|

市场调查报告书

商品编码

1913382

去中心化身分市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Decentralized Identity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

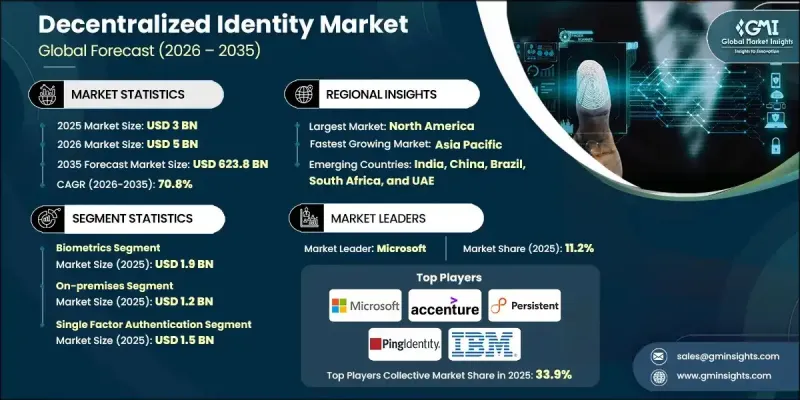

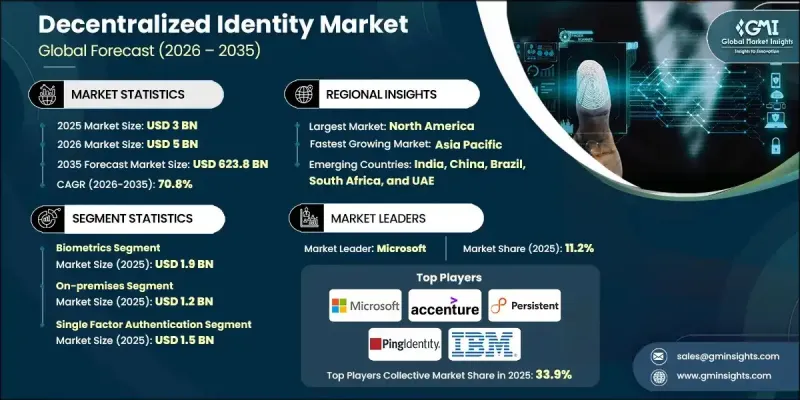

全球去中心化身分市场预计到 2025 年将达到 30 亿美元,到 2035 年将达到 6,238 亿美元,年复合成长率达 70.8%。

这一快速增长的驱动力源于全球向以隐私、安全和用户控制为优先的数位身分生态系统的转变。各国政府和企业正在加速采用去中心化身分框架,以支援跨公共和私有平台的安全数位互动。与资料保护、身分验证和合规性相关的监管要求正在加速这一趋势,而数位服务的扩展也持续增加对可靠身分註册解决方案的需求。安全的数位身分钱包支援可重复使用的、经过加密检验的凭证,从而减少重复的身份验证流程和操作摩擦。这些系统还能在保护用户隐私的同时降低合规成本。多个地区的管理方案正在加强这一势头,推动标准化、可互通的身份基础设施的建设,从而支持跨境和跨行业的数位互动。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 30亿美元 |

| 市场规模预测 | 6238亿美元 |

| 复合年增长率 | 70.8% |

预计到2025年,生物识别市场规模将达到19亿美元。人们对身分滥用和复杂欺骗技术的日益担忧,推动了对更高安全等级的生物识别认证方法的需求。受监管产业正日益依赖生物识别作为去中心化身分系统的基础要素,以支援安全且防篡改的检验流程。

到2025年,本地部署模式的市场规模将达到12亿美元。对资料管治和主权要求严格的组织更倾向于采用在地部署的去中心化身分平台,以确保对敏感资讯的完全控制。这些解决方案支援客製化,可与现有身分管理基础架构无缝集成,并可应用内部安全框架。

美国去中心化身分市场预计到2025年将达到9.243亿美元,2026年至2035年的复合年增长率将达到66.7%。市场成长得益于对区块链数位钱包和企业身分整合倡议投资的不断增加。公共部门框架和行业标准的推出正在加速多个受监管行业的采用,鼓励技术提供商投资于先进的云端解决方案和联合开发项目。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 产业影响因素

- 司机

- 政府主导的数位身分识别项目

- 诈骗、资料外洩和身分盗窃造成的损失日益增加

- 企业需要有效率且合规的新员工入职流程。

- Web3、代币化资产和数位钱包生态系统的成长

- 多重云端和零信任架构的兴起

- 产业潜在风险与挑战

- 缺乏全球信任框架与法律认可

- 使用者体验差和互通性不足

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 新兴经营模式

- 合规要求

- 永续性措施

- 消费者心理分析

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线丰富

- 科技

- 创新

- 按地区分類的企业发展状况比较

- 全球发展分析

- 服务网路覆盖范围

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 主要发展(2022-2035 年)

- 企业合併(M&A)

- 商业伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型 (DX) 计划

- 新兴/Start-Ups竞赛的趋势

第五章 依ID类型分類的市场估算与预测(2022-2035年)

- 生物识别

- 非生物识别

第六章 按组件分類的市场估计和预测(2022-2035 年)

- 解决方案/平台

- 去中心化身分平台

- ID钱包

- 检验凭证管理系统

- 基于区块链的身份网络

- 服务

- 咨询和实施支持

- 整合和互通性服务

- 託管服务

- 身分管治服务

第七章 依部署方式分類的市场估算与预测(2022-2035 年)

- 本地部署

- 基于云端的

- 杂交种

第八章 依认证方式分類的市场估算与预测(2022-2035 年)

- 单因素身份验证

- 多因素身份验证

第九章 依公司规模分類的市场估计与预测(2022-2035 年)

- 大公司

- 小型企业

第十章 各产业市场估算与预测(2022-2035 年)

- BFSI

- 零售与电子商务

- 资讯科技/通讯

- 政府/公共部门

- 医疗保健

- 房地产

- 媒体与娱乐

- 其他的

第十一章 各地区市场估计与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- 主要企业

- Accenture

- Microsoft

- IBM

- Gen Digital Inc.

- Ping Identity

- 按地区分類的主要企业

- 北美洲

- 1Kosmos Inc.

- Evernym Inc.

- Civic Technologies, Inc.

- Kiva Microfunds, Inc.

- 欧洲

- Datarella GmbH

- Validated ID, SL

- Nuggets

- 亚太地区

- Finema Co., Ltd.

- Ontology

- Persistent Systems

- Wipro DICE ID

- 北美洲

- 小众/颠覆性公司

- Affinidi

- Alchemy Insights, Inc.

- Dragonchain Inc.

The Global Decentralized Identity Market was valued at USD 3 billion in 2025 and is estimated to grow at a CAGR of 70.8% to reach USD 623.8 billion by 2035.

The rapid growth is driven by the global transition toward digital identity ecosystems that emphasize privacy, security, and user control. Governments and enterprises are increasingly adopting decentralized identity frameworks to support secure digital interactions across public and private platforms. Regulatory requirements related to data protection, identity verification, and compliance are accelerating adoption, while the expansion of digital services continues to increase demand for reliable identity onboarding solutions. Secure digital identity wallets enable reusable and cryptographically verified credentials, reducing repetitive authentication processes and operational friction. These systems also lower compliance costs while preserving user privacy. Regulatory initiatives across multiple regions are reinforcing this momentum, encouraging standardized and interoperable identity infrastructures that support cross-border and cross-sector digital engagement.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3 Billion |

| Forecast Value | $623.8 Billion |

| CAGR | 70.8% |

The biometrics segment reached USD 1.9 billion in 2025. Rising concerns related to identity misuse and advanced impersonation techniques are driving demand for biometric-based credentials that offer higher assurance levels. Regulated industries are increasingly relying on biometric authentication as a foundational element of decentralized identity systems, supporting secure and tamper-resistant verification processes.

The on-premises deployment model generated USD 1.2 billion in 2025. Organizations with strict data governance and sovereignty requirements favor on-premises decentralized identity platforms to retain full control over sensitive information. These solutions allow customization, seamless integration with existing identity management infrastructures, and enforcement of internal security frameworks.

U.S. Decentralized Identity Market reached USD 924.3 million in 2025 and is expected to grow at a CAGR of 66.7% from 2026 to 2035. Market growth is supported by increasing investment in blockchain-enabled digital wallets and enterprise identity integration initiatives. Public sector frameworks and industry standards are accelerating adoption across multiple regulated sectors, prompting technology providers to invest in advanced cloud-based solutions and collaborative development programs.

Key companies active in the Global Decentralized Identity Market include Microsoft, IBM, Accenture, Ping Identity, 1Kosmos Inc., Civic Technologies, Inc., Evernym Inc., Ontology, Wipro DICE ID, Persistent Systems, Validated ID, SL, Gen Digital Inc., Affinidi, Alchemy Insights, Inc., Datarella GmbH, Dragonchain Inc., Finema Co., Ltd., Nuggets, and Kiva Microfunds, Inc. These organizations continue to shape market evolution through innovation, partnerships, and large-scale deployments. Companies operating in the Global Decentralized Identity Market are strengthening their market position through investments in advanced cryptographic technologies and interoperable identity frameworks. Many players are focusing on biometric integration and verifiable credentials to enhance trust and security. Strategic partnerships with governments, enterprises, and standards bodies are helping expand adoption and ensure regulatory alignment. Firms are also prioritizing scalability through cloud and hybrid deployment models while maintaining data privacy compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Identity type trends

- 2.2.2 Component trends

- 2.2.3 Deployment mode trends

- 2.2.4 Authentication method trends

- 2.2.5 Enterprise size trends

- 2.2.6 Industry vertical trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government-led digital ID programs

- 3.2.1.2 Rising fraud, data breaches & identity theft costs

- 3.2.1.3 Enterprise need for streamlined & compliant onboarding

- 3.2.1.4 Growth of Web3, tokenized assets & digital wallet ecosystems

- 3.2.1.5 Increased multi-cloud & zero-trust adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of global trust frameworks & legal recognition

- 3.2.2.2 Poor user experience & interoperability gaps

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Consumer Sentiment Analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Identity Type, 2022-2035 (USD Billion)

- 5.1 Key trends

- 5.2 Biometrics

- 5.3 Non-biometrics

Chapter 6 Market Estimates & Forecast, By Component, 2022-2035 (USD Billion)

- 6.1 Key trends

- 6.2 Solutions/platforms

- 6.2.1 Decentralized identity platforms

- 6.2.2 Identity wallets

- 6.2.3 Verifiable credential management systems

- 6.2.4 Blockchain identity networks

- 6.3 Services

- 6.3.1 Consulting & implementation

- 6.3.2 Integration & interoperability services

- 6.3.3 Managed services

- 6.3.4 Identity governance services

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2022-2035 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Authentication Method, 2022-2035 (USD Billion)

- 8.1 Key trends

- 8.2 Single-factor authentication

- 8.3 Multi-factor authentication

Chapter 9 Market Estimates & Forecast, By Enterprise Size, 2022-2035 (USD Billion)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 Small and medium-sized enterprises

Chapter 10 Market Estimates & Forecast, By Industry Vertical, 2022-2035 (USD Billion)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Retail & eCommerce

- 10.4 IT & telecommunication

- 10.5 Government & public sector

- 10.6 Healthcare

- 10.7 Real estate

- 10.8 Media & entertainment

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Accenture

- 12.1.2 Microsoft

- 12.1.3 IBM

- 12.1.4 Gen Digital Inc.

- 12.1.5 Ping Identity

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 1Kosmos Inc.

- 12.2.1.2 Evernym Inc.

- 12.2.1.3 Civic Technologies, Inc.

- 12.2.1.4 Kiva Microfunds, Inc.

- 12.2.2 Europe

- 12.2.2.1 Datarella GmbH

- 12.2.2.2 Validated ID, SL

- 12.2.2.3 Nuggets

- 12.2.3 Asia Pacific

- 12.2.3.1 Finema Co., Ltd.

- 12.2.3.2 Ontology

- 12.2.3.3 Persistent Systems

- 12.2.3.4 Wipro DICE ID

- 12.2.1 North America

- 12.3 Niche / Disruptors

- 12.3.1 Affinidi

- 12.3.2 Alchemy Insights, Inc.

- 12.3.3 Dragonchain Inc.