|

市场调查报告书

商品编码

1913430

智慧卡市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Smart Card Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

全球智慧卡市场预计到 2025 年将达到 652 亿美元,到 2035 年将达到 1,228 亿美元,年复合成长率为 6.3%。

智慧卡彻底改变了支付方式,取代了传统的磁条卡和接触式卡,实现了非接触式交易。除了付款之外,智慧卡还透过储存预先註册的使用者资料进行身份验证,从而革新了安全应用,帮助机构检验对建筑物、电脑系统和其他安全区域的存取权限。智慧卡的应用已扩展到医疗保健、政府和交通运输等领域,提供诸如医疗记录追踪、电子旅行登记和安全识别等功能。在美国,预计到2023年,非接触式交易量将超过170亿笔,随着消费者越来越倾向于使用数位支付方式而非现金,这一数字也将继续增长。在那些安全存取和无缝数位互动至关重要的行业,智慧卡技术的应用至关重要。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 652亿美元 |

| 预测金额 | 1228亿美元 |

| 复合年增长率 | 6.3% |

预计到2025年,智慧卡市占率将达到66.5%。智能卡已成为数位存取的基础,并在银行、金融、政府和安全等领域中广泛应用。主要分销合作伙伴透过提供多功能智慧卡,正推动着市场成长。

受全球智慧型手机用户数量不断增长的推动,预计到2025年,电信业的市场规模将达到282亿美元。到2025年底,全球将有超过60亿人上网,显示该产业的影响力巨大。

预计2025年,美国智慧卡市场规模将达到121亿美元。美国在智慧卡应用方面处于全球领先地位,联邦政府机构正利用这项技术进行身份验证、安全身份核查和非接触式应用。政府专案采用智慧卡体现了美国对安全和数位转型的重视。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 对非接触式支付解决方案的需求不断增长

- 政府数位化倡议与电子管治项目

- 在新兴市场拓展银行服务

- 在交通运输和旅游领域不断拓展应用

- 产业潜在风险与挑战

- 来自行动支付和数位钱包解决方案的竞争日益加剧

- 卡片使用寿命短,更换成本高

- 市场机会

- 开发永续且环保的卡片材料

- 升级忠诚度计画和多用途卡

- 电信和SIM卡应用领域的成长

- 智慧城市与城市基础建设发展

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 美国资讯处理标准(FIPS)

- 加拿大个人资讯保护与电子文件法

- 欧洲

- 一般资料保护规则(GDPR)

- 德国电子身分证(eID)法规

- 法国Carte Vital健康保险智慧卡标准

- 英国生物识别居住许可(BRP)

- 亚太地区

- 中国居民身分证(电子身分证)法

- 关于日本个人号码卡系统的相关规定

- 印度的 Aadhaar 验证和 eKYC 法规

- 拉丁美洲

- 巴西PIX即时支付系统的安全要求

- 墨西哥CURP电子识别标准

- 中东和非洲

- 阿拉伯联合大公国(阿联酋)ID卡系统条例

- 沙乌地阿拉伯国民身分证(Abshah)智慧卡框架

- 南非智能ID卡法案(1997 年)

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 永续性和环境影响

- 环境影响评估

- 社会影响力和社区服务

- 公司管治与企业社会责任

- 永续金融与投资趋势

- 产业采用模式

- 银行业及金融服务业的采用

- 政府和公共部门采用

- 交通运输和出行领域的趋势

- 医疗领域采用的驱动因素

- 通讯业使用模式

- 未来前景与机会

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 智慧卡

- 介面

- 询问

- 非接触式

- 相容NFC

- 基于RFID的

- 双介面

- 尖端

- 记忆卡

- 微处理器卡

- 介面

- 智慧卡读卡器

- 介面

- 联繫类型

- 非接触式

- 双介面

- 成分

- 硬体

- 软体

- 服务

- 介面

第六章 依功能分類的市场估计与预测,2022-2035年

- 交易

- 沟通

- 安全和存取控制

- 其他的

第七章 按应用领域分類的市场估算与预测,2022-2035年

- BFSI

- 沟通

- 政府和医疗领域

- 零售与电子商务

- 运输

- 媒体与娱乐

- 教育和学术机构

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ANZ

- 新加坡

- 马来西亚

- 印尼

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第九章:公司简介

- 世界公司

- Thales

- IDEMIA

- Giesecke+Devrient

- NXP Semiconductors

- Infineon

- STMicroelectronics

- CPI Card

- HID Global

- Watchdata

- Eastcompeace

- Samsung Electronics

- Valid

- Ingenico

- Hengbao

- 本地公司

- Linxens

- Paragon ID

- Perfect Plastic Printing

- Identiv

- VeriFone

- SecureID

- CardLogix

- Bartronics

- 新兴企业

- Kona I

- BrilliantTS

- Goldpac

- Wuhan Tianyu Information Industry

- Feitian

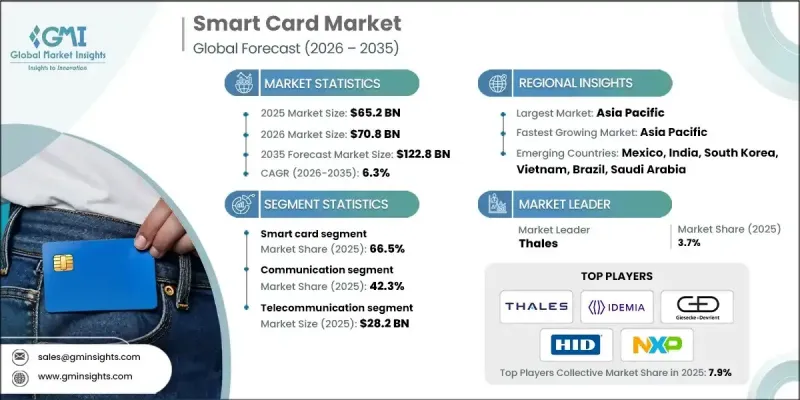

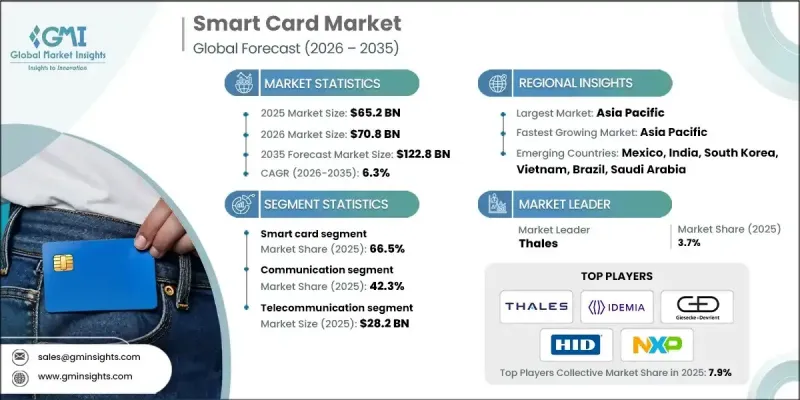

The Global Smart Card Market was valued at USD 65.2 billion in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 122.8 billion by 2035.

Smart cards have revolutionized payment methods, enabling users to conduct transactions through contactless interfaces instead of traditional magnetic stripe or contract cards. Beyond payments, smart cards have transformed security applications by storing preloaded user data for authentication purposes, helping organizations validate access to buildings, computer systems, and other secured areas. Their use has expanded across healthcare, government, and transportation sectors, providing functionalities such as medical record tracking, electronic passenger lists, and secure identification. In the U.S., contactless transactions have exceeded 17 billion by 2023 and continue to grow as consumers increasingly prefer digital payment methods over cash. The adoption of smart card technology has become critical in sectors where secure access and seamless digital interaction are essential.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $65.2 Billion |

| Forecast Value | $122.8 Billion |

| CAGR | 6.3% |

The smart cards segment held a 66.5% share in 2025. They have become a cornerstone of digital access, with widespread adoption in banking, finance, government, and security applications. Key distribution partners have accelerated growth by offering smart cards for multiple purposes.

The telecommunication segment was valued at USD 28.2 billion in 2025, supported by the rise in smartphone users globally. By late 2025, over 6 billion people were using the internet, indicating the sector's strong influence.

U.S. Smart Card Market reached USD 12.1 billion in 2025. The country leads in smart card adoption, with federal agencies utilizing the technology for credentialing, secure identification, and contactless applications. Smart card implementation in government programs demonstrates the nation's commitment to security and digital transformation.

Prominent companies operating in the Global Smart Card Market include Thales, IDEMIA, Giesecke & Devrient, HID Global, NXP Semiconductors, CPI Card, Infineon Technologies, Eastcompeace, Hengbao, and Watchdata Technologies. To strengthen their presence, companies in the Smart Card Market are focusing on product innovation by developing advanced, multi-functional cards with enhanced security features and contactless capabilities. Strategic collaborations with payment networks, telecommunications providers, and government agencies are being leveraged to expand reach and increase adoption. Firms are also investing in R&D to integrate emerging technologies such as AI and biometrics into smart cards, improving functionality and user experience.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Functionality

- 2.2.4 Application

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for contactless payment solutions

- 3.2.1.2 Government digitalization initiatives and e-governance programs

- 3.2.1.3 Expansion of banking services in emerging markets

- 3.2.1.4 Growing transportation and mobility applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Growing competition from mobile payment and digital wallet solutions

- 3.2.2.2 Short card lifecycle and replacement costs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of sustainable and eco-friendly card materials

- 3.2.3.2 Enhanced loyalty programs and multi-application cards

- 3.2.3.3 Growth in telecom and sim card applications

- 3.2.3.4 Smart cities and urban infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Federal Information Processing Standards (FIPS)

- 3.4.1.2 Canadian Personal Information Protection and Electronic Documents Act

- 3.4.2 Europe

- 3.4.2.1 EU General Data Protection Regulation (GDPR)

- 3.4.2.2 German electronic identity card (eID) regulations

- 3.4.2.3 French carte vitale health insurance smart card standards

- 3.4.2.4 UK biometric residence permit (BRP)

- 3.4.3 Asia Pacific

- 3.4.3.1 China's Resident Identity Card (eID card) law

- 3.4.3.2 Japan My Number card system regulations

- 3.4.3.3 Indian Aadhaar authentication and eKYC regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil PIX instant payment system security requirements

- 3.4.4.2 Mexican CURP electronic identity card standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Emirates ID card system regulations

- 3.4.5.2 Saudi Arabian national ID (Absher) smart card framework

- 3.4.5.3 South African smart ID card act 1997

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental impact assessment

- 3.10.2 Social impact & community benefits

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable finance & investment trends

- 3.11 Industry adoption patterns

- 3.11.1 Banking and financial services sector adoption

- 3.11.2 Government and public sector implementation

- 3.11.3 Transportation and mobility sector trends

- 3.11.4 Healthcare sector adoption drivers

- 3.11.5 Telecommunications industry usage patterns

- 3.12 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2022 - 2035 ($Bn, units)

- 5.1 Key trends

- 5.2 Smart Card

- 5.2.1 Interface

- 5.2.1.1 Contact

- 5.2.1.2 Contactless

- 5.2.1.2.1 NFC-enabled

- 5.2.1.2.2 RFID-based

- 5.2.1.3 Dual Interface

- 5.2.2 Chip

- 5.2.3 Memory cards

- 5.2.4 Microprocessor cards

- 5.2.1 Interface

- 5.3 Smart Card Readers

- 5.3.1 Interface

- 5.3.1.1 Contact-based

- 5.3.1.2 Contactless

- 5.3.1.3 Dual Interface

- 5.3.2 Component

- 5.3.2.1 Hardware

- 5.3.2.2 Software

- 5.3.2.3 Services

- 5.3.1 Interface

Chapter 6 Market Estimates & Forecast, By Functionality, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 Transaction

- 6.3 Communication

- 6.4 Security & Access Control

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, units)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Telecommunication

- 7.4 Government & healthcare

- 7.5 Retail & ecommerce

- 7.6 Transportation

- 7.7 Media & entertainment

- 7.8 Education & academic institutions

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.3.8 Benelux

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Singapore

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.4.9 Vietnam

- 8.4.10 Thailand

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global companies

- 9.1.1 Thales

- 9.1.2 IDEMIA

- 9.1.3 Giesecke+Devrient

- 9.1.4 NXP Semiconductors

- 9.1.5 Infineon

- 9.1.6 STMicroelectronics

- 9.1.7 CPI Card

- 9.1.8 HID Global

- 9.1.9 Watchdata

- 9.1.10 Eastcompeace

- 9.1.11 Samsung Electronics

- 9.1.12 Valid

- 9.1.13 Ingenico

- 9.1.14 Hengbao

- 9.2 Regional companies

- 9.2.1 Linxens

- 9.2.2 Paragon ID

- 9.2.3 Perfect Plastic Printing

- 9.2.4 Identiv

- 9.2.5 VeriFone

- 9.2.6 SecureID

- 9.2.7 CardLogix

- 9.2.8 Bartronics

- 9.3 Emerging companies

- 9.3.1 Kona I

- 9.3.2 BrilliantTS

- 9.3.3 Goldpac

- 9.3.4 Wuhan Tianyu Information Industry

- 9.3.5 Feitian