|

市场调查报告书

商品编码

1913421

聚异丁烯市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Polyisobutylene Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

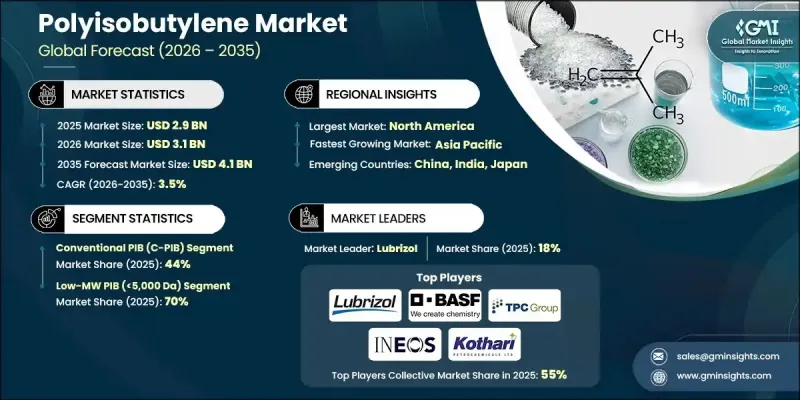

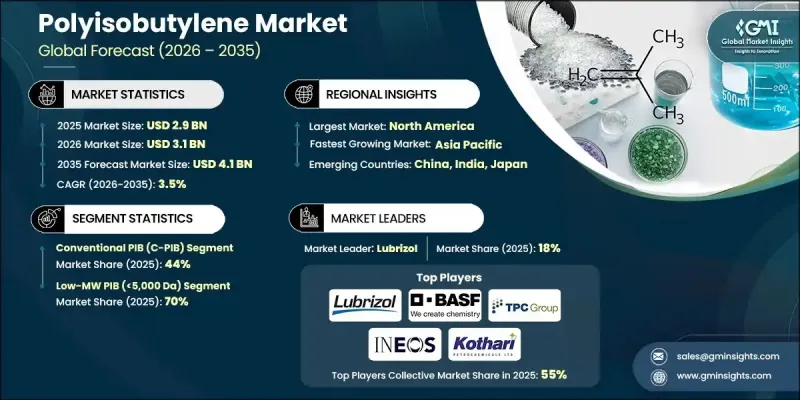

全球聚异丁烯市场预计到 2025 年将达到 29 亿美元,到 2035 年将达到 41 亿美元,年复合成长率为 3.5%。

食品接触和个人护理等行业日益严格的安全和品质标准推动了这一增长,促进了兼容型聚异丁烯 (PIB) 的应用。包括美国食品药物管理局(FDA) 在内的监管核准批准了 PIB 用于食品接触黏合剂和涂料,并设定了特定的最低数均分子量标准以确保安全性。化妆品级和氢化 PIB 在润肤剂和成膜应用中具有稳定性和皮肤相容性,从而在细分市场中占据高端市场。新兴地区基础设施的不断完善推动了对黏合剂、密封剂和玻璃涂层解决方案的需求,而 PIB 因其黏合性、柔软性、耐化学性和极低的水蒸气渗透性而备受青睐。此外,永续性趋势和日益严格的法规正在推动生物基 PIB 和清洁製造流程的发展,而不断完善的合规框架则推动了对低影响催化剂和环保原材料的研发。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 29亿美元 |

| 预测金额 | 41亿美元 |

| 复合年增长率 | 3.5% |

由于传统聚异丁烯(C-PIB)在黏合剂、密封剂、工业油、口香糖基料、涂料等领域的广泛应用,预计到2025年,C-PIB市场份额将达到44%。建筑和包装行业对C-PIB的需求密切相关,这两个行业依赖其柔软性、黏合性和防潮性能。 C-PIB的市场价格通常在每公斤0.8美元至1.5美元之间,具体价格取决于分子量和纯度,TPC集团、BASF和英力士等主要生产商拥有强大的供应基础。

到2025年,高分子量聚异丁烯(PIB,分子量大于100,000道尔顿)将占据10%的市场份额,主要用于口香糖基料、医疗设备和特种密封剂等需要无味、无毒和高阻隔性能的特定应用领域。製造流程的进步提高了产量并增强了耐热性,从而拓展了其在医疗和食品级应用领域的应用范围。

预计到2025年,北美聚异丁烯市场将占全球市场份额的33%,这主要得益于汽车行业的强劲发展、高反应性聚异丁烯的充足供应以及完善的添加剂生产商网络。美国凭藉其一体化的石化联合企业和丰富的原料供应,仍然是主要的产能来源地;而加拿大的汽车和润滑油产业则为区域供应链和下游应用提供了补充。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依产品类型分類的市场规模及预测(2022-2035年)

- 传统聚异丁烯(C-PIB)

- 高反应性聚异丁烯(HR-PIB)

第六章 以分子量分類的市场规模及预测(2022-2035年)

- 低分子量聚异丁烯二酚(平均分子量<5,000道尔顿)

- 中等分子量聚异丁烯二酚(平均分子量 40,000-100,000 道尔顿)

- 高分子量聚异丁烯 (Mn>100,000 Da)

第七章 依应用领域分類的市场规模及预测(2022-2035年)

- 润滑油添加剂

- 燃油添加剂

- 黏合剂和密封剂

- 轮胎和橡胶製品

- 电气绝缘

- 个人护理及化妆品

- 食品接触应用

- 拉伸膜/包装

- 其他的

第八章 依等级分類的市场规模及预测,2022-2035年

- 食品级聚异丁基 ...

- 化妆品级聚异丁基 ...

- 医药级PIB

- 其他的

第九章 2022-2035年各地区市场规模及预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第十章:公司简介

- Braskem

- RB Products

- TPC Group

- Lanxess

- Infineum International

- Kothari Petrochemicals

- Janex

- ExxonMobil Corporation

- Berkshire Hathaway

- Lubrizol

- Chevron Oronite Company

- Mayzo

The Global Polyisobutylene Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 3.5% to reach USD 4.1 billion by 2035.

The growth is driven by increasing safety and quality standards in industries such as food contact and personal care, which encourage the adoption of compliant PIB grades. Regulatory approvals, including those by the U.S. FDA, allow PIB in food-contact adhesives and coatings, with specific minimum number-average molecular weight thresholds to ensure safety. Cosmetic and hydrogenated PIB grades provide stability and skin compatibility for emollients and film-forming applications, supporting premium pricing in niche markets. The expansion of infrastructure in emerging regions fuels demand for adhesives, sealants, and glazing solutions, where PIB's tack, flexibility, chemical resistance, and extremely low moisture vapor transmission are highly valued. Additionally, sustainability trends and regulatory tightening are encouraging the development of bio-based PIB and cleaner production processes, while evolving compliance frameworks are directing R&D toward lower-impact catalysts and environmentally friendly feedstocks.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 3.5% |

The conventional PIB (C-PIB) segment held 44% share in 2025, owing to its extensive use in adhesives, sealants, industrial oils, chewing gum bases, and coatings. Demand for C-PIB closely follows construction and packaging sectors that rely on its flexibility, tack, and moisture barrier properties. Market prices for C-PIB typically range from USD 0.8-1.5 per kilogram, depending on molecular weight and purity, with major producers such as TPC Group, BASF, and INEOS maintaining strong supply positions.

The high-molecular-weight PIB (>100,000 Da) segment accounted for 10% share in 2025, serving niche applications like chewing gum bases, medical devices, and specialized sealants that require tastelessness, non-toxicity, and high barrier strength. Advances in production processes have increased yields and expanded temperature tolerance, broadening the application spectrum for medical and food-grade uses.

North America Polyisobutylene Market held 33% share in 2025, driven by a concentration of automotive hubs, strong merchant high-reactivity PIB supply, and a robust network of additive formulators. The U.S. remains a key contributor to production capacity, supported by integrated petrochemical complexes and abundant feedstocks, while Canada's automotive and lubricant sectors complement regional supply and downstream applications.

Key players in the Global Polyisobutylene Market include TPC Group, Braskem SA, Lanxess, RB Products, Infineum International Ltd, Kothari Petrochemicals, Janex, ExxonMobil Corporation, Berkshire Hathaway, Lubrizol, Chevron Oronite Company, and Mayzo. To strengthen their presence, companies in the Polyisobutylene Market focus on several strategic approaches. They invest heavily in process optimization and R&D to enhance product quality, expand molecular weight ranges, and develop bio-based and sustainable grades. Strategic collaborations and partnerships allow for technology sharing, faster commercialization, and access to new regional markets. Firms also pursue capacity expansions in key geographies, particularly near high-demand industrial hubs, ensuring reliable supply chains. Additionally, regulatory compliance and certifications are emphasized to support entry into food, cosmetic, and medical applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Molecular weight

- 2.2.3 Grade

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Conventional polyisobutylene (C-PIB)

- 5.3 Highly reactive polyisobutylene (HR-PIB)

Chapter 6 Market Size and Forecast, By Molecular Weight, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Low molecular weight PIB (Mn < 5,000 Da)

- 6.3 Medium molecular weight PIB (Mn 40,000-100,000 Da)

- 6.4 High molecular weight PIB (Mn > 100,000 Da)

Chapter 7 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Lubricant additives

- 7.3 Fuel additives

- 7.4 Adhesives & sealants

- 7.5 Tires & rubber products

- 7.6 Electrical insulation

- 7.7 Personal care & cosmetics

- 7.8 Food contact applications

- 7.9 Stretch films & packaging

- 7.10 Others

Chapter 8 Market Size and Forecast, By Grade, 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Food-grade PIB

- 8.3 Cosmetic-grade PIB

- 8.4 Pharmaceutical-grade PIB

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Braskem

- 10.2 RB Products

- 10.3 TPC Group

- 10.4 Lanxess

- 10.5 Infineum International

- 10.6 Kothari Petrochemicals

- 10.7 Janex

- 10.8 ExxonMobil Corporation

- 10.9 Berkshire Hathaway

- 10.10 Lubrizol

- 10.11 Chevron Oronite Company

- 10.12 Mayzo