|

市场调查报告书

商品编码

1913416

乙烯-乙烯醇共聚物市场机会、成长要素、产业趋势分析及2026年至2035年预测Ethylene-Vinyl Alcohol Copolymer (EVOH) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

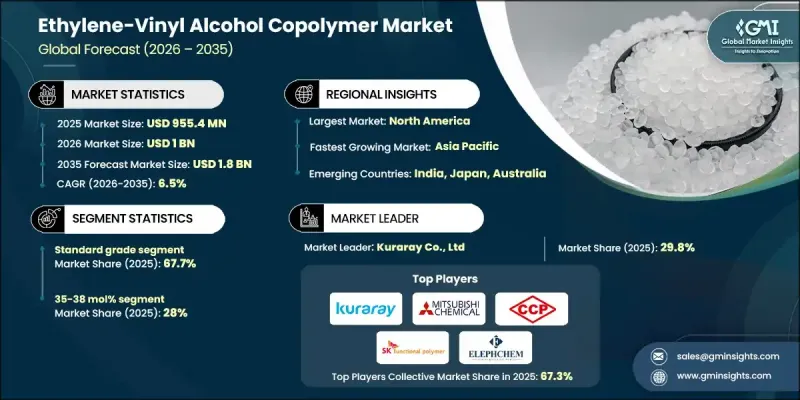

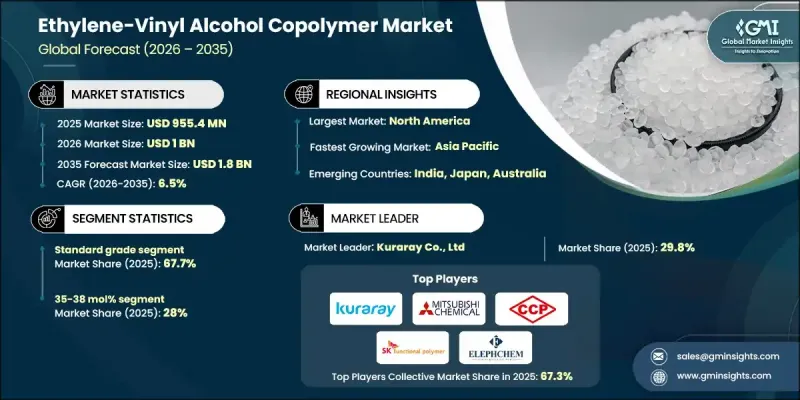

2025年全球乙烯-乙烯醇共聚物市值为9.554亿美元,预计2035年将达到18亿美元,年复合成长率为6.5%。

市场成长得益于多个终端应用产业对先进阻隔材料日益增长的需求。乙烯-乙烯醇共聚物(EVOH)因其优异的气体渗透性、气味迁移和水分渗透性能而广受认可,使其成为对性能要求极高的应用领域的首选解决方案。人们对产品安全、保质期和法规遵循的日益关注,正在加速高阻隔材料的应用,尤其是在包装价值链中。製造商优先考虑能够延长产品完整性并支援减少废弃物的倡议。同时,环境法规遵循要求正在推动有助于排放排放和提高技术应用中密封效率的材料的广泛应用。汽车製造商也在扩大EVOH基部件的应用,以满足不断变化的蒸气控制和永续性标准。在对材料效率和聚合物加工技术创新的日益重视的推动下,市场需求仍然强劲。随着各行业寻求兼具耐用性、可靠性和法规遵从性的材料,EVOH在全球市场中占据有利地位,可望保持长期稳定的成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 9.554亿美元 |

| 预测金额 | 18亿美元 |

| 复合年增长率 | 6.5% |

预计到2025年,标准级EVOH将占据67.7%的市场份额,并在2035年之前以6.2%的复合年增长率成长。由于其在多个行业领域的广泛适用性以及卓越的性价比,该等级产品将继续占据主导地位。特种级EVOH因其更高的阻隔强度、耐化学腐蚀性或热稳定性等特性,在应用领域日益受到青睐。

2025 年,35-38 摩尔% 类别占了 28% 的市占率。此成分范围因其在加工性和阻隔效果方面的最佳平衡而受到认可,从而支持在包装、汽车和医疗应用中的稳定性能。

预计2026年至2035年,北美乙烯-乙烯醇共聚物市场将以5.8%的复合年增长率成长。推动市场需求成长的因素包括:对永续材料解决方案的日益重视、回收技术的进步以及对循环经济倡议投资的不断增加。监管政策的调整和政府支持的永续性项目也持续推动先进乙烯-乙烯醇共聚物(EVOH)配方的应用。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 食品包装对长期保存期限的需求日益增长

- 车辆燃油渗透的严格规定

- 药品包装需求成长

- 产业潜在风险与挑战

- 低乙烯EVOH对湿度高度敏感

- 高端定价与通用阻隔材料对比

- 市场机会

- 生物基特级初榨橄榄油市场趋势

- 医疗设备领域的新兴应用

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按年级

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计资料(HS编码)(註:贸易统计仅适用于主要国家)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 各等级市场估算与预测,2022-2035年

- 标准级

- 特级

第六章 依乙烯含量分類的市场估算与预测,2022-2035年

- 小于29摩尔%

- 29-35摩尔百分比

- 35-38摩尔百分比

- 38-44摩尔百分比

- >44摩尔百分比

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 食品/饮料

- 生肉/禽肉包装

- 乳製品

- 加工食品和蒸馏食品

- 零嘴零食和糖果甜点

- 调味品、酱汁、沙拉酱

- 烘焙产品

- 其他的

- 製药

- 泡壳包装

- 输液袋和输液剂

- 药品包装袋和药包

- 其他的

- 车

- 农业

- 青贮膜

- 温室薄膜

- 多卷胶片

- 其他的

- 化妆品和个人护理

- 护肤品包装

- 护髮产品包装

- 香水包装

- 其他的

- 建造

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- Bouling Chemical Co., Limited

- Chang Chun Petrochemical Co., Ltd

- Dow Chemical Company

- Elephchem

- Exxon Mobil Chemical

- Kuraray Co., Ltd

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Mondi Group

- SK Functional Polymer

The Global Ethylene-Vinyl Alcohol Copolymer Market was valued at USD 955.4 million in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 1.8 billion by 2035.

Market growth is supported by rising demand for advanced barrier materials across multiple end-use industries. Ethylene-vinyl alcohol copolymer is widely recognized for its strong resistance to gas transmission, odor migration, and moisture penetration, making it a preferred solution for performance-driven applications. Increasing focus on product safety, preservation, and regulatory compliance has accelerated adoption of high-barrier materials, particularly within packaging value chains. Manufacturers are prioritizing solutions that extend product integrity while supporting waste reduction initiatives. In parallel, environmental compliance requirements are encouraging wider use of materials that help limit emissions and improve containment efficiency in technical applications. Automotive manufacturers are also increasing adoption of EVOH-based components to meet evolving vapor control and sustainability standards. Growing emphasis on material efficiency, combined with innovation in polymer processing, continues to strengthen demand. As industries seek durable, reliable, and regulation-ready materials, EVOH remains well positioned for steady long-term growth across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $955.4 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 6.5% |

The standard grade EVOH accounted for 67.7% share in 2025 and is expected to grow at a CAGR of 6.2% through 2035. This grade continues to dominate due to its adaptability across multiple industries and its balance between cost efficiency and functional performance. Specialty grades are gaining traction in applications that require enhanced barrier strength, chemical resistance, or thermal stability.

The 35-38 mol% category held 28% share in 2025. This composition range is favored for its optimal balance between processability and barrier effectiveness, supporting consistent performance across packaging, automotive, and healthcare-related uses.

North America Ethylene-Vinyl Alcohol Copolymer Market is forecast to grow at a CAGR of 5.8% between 2026 and 2035. Demand is being driven by increased emphasis on sustainable material solutions, advancements in recycling technologies, and growing investment in circular economy initiatives. Regulatory alignment and government-supported sustainability programs continue to encourage adoption of advanced EVOH formulations.

Key companies operating in the Ethylene-Vinyl Alcohol Copolymer Market include Kuraray Co., Ltd, Mitsubishi Chemical Corporation, Dow Chemical Company, Mitsui Chemicals, Inc., Exxon Mobil Chemical, Mondi Group, Chang Chun Petrochemical Co., Ltd, SK Functional Polymer, Bouling Chemical Co., Limited, and Elephchem. Companies in the Ethylene-Vinyl Alcohol Copolymer (EVOH) Market are strengthening their competitive position through innovation, capacity expansion, and strategic collaboration. Manufacturers are investing in research to enhance barrier performance, recyclability, and material compatibility with sustainable packaging systems. Product portfolio diversification allows suppliers to address a wider range of application requirements. Strategic partnerships with packaging and automotive manufacturers support long-term supply agreements and early adoption of new grades.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Ethylene content

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for extended shelf life in food packaging

- 3.2.1.2 Stringent automotive fuel permeation regulations

- 3.2.1.3 Growth in pharmaceutical packaging demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High moisture sensitivity of low ethylene EVOH

- 3.2.2.2 Premium pricing vs commodity barrier materials

- 3.2.3 Market opportunities

- 3.2.3.1 Bio-based EVOH market development

- 3.2.3.2 Emerging applications in medical devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By grade

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Standard grade

- 5.3 Specialty grade

Chapter 6 Market Estimates and Forecast, By Ethylene Content, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 <29 mol%

- 6.3 29-35 mol%

- 6.4 35-38 mol%

- 6.5 38-44 mol%

- 6.6 >44 mol%

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.2.1 Fresh meat & poultry packaging

- 7.2.2 Dairy products

- 7.2.3 Processed foods & ready-to-eat meals

- 7.2.4 Snacks & confectionery

- 7.2.5 Condiments, sauces & dressings

- 7.2.6 Bakery products

- 7.2.7 Others

- 7.3 Pharmaceuticals

- 7.3.1 Blister packs

- 7.3.2 IV bags & infusion solutions

- 7.3.3 Drug pouches & sachets

- 7.3.4 Others

- 7.4 Automotive

- 7.5 Agriculture

- 7.5.1 Silage films

- 7.5.2 Greenhouse films

- 7.5.3 Mulch films

- 7.5.4 Others

- 7.6 Cosmetics & personal care

- 7.6.1 Skincare product packaging

- 7.6.2 Haircare product packaging

- 7.6.3 Fragrance & perfume packaging

- 7.6.4 Others

- 7.7 Construction

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Bouling Chemical Co., Limited

- 9.2 Chang Chun Petrochemical Co., Ltd

- 9.3 Dow Chemical Company

- 9.4 Elephchem

- 9.5 Exxon Mobil Chemical

- 9.6 Kuraray Co., Ltd

- 9.7 Mitsubishi Chemical Corporation

- 9.8 Mitsui Chemicals, Inc.

- 9.9 Mondi Group

- 9.10 SK Functional Polymer