|

市场调查报告书

商品编码

1913367

感染控制用品市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035 年)Infection Control Supplies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

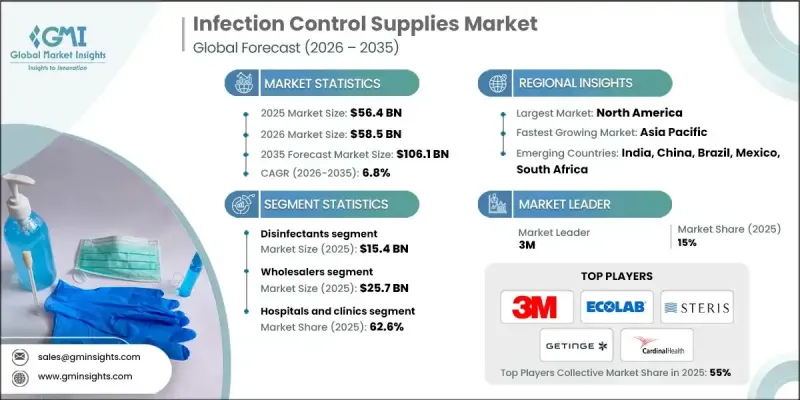

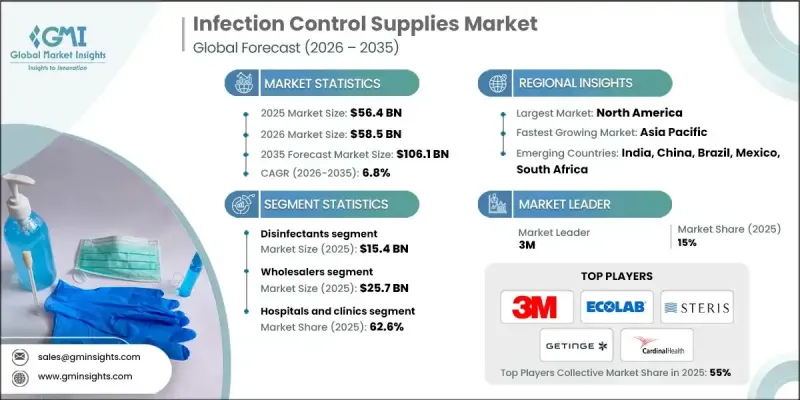

全球感染控制用品市场预计到 2025 年将达到 564 亿美元,到 2035 年将达到 1,061 亿美元,年复合成长率为 6.8%。

市场成长得益于医疗环境中感染疾病率的上升、对预防通讯协定的日益重视以及防护和消毒技术的不断创新。全球医疗系统日益重视降低感染风险,以改善患者预后并降低治疗成本。长期健康问题的日益增多增加了患者与医疗机构的接触,提高了感染风险,并进一步强化了对强有力的感染预防措施的需求。免疫功能低下的患者需要加强保护,这进一步推动了对先进感染控制解决方案的需求。全球重症监护和外科手术能力的提升也促进了现代消毒和灭菌技术的广泛应用。随着医疗机构更加重视安全、效率和合规性,感染控制用品已成为临床运作的重要组成部分,从而支持了医院、诊所和门诊机构市场的持续成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 564亿美元 |

| 市场规模预测 | 1061亿美元 |

| 复合年增长率 | 6.8% |

预计到2025年,消毒剂品类将创造154亿美元的收入,占市场份额的27.2%。由于人们对卫生标准的认识不断提高以及合规要求日益严格,医疗机构对消毒剂的需求仍然强劲。法律规范和以卫生为中心的政策也进一步推动了医疗机构对消毒剂的采用。

2025年,批发分销管道的价值将达到257亿美元。这些仲介业者在确保获得必要的感染控制产品方面发挥着至关重要的作用。它们的规模、定价柔软性和物流能力使它们成为需要确保稳定供应的大规模医疗机构的首选采购管道。

预计到2024年,北美感染控制用品市占率将达到42.5%。该地区的领先地位得益于其完善的医疗基础设施、高度的感染预防意识以及严格的监管执行。医疗程序的不断增加和机构合规要求的严格性也持续支撑全部区域稳定的需求。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 产业影响因素

- 司机

- 医疗相关感染(HAI)激增

- 人口老化趋势日益加剧

- 慢性病发生率呈上升趋势

- 提高公共卫生意识

- 产业潜在风险与挑战

- 缺乏感染控制和预防意识

- 缺乏卫生知识

- 市场机会

- 扩建门诊及门诊治疗设施

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术进步

- 当前技术趋势

- 新兴技术

- 价格分析(2024)

- 未来市场趋势

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 企业矩阵分析

- 主要企业的竞争分析

- 竞争定位矩阵

- 主要趋势

- 企业合併(M&A)

- 合伙/合资企业

- 新产品发布

- 扩张计划

第五章 按产品分類的市场估算与预测(2022-2035 年)

- 消毒剂

- 产品类型

- 干洗手剂

- 表面消毒剂

- 皮肤消毒剂

- 器械消毒剂

- 剂型

- 消毒纸巾

- 液体消毒剂

- 消毒喷雾

- 美国环保署分类

- 低效率消毒剂

- 中级消毒剂

- 高效消毒剂

- 产品类型

- 清洁配件

- 清洁和消毒设备

- 超音波清洗器

- 清洗消毒机

- 紫外线消毒器

- 清洗消毒机

- 一次性安全产品

- 外科用覆盖巾及罩衣

- 口罩

- 风镜

- 手套

- 盖子和封口

- 其他一次性安全产品

- 其他产品

第六章 按分销管道分類的市场估算与预测(2022-2035 年)

- 批发商

- 零售商

- 药局

- 电子商务

- 其他分销管道

7. 依最终用途分類的市场估计与预测(2022-2035 年)

- 医院和诊所

- 医疗设备製造商

- 製药公司

- 研究所

- 其他最终用途

第八章 各地区市场估算与预测(2021-2034 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第九章:公司简介

- 3M

- Advanced Sterilization Products(ASP)

- Belimed Deutschland GmbH(Metal Zug Group)

- Cardinal Health

- Cantel Medical

- Dentsply Sirona

- Ecolab

- Envista Holdings Corporation

- Getinge

- Henry Schein

- Kimberly-Clark Corporation

- Matachana Group

- Reckitt

- Steelco

- Steris

The Global Infection Control Supplies Market was valued at USD 56.4 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 106.1 billion by 2035.

Market growth is supported by the rising incidence of infectious conditions within healthcare environments, increased emphasis on prevention protocols, and continuous innovation in protective and disinfection technologies. Healthcare systems worldwide are placing greater priority on minimizing infection risks to improve patient outcomes and reduce treatment costs. The growing burden of long-term health conditions has intensified interactions with healthcare facilities, increasing exposure risks and reinforcing the need for robust infection prevention measures. Patients with compromised immunity require heightened protection, further driving demand for advanced infection control solutions. Expansion of critical care and surgical capacity globally has also contributed to higher utilization of modern disinfection and sterilization technologies. As healthcare providers focus on safety, efficiency, and regulatory compliance, infection control supplies have become a fundamental component of clinical operations, supporting sustained market expansion across hospitals, clinics, and outpatient care settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $56.4 Billion |

| Forecast Value | $106.1 Billion |

| CAGR | 6.8% |

The disinfectants category generated USD 15.4 billion during 2025 and accounted for a 27.2% share. Strong demand continues across healthcare environments due to heightened awareness of sanitation standards and strict compliance requirements. Regulatory oversight and hygiene-focused policies continue to reinforce adoption across medical facilities.

The wholesalers distribution channel reached USD 25.7 billion in 2025. These intermediaries play a critical role in ensuring reliable access to essential infection control products. Their scale, pricing flexibility, and logistical capabilities make them a preferred sourcing option for large healthcare organizations that require consistent supply availability.

North America Infection Control Supplies Market represented 42.5% share in 2024. Regional dominance is supported by a well-developed healthcare infrastructure, high awareness of infection prevention, and strict regulatory enforcement. Rising procedural volumes and strong institutional compliance requirements continue to support stable demand across the region.

Key companies active in the Global Infection Control Supplies Market include Ecolab, 3M, Steris, Getinge, Cardinal Health, Kimberly-Clark Corporation, Henry Schein, Reckitt, Advanced Sterilization Products, Belimed Deutschland GmbH, Steelco, Cantel Medical, Matachana Group, Dentsply Sirona, and Envista Holdings Corporation. Companies operating in the Global Infection Control Supplies Market are strengthening their market position through innovation, portfolio expansion, and strategic partnerships. Manufacturers are investing in advanced product development to improve effectiveness, safety, and ease of use. Expansion of automated and digital-enabled solutions is enhancing efficiency and compliance for healthcare providers. Strategic collaborations with hospitals and distributors help secure long-term supply contracts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in healthcare-associated infections (HAIs)

- 3.2.1.2 Rising geriatric population base

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing public health awareness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness regarding infection control and prevention

- 3.2.2.2 Insufficient knowledge related to hygienic conditions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and ambulatory care facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Disinfectants

- 5.2.1 Product type

- 5.2.1.1 Hand disinfectants

- 5.2.1.2 Surface disinfectants

- 5.2.1.3 Skin disinfectants

- 5.2.1.4 Instrument disinfectants

- 5.2.2 Formulation

- 5.2.2.1 Disinfectant wipes

- 5.2.2.2 Liquid disinfectants

- 5.2.2.3 Disinfectant sprays

- 5.2.3 EPA classification

- 5.2.3.1 Low-level disinfectants

- 5.2.3.2 Intermediate-level disinfectants

- 5.2.3.3 High-level disinfectants

- 5.2.1 Product type

- 5.3 Cleaning accessories

- 5.4 Cleaning and disinfection equipment

- 5.4.1 Ultrasonic cleaners

- 5.4.2 Flusher disinfectors

- 5.4.3 UV-ray disinfectors

- 5.4.4 Washer disinfectors

- 5.5 Disposable safety products

- 5.5.1 Surgical drapes and gowns

- 5.5.2 Face masks

- 5.5.3 Goggles

- 5.5.4 Gloves

- 5.5.5 Covers and closures

- 5.5.6 Others disposable safety products

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Wholesalers

- 6.3 Retailers

- 6.4 Pharmacies

- 6.5 E-commerce

- 6.6 Other distribution channels

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Medical device companies

- 7.4 Pharmaceutical companies

- 7.5 Research laboratories

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Advanced Sterilization Products (ASP)

- 9.3 Belimed Deutschland GmbH (Metal Zug Group)

- 9.4 Cardinal Health

- 9.5 Cantel Medical

- 9.6 Dentsply Sirona

- 9.7 Ecolab

- 9.8 Envista Holdings Corporation

- 9.9 Getinge

- 9.10 Henry Schein

- 9.11 Kimberly-Clark Corporation

- 9.12 Matachana Group

- 9.13 Reckitt

- 9.14 Steelco

- 9.15 Steris