|

市场调查报告书

商品编码

1913424

仲磺酸盐市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Secondary Alkane Sulfonate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

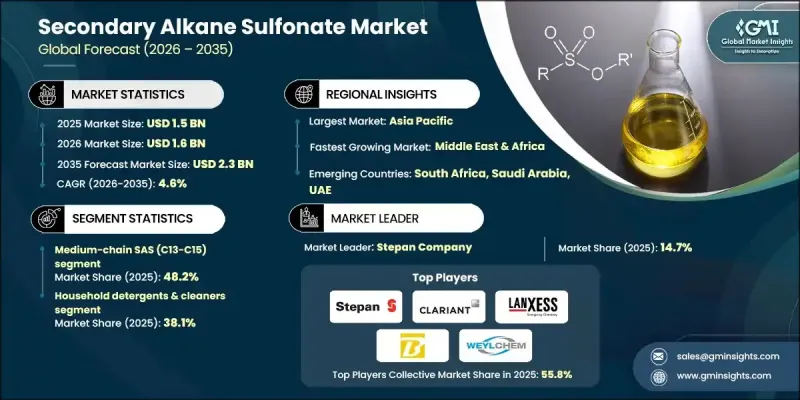

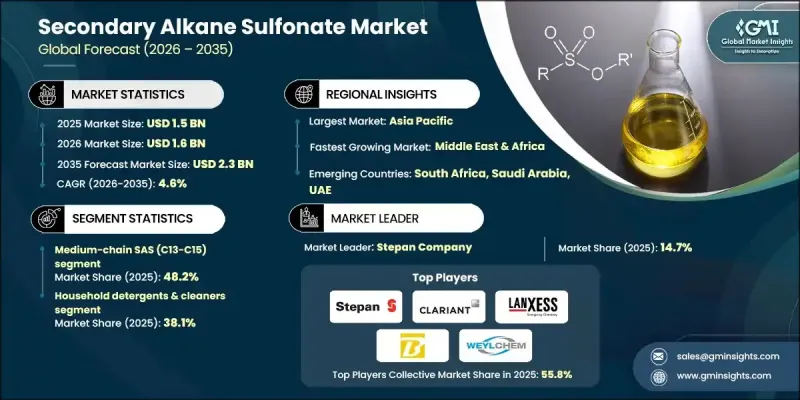

全球仲烷磺酸盐市场预计到 2025 年将达到 15 亿美元,到 2035 年将达到 23 亿美元,年复合成长率为 4.6%。

磺酸盐是一类合成阴离子界面活性剂,以其优异的发泡、乳化性和清洁性而闻名,广泛应用于清洁剂和其他清洁产品。其环境永续特性,例如可生物降解性,符合消费者日益增长的需求以及对环保清洁产品的监管要求。人们对永续产品的日益关注以及对不可生物降解表面活性剂的监管压力,正在推动二级烷基磺酸钠市场的进一步扩张。同时,中东和非洲地区正崛起为成长最快的地区,受益于都市化、可支配收入的增加以及对高端清洁产品需求的成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 15亿美元 |

| 预测金额 | 23亿美元 |

| 复合年增长率 | 4.6% |

预计到 2025 年,中链 SAS(C13-C15)将占市场份额的 48.2%,到 2035 年将以 4.7% 的复合年增长率增长。这些中链变体因其在生物降解性、性能和成本效益方面的出色平衡而备受青睐,在个人护理和清洁应用中均能提供可靠的效果。

到 2025 年,家用清洁剂和清洁剂市场份额将达到 38.1%。其主导地位得益于都市化加快、消费者对永续产品的偏好以及鼓励环保配方创新的法规不断加强。

预计从 2026 年到 2035 年,北美仲磺酸盐市场将以 4.6% 的复合年增长率成长。意识提升对永续解决方案的意识不断提高,以及化学品回收和减少废弃物的趋势,正在推动家用和工业清洁领域对环保表面活性剂的需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 对可生物降解界面活性剂的需求不断增长

- 家庭和个人护理行业的成长

- 在硬水环境下表现出色

- 产业潜在风险与挑战

- 原物料价格波动

- 与其他界面活性剂的竞争

- 市场机会

- 利用可再生原料开发生物基SAS

- 开发新兴应用

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 短链 SAS(C10-C12)

- 中链 SAS(C13-C15)

- 长链SAS(C16-C18)

第六章 按应用领域分類的市场估算与预测,2022-2035年

- 个人保健产品

- 洗髮精和护髮产品

- 沐浴凝胶和沐浴啫咖哩

- 洗手剂液

- 洗面乳

- 牙膏

- 其他的

- 家用清洁剂和清洁剂

- 清洁剂

- 液体清洁剂

- 多用途清洁剂

- 卫生和浴室清洁剂

- 地板清洁剂

- 其他的

- 工业和机构 (I&I) 清洁

- 金属清洁剂

- 汽车清洁剂

- 食品加工洗涤剂

- 医用清洁剂

- 其他的

- 纺织皮革加工

- 纺织品染色和整理

- 皮革鞣製和染色

- 其他的

- 其他的

第七章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第八章 公司简介

- BIG SUN Chemical Corporation

- Clariant AG

- LANXESS AG

- SC Johnson &Son

- Shaoxing Shangyu Simo Research Institute of Organic Chemistry

- Stepan Company

- WeylChem Performance Products GmbH

- Others

The Global Secondary Alkane Sulfonate Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 2.3 billion by 2035.

Secondary alkane sulfonates are synthetic anionic surfactants known for their exceptional foaming, emulsifying, and cleaning capabilities, making them widely used in detergents and other cleaning formulations. They are environmentally sustainable, being biodegradable, which aligns with increasing consumer demand and regulatory mandates for eco-friendly cleaning solutions. Rising awareness of sustainable products, coupled with regulatory pressures against non-biodegradable surfactants, is driving further expansion in the Secondary Alkane Sulfonate Market. Meanwhile, the Middle East and Africa are emerging as the fastest-growing regions, benefiting from urbanization, higher disposable incomes, and rising demand for premium cleaning products.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 billion |

| Forecast Value | $2.3 billion |

| CAGR | 4.6% |

The medium-chain SAS (C13-C15) accounted for 48.2% share in 2025 and is expected to grow at a CAGR of 4.7% through 2035. These medium-chain variants are favored for their balance of biodegradability, performance, and cost efficiency, delivering reliable results in both personal care and cleaning applications.

The household detergents and cleaners segment held 38.1% share in 2025. Their dominance is fueled by growing urbanization, consumer preference for sustainable products, and stricter regulations driving innovations in eco-friendly formulations.

North America Secondary Alkane Sulfonate Market is expected to grow at a CAGR of 4.6% from 2026 to 2035. Increased consumer awareness of sustainable solutions, alongside trends in chemical recycling and waste reduction, is propelling demand for environmentally friendly surfactants across both household and industrial cleaning sectors.

Key companies in the Global Secondary Alkane Sulfonate Market include BIG SUN Chemical Corporation, Clariant AG, LANXESS AG, S.C. Johnson & Son, Shaoxing Shangyu Simo Research Institute of Organic Chemistry, Stepan Company, WeylChem Performance Products GmbH, among others. Leading players in the Global Secondary Alkane Sulfonate Market are adopting strategies to strengthen their presence by focusing on product innovation, expanding production capacities, and enhancing R&D for sustainable surfactant solutions. Companies are forming strategic partnerships, acquiring regional manufacturers, and leveraging technological advancements to improve efficiency and reduce environmental impact. Marketing initiatives emphasizing biodegradability and regulatory compliance help brands differentiate their offerings, while geographic expansion into high-growth regions ensures access to new consumer bases and industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biodegradable surfactants

- 3.2.1.2 Growth in household & personal care industries

- 3.2.1.3 Superior performance in hard water conditions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 Competition from alternative surfactants

- 3.2.3 Market opportunities

- 3.2.3.1 Development of bio-based SAS from renewable feedstocks

- 3.2.3.2 Emerging applications development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Short-chain SAS (C10-C12)

- 5.3 Medium-chain SAS (C13-C15)

- 5.4 Long-chain SAS (C16-C18)

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Personal care products

- 6.2.1 Shampoos & hair care

- 6.2.2 Shower gels & body washes

- 6.2.3 Liquid hand soaps

- 6.2.4 Facial cleansers

- 6.2.5 Toothpastes

- 6.2.6 Others

- 6.3 Household detergents & cleaners

- 6.3.1 Dishwashing liquids

- 6.3.2 Liquid laundry detergents

- 6.3.3 All-purpose cleaners

- 6.3.4 Sanitary & bathroom cleaners

- 6.3.5 Floor cleaners

- 6.3.6 Others

- 6.4 Industrial & institutional (i&i) cleaning

- 6.4.1 Metal cleaners

- 6.4.2 Automotive cleaners

- 6.4.3 Food processing cleaners

- 6.4.4 Healthcare disinfectant cleaners

- 6.4.5 Others

- 6.5 Textile & leather processing

- 6.5.1 Textile dyeing & finishing

- 6.5.2 Leather tanning & dyeing

- 6.5.3 Others

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 BIG SUN Chemical Corporation

- 8.2 Clariant AG

- 8.3 LANXESS AG

- 8.4 S.C. Johnson & Son

- 8.5 Shaoxing Shangyu Simo Research Institute of Organic Chemistry

- 8.6 Stepan Company

- 8.7 WeylChem Performance Products GmbH

- 8.8 Others