|

市场调查报告书

商品编码

1913368

无线火灾侦测系统市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Wireless Fire Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

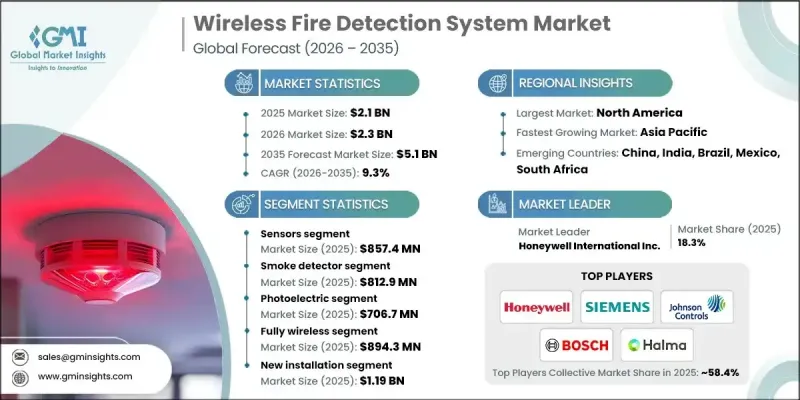

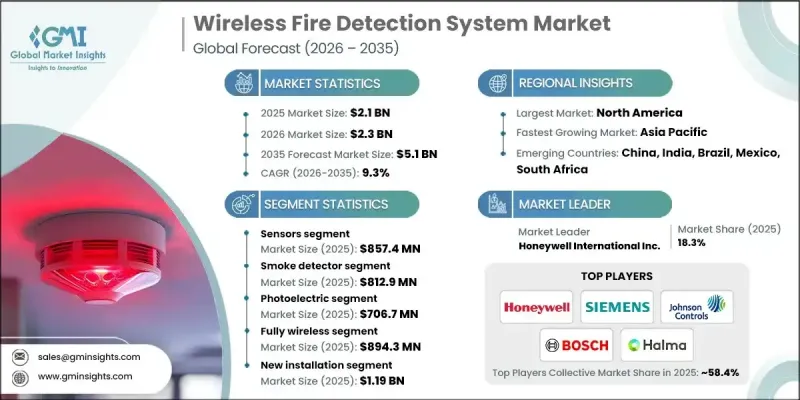

全球无线火灾侦测系统市场预计到 2025 年将达到 21 亿美元,到 2035 年将达到 51 亿美元,年复合成长率为 9.3%。

住宅、商业和工业设施对更高消防安全保障的需求不断增长,推动了这一成长。智慧建筑技术、物联网解决方案和无线通讯的整合,实现了对火灾紧急情况的即时监控和快速响应。无线火灾侦测系统无需有线基础设施,可在各种环境中灵活安装、快速部署并实现高效的火灾管理。这些系统包括无线烟雾和热探测器、控制面板、警报模组和通讯网关。它们能够在复杂的布局中有效运行,例如历史建筑和具有多个区域的大型设施,因此比传统的有线系统得到了更广泛的应用。预测性维护、自动警报和远端监控功能减少了消防安全管理的人工干预,同时提高了营运效率。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 21亿美元 |

| 预测金额 | 51亿美元 |

| 复合年增长率 | 9.3% |

预计到2025年,感测器业务板块的收入将达到8.574亿美元。感测器在无线火灾侦测系统中发挥至关重要的作用,能够即时发出烟雾、高温和火灾警报。无线感测器,包括烟雾侦测器、热探测器和多感测器侦测器,具有安装柔软性、可靠性高以及适应性强等优点,可用于维修建筑或复杂的建筑结构。

预计到2025年,光电式火灾侦测器市场规模将达到7.067亿美元。光电式侦测器对阴燃火灾高度敏感,能够实现早期侦测并最大限度地减少误报。其在住宅、商业和工业建筑中的广泛应用,得益于电池续航能力的提升、无线连接功能以及与智慧建筑平台的集成,从而提高了整体消防安全性能。

预计到2025年,北美无线火灾侦测系统市场份额将达到32.3%,这主要得益于先进技术的应用、健全的法规结构以及对数位化安全解决方案的大力投资。美国拥有众多领先的製造商和技术创新者,这促进了下一代探测器的持续发展、快速商业化以及与物联网和云端监控系统的无缝整合。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 智慧建筑和物联网消防安全系统的应用日益普及

- 政府监管力道加大,建筑安全标准更严格

- 现有设施对低布线火灾侦测解决方案的需求日益增长

- 无线通讯、感测器和基于人工智慧的感测技术的进步

- 提高住宅、商业和工业领域的消防安全意识

- 产业潜在风险与挑战

- 高昂的初始投资成本

- 对人口密集都市区网路可靠性和潜在讯号干扰的担忧

- 市场机会

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 定价策略

- 新兴经营模式

- 合规要求

- 永续性措施

- 消费者心理分析

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 地理分布比较

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2022-2025 年主要发展动态

- 併购

- 合作伙伴关係和合资企业

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 按组件分類的市场估算与预测,2022-2035年

- 感应器

- 检举按钮

- 火警控制面板

- 输入/输出模组

- 其他的

6. 按感测器类型分類的市场估算与预测,2022-2035 年

- 烟雾侦测器

- 热探测器

- 气体探测器

- 多感测器侦测器

第七章 按类型分類的市场估计与预测,2022-2035年

- 光电式

- 电离式

- 双感测器

- 其他的

第八章 按车型分類的市场估计与预测,2022-2035年

- 完全无线

- 杂交种

第九章 依安装量分類的市场估算与预测,2022-2035年

- 新安装

- 维修

第十章 依应用领域分類的市场估计与预测,2022-2035年

- 住宅

- 产业

- 商业的

- BFSI

- 教育

- 政府

- 卫生保健

- 饭店业

- 零售

- 其他的

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第十二章:公司简介

- Apollo Fire Detectors Ltd.

- Electro Detectors Ltd.

- EMS Security Group

- EuroFyre Ltd.

- Gentex Corporation

- Halma PLC(Apollo, Advanced, etc.)

- Hochiki Corporation

- Honeywell International Inc.

- Johnson Controls International plc(Tyco/SimplexGrinnell)

- Kidde Technologies Inc.

- Robert Bosch GmbH(Bosch Security Systems)

- Schneider Electric

- Securiton AG

- Siemens AG

- System Sensor

The Global Wireless Fire Detection System Market was valued at USD 2.1 billion in 2025 and is estimated to grow at a CAGR of 9.3% to reach USD 5.1 billion by 2035.

The growth is driven by the rising demand for enhanced fire safety and security across residential, commercial, and industrial spaces. The integration of smart building technologies, IoT-enabled solutions, and wireless communication is enabling real-time monitoring and faster responses to fire emergencies. Wireless fire detection systems eliminate the need for wired infrastructure, offering flexible installation, faster deployment, and efficient fire management across diverse environments. These systems include wireless smoke and heat detectors, control panels, alarm modules, and communication gateways. Their ability to operate effectively in complex layouts, including heritage buildings and large facilities with multiple zones, makes them increasingly preferred over traditional wired systems. With predictive maintenance, automated alerts, and remote monitoring, these solutions enhance operational efficiency while reducing human intervention in fire safety management.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 9.3% |

The sensors segment generated USD 857.4 million in 2025. Sensors are vital to any wireless fire detection system, providing real-time alerts for smoke, heat, and fire events. Wireless sensors, including smoke, heat, and multi-sensor detectors, offer installation flexibility, reliability, and suitability for retrofitted or complex building structures.

The photoelectric segment reached USD 706.7 million in 2025. Photoelectric detectors are highly sensitive to smoldering fires, enabling early detection and minimizing false alarms. Their widespread use in residential, commercial, and industrial setups is supported by improved battery life, wireless connectivity, and integration with smart building platforms, enhancing overall fire safety performance.

North America Wireless Fire Detection System Market held 32.3% share in 2025, driven by advanced technological adoption, strong regulatory frameworks, and robust investments in digital safety solutions. The U.S. hosts leading manufacturers and technology innovators, fostering continuous advancements, rapid commercialization of next-generation detectors, and seamless integration with IoT and cloud-based monitoring systems.

Key market participants in the Global Wireless Fire Detection System Market include Siemens AG, Kidde Technologies Inc., Schneider Electric, Honeywell International Inc., Robert Bosch GmbH (Bosch Security Systems), EMS Security Group, EuroFyre Ltd., System Sensor, Gentex Corporation, Securiton AG, Apollo Fire Detectors Ltd., Johnson Controls International plc (Tyco/SimplexGrinnell), Hochiki Corporation, Electro Detectors Ltd., and Halma PLC (Apollo, Advanced, etc.). Companies operating in the Global Wireless Fire Detection System Market are employing several strategies to strengthen their market position. These include developing next-generation detectors with enhanced sensitivity and IoT connectivity, forming strategic alliances with smart building and security solution providers, and expanding distribution networks across residential, commercial, and industrial sectors. They focus on continuous R&D to improve battery life, reduce false alarms, and enhance interoperability with building automation systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Sensor type trends

- 2.2.3 Type trends

- 2.2.4 Model trends

- 2.2.5 Installation trends

- 2.2.6 Application trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of smart buildings and IoT-enabled fire safety systems.

- 3.2.1.2 Stricter government regulations and building safety standards.

- 3.2.1.3 Rising demand for retrofit low-wiring fire detection solutions.

- 3.2.1.4 Advancements in wireless communication, sensors, and AI-based detection.

- 3.2.1.5 Growing fire-safety awareness across residential, commercial, and industrial sectors.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Concerns regarding network reliability and potential signal interference in dense urban areas.

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Sustainability Measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Sensors

- 5.3 Call Points

- 5.4 Fire Alarm Panels

- 5.5 Input/Output Modules

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Smoke Detector

- 6.3 Heat Detector

- 6.4 Gas Detector

- 6.5 Multi-sensor Detector

Chapter 7 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Photoelectric

- 7.3 Ionization

- 7.4 Dual Sensor

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Model, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Fully Wireless

- 8.3 Hybrid

Chapter 9 Market Estimates and Forecast, By Installation, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 New Installation

- 9.3 Retrofit

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Industrial

- 10.4 Commercial

- 10.4.1 BFSI

- 10.4.2 Education

- 10.4.3 Government

- 10.4.4 Healthcare

- 10.4.5 Hospitality

- 10.4.6 Retail

- 10.4.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Apollo Fire Detectors Ltd.

- 12.2 Electro Detectors Ltd.

- 12.3 EMS Security Group

- 12.4 EuroFyre Ltd.

- 12.5 Gentex Corporation

- 12.6 Halma PLC (Apollo, Advanced, etc.)

- 12.7 Hochiki Corporation

- 12.8 Honeywell International Inc.

- 12.9 Johnson Controls International plc (Tyco / SimplexGrinnell)

- 12.10 Kidde Technologies Inc.

- 12.11 Robert Bosch GmbH (Bosch Security Systems)

- 12.12 Schneider Electric

- 12.13 Securiton AG

- 12.14 Siemens AG

- 12.15 System Sensor