|

市场调查报告书

商品编码

1913463

毫米波技术市场机会、成长要素、产业趋势分析及2026年至2035年预测Millimeter Wave Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

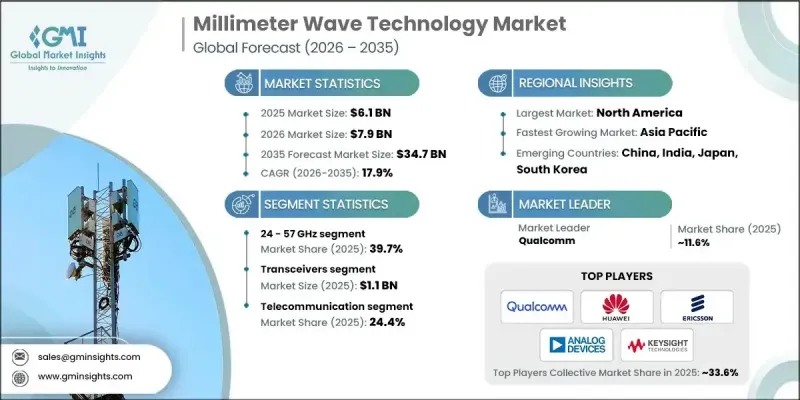

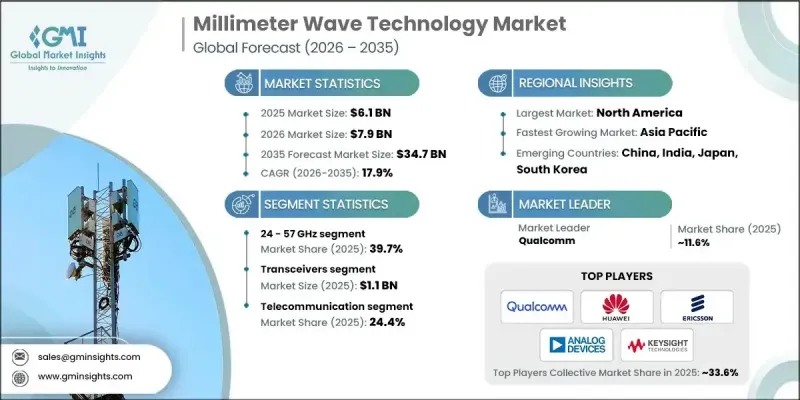

全球毫米波技术市场预计到 2025 年将达到 61 亿美元,到 2035 年将达到 347 亿美元,年复合成长率为 17.9%。

对超高速资料传输日益增长的需求、下一代无线网路的不断扩展部署以及对先进通讯基础设施投入的不断增加,共同推动了毫米波技术的发展。随着网路营运商和技术供应商优先考虑更高的容量、更低的延迟和更高的频谱效率,毫米波技术正获得广泛应用。频宽频宽数位服务的日益普及以及各行各业对先进成像和感测能力的需求,也进一步推动了这一需求。公共和私营部门为加强连接基础设施而进行的投资,正在加速毫米波解决方案的采用,尤其是在网路密集的环境中。正在进行的基础设施建设倡议也越来越多地将这些技术融入其中,以实现高容量的网路架构。此外,人们对身临其境型数位平台的兴趣日益浓厚,也推动了对更快、更可靠的无线效能的需求。这些因素共同推动了毫米波技术在全球范围内,在各种应用和地区中持续普及。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 61亿美元 |

| 预测金额 | 347亿美元 |

| 复合年增长率 | 17.9% |

预计到2025年,24-57 GHz频宽将占据39.7%的市占率。此频宽广泛用于支援低延迟、高吞吐量的无线通讯和先进的感测系统。人们对频谱优化和高效讯号传输的日益关注,正推动着在该频宽内运行的高效能解决方案的开发,以提高整体网路可靠性和容量。

预计到2025年,收发器业务的营收将达到11亿美元。这些组件在实现高速资料交换、高效讯号处理和无缝系统整合方面发挥关键作用。不断提高的效能要求正在推动收发器设计的创新,以支援更高的资料速率、更低的功耗以及与下一代无线标准的兼容性。

预计到2025年,北美毫米波技术市占率将达到35%。该地区市场扩张的动力源于持续的网路升级、对数位基础设施的大力投资以及连接技术的加速普及。此外,不断推进的城市发展倡议和云端服务的广泛应用也进一步促进了区域市场的成长。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 生态系分析

- 产业影响因素

- 司机

- 对5G网路的需求不断增长

- 对高频宽应用的需求不断增长

- 加大对通讯基础设施的投资

- 在医学影像领域不断扩展的应用

- 安全系统应用范围不断扩大

- 挑战与困难

- 范围和普遍性有限

- 传播方面的挑战

- 市场机会

- 智慧城市的发展

- 扩增实境(AR)和虚拟实境(VR)应用的发展

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 新兴经营模式

- 合规要求

- 永续性措施

- 消费者心理分析

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 地理分布比较

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 按组件分類的市场估算与预测,2022-2035年

- 转变

- PIN二极体开关

- 场效电晶体开关

- MEMS开关

- 同轴开关

- 波导开关

- 天线

- 相位阵列天线

- 线性阵列

- 平面阵列

- 共形阵列

- 非相位阵列天线

- 贴片天线

- 喇叭天线

- 反射器天线

- 相位阵列天线

- 收发器

- 通讯与网路

- 介面

- 射频/无线

- 影像

- 感测器和控制装置

- 电源/电池

- 其他的

第六章 依频段分類的市场估计与预测,2022-2035年

- 24-57 GHz

- 57-86 GHz

- 86~300 GHz

7. 依最终用途分類的市场估计与预测,2022-2035 年

- 沟通

- 卫生保健

- 工业的

- 车

- 运输

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第九章:公司简介

- 主要企业

- Qualcomm

- Huawei

- Ericsson

- Keysight Technologies Inc.

- Broadcom

- 按地区分類的主要企业

- 北美洲

- Analog Devices, Inc.

- Bridgewave Communications Inc.

- L3Harris Technologies Inc.

- Millimeter Wave Products Inc.

- 亚太地区

- Siklu Communication Ltd.

- NEC Corporation

- Eravant(SAGE Millimeter Inc.)

- 欧洲

- Farran Technology Ltd.

- Infineon

- Kyocera Corporation

- Smiths Interconnect Group Limited

- 北美洲

- 小众玩家/颠覆者

- Cambium Networks

- Ducommun Incorporated

- E-band Communications LLC

- Aviat Networks

The Global Millimeter Wave Technology Market was valued at USD 6.1 billion in 2025 and is estimated to grow at a CAGR of 17.9% to reach USD 34.7 billion by 2035.

Growth is supported by rising requirements for ultra-fast data transmission, expanding deployment of next-generation wireless networks, and increasing capital allocation toward advanced communication infrastructure. Millimeter wave technology is gaining traction as network operators and technology providers prioritize higher capacity, reduced latency, and improved spectral efficiency. Demand is further strengthened by the wider adoption of bandwidth-intensive digital services and the need for enhanced imaging and sensing capabilities across multiple industries. Public and private sector investments aimed at strengthening connectivity frameworks are accelerating the deployment of millimeter wave solutions, particularly in dense network environments. Ongoing infrastructure development initiatives are increasingly incorporating these technologies to enable high-capacity network architectures. Additionally, growing interest in immersive digital platforms is supporting demand for faster and more reliable wireless performance. These combined factors are driving sustained global adoption of millimeter wave technology across diverse applications and regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.1 Billion |

| Forecast Value | $34.7 Billion |

| CAGR | 17.9% |

The 24-57 GHz frequency range accounted for 39.7% share in 2025. This band is widely used to support low-latency, high-throughput wireless communication and advanced sensing systems. Increasing focus on spectrum optimization and efficient signal transmission is encouraging the development of high-performance solutions operating within this frequency range to improve overall network reliability and capacity.

The transceivers segment generated USD 1.1 billion in 2025. These components play a critical role in enabling fast data exchange, efficient signal processing, and seamless system integration. Growing performance expectations are driving innovation in transceiver design to support higher data rates, reduced power consumption, and compatibility with next-generation wireless standards.

North America Millimeter Wave Technology Market represented 35% share in 2025. Market expansion in the region is supported by continuous network upgrades, strong investment in digital infrastructure, and accelerating deployment of connected technologies. Increasing urban development initiatives and widespread adoption of cloud-based services are further contributing to regional market growth.

Major companies operating in the Global Millimeter Wave Technology Market include Qualcomm, Ericsson, Huawei, Broadcom, Analog Devices, Inc., NEC Corporation, Infineon, Keysight Technologies Inc., Kyocera Corporation, Siklu Communication Ltd., Aviat Networks, Cambium Networks, Farran Technology Ltd., Bridgewave Communications Inc., L3Harris Technologies Inc., Smiths Interconnect Group Limited, Eravant (SAGE Millimeter Inc.), Millimeter Wave Products Inc., Ducommun Incorporated, and E-band Communications LLC. Companies in the Global Millimeter Wave Technology Market are focusing on strengthening their competitive position through continuous research and development aimed at improving signal efficiency, component integration, and system reliability. Many players are investing in advanced semiconductor technologies and compact designs to enhance performance while reducing power consumption. Strategic collaborations with network operators and infrastructure providers are helping accelerate commercialization and large-scale deployment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Frequency band trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for 5G Networks

- 3.3.1.2 Increasing demand for high-bandwidth applications

- 3.3.1.3 Rising investments in telecommunication infrastructure

- 3.3.1.4 Increasing applications in healthcare imaging

- 3.3.1.5 Increasing deployment in security systems

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Limited range and penetration

- 3.3.2.2 Propagation challenges

- 3.3.3 Market opportunities

- 3.3.3.1 Advancements in smart cities

- 3.3.3.2 Expansion of AR/VR applications

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Switches

- 5.2.1 PIN diode switches

- 5.2.2 FET switches

- 5.2.3 MEMS switches

- 5.2.4 Coaxial switches

- 5.2.5 Waveguide switches

- 5.3 Antennas

- 5.3.1 Phased array antennas

- 5.3.1.1 Linear arrays

- 5.3.1.2 Planar arrays

- 5.3.1.3 Conformal arrays

- 5.3.2 Non-Phased array antennas

- 5.3.2.1 Patch antennas

- 5.3.2.2 Horn antennas

- 5.3.2.3 Reflector Antennas

- 5.3.1 Phased array antennas

- 5.4 Transceiver

- 5.5 Communications and networking

- 5.6 Interface

- 5.7 RF & radio

- 5.8 Imaging

- 5.9 Sensor & controls

- 5.10 Power & battery

- 5.11 Others

Chapter 6 Market Estimates and Forecast, By Frequency Band, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 24 - 57 GHz

- 6.3 57 - 86 GHz

- 6.4 86 - 300 GHz

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Telecommunication

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Automotive

- 7.6 Transportation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Qualcomm

- 9.1.2 Huawei

- 9.1.3 Ericsson

- 9.1.4 Keysight Technologies Inc.

- 9.1.5 Broadcom

- 9.2 Regional key players

- 9.2.1 North America

- 9.2.1.1 Analog Devices, Inc.

- 9.2.1.2 Bridgewave Communications Inc.

- 9.2.1.3 L3Harris Technologies Inc.

- 9.2.1.4 Millimeter Wave Products Inc.

- 9.2.2 Asia Pacific

- 9.2.2.1 Siklu Communication Ltd.

- 9.2.2.2 NEC Corporation

- 9.2.2.3 Eravant (SAGE Millimeter Inc.)

- 9.2.3 Europe

- 9.2.3.1 Farran Technology Ltd.

- 9.2.3.2 Infineon

- 9.2.3.3 Kyocera Corporation

- 9.2.3.4 Smiths Interconnect Group Limited

- 9.2.1 North America

- 9.3 Niche Players/Disruptors

- 9.3.1 Cambium Networks

- 9.3.2 Ducommun Incorporated

- 9.3.3 E-band Communications LLC

- 9.3.4 Aviat Networks