secondary markets and smaller operational settings.

North America Arc Welding Equipment Market held a 38.2% share in 2025 and is forecast to grow at a CAGR of 7.1% through 2035. Strong manufacturing capacity, strict enforcement of safety standards, and consistent equipment upgrades support regional dominance. Regulatory mandates establish detailed technical requirements that directly influence purchasing behavior and equipment replacement cycles.

Key companies active in the Global Arc Welding Equipment Market include The Lincoln Electric Company, ESAB, Fronius International, Panasonic Welding Systems, Illinois Tool Works, Miller Electric Mfg., OTC Daihen, Daihen, Denyo, Ador Welding, CLOOS Welding Equipment, Amada Miyachi America, Kobe Steel, Jinan Huaao Electric Welding Machine, and Arcon Welding Equipment. Companies in the Global Arc Welding Equipment Market strengthen their competitive position through continuous product innovation, regulatory compliance, and expansion of distribution networks. Manufacturers invest in safety-focused engineering, energy efficiency, and digital monitoring capabilities to meet evolving industry standards. Strategic partnerships with distributors enhance market reach, while localized manufacturing improves supply reliability. After-sales service, training support, and consumables integration help build long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Welding technology trends

- 2.2.3 Power source trends

- 2.2.4 End use industry trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety regulations

- 3.2.1.2 Sustained steel production and infrastructure build-out

- 3.2.1.3 Health risk awareness encouraging safer technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and integration costs

- 3.2.2.2 Technical skills shortage and compliance burden

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of renewable energy and green infrastructure projects

- 3.2.3.2 Development of AI-driven and IoT enabled welding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Price trend analysis

- 3.5.1 Region and welding technology

- 3.6 Technology and innovation landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Regulatory framework

- 3.7.1 By region

- 3.7.1.1 North America

- 3.7.1.2 Europe

- 3.7.1.3 Asia Pacific

- 3.7.1.4 Latin America

- 3.7.1.5 Middle East and Africa

- 3.7.1 By region

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Welding Technology 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shielded metal arc welding (SMAW)

- 5.3 Gas metal arc welding (GMAW/MIG)

- 5.4 Flux-cored arc welding (FCAW)

- 5.5 Gas tungsten arc welding (GTAW)

- 5.6 Submerged arc welding (SAW)

- 5.7 Others (plasma arc welding (PAW), etc.)

Chapter 6 Market Estimates & Forecast, By Power Source, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 AC arc welding equipment

- 6.3 DC arc welding equipment

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive & transportation

- 7.3 Heavy industry & fabrication

- 7.4 Construction & infrastructure

- 7.5 Shipbuilding & marine

- 7.6 Aerospace & defense

- 7.7 Energy and power

- 7.8 Oil and gas

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Ador Welding

- 10.2 Amada Miyachi America

- 10.3 Arcon Welding Equipment

- 10.4 CLOOS Welding Equipment

- 10.5 Daihen

- 10.6 Denyo

- 10.7 ESAB

- 10.8 Fronius International

- 10.9 Illinois Tool Works (ITW Welding)

- 10.10 Jinan Huaao Electric Welding Machine

- 10.11 Kobe Steel (Kobelco)

- 10.12 Miller Electric Mfg. (part of ITW Welding)

- 10.13 OTC Daihen

- 10.14 Panasonic Welding Systems

- 10.15 The Lincoln Electric Company