|

市场调查报告书

商品编码

1913393

汽车夜视系统市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Automotive Night Vision System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

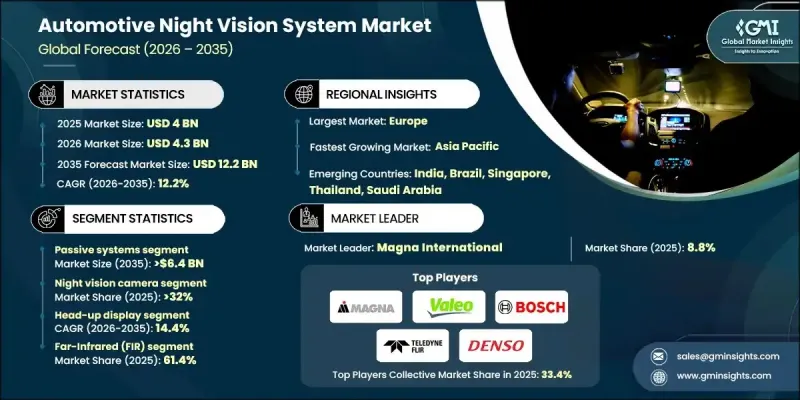

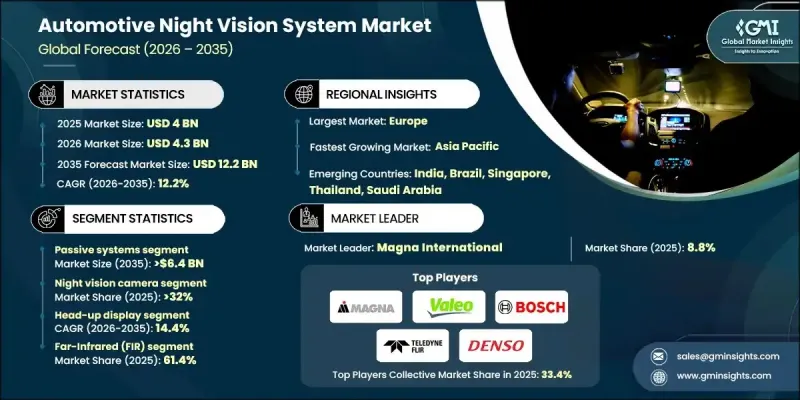

全球汽车夜视系统市场预计到 2025 年将达到 40 亿美元,到 2035 年将达到 122 亿美元,年复合成长率为 12.2%。

市场扩张的驱动力在于人们对预防事故的日益重视以及智慧安全技术在现代车辆中日益普及。电动车和自动驾驶汽车平台的进步进一步加速了这些技术的普及,夜视系统作为更广泛安全架构的补充,发挥重要作用。人们对在低光源驾驶环境下能见度挑战的日益关注,正在增强高阶和中阶车型对夜视系统的需求。监管机构对先进安全技术的激励措施,间接推动了夜视系统的普及,促使製造商将夜视功能整合到全面的驾驶辅助系统中。红外线感测技术的不断进步、热成像精度的提高、即时资料处理能力的增强,以及可靠性和实用性的提升,使得这些系统对原厂配套设备(OEM)整合越来越有吸引力。这些因素共同作用,使夜视系统成为下一代汽车安全战略的关键组成部分。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 40亿美元 |

| 市场规模预测 | 122亿美元 |

| 复合年增长率 | 12.2% |

预计到 2025 年,被动式夜视系统市占率将达到 46%,到 2035 年市场规模将达到 64 亿美元。该细分市场之所以能够继续保持领先地位,是因为它无需依赖外部光源即可检测热源模式,在低能见度环境下性能稳定,并且能够支援安全主导的车辆应用。

预计到 2025 年,夜视摄影机市占率将达到 32%,市场规模将达到 13 亿美元。影像清晰度、侦测精度和系统耐用性的不断提高,使得夜视摄影机在各种驾驶条件下都能表现得更加可靠,从而促进了汽车製造商对该技术的采用。

美国汽车夜视系统市场预计到 2025 年将达到 7.61 亿美元,预计 2026 年至 2035 年间将保持强劲成长。美国市场的成长动能是由消费者对先进安全功能的偏好以及高端汽车类别中智慧汽车技术的日益普及所推动的。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率分析

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 人们对道路安全和减少事故的关注日益增长。

- 加强对ADAS(高级驾驶辅助系统)的监管支持

- 红外线感测器和处理技术的进步

- 汽车高端安全功能的需求日益增长

- 扩展数位驾驶座和抬头显示器

- 产业潜在风险与挑战

- 夜视系统组件高成本

- 系统整合和协调的复杂性

- 市场机会

- 扩展到中檔乘用车

- 与自动驾驶和半自动驾驶系统的集成

- 电动车和软体定义汽车的成长

- 新兴汽车市场需求不断成长

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 美国联邦机动车辆安全标准 (FMVSS)

- 加拿大-CMVSS

- 欧洲

- 英国-联合国欧洲经济委员会汽车法规

- 德国 - ISO 26262 功能安全

- 法国 - 联合国欧洲经济委员会 R152

- 义大利 - ISO 14001 环境管理体系

- 西班牙 - ISO 9001 品质管理体系

- 亚太地区

- 中国-GB汽车标准

- 日本 - ISO 26262 功能安全

- 印度-AIS汽车标准

- 拉丁美洲

- 巴西 - CONTRAN 汽车法规

- 墨西哥-NOM汽车标准

- 阿根廷 - ISO 14001 环境管理体系

- 中东和非洲

- 阿联酋 - 联合国欧洲经济委员会车辆法规

- 南非 - ISO 26262 功能安全

- 沙乌地阿拉伯汽车标准协会 (SASO)

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 成本細項分析

- 开发成本结构

- 研发成本分析

- 行销和销售成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 未来市场展望与机会

- OEM和一级供应商采购和招募标准

- 原始设备製造商 (OEM) 决定是否采用夜视技术的因素

- 成本与安全价值评估

- OEM厂商采用情况的区域差异

- 一级供应商选择标准

- ADAS堆迭整合及系统结构的作用

- 性能、准确性和误报之间的权衡

- 责任、安全检验与监管风险

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 主要企业的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 主要趋势

- 企业合併(M&A)

- 商业伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 按产品分類的市场估算与预测(2022-2035 年)

- 主动系统

- 被动系统

- 校准和调整系统

- 其他的

第六章 按组件分類的市场估计和预测(2022-2035 年)

- 夜视摄影机

- 红外线感测器

- 影像处理与控制单元

- 显示模组

- 照明单元

- 软体演算法

第七章 按显示器分類的市场估算与预测(2022-2035 年)

- 抬头显示器(HUD)

- 仪表丛集

- 导航显示

- 复合显示系统

第八章 按技术分類的市场估算和预测(2022-2035 年)

- 远红外线 (FIR)

- 近红外线(NIR)

第九章 按车辆类型分類的市场估计和预测(2022-2035 年)

- 搭乘用车

- 轿车

- SUV

- 掀背车

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第十章 按应用领域分類的市场估算与预测(2022-2035 年)

- 行人侦测

- 动物检测

- 障碍物和物体检测

- 碰撞警报和避免系统

- 驾驶辅助和更佳的视野

第十一章 依销售管道分類的市场估计与预测(2022-2035 年)

- OEM

- 售后市场

第十二章 各地区市场估算与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 葡萄牙

- 克罗埃西亚

- 比荷卢经济联盟国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

第十三章:公司简介

- 国际公司

- Bosch

- Continental

- Magna International

- Valeo

- DENSO

- ZF Friedrichshafen

- Teledyne FLIR

- Autoliv

- Veoneer

- Panasonic

- 本地公司

- Hella

- Gentex

- Harman International

- Visteon

- Hitachi Astemo

- Mobileye

- Ficosa International

- Hyundai Mobis

- Mitsubishi Electric

- Aptiv

- 新创公司/颠覆者

- Omnivision Technologies

- Infineon Technologies

- Omron

- Texas Instruments

- Luminar Technologies

- Hikvision Automotive

- Raytron Technology

The Global Automotive Night Vision System Market was valued at USD 4 billion in 2025 and is estimated to grow at a CAGR of 12.2% to reach USD 12.2 billion by 2035.

Market expansion is driven by increasing focus on accident prevention, along with the growing integration of intelligent safety technologies in modern vehicles. Advancements in electric and autonomous vehicle platforms are further accelerating adoption, as night vision systems complement broader safety architectures. Heightened awareness of visibility challenges during low-light driving conditions has strengthened demand across both premium and mid-priced vehicles. Regulatory encouragement for advanced safety technologies is indirectly reinforcing adoption as manufacturers package night vision capabilities within comprehensive driver assistance offerings. Ongoing progress in infrared sensing, thermal imaging accuracy, and real-time data processing is enhancing reliability and usability, making these systems increasingly attractive for original equipment integration. Together, these factors are establishing night vision systems as a critical component in next-generation automotive safety strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 12.2% |

The passive night vision systems segment held 46% share in 2025 and is projected to reach USD 6.4 billion in value by 2035. This segment continues to lead due to its ability to detect heat patterns without relying on external light sources, delivering consistent performance in challenging visibility environments and supporting safety-oriented vehicle applications.

The night vision camera segment represented 32% share in 2025, with an estimated valuation of USD 1.3 billion. Continuous improvements in image clarity, sensing precision, and system durability are enhancing performance reliability across a wide range of driving conditions, supporting broader adoption by vehicle manufacturers.

US Automotive Night Vision System Market reached USD 761 million in 2025 and is expected to show strong growth between 2026 and 2035. Market momentum in the United States is supported by consumer preference for advanced safety features and increasing deployment of intelligent vehicle technologies across higher-value vehicle categories.

Key companies operating in the Global Automotive Night Vision System Market include Bosch, Continental, Valeo, Autoliv, Magna International, DENSO, Harman, Gentex, Teledyne Flir, Omnivision, and Delphi Technologies. Companies active in the automotive night vision system market are reinforcing their market position through continuous innovation, strategic collaborations, and deeper integration with vehicle safety platforms. Leading players are investing in enhanced sensor performance, advanced image processing software, and compact system designs to improve reliability and cost efficiency. Close collaboration with automakers enables early-stage integration into new vehicle architectures. Firms are also expanding production capabilities and focusing on scalable solutions to support broader adoption beyond luxury segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Component

- 2.2.4 Display

- 2.2.5 Technology

- 2.2.6 Vehicle

- 2.2.7 Application

- 2.2.8 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growing focus on road safety and accident reduction

- 3.2.1.3 Increasing regulatory support for advanced driver assistance systems

- 3.2.1.4 Advancements in infrared sensor and processing technologies

- 3.2.1.5 Rising demand for premium safety features in vehicles

- 3.2.1.6 Expansion of digital cockpits and head-up displays

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of night vision system components

- 3.2.2.2 Complexity of system integration and calibration

- 3.2.3 Market opportunities

- 3.2.3.1 Penetration into mid-range passenger vehicles

- 3.2.3.2 Integration with autonomous and semi-autonomous driving systems

- 3.2.3.3 Growth of electric and software-defined vehicles

- 3.2.3.4 Emerging demand in developing automotive markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - FMVSS

- 3.4.1.2 Canada - CMVSS

- 3.4.2 Europe

- 3.4.2.1 UK - UNECE Vehicle Regulations

- 3.4.2.2 Germany - ISO 26262 Functional Safety

- 3.4.2.3 France - UNECE R152

- 3.4.2.4 Italy - ISO 14001 Environmental Management Systems

- 3.4.2.5 Spain - ISO 9001 Quality Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China - GB Automotive Standards

- 3.4.3.2 Japan - ISO 26262 Functional Safety

- 3.4.3.3 India - AIS Automotive Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil - CONTRAN Automotive Regulations

- 3.4.4.2 Mexico - NOM Automotive Standards

- 3.4.4.3 Argentina - ISO 14001 Environmental Management Systems

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - UNECE Vehicle Regulations

- 3.4.5.2 South Africa - ISO 26262 Functional Safety

- 3.4.5.3 Saudi Arabia - SASO Automotive Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 OEM & Tier-1 Procurement and Adoption Criteria

- 3.12.1 OEM decision drivers for night vision adoption

- 3.12.2 Cost vs safety value assessment

- 3.12.3 Regional OEM adoption differences

- 3.12.4 Tier-1 supplier selection criteria

- 3.13 ADAS stack integration & system architecture role

- 3.14 Performance, accuracy & false-detection trade-offs

- 3.15 Liability, safety validation & regulatory risk

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Active system

- 5.3 Passive system

- 5.4 Calibration and alignment system

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Night vision camera

- 6.3 Infrared sensors

- 6.4 Image processing and controlling unit

- 6.5 Display module

- 6.6 Illumination unit

- 6.7 Software and algorithms

Chapter 7 Market Estimates & Forecast, By Display, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Head-up display

- 7.3 Instrument cluster

- 7.4 Navigation display

- 7.5 Combined Display System

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Far-Infrared (FIR)

- 8.3 Near-Infrared (NIR)

Chapter 9 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger vehicle

- 9.2.1 Sedan

- 9.2.2 SUV

- 9.2.3 Hatchback

- 9.3 Commercial Vehicle

- 9.3.1 LCV

- 9.3.2 MCV

- 9.3.3 HCV

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Pedestrian detection

- 10.3 Animal detection

- 10.4 Obstacle and object detection

- 10.5 Collision warning and avoidance

- 10.6 Driver assistance and enhanced visibility

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Portugal

- 12.3.9 Croatia

- 12.3.10 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Singapore

- 12.4.7 Thailand

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Turkey

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Bosch

- 13.1.2 Continental

- 13.1.3 Magna International

- 13.1.4 Valeo

- 13.1.5 DENSO

- 13.1.6 ZF Friedrichshafen

- 13.1.7 Teledyne FLIR

- 13.1.8 Autoliv

- 13.1.9 Veoneer

- 13.1.10 Panasonic

- 13.2 Regional Players

- 13.2.1 Hella

- 13.2.2 Gentex

- 13.2.3 Harman International

- 13.2.4 Visteon

- 13.2.5 Hitachi Astemo

- 13.2.6 Mobileye

- 13.2.7 Ficosa International

- 13.2.8 Hyundai Mobis

- 13.2.9 Mitsubishi Electric

- 13.2.10 Aptiv

- 13.3 Emerging / Disruptor Players

- 13.3.1 Omnivision Technologies

- 13.3.2 Infineon Technologies

- 13.3.3 Omron

- 13.3.4 Texas Instruments

- 13.3.5 Luminar Technologies

- 13.3.6 Hikvision Automotive

- 13.3.7 Raytron Technology