|

市场调查报告书

商品编码

1913480

医用吸痰设备市场机会、成长要素、产业趋势分析及2026年至2035年预测Medical Suction Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

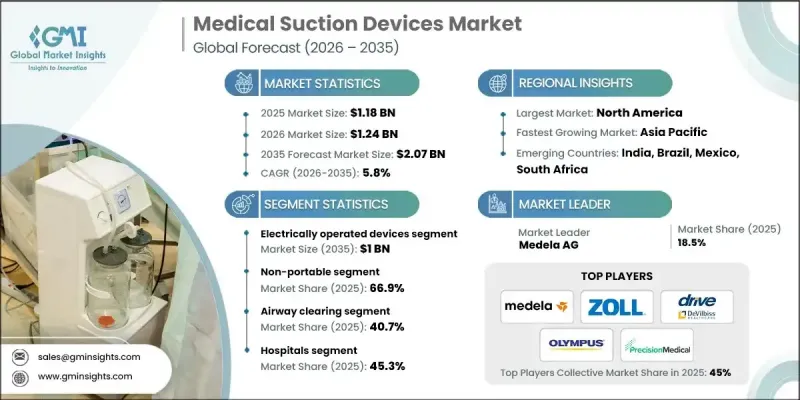

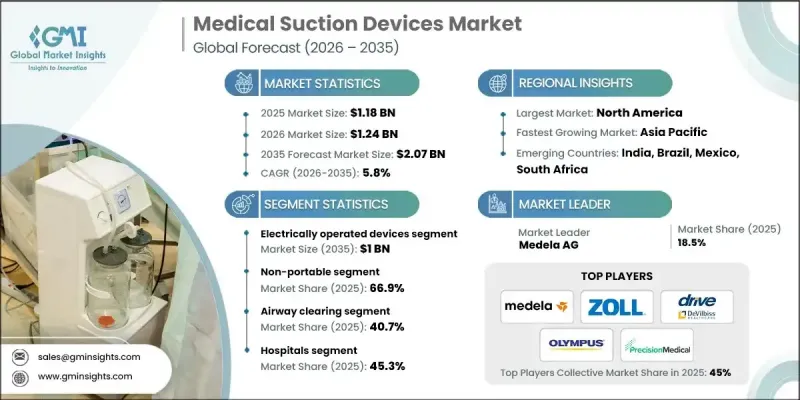

全球医用吸痰设备市场预计到 2025 年将达到 11.8 亿美元,预计到 2035 年将达到 20.7 亿美元,年复合成长率为 5.8%。

这一上升趋势得益于长期呼吸系统疾病负担的加重、依赖吸痰技术的医疗程序的扩展以及居家医疗解决方案日益普及。随着呼吸系统疾病的日益普遍,有效的呼吸道清除对于减少併发症和促进患者康復至关重要。医用吸痰系统也被广泛应用于各种临床环境中,透过清除体液和分泌物,在医疗过程中保持视野清晰和环境清洁。全球外科手术和诊断程序的不断增加进一步强化了对这些设备的需求。此外,微创医疗技术的兴起也推动了对精准可控的体液管理的需求,进而促进了能够确保准确性、安全性和稳定临床效果的先进吸痰解决方案的应用。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 11.8亿美元 |

| 预测金额 | 20.7亿美元 |

| 复合年增长率 | 5.8% |

预计到2025年,电动医用吸痰设备市场规模将达5.736亿美元。这些设备因其性能可靠、吸力控制可调以及能够支援连续运行而备受青睐。其设计兼具功能一致性、便携性和自动化安全功能,因此在医疗保健领域中广泛应用。

预计到2025年,非携带式吸痰系统市占率将达到66.9%。这些固定式设备主要用于医院和高级医疗机构,满足其高容量、不间断吸痰的需求。其坚固耐用的设计可为关键医疗程序和长期患者管理提供可靠且持续的性能。

预计到 2025 年,美国医用吸痰设备市场规模将达到 4.433 亿美元。慢性呼吸系统疾病发生率的上升持续推动急诊、急性照护和长期照护机构对呼吸道管理解决方案的需求。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 产业影响因素

- 司机

- 慢性呼吸系统疾病呈上升趋势

- 需要吸痰设备的手术数量增加

- 人们越来越偏好居家医疗

- 提高新兴经济体对携带式医用吸痰设备的认识

- 产业潜在风险与挑战

- 熟练专业人员短缺

- 吸痰装置的报销限额

- 市场机会

- 持续的技术改进

- 扩大公共医疗基础设施

- 司机

- 成长潜力分析

- 监管环境

- 技术进步

- 当前技术趋势

- 新兴技术

- 供应链分析

- 2024年定价分析

- 未来市场趋势

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 公司市占率分析

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 合作伙伴关係和合资企业

- 新产品发布

- 扩张计划

第五章 按类型分類的市场估算与预测,2022-2035年

- 电子设备

- 手动装置

- 文丘里管

第六章 市场估算与预测:2022-2035年手机性别分布

- 不便携带式

- 可携式的

第七章 按应用领域分類的市场估算与预测,2022-2035年

- 气道管理

- 外科

- 胃

- 其他的

第八章 依最终用途分類的市场估算与预测,2022-2035年

- 医院

- 诊所

- 其他的

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第十章:公司简介

- Allied Healthcare Products, Inc.

- Precision Medical, Inc.

- Drive Medical

- Integra Biosciences AG

- Medicop, Inc.

- ATMOS MedizinTechnik GmbH &Co. KG

- ZOLL Medical Corporation

- Welch Vacuum

- Laerdal Medical

- Amsino International, Inc.

- Olympus Corporation

- Medtronic

The Global Medical Suction Devices Market was valued at USD 1.18 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 2.07 billion by 2035.

The upward trend is supported by the rising burden of long-term respiratory conditions, the expanding volume of medical interventions that rely on suction technology, and the growing acceptance of home-based healthcare solutions. As respiratory disorders become more common, effective airway clearance has become essential to reduce complications and support patient recovery. Medical suction systems are also widely relied upon to maintain visibility and cleanliness during medical procedures by removing fluids and secretions across diverse clinical settings. The increasing global volume of surgical and diagnostic procedures continues to reinforce demand for these devices. In addition, the shift toward less invasive medical techniques has increased the need for precise and controlled fluid management, driving the adoption of advanced suction solutions that support accuracy, safety, and consistent clinical outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.18 Billion |

| Forecast Value | $2.07 Billion |

| CAGR | 5.8% |

The electrically powered medical suction devices segment generated USD 573.6 million in 2025. These devices are favored for their dependable performance, adjustable suction control, and ability to support continuous operation. Their design enables consistent functionality, portability options, and automated safety features, making them widely used across healthcare environments.

The non-portable suction systems segment accounted for 66.9% share in 2025. These stationary units are primarily used in hospitals and advanced care facilities where high-capacity and uninterrupted suction is required. Their robust design supports critical medical procedures and long-term patient management by delivering reliable and sustained performance.

U.S. Medical Suction Devices Market recorded USD 443.3 million in 2025. The rising incidence of chronic respiratory conditions continues to drive demand for airway management solutions across emergency, acute, and extended care settings.

Key companies operating in the Global Medical Suction Devices Market include Medtronic, Laerdal Medical, Allied Healthcare Products, Inc., Olympus Corporation, Drive DeVilbiss Healthcare, ATMOS MedizinTechnik GmbH & Co. KG, ZOLL Medical Corporation, Precision Medical, Inc., Amsino International, Inc., Integra Biosciences AG, Medicop, Inc., and Welch Vacuum. Companies in the Global Medical Suction Devices Market are strengthening their market position through innovation, product diversification, and strategic expansion. Many manufacturers are investing in advanced device designs that improve reliability, ease of use, and patient safety. Emphasis is being placed on developing compact, energy-efficient, and user-friendly systems suited for both clinical and home-care environments. Firms are also expanding their geographic footprint through partnerships and distribution agreements to improve market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Portability trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic respiratory disorders

- 3.2.1.2 Rising number of procedures that require suction devices.

- 3.2.1.3 Increasing preference for home healthcare

- 3.2.1.4 Increase in awareness regarding portable medical suction devices in emerging economies.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Limited reimbursement for suction devices

- 3.2.3 Market opportunities

- 3.2.3.1 Ongoing technology improvements

- 3.2.3.2 Expansion of public healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Electrically operated devices

- 5.3 Manually operated devices

- 5.4 Venturi

Chapter 6 Market Estimates and Forecast, By Portability, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Non portable

- 6.3 Portable

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Airway clearing

- 7.3 Surgical

- 7.4 Gastric

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 clinics

- 8.4 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Allied Healthcare Products, Inc.

- 10.2 Precision Medical, Inc.

- 10.3 Drive Medical

- 10.4 Integra Biosciences AG

- 10.5 Medicop, Inc.

- 10.6 ATMOS MedizinTechnik GmbH & Co. KG

- 10.7 ZOLL Medical Corporation

- 10.8 Welch Vacuum

- 10.9 Laerdal Medical

- 10.10 Amsino International, Inc.

- 10.11 Olympus Corporation

- 10.12 Medtronic