|

市场调查报告书

商品编码

1913448

压力式咖啡机市场机会、成长要素、产业趋势分析及预测(2026-2035年)Pressure Coffee Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

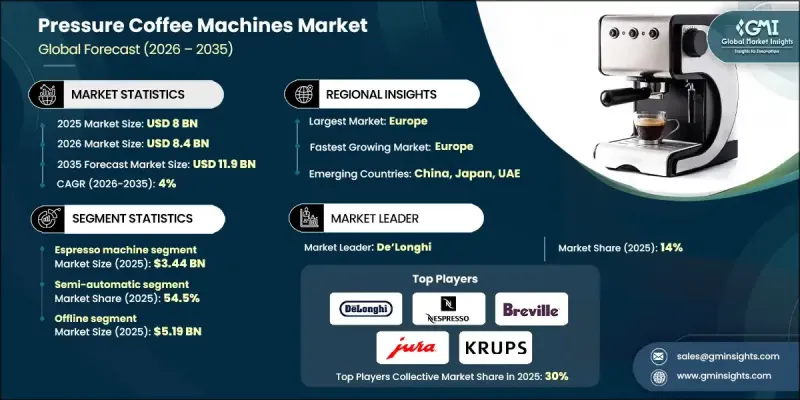

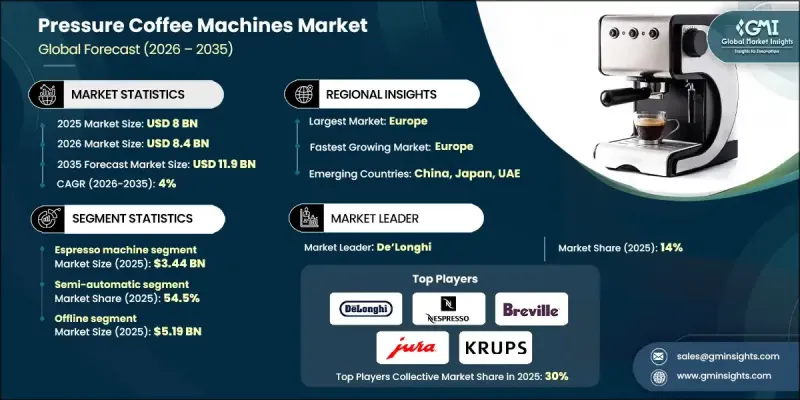

全球压力式咖啡机市场预计到 2025 年将达到 80 亿美元,到 2035 年将达到 119 亿美元,年复合成长率为 4%。

全球咖啡消费量持续成长,推动市场发展,其驱动力包括生活方式的改变、城市人口的成长以及消费者对高品质咖啡日益增长的需求。消费者对咖啡的风味、冲泡方法和咖啡豆产地越来越挑剔,推动了对高端冲泡解决方案的需求。咖啡已成为日常生活不可或缺的一部分,尤其在年轻一代中,咖啡越来越被视为一种社交和自我表达的方式。这种转变促使消费者增加对能够提供稳定品质的高阶冲泡设备的投入。咖啡文化的兴起和国际咖啡品牌的流行进一步提升了消费者对便利性和饮品品质的期望。因此,为了在家庭和商业环境中重现专业级的咖啡体验,消费者对压力式咖啡机的投资正在不断增长,从而增强了市场的长期稳定性。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 80亿美元 |

| 预测金额 | 119亿美元 |

| 复合年增长率 | 4% |

预计到2025年,浓缩咖啡咖啡机市场规模将达到34.4亿美元,反映了其在整体市场中的强劲地位。由于能够透过加压萃取製作浓缩咖啡,这些机器被广泛应用于住宅和商业场所。消费者对特产饮料的持续需求将继续推动其普及,而科技的进步也提高了义式咖啡机的易用性和可靠性,使其对经验丰富的用户和新买家都更具吸引力。

截至2025年,半自动咖啡机占了54.5%的市场。这类咖啡机之所以经久不衰,是因为它们兼顾了使用者控制和操作辅助功能。使用者可以调节关键的冲煮参数,而压力和温度的稳定性则由机器自动控制。这种柔软性使得用户无需像全手动系统那样进行复杂的操作即可实现个性化定制,从而使半自动咖啡机更易于使用且用途广泛。

预计到2025年,美国压力式咖啡机市场将占据68%的市场份额,并创造15.2亿美元的收入。美国浓厚的咖啡文化以及消费者对高品质家用咖啡机的日益增长的需求,持续推动市场需求。消费者越来越倾向于选择兼具便利性、个人化和先进技术的咖啡机,这使得压力式咖啡机成为住宅和商用领域的核心产品类别。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 咖啡消费量增加

- 家庭咖啡冲泡文化

- 技术进步

- 产业潜在风险与挑战

- 安装和维修成本高昂

- 仿冒品的风险

- 机会

- 智慧互联繫统

- 能源效率和永续性认证

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 按类型分類的市场估算与预测,2022-2035年

- 浓缩咖啡机

- 泵式咖啡机

- 滴滤咖啡机

- 手滴式咖啡机

- 其他(法国媒体)

6. 2022-2035年按营运方式分類的市场估计与预测

- 半自动

- 全自动

第七章 依压力范围分類的市场估计与预测,2022-2035年

- 5巴或更低

- 5至10巴

- 10 至 15 巴

- 15巴或以上

第八章 按设备类型分類的市场估算与预测,2022-2035年

- 固定式

- 内建

9. 依最终用途分類的市场估计与预测,2022-2035 年

- 住宅

- 商业的

- 适用于办公室/企业

- 咖啡馆/餐厅

- 饭店

- 医院

- 其他(教育机构、会议厅等)

第十章 按分销管道分類的市场估算与预测,2022-2035年

- 直销

- 间接销售

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- AGARO

- BLACK+DECKER

- Bosch

- Breville

- Continental

- De'Longhi

- ECM

- Gaggia

- Jura

- Krups

- Lavazza

- Miele

- Nespresso

- Russell Hobbs

- SMEG SpA

The Global Pressure Coffee Machines Market was valued at USD 8 billion in 2025 and is estimated to grow at a CAGR of 4% to reach USD 11.9 billion by 2035.

Rising global coffee consumption continues to support market development, driven by evolving lifestyles, increasing urban populations, and a growing appreciation for high-quality coffee. Consumers are becoming more selective about taste, preparation methods, and bean sourcing, which is elevating demand for premium brewing solutions. Coffee has become an integral part of daily routines, particularly among younger demographics, who associate it with social interaction and personal expression. This shift has increased spending on advanced brewing equipment that delivers consistent quality. The expanding cafe culture and wider presence of international coffee brands have further shaped expectations around convenience and beverage quality. As a result, consumers are increasingly investing in pressure-based coffee machines to recreate professional-grade coffee experiences at home and in commercial environments, reinforcing long-term market stability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 4% |

The espresso machines segment generated USD 3.44 billion in 2025, reflecting its strong position within the overall market. These machines are widely used across residential and commercial settings due to their ability to produce concentrated coffee using pressurized extraction. Ongoing demand for specialty beverages continues to support adoption, while technological advancements have improved usability and consistency, broadening their appeal among both experienced users and new buyers.

The semi-automatic category accounted for 54.5% share in 2025. These machines remain popular because they balance user control with operational support. Users can influence key brewing variables while relying on the machine to manage pressure and temperature stability. This flexibility allows for customization without the complexity associated with fully manual systems, making semi-automatic models accessible and versatile.

U.S. Pressure Coffee Machines Market held 68% share and generated USD 1.52 billion in 2025. Strong domestic coffee culture and rising interest in premium home brewing solutions continue to drive demand. Consumers increasingly favor machines that offer convenience, personalization, and technological refinement, positioning pressure coffee machines as a core category across residential and professional settings.

Key companies operating in the Global Pressure Coffee Machines Market include De'Longhi, Breville, Bosch, Nespresso, Jura, Miele, Gaggia, Krups, Lavazza, SMEG S.p.A., BLACK+DECKER, Russell Hobbs, AGARO, ECM, and Continental. These brands remain competitive through product innovation, design differentiation, and global distribution strength. Companies in the Global Pressure Coffee Machines Market are strengthening their market position by focusing on innovation, product differentiation, and brand positioning. Manufacturers are investing in advanced engineering to improve consistency, durability, and ease of use while catering to both entry-level and premium segments. Design aesthetics and compact form factors are being emphasized to align with modern living spaces. Firms are also expanding their global retail and online presence to improve accessibility and brand visibility. Strategic collaborations with coffee brands and service providers help enhance product credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 Pressure range

- 2.2.5 Installation

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising coffee consumption

- 3.2.1.2 Home-brewing culture

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High acquisition & maintenance costs

- 3.2.2.2 Counterfeit product risks

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected systems

- 3.2.3.2 Energy efficiency & sustainability credentials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Espresso machine

- 5.3 Pump coffee machine

- 5.4 Drip coffee machine

- 5.5 Pour-over coffee machine

- 5.6 Others (French press)

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates and Forecast, By Pressure Range, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 5 bars

- 7.3 5 to 10 bars

- 7.4 10 to 15 bars

- 7.5 Above 15 bars

Chapter 8 Market Estimates and Forecast, By Installation, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Freestanding

- 8.3 Built-in

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Office/Corporate

- 9.3.2 Cafes/Restaurants

- 9.3.3 Hotels

- 9.3.4 Hospitals

- 9.3.5 Others (institutions, conference venues)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AGARO

- 12.2 BLACK+DECKER

- 12.3 Bosch

- 12.4 Breville

- 12.5 Continental

- 12.6 De’Longhi

- 12.7 ECM

- 12.8 Gaggia

- 12.9 Jura

- 12.10 Krups

- 12.11 Lavazza

- 12.12 Miele

- 12.13 Nespresso

- 12.14 Russell Hobbs

- 12.15 SMEG S.p.A.