|

市场调查报告书

商品编码

1913470

商用车座椅市场机会、成长要素、产业趋势分析及2026年至2035年预测Commercial Vehicle Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

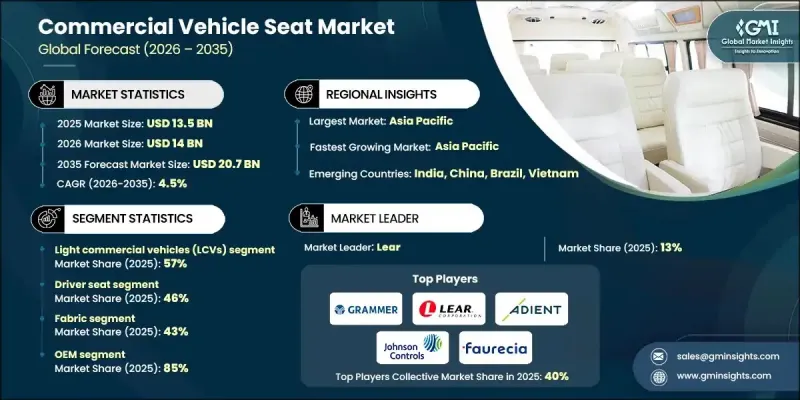

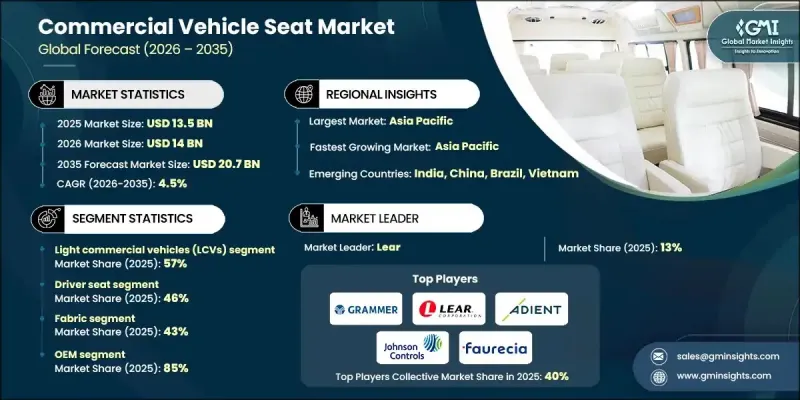

全球商用车座椅市场预计到 2025 年将达到 135 亿美元,到 2035 年将达到 207 亿美元,年复合成长率为 4.5%。

随着车队营运商将驾驶人的健康、效率和长期成本控制放在首位,市场发展日益受到以人体工学和舒适性为导向的座椅解决方案的驱动。座椅设计不佳被广泛认为是导致身体不适和生产力下降的因素之一,因此,能够提供姿势支撑、减轻疲劳并改善日常驾驶体验的座椅需求不断增长。商用车座椅正从基本的舒适性发展成为与车辆电子设备和驾驶员监控平台整合的先进技术系统。电动调节、温度控制、记忆设定和按摩功能等特性,反映了商用车内装向高价值方向发展的趋势。全球范围内不断加强的座椅性能、乘员保护和材料标准等安全标准也对市场产生了积极影响,促使製造商采用更先进的设计。同时,物流、货运和配送服务的扩张持续推动全球商用车需求,并在新车生产和更换週期中带动座椅安装量的稳定成长。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 135亿美元 |

| 预测金额 | 207亿美元 |

| 复合年增长率 | 4.5% |

预计到2025年,轻型商用车市占率将达到57%,并在2026年至2035年间以3.9%的复合年增长率成长。这一主导地位反映了其在配送服务、酒店服务和市政运营等领域的广泛应用。此类车辆总重低于6000公斤(13228磅),需要具备耐用、耐磨的特性,并配备简化的调节机构和经济实惠的座椅,以满足高使用率且注重预算的运营商的需求。

预计到2025年,驾驶室市占率将达到46%,并在2026年至2035年间以4.8%的复合年增长率实现最快成长。驾驶室因其在安全、舒适性和员工留任方面发挥的关键作用而具有更高的价值。先进的人体工学设计、电动功能、气候控制系统和优质材料不仅提升了驾驶室的价格,也有助于保障驾驶员的健康和持续提高生产力。

预计到2025年,亚太地区商用车座椅市占率将达39%。该地区的领先地位得益于大规模的汽车製造、新兴经济体的基础设施建设、成熟的汽车生产基地以及不断增长的商务传输和出行服务需求的人口趋势。都市区的成长推动了公共交通车队和商用车投资的增加,从而持续带动了全部区域对座椅系统的需求。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率分析

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 对轻巧且符合人体工学的座椅的需求日益增长

- 严格的安全和排放气体标准

- 电子商务和物流的成长

- 永续材料领域的进展

- 公共交通扩建与车队现代化

- 产业潜在风险与挑战

- 先进座椅技术高成本

- 供应链中断

- 市场机会

- 消费者对注重人体工学和舒适性的驾驶座的需求日益增长。

- 电动和自动驾驶商用车的普及率不断提高

- 扩大公共交通和公车队

- 模组化和折迭式座椅设计的兴起

- 售后市场对替换零件的需求不断增长

- 成长潜力分析

- 监管环境

- 北美洲

- 美国:FMVSS 207号-座椅系统

- 加拿大:CMVSS 208 - 正面碰撞中的乘员保护

- 欧洲

- 德国:ECE R17 - 座椅、座椅锚点、头枕

- 英国:ECE R25 - 车辆座椅头枕

- 法国:ECE R129 - 儿童限制系统(i-Size)

- 义大利:ECE R17 - 座椅、座椅锚点、头枕

- 亚太地区

- 中国:GB 15083 - 汽车座椅强度要求及试验方法

- 印度:AIS-023 - 商用车辆座椅、固定装置和头枕

- 日本:JASO D 601-商用车辆座椅

- 拉丁美洲

- 巴西:CONTRAN 第 780 号决议案-商用车辆安全标准

- 中东和非洲

- 阿联酋:GSO 2014 - 机动车辆安全要求

- 北美洲

- 波特五力分析

- PESTEL 分析

- 技术与创新展望

- 当前技术趋势

- 新兴技术

- 生产统计

- 生产基地

- 消费基础

- 出口和进口

- 定价分析

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与投资机会

- 智慧互联和车辆系统集成

- 疲劳和注意力分散检测系统(整合式)

- 支援远端资讯处理功能的座椅感测器生态系统

- ADAS整合:乘员侦测与安全气囊优化

- 驾驶员健康分析与预测性健康监测

- 基于云端的车队智慧平台和表格数据分析

- 车辆电气化对座椅系统的影响

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 依座位容量分類的市场估算与预测,2022-2035年

- 驾驶座

- 乘客座椅

- 后座

- 折迭式座椅

第六章 按材料分類的市场估算与预测,2022-2035年

- 织物

- 乙烯基塑料

- 皮革

- 合成材料

第七章 依车辆类型分類的市场估计与预测,2022-2035年

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 公车和长途客车

第八章 按技术分類的市场估算与预测,2022-2035年

- 标准/传统座位

- 电动座椅

- 加热和通风座椅

- 记忆座椅

- 按摩座椅

第九章 依销售管道分類的市场估计与预测,2022-2035年

- OEM

- 售后市场

第十章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十一章 公司简介

- 世界玩家

- Adient

- Brose Fahrzeugteile

- Faurecia

- GRAMMER

- Hyundai Dymos

- Johnson Controls

- Lear

- Magna International

- RECARO Automotive Seating

- TS TECH

- Daimler

- Iveco

- 主要製造商(按地区划分)

- Dongfeng Auto Seating

- GRM Seating Solutions

- Kongsberg Automotive

- Seoyon E-Hwa

- Sogefi

- Sumitomo Riko

- Sundaram Clayton

- Tachi-S

- Toyota Boshoku

- Zhejiang Panyu-Jeep Vehicle

- 新兴製造商

- Autofurn International

- Blitz

- Bostrom Seating Systems

- Firth Seating Technologies

- King Long Commercial Vehicle Seating

The Global Commercial Vehicle Seat Market was valued at USD 13.5 billion in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 20.7 billion by 2035.

Market development is increasingly influenced by the shift toward ergonomic, comfort-oriented seating solutions, as fleet operators prioritize driver well-being, efficiency, and long-term cost control. Poor seating design is widely recognized as a contributor to physical discomfort and reduced productivity, which has accelerated demand for seats that support posture, reduce fatigue, and improve daily driving conditions. Commercial vehicle seating has evolved beyond basic comfort to become a technology-enabled system integrated with vehicle electronics and driver monitoring platforms. Features such as powered adjustments, temperature-controlled seating, memory settings, and massage functions reflect a broader move toward higher-value interiors in commercial vehicles. The market is also benefiting from tighter global safety requirements covering seating performance, occupant protection, and material standards, which are pushing manufacturers toward more advanced designs. In parallel, the expansion of logistics, freight movement, and delivery services continues to stimulate demand for commercial vehicles worldwide, reinforcing steady growth in seating installations across new vehicle production and replacement cycles.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.5 Billion |

| Forecast Value | $20.7 Billion |

| CAGR | 4.5% |

The light commercial vehicles segment held a 57% share in 2025 and is expected to grow at a CAGR of 3.9% from 2026 to 2035. This leadership reflects their widespread use across delivery services, service-oriented businesses, and municipal operations. Vehicles in this category, with gross vehicle weights below 6,000 kilograms or 13,228 pounds, require seating that balances durability, resistance to wear, simplified adjustment mechanisms, and cost efficiency to meet the expectations of high-usage and budget-conscious operators.

The driver seat segment accounted for 46% share in 2025 and is forecast to register the fastest growth, with a CAGR of 4.8% from 2026 to 2035. Driver seats command a higher value due to their critical role in safety, comfort, and workforce retention. Advanced ergonomics, powered functionality, climate features, and premium materials contribute to stronger pricing while supporting operator health and sustained productivity.

Asia Pacific Commercial Vehicle Seat Market held a 39% share in 2025. The region's dominance is supported by large-scale vehicle manufacturing, infrastructure development across emerging economies, established automotive production bases, and demographic trends that are increasing demand for commercial transportation and mobility services. Rising urban populations are driving greater investment in public transport fleets and commercial vehicles, which continues to boost demand for seating systems across the region.

Key participants in the Global Commercial Vehicle Seat Market include Lear, Adient, GRAMMER, Faurecia, TS TECH, RECARO Automotive Seating, Hyundai Dymos, Johnson Controls, Daimler, and Iveco. Companies operating in the Global Commercial Vehicle Seat Market are reinforcing their market position through a combination of innovation, strategic partnerships, and global expansion. Manufacturers are investing heavily in research and development to enhance ergonomic performance, integrate smart features, and improve material durability while meeting evolving safety standards. Many players are aligning closely with vehicle OEMs to secure long-term supply agreements and participate early in platform development cycles. Expansion into high-growth regions and localization of production are being used to reduce costs and improve responsiveness to regional demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Seat

- 2.2.4 Material

- 2.2.5 Technology

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising demand for lightweight and ergonomic seating

- 3.2.1.3 Stringent safety and emission regulations

- 3.2.1.4 Growth in e-commerce and logistics

- 3.2.1.5 Advancements in sustainable materials

- 3.2.1.6 Expansion of public transportation and fleet modernization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced seating technologies

- 3.2.2.2 Supply chain disruptions

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for ergonomic and comfort-focused driver seats

- 3.2.3.2 Rising adoption of electric and autonomous commercial vehicles

- 3.2.3.3 Expansion of public transport and bus fleets

- 3.2.3.4 Increasing use of modular and folding seating designs

- 3.2.3.5 Strong aftermarket replacement demand

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US: FMVSS No. 207 - seating systems

- 3.4.1.2 Canada: CMVSS 208 - occupant protection in frontal impacts

- 3.4.2 Europe

- 3.4.2.1 Germany: ECE R17 - seats, seat anchorages and head restraints

- 3.4.2.2 UK: ECE R25 - head restraints for vehicle seats

- 3.4.2.3 France: ECE R129 - Child Restraint Systems (i-Size)

- 3.4.2.4 Italy: ECE R17 - seats, seat anchorages and head restraints

- 3.4.3 Asia Pacific

- 3.4.3.1 China: GB 15083 - strength requirement and test of motor vehicle seats

- 3.4.3.2 India: AIS-023 - seats, their anchorages and head restraints for commercial vehicles

- 3.4.3.3 Japan: JASO D 601 - commercial vehicle seats

- 3.4.4 Latin America

- 3.4.4.1 Brazil: CONTRAN Resolution 780 - commercial vehicle safety standards

- 3.4.5 MEA

- 3.4.5.1 UAE: GSO 2014 - motor vehicle safety requirements

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Pricing analysis

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & investment opportunities

- 3.14 Smart Connectivity & Vehicle System Integration

- 3.14.1 Fatigue & distraction detection systems ( integration)

- 3.14.2 Telematics-enabled seat sensor ecosystems

- 3.14.3 ADAS Co-Integration: occupancy sensing & airbag optimization

- 3.14.4 Driver wellness analytics & predictive health monitoring

- 3.14.5 Cloud-based fleet intelligence platforms & seat data analytics

- 3.15 Vehicle electrification impact on seating systems

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Seat, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Driver seat

- 5.3 Passenger seat

- 5.4 Rear seat

- 5.5 Folding seat

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Vinyl

- 6.4 Leather

- 6.5 Synthetic materials

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Light commercial vehicles (LCV)

- 7.3 Heavy commercial vehicles (HCV)

- 7.4 Buses & coaches

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Standard/conventional seats

- 8.3 Powered/electric seats

- 8.4 Heated & ventilated seats

- 8.5 Memory seats

- 8.6 Massage seats

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Adient

- 11.1.2 Brose Fahrzeugteile

- 11.1.3 Faurecia

- 11.1.4 GRAMMER

- 11.1.5 Hyundai Dymos

- 11.1.6 Johnson Controls

- 11.1.7 Lear

- 11.1.8 Magna International

- 11.1.9 RECARO Automotive Seating

- 11.1.10 TS TECH

- 11.1.11 Daimler

- 11.1.12 Iveco

- 11.2 Regional Players

- 11.2.1 Dongfeng Auto Seating

- 11.2.2 GRM Seating Solutions

- 11.2.3 Kongsberg Automotive

- 11.2.4 Seoyon E-Hwa

- 11.2.5 Sogefi

- 11.2.6 Sumitomo Riko

- 11.2.7 Sundaram Clayton

- 11.2.8 Tachi-S

- 11.2.9 Toyota Boshoku

- 11.2.10 Zhejiang Panyu-Jeep Vehicle

- 11.3 Emerging Players

- 11.3.1 Autofurn International

- 11.3.2 Blitz

- 11.3.3 Bostrom Seating Systems

- 11.3.4 Firth Seating Technologies

- 11.3.5 King Long Commercial Vehicle Seating