|

市场调查报告书

商品编码

1913423

双轴延伸聚丙烯市场成长机会、成长要素、产业趋势分析及2026年至2035年预测Biaxially Oriented Polypropylene (BOPP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

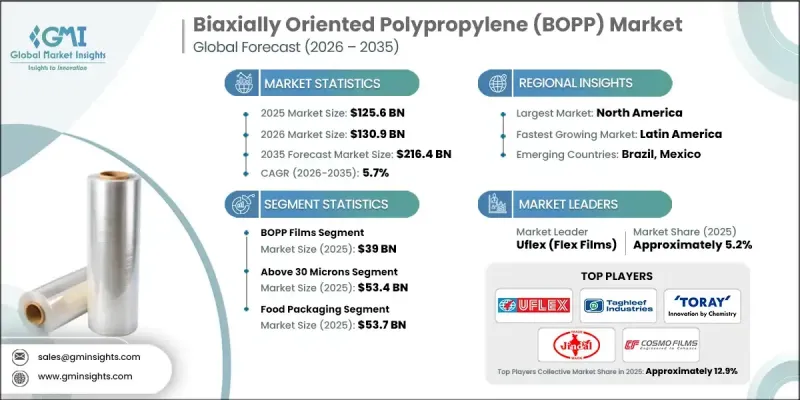

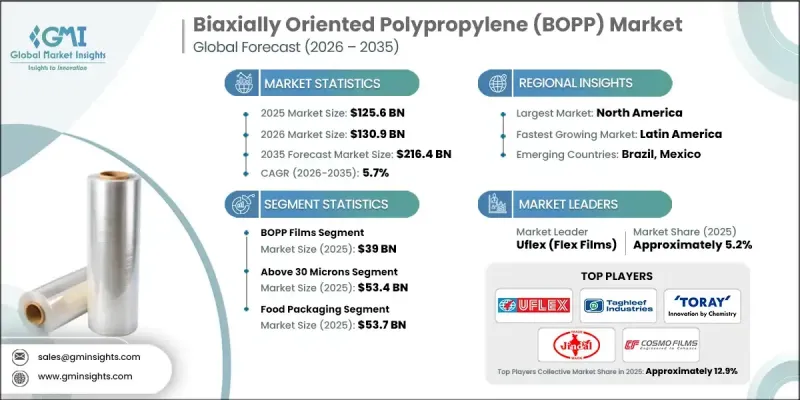

全球双轴延伸聚丙烯(BOPP) 市场预计到 2025 年将达到 1,256 亿美元,到 2035 年将达到 2,164 亿美元,年复合成长率为 5.7%。

受对柔性包装需求不断增长的推动,尤其是食品饮料包装行业的需求,市场持续成长。消费者生活方式的改变以及对便利、保质期长的产品的偏好日益增强,促使消费者更加依赖兼具耐用性、透明度和优异阻隔性能的包装材料,从而推动了双向拉伸聚丙烯(BOPP)解决方案的持续普及。製造商正在扩大生产规模并改进薄膜性能,以满足不断变化的包装需求,从而促进成熟市场和新兴市场的成长。除包装领域外,BOPP在标籤和复合应用领域的日益广泛应用也提振了市场需求,其光学透明度、机械强度和印刷适性使其成为高端品牌和装饰性包装的理想选择。不断增长的线上零售活动进一步推动了对轻质、柔软性和防护性包装材料的需求,从而推动了市场的长期成长势头。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1256亿美元 |

| 预测金额 | 2164亿美元 |

| 复合年增长率 | 5.7% |

预计2025年,双向拉伸聚丙烯薄膜(BOPP)市场规模将达390亿美元,2026年至2035年的复合年增长率(CAGR)为7%。製造商正在拓展产品线,涵盖片材、涂层产品和特殊薄膜,以满足多样化的功能和视觉需求。同时,工业应用领域对耐用且适应性强的材料的需求持续成长。

预计到2025年,食品包装市场规模将达到537亿美元(占42.7%的市场份额),并在2035年之前以5.6%的复合年增长率成长。由于双向拉伸聚丙烯薄膜(BOPP)在延长产品保鲜期和维持产品品质方面发挥重要作用,食品包装市场仍是BOPP最大的消费市场。个人护理、医药和工业包装应用领域的额外需求也持续推动整体市场扩张。

预计到 2025 年,北美双轴延伸聚丙烯(BOPP) 市场规模将达到 380 亿美元。该地区的需求成长主要得益于食品、饮料和个人护理行业对柔性包装的强劲需求,以及对可回收、高性能薄膜解决方案日益增长的兴趣,而这些解决方案又得到了先进製造和物流能力的支持。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 双向拉伸聚丙烯薄膜

- BOPP片材和板材

- BOPP涂层产品

- 双向拉伸聚丙烯(BOPP)层压板

- 双向拉伸聚丙烯(BOPP)技术薄膜

- 双向拉伸聚丙烯(BOPP)工业应用

- 其他BOPP特种产品

第六章 依厚度分類的市场估计与预测,2022-2035年

- 小于15微米

- 15-30微米

- 30微米或以上

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 食品包装

- 零嘴零食和糖果甜点

- 烘焙产品

- 冷冻食品

- 饮料包装

- 瓶装水标籤

- 软性饮料标籤

- 个人护理及化妆品

- 洗髮精和润肤露标籤

- 化妆品包装纸

- 药品包装

- 泡壳包装

- 药品标籤

- 工业包装

- 电绝缘材料

- 层压板

- 标籤和胶带

- 感压标籤

- 胶带

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- Taghleef Industries

- Jindal Poly Films

- Cosmo Films

- Uflex(Flex Films)

- Toray Industries

- Polyplex Corporation

- Innovia Films

- SRF Limited

- Treofan Group

- Oben Holding Group

- CCL Industries

- Nan Ya Plastics Corporation

The Global Biaxially Oriented Polypropylene (BOPP) Market was valued at USD 125.6 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 216.4 billion by 2035.

The market continues to expand as demand for flexible packaging accelerates, particularly across packaged food and beverage categories. Changing consumer lifestyles and preferences for convenient, shelf-stable products have increased reliance on packaging materials that deliver durability, clarity, and strong barrier performance, which supports consistent adoption of BOPP solutions. Producers are scaling output and refining film properties to align with evolving packaging expectations, supporting growth across both mature and developing economies. Beyond packaging, rising utilization of BOPP in labeling and lamination applications is strengthening demand, as its optical clarity, mechanical strength, and print compatibility make it well-suited for premium branding and decorative packaging. Expanding online retail activity has further increased the need for lightweight, flexible, and protective packaging materials, reinforcing long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $125.6 Billion |

| Forecast Value | $216.4 Billion |

| CAGR | 5.7% |

The BOPP films segment generated USD 39 billion in 2025 and is expected to grow at a CAGR of 7% from 2026 to 2035. Manufacturers are broadening offerings across sheets, coated formats, and specialty films to meet varied functional and visual requirements, while industrial usage continues to increase due to the need for resilient and adaptable materials.

The food packaging segment accounted for USD 53.7 billion in 2025, representing a 42.7% share, and is projected to grow at a CAGR of 5.6% through 2035. This segment remains the largest consumer of BOPP due to its role in extending product freshness and maintaining quality. Additional demand from personal care, pharmaceutical, and industrial packaging applications continues to support overall market expansion.

North America Biaxially Oriented Polypropylene (BOPP) Market recorded USD 38 billion in 2025. Regional demand is driven by strong consumption of flexible packaging across food, beverage, and personal care industries, along with a rising focus on recyclable and high-performance film solutions supported by advanced manufacturing and logistics capabilities.

Key companies active in the Global Biaxially Oriented Polypropylene Market include Jindal Poly Films, Toray Industries, Taghleef Industries, Cosmo Films, Uflex (Flex Films), and other global and regional producers. Companies in the Global Biaxially Oriented Polypropylene (BOPP) Market are strengthening their market position through capacity expansions, product innovation, and sustainability-driven initiatives. Manufacturers are investing in advanced film technologies to enhance barrier properties, print quality, and recyclability to align with brand owner requirements. Strategic partnerships with packaging converters and end-use industries help secure long-term demand and accelerate customized product development. Firms are also optimizing supply chains and expanding regional manufacturing footprints to improve responsiveness and cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Thickness

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 BOPP films

- 5.3 BOPP sheets & boards

- 5.4 BOPP coated products

- 5.5 BOPP laminates

- 5.6 BOPP technical films

- 5.7 BOPP industrial applications

- 5.8 Other BOPP specialty products

Chapter 6 Market Estimates and Forecast, By Thickness, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Below 15 microns

- 6.3 15-30 microns

- 6.4 Above 30 microns

Chapter 7 Market Estimates and Forecast, By Application, 2022- 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Food packaging

- 7.2.1 Snacks & confectionery

- 7.2.2 Bakery products

- 7.2.3 Frozen foods

- 7.3 Beverage packaging

- 7.3.1 Bottled water labels

- 7.3.2 Soft drink labels

- 7.4 Personal care & cosmetics

- 7.4.1 Shampoo & lotion labels

- 7.4.2 Cosmetic wrappers

- 7.5 Pharmaceutical packaging

- 7.5.1 Blister packs

- 7.5.2 Medicine labels

- 7.6 Industrial packaging

- 7.6.1 Electrical insulation

- 7.6.2 Laminates

- 7.7 Labels & tapes

- 7.7.1 Pressure-sensitive labels

- 7.7.2 Adhesive tapes

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Taghleef Industries

- 9.2 Jindal Poly Films

- 9.3 Cosmo Films

- 9.4 Uflex (Flex Films)

- 9.5 Toray Industries

- 9.6 Polyplex Corporation

- 9.7 Innovia Films

- 9.8 SRF Limited

- 9.9 Treofan Group

- 9.10 Oben Holding Group

- 9.11 CCL Industries

- 9.12 Nan Ya Plastics Corporation