|

市场调查报告书

商品编码

1913450

自主农业机械市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Autonomous Farm Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

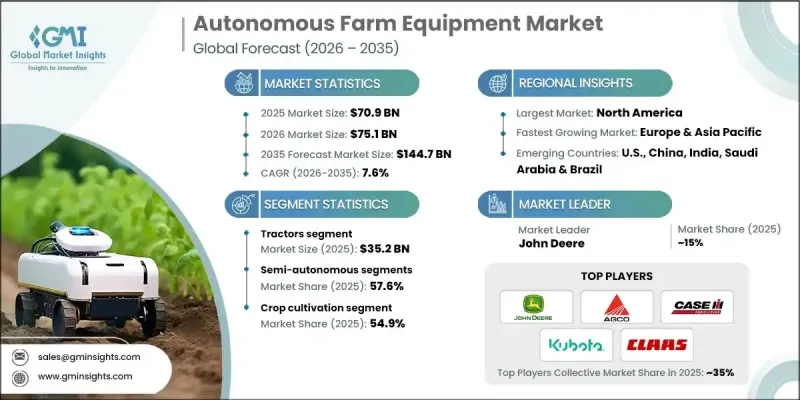

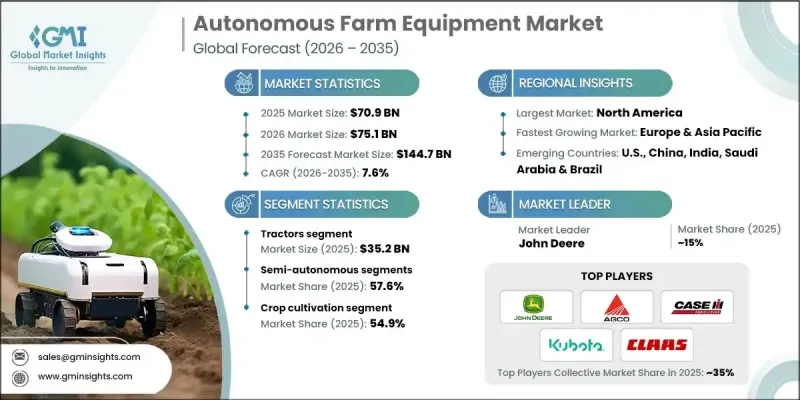

全球自主农业机械市场预计到 2025 年将达到 709 亿美元,到 2035 年将达到 1,447 亿美元,年复合成长率为 7.6%。

该行业的成长主要得益于精密农业技术的日益普及。这些技术使农民能够优化投入使用、最大限度地减少资源浪费并提高作物产量。拖拉机、收割机和无人机等自主机械使农民能够在最佳时机施用投入物,从而提高盈利并减少对环境的影响。人工智慧、物联网、机器人和机器视觉的融合正在革新农业,使作物监测、土壤评估和自动化收割等高级任务成为可能,并最大限度地减少人为干预。包括5G和云端平台在内的先进通讯网路实现了即时监控和远端控制,进一步提高了效率并促进了技术的普及应用。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 709亿美元 |

| 预测金额 | 1447亿美元 |

| 复合年增长率 | 7.6% |

预计到2025年,曳引机市场规模将达到352亿美元,2026年至2035年的复合年增长率将达到7.4%。拖拉机在关键农业作业中至关重要,随着人工智慧、GPS导航和物联网连接的集成,它们正朝着高效的半自动或全自动机械发展。劳动力短缺和营运成本上升正在推动市场需求,这些拖拉机在提高作业精度和生产效率的同时,减少了对人工的依赖。

半自动设备市占率占比达57.6%,预计2026年至2035年将以7.1%的复合年增长率成长。这类设备兼顾自动化和人工监管,使农民能够在保持作业柔软性的同时,获得诸如自动转向和精准控制等功能。这种混合模式解决了投资成本和技术复杂性的担忧,既能促进自动化系统的顺利应用,又能提高重复性工作的效率。

美国自主农业设备市场预计到2025年将达到185亿美元,2026年至2035年的复合年增长率将达到8.5%。规模较大的农场和技术先进的农业部门正在推动自主解决方案的普及。成熟製造商和新兴企业对人工智慧、机器人和物联网的大量投资正在加速这一进程。政府对智慧农业技术和永续实践的激励措施也进一步推动了市场扩张。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 司机

- 扩大精密农业的引进

- 技术进步

- 政府政策与补贴

- 劳动短缺和成本上升

- 产业潜在风险与挑战

- 高昂的初始投资和成本壁垒

- 连接性和基础设施限制

- 司机

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 2022-2035年按产品分類的市场估算与预测

- 联结机

- 收割机

- 播种机

- 喷雾器

- 无人驾驶飞行器(UAV)

- 其他(耕耘机、灌溉设备)

第六章 按技术分類的市场估计与预测,2022-2035年

- 导引与导航系统

- 感测器技术

- 人工智慧(AI)和机器学习

- 机器人与自动化

- 连接和通讯系统

第七章 2022-2035年各细分市场的估计与预测

- 完全自主

- 半自主

第八章 按产量分類的市场估计与预测,2022-2035年

- 不到30马力

- 31-100马力

- 超过100马力

第九章 按应用领域分類的市场估算与预测,2022-2035年

- 作物种植

- 园艺和幼苗

- 酪农和畜牧业管理

- 林业和木材管理

第十章 按分销管道分類的市场估算与预测,2022-2035年

- 直销

- 间接销售

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

第十二章:公司简介

- AGCO Corporation

- Agrobot

- Autonomous Solutions Inc.

- Case IH

- Claas

- Dot Technology Corp

- DroneDeploy

- Fendt

- Harvest Automation

- John Deere

- Kinze Manufacturing

- Kubota Corporation

- New Holland Agriculture

- Precision Planting

- Raven Industries

The Global Autonomous Farm Equipment Market was valued at USD 70.9 billion in 2025 and is estimated to grow at a CAGR of 7.6% to reach USD 144.7 billion by 2035.

Growth in this sector is fueled by the increasing adoption of precision farming techniques. These methods allow farmers to optimize input use, minimize resource wastage, and maximize crop output. Autonomous machines such as tractors, harvesters, and drones enable farmers to apply inputs at the most effective times, improving profitability while reducing environmental impact. The convergence of AI, IoT, robotics, and machine vision is revolutionizing agriculture, enabling sophisticated operations like crop monitoring, soil assessment, and automated harvesting with minimal human intervention. Advanced communication networks, including 5G and cloud platforms, allow real-time monitoring and remote operation, further enhancing efficiency and adoption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $70.9 Billion |

| Forecast Value | $144.7 Billion |

| CAGR | 7.6% |

The tractors segment accounted for USD 35.2 billion in 2025 and is expected to grow at a CAGR of 7.4% from 2026 to 2035. They remain critical for essential farm operations, and the integration of AI, GPS navigation, and IoT connectivity has transformed them into highly efficient, semi- or fully-autonomous machines. Labor shortages and rising operational costs drive demand, as these tractors reduce reliance on manual work while boosting precision and productivity.

The semi-autonomous equipment segment held a 57.6% share and is projected to grow at a CAGR of 7.1% from 2026 to 2035. This equipment offers a balance between automation and human oversight, providing features like auto-steering and precision controls while allowing farmers to retain operational flexibility. This hybrid approach addresses concerns over investment costs and technical complexity, enabling smoother adoption of automated systems and improving efficiency for repetitive tasks.

U.S. Autonomous Farm Equipment Market was valued at USD 18.5 billion in 2025 and is forecasted to grow at a CAGR of 8.5% from 2026 to 2035. Large-scale farms and a technologically advanced agricultural sector drive the adoption of autonomous solutions. Substantial investments in AI, robotics, and IoT by both established manufacturers and startups accelerate deployment. Government incentives for smart farming technologies and sustainable practices further stimulate market expansion.

Key players in the Global Autonomous Farm Equipment Market include Case IH, John Deere, Kinze Manufacturing, Kubota Corporation, AGCO Corporation, Claas, Dot Technology Corp, DroneDeploy, Precision Planting, New Holland Agriculture, Fendt, Harvest Automation, Autonomous Solutions Inc., and Agrobot. Companies in the Autonomous Farm Equipment Market are focusing on multiple strategies to strengthen their foothold. They are investing heavily in research and development to enhance the capabilities of autonomous machines, including AI-driven navigation and advanced sensor integration. Strategic partnerships and collaborations with tech startups and agri-tech firms help expand product portfolios and enter new markets. Firms are also emphasizing after-sales services, training, and support programs to boost customer adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Operation

- 2.2.5 Power output

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of precision agriculture

- 3.2.1.2 Technological advancements

- 3.2.1.3 Government initiatives and subsidies

- 3.2.1.4 Labor shortages and rising costs

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and cost barriers

- 3.2.2.2 Connectivity and infrastructure limitations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Tractor

- 5.3 Harvesters

- 5.4 Planters

- 5.5 Sprayers

- 5.6 UAVs

- 5.7 Others (cultivators, irrigation equipment)

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Guidance & navigation systems

- 6.3 Sensor technologies

- 6.4 Artificial intelligence & machine learning

- 6.5 Robotics & automation

- 6.6 Connectivity and communication systems

Chapter 7 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Fully autonomous

- 7.3 Semi-autonomous

Chapter 8 Market Estimates & Forecast, By Power Output, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Below 30 HP

- 8.3 31-100 HP

- 8.4 Above 100 HP

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Crop cultivation

- 9.3 Horticulture & nursery

- 9.4 Dairy & livestock management

- 9.5 Forestry & timber management

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 AGCO Corporation

- 12.2 Agrobot

- 12.3 Autonomous Solutions Inc.

- 12.4 Case IH

- 12.5 Claas

- 12.6 Dot Technology Corp

- 12.7 DroneDeploy

- 12.8 Fendt

- 12.9 Harvest Automation

- 12.10 John Deere

- 12.11 Kinze Manufacturing

- 12.12 Kubota Corporation

- 12.13 New Holland Agriculture

- 12.14 Precision Planting

- 12.15 Raven Industries