|

市场调查报告书

商品编码

1913360

压迫疗法市场机会、成长要素、产业趋势分析及2026年至2035年预测Compression Therapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

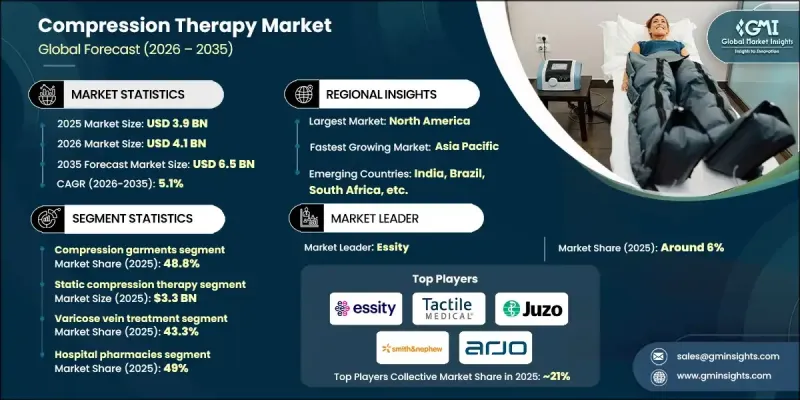

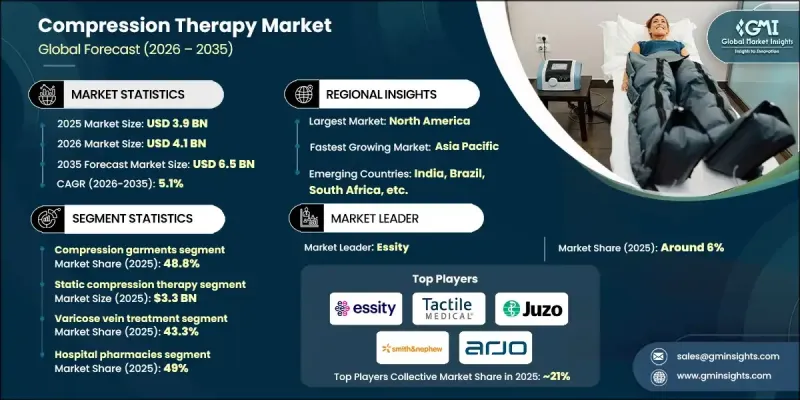

全球压迫疗法市场预计到 2025 年将达到 39 亿美元,到 2035 年将达到 65 亿美元,年复合成长率为 5.1%。

推动该市场成长的因素包括静脉疾病盛行率上升、人们对现有治疗方案的认知度提高以及运动相关损伤和事故的增加。居家医疗解决方案的扩展、对非侵入性治疗方法需求的增长以及整形外科手术和术后护理的激增也进一步推动了市场成长。设备方面的技术创新、材料的改进以及以患者为中心的设计正在改善治疗效果。压迫疗法正日益成为运动员和復健专业人员促进復原和改善活动能力的首选。随着专业和休閒运动参与度的提高,预计压力解决方案在復健、提升运动表现和预防伤害方面的应用将推动全球医疗保健和运动医学领域的持续成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 39亿美元 |

| 预测金额 | 65亿美元 |

| 复合年增长率 | 5.1% |

截至2025年,压力服市占率达48.8%。压力服,包括长筒袜、袖套和紧身裤,提供从脚踝处压力最大并向上逐渐减弱的梯度压力,有助于促进血液循环、减轻肿胀并预防血栓形成。人们对淋巴水肿、深层静脉栓塞症栓塞(DVT)和术后恢復的日益关注推动了该领域的需求。现代设计着重于舒适性、透气性和美观性,进而提高患者的依从性和延长穿着时间。

2025年,静态压迫疗法市场规模预计将达33亿美元。这种疗法透过服装、绷带和固定装置对患处施加持续压力,以改善淋巴排放和血液循环。它广泛应用于慢性静脉疾病、术后康復和损伤康復,有助于促进癒合和恢復活动能力。

预计到2025年,北美压迫疗法市占率将达到32.1%。该地区受益于先进的医疗基础设施、完善的报销政策以及非侵入性治疗方法的广泛接受度。静脉疾病、淋巴水肿和深层静脉栓塞症(DVT)的高发生率,加上人口老化和肥胖率上升,持续推动临床和居家照护环境中对压力服和气动装置的需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 产业影响因素

- 司机

- 运动伤害和事故增多

- 整形外科和术后手术数量激增

- 静脉疾病呈上升趋势

- 提高患者对治疗方案的认识

- 近期技术进步

- 产业潜在风险与挑战

- 替代治疗方法的可近性

- 配戴不适导致依从性降低

- 使用压迫疗法可能产生的副作用

- 机会

- 智慧纺织品与物联网赋能型压缩服装的开发

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- LAMEA

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价值链分析

- 救赎方案

- 对消费行为的洞察

- 定价分析

- 环境与永续性考量

- 政策环境

- 波特五力分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

第四章 竞争情势

- 介绍

- 企业矩阵分析

- 公司市占率分析

- 世界

- 北美洲

- 欧洲

- 亚太地区

- LAMEA

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 2022-2035年按产品分類的市场估算与预测

- 压力衣

- 加压绷带

- 压力袜

- 一级压缩

- 二级压缩等级

- 三级压缩

- 其他压缩服

- 压缩矫正器具

- 压缩胶带

- 压缩帮浦

第六章 按技术分類的市场估计与预测,2022-2035年

- 静态压迫疗法

- 动态压迫疗法

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 静脉曲张治疗

- 深层静脉栓塞症治疗

- 淋巴水肿治疗

- 腿部溃疡治疗

- 其他用途

第八章 按分销管道分類的市场估算与预测,2022-2035年

- 医院药房

- 零售药房

- 网路药房

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十章:公司简介

- ALCARE

- Arjo

- Bio Compression Systems

- Cardinal Health

- ConvaTec

- Enovis

- essity

- HARTMANN

- Juzo

- medi

- SANYLEG

- SIGVARIS GROUP

- Smith+Nephew

- Solventum

- Tactile Medical

The Global Compression Therapy Market was valued at USD 3.9 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 6.5 billion by 2035.

The market is fueled by the rising prevalence of venous disorders, increased awareness of available treatment options, and a growing number of sports-related injuries and accidents. Expansion in home healthcare solutions, rising demand for non-invasive therapies, and a surge in orthopedic and post-surgical procedures are further driving growth. Technological innovations in devices, improved materials, and patient-centric designs are enhancing treatment efficacy. Athletes and rehabilitation professionals increasingly prefer compression therapy for faster recovery and improved mobility. As professional and recreational sports participation grows, the adoption of compression solutions for healing, performance, and injury prevention is expected to provide sustained momentum across medical and sports medicine applications globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 5.1% |

The compression garments segment held 48.8% share in 2025. These garments, including stockings, sleeves, and tights, provide graduated pressure, highest at the ankle and gradually reducing upward, to enhance blood circulation, reduce swelling, and prevent clot formation. Rising cases of lymphedema, deep vein thrombosis (DVT), and postoperative recovery needs are driving segmental demand. Modern designs emphasize comfort, breathability, and aesthetics, ensuring higher patient compliance and prolonged use.

The static compression therapy segment reached USD 3.3 billion in 2025. This therapy delivers continuous pressure through garments, wraps, or bandages over affected areas, improving lymphatic drainage and blood flow. It is widely applied in chronic venous disorders, post-surgical recovery, and injury rehabilitation to accelerate healing and restore mobility.

North America Compression Therapy Market held 32.1% share in 2025. The region benefits from advanced healthcare infrastructure, strong insurance reimbursement policies, and widespread acceptance of non-invasive treatment options. High prevalence of venous disorders, lymphedema, and DVT, along with an aging population and rising obesity rates, continues to drive demand for compression garments and pneumatic devices in both clinical and home care settings.

Key companies operating in the Global Compression Therapy Market include Tactile Medical, Smith+Nephew, ALCARE, Arjo, Bio Compression Systems, Cardinal Health, ConvaTec, Enovis, Essity, HARTMANN, Juzo, Medi, SANYLEG, SIGVARIS GROUP, and Solventum. Companies in the Global Compression Therapy Market are strengthening their position through several strategic initiatives. They focus on continuous product innovation, integrating smart technologies and advanced materials to improve comfort, durability, and therapeutic effectiveness. Geographic expansion enables access to emerging markets, while collaborations with healthcare providers and rehabilitation centers enhance product adoption. Firms are also emphasizing affordability and customizable solutions to cater to diverse patient needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of sports injuries and accidents

- 3.2.1.2 Surge in orthopedic and post-surgical procedures

- 3.2.1.3 Rising prevalence of venous disorders

- 3.2.1.4 Growing awareness among patients regarding treatment options

- 3.2.1.5 Recent technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatments

- 3.2.2.2 Reduced compliance due to wearer discomfort

- 3.2.2.3 Side effects associated with the use of compression therapy

- 3.2.3 Opportunities

- 3.2.3.1 Development of smart textiles and IoT-enabled compression wear

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Reimbursement scenario

- 3.8 Consumer behavioral insights

- 3.9 Pricing analysis

- 3.10 Environmental and sustainability considerations

- 3.11 Policy landscape

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

- 3.15 Future market trends

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Compression garments

- 5.2.1 Compression bandages

- 5.2.2 Compression stockings

- 5.2.2.1 Compression class I

- 5.2.2.2 Compression class II

- 5.2.2.3 Compression class III

- 5.2.3 Other compression garments

- 5.3 Compression braces

- 5.4 Compression tapes

- 5.5 Compression pumps

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Static compression therapy

- 6.3 Dynamic compression therapy

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Varicose veins treatment

- 7.3 Deep vein thrombosis treatment

- 7.4 Lymphedema treatment

- 7.5 Leg ulcer treatment

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALCARE

- 10.2 Arjo

- 10.3 Bio Compression Systems

- 10.4 Cardinal Health

- 10.5 ConvaTec

- 10.6 Enovis

- 10.7 essity

- 10.8 HARTMANN

- 10.9 Juzo

- 10.10 medi

- 10.11 SANYLEG

- 10.12 SIGVARIS GROUP

- 10.13 Smith+Nephew

- 10.14 Solventum

- 10.15 Tactile Medical