|

市场调查报告书

商品编码

1913427

压敏黏着剂市场机会、成长要素、产业趋势分析及2026年至2035年预测Pressure Sensitive Adhesives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

全球压敏黏着剂市场预计到 2025 年将达到 99 亿美元,到 2035 年将达到 177 亿美元,年复合成长率为 6%。

在包装、电子商务、汽车、电子和医疗等行业需求不断增长的推动下,市场持续稳定成长。压敏黏着剂无需固化、加热或额外加工时间,即可实现快速、清洁、高效的黏合,使其成为现代製造和物流趋势的理想之选,这些趋势强调轻量化设计、自动化和操作柔软性。 2021年至2024年的成长将主要得益于小包裹量的激增,尤其是电子商务的扩张和全球供应链需求的推动,宅配胶带和标籤在亚洲、北美和欧洲的普及率将保持在较高水准。欧洲和北美的监管变化(例如,VOC和溶剂限制)正在加速向水性、热熔、丙烯酸和生物基化学品的转变,这些化学品有助于实现永续性和可回收性。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 99亿美元 |

| 预测金额 | 177亿美元 |

| 复合年增长率 | 6% |

预计到2025年,水性黏合剂(PSA)市占率将达到46%,并在2035年之前以5.7%的复合年增长率成长。随着加工商和品牌所有者优先考虑更清洁的解决方案、更快的加工速度和更高的能源效率,水性和热熔技术的应用正在增加。北美和欧洲的监管压力持续推动从传统溶剂型系统向水性系统的转型。紫外光固化胶也因其在高温条件下需要快速固化和精确涂覆的特殊应用而日益普及。

预计到2025年,胶带市占率将达到46.3%,并在2035年之前以4.6%的复合年增长率成长。胶带和标籤主要应用于包装、物流、汽车和建筑业,而图形、薄膜和层压板等高价值细分市场则满足高端需求。品牌拥有者对能够黏附于低能耗塑胶、涂层薄膜和再生材料的压敏黏着剂(PSA)的需求日益增长,从而推动了对特种胶带、安全标籤、保护膜和表面保护层压板的需求。

预计到2024年,北美压敏黏着剂市场规模将达24亿美元,到2034年将达到44亿美元,年复合成长率(CAGR)为6.1%。美国仍然是该地区的核心市场,其成长主要得益于先进製造业、电子商务物流、医疗耗材以及高性能汽车和电子胶带等行业的需求。全球领先的黏合剂製造商和本地加工商正在向永续的低VOC(挥发性有机化合物)技术转型,以满足日益增长的监管和消费者需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 电子商务中包装和标籤用量增加

- 转向轻量化和模组化产品设计

- 更严格的挥发性有机化合物 (VOC) 法规有利于低排放化学品。

- 产业潜在风险与挑战

- 原物料价格波动与供应风险

- 回收、衬垫废弃物和报废产品问题

- 市场机会

- 医疗、卫生和穿戴式装置的扩展

- 亚太地区的电动车和电子产品小型化

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)

(註:贸易统计数据仅涵盖主要国家。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 按技术分類的市场估算与预测,2022-2035年

- 水性涂料

- 丙烯酸乳液

- 醋酸乙烯酯

- 其他的

- 溶剂型

- 丙烯酸溶剂型

- 橡胶基溶剂型

- 其他的

- 热熔胶

- 苯乙烯嵌段共聚物(SBC)

- 乙烯-醋酸乙烯酯共聚物(EVA)

- 聚烯

- 其他的

第六章 2022-2035年按产品分類的市场估算与预测

- 橡皮

- 丙烯酸纤维

- 硅酮

- 其他的

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 磁带

- 包装胶带

- 遮蔽胶带

- 双面胶带

- 医用胶带

- 电工胶带

- 其他的

- 标籤

- 产品标籤

- 条码标籤

- 安全标籤

- 其他的

- 形象的

- 招牌

- 车身贴膜

- 墙面图案

- 地面图案

- 其他的

- 薄膜和层压材料

- 保护膜

- 装饰膜

- 窗膜

- 其他的

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第九章:公司简介

- Wacker Chemie AG

- Evonik Industries AG

- Franklin International, Inc.

- Momentive Performance Materials Inc.

- LG Chem Ltd.

- Beardow Adams(Adhesives)Limited

- 3M Company

- Henkel AG &Co. KGaA

- Avery Dennison Corporation

- HB Fuller Company

- Arkema SA(Bostik)

- Dow Inc.

- BASF SE

- Sika AG

- Ashland Inc.

- Mactac LLC

- Toyo Ink SC Holdings Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Illinois Tool Works Inc.(ITW)

- Sun Chemical Corporation

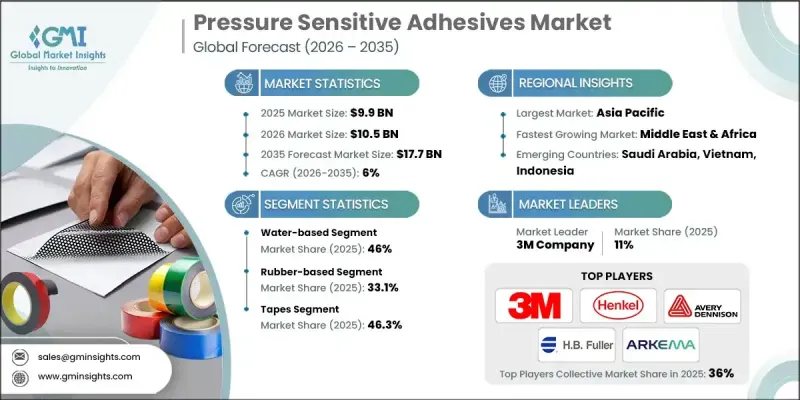

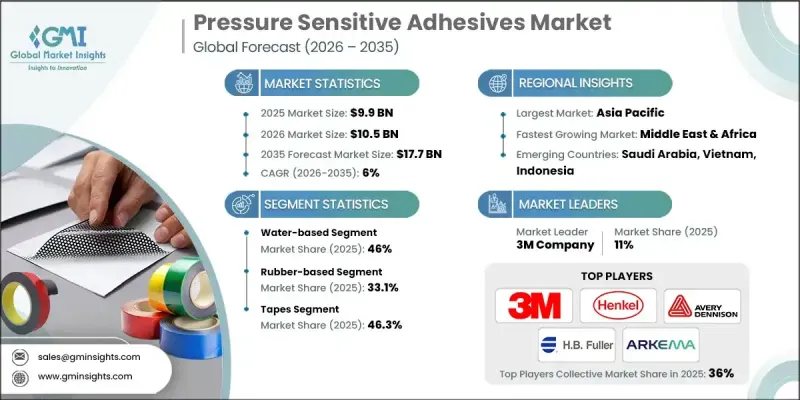

The Global Pressure Sensitive Adhesives Market was valued at USD 9.9 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 17.7 billion by 2035.

The market has steadily grown alongside rising demand in packaging, e-commerce, automotive, electronics, and healthcare applications. Pressure-sensitive adhesives provide fast, clean, and efficient bonding without requiring curing, heat, or additional processing time, making them ideal for modern manufacturing and logistics trends emphasizing lightweight design, automation, and operational flexibility. Growth from 2021 to 2024 was particularly driven by surging parcel volumes fueled by e-commerce expansion and global supply chain demands, with courier tapes and labels maintaining high adoption across Asia, North America, and Europe. Regulatory shifts in Europe and North America, including VOC and solvent restrictions, have accelerated the transition from traditional solvent-based PSAs to water-based, hot-melt, acrylic, and bio-based chemistries that support sustainability and recyclability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.9 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 6% |

The water-based PSA segment accounted for 46% share in 2025 and is expected to grow at a CAGR of 5.7% through 2035. Adoption of water-based and hot-melt technologies is rising as converters and brand owners prioritize cleaner solutions, faster processing, and energy efficiency. Regulatory pressure in North America and Europe continues to encourage a shift away from traditional solvent-based systems. UV-cured chemistries are also gaining traction for specialized applications requiring rapid curing and precise coating under high-temperature conditions.

The tapes segment held a 46.3% in 2025 and is forecast to grow at a CAGR of 4.6% through 2035. Tapes and labels lead usage primarily in packaging, logistics, automotive, and construction, while high-value segments like graphics, films, and laminates cater to premium demands. Brand owners increasingly require PSAs capable of adhering to low-energy plastics, coated films, and recycled materials, driving the demand for specialty tapes, security labels, protective films, and surface-protectant laminates.

North America Pressure Sensitive Adhesives Market generated USD 2.4 billion in 2024 and is estimated to reach USD 4.4 billion by 2034, growing at a CAGR of 6.1%. The U.S. remains the central market in the region, supported by advanced manufacturing, e-commerce logistics, healthcare consumables, and high-performance automotive and electronics tapes. Both global adhesive majors and regional converters are transitioning toward sustainable, low-VOC technologies to meet growing regulatory and consumer demands.

Key players operating in the Global Pressure Sensitive Adhesives Market include Wacker Chemie AG, Evonik Industries AG, Franklin International, Inc., Momentive Performance Materials Inc., LG Chem Ltd., Beardow Adams (Adhesives) Limited, 3M Company, Henkel AG & Co. KGaA, Avery Dennison Corporation, H.B. Fuller Company, Arkema S.A. (Bostik), Dow Inc., BASF SE, Sika AG, Ashland Inc., Mactac LLC, Toyo Ink SC Holdings Co., Ltd., Nippon Paint Holdings Co., Ltd., Illinois Tool Works Inc. (ITW), and Sun Chemical Corporation. Companies in the Global Pressure Sensitive Adhesives Market are employing multiple strategies to strengthen their presence and market position. They focus heavily on research and development to introduce innovative, sustainable, and high-performance adhesive solutions. Geographic expansion into emerging markets allows firms to access growing industrial and e-commerce sectors. Strategic partnerships with converters, packaging companies, and industrial manufacturers enhance distribution channels and product adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Product

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce packaging and labeling volumes

- 3.2.1.2 Shift toward lightweight, modular product designs

- 3.2.1.3 Stricter VOC rules favor low-emission chemistries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility and supply risks

- 3.2.2.2 Recycling, liner waste and end-of-life issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of medical, hygiene and wearable devices

- 3.2.3.2 EVs and electronics miniaturization in Asia Pacific

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Water-based

- 5.2.1 Acrylic emulsion

- 5.2.2 Vinyl acetate-based

- 5.2.3 Others

- 5.3 Solvent-based

- 5.3.1 Acrylic solvent-based

- 5.3.2 Rubber solvent-based

- 5.3.3 Others

- 5.4 Hot melt

- 5.4.1 Styrenic block copolymers (SBC)

- 5.4.2 Ethylene vinyl acetate (EVA)

- 5.4.3 Polyolefin-based

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Rubber-based

- 6.3 Acrylic

- 6.4 Silicone

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tapes

- 7.2.1 Packaging tapes

- 7.2.2 Masking tapes

- 7.2.3 Double-sided tapes

- 7.2.4 Medical tapes

- 7.2.5 Electrical tapes

- 7.2.6 Others

- 7.3 Labels

- 7.3.1 Product labels

- 7.3.2 Barcode labels

- 7.3.3 Security labels

- 7.3.4 Others

- 7.4 Graphics

- 7.4.1 Signage

- 7.4.2 Vehicle wraps

- 7.4.3 Wall graphics

- 7.4.4 Floor graphics

- 7.4.5 Others

- 7.5 Films & laminates

- 7.5.1 Protective films

- 7.5.2 Decorative films

- 7.5.3 Window films

- 7.5.4 Others

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Wacker Chemie AG

- 9.2 Evonik Industries AG

- 9.3 Franklin International, Inc.

- 9.4 Momentive Performance Materials Inc.

- 9.5 LG Chem Ltd.

- 9.6 Beardow Adams (Adhesives) Limited

- 9.7 3M Company

- 9.8 Henkel AG & Co. KGaA

- 9.9 Avery Dennison Corporation

- 9.10 H.B. Fuller Company

- 9.11 Arkema S.A. (Bostik)

- 9.12 Dow Inc.

- 9.13 BASF SE

- 9.14 Sika AG

- 9.15 Ashland Inc.

- 9.16 Mactac LLC

- 9.17 Toyo Ink SC Holdings Co., Ltd.

- 9.18 Nippon Paint Holdings Co., Ltd.

- 9.19 Illinois Tool Works Inc. (ITW)

- 9.20 Sun Chemical Corporation